Workers comp and general liability insurance near me – sounds boring, right? Wrong! This isn’t your grandpa’s insurance lecture. We’re diving headfirst into the wild world of protecting your business, from workplace accidents to slip-and-falls. Think of it as a superhero cape for your company, shielding you from potentially devastating financial blows. We’ll break down the essentials, the jargon, and even help you find the perfect policy that fits your needs (and your budget!). Get ready to become an insurance pro.

This guide unpacks the crucial differences between workers’ compensation (protecting your employees) and general liability (protecting your business from third-party claims). We’ll explore how to find local providers, decipher policy details, and navigate the sometimes-tricky world of claims. We’ll also tackle budgeting, legal compliance, and everything in between. By the end, you’ll be armed with the knowledge to confidently choose the right insurance and sleep soundly knowing your business is protected.

Understanding Workers’ Compensation Insurance

Source: amazonaws.com

Sorting out workers comp and general liability insurance near you can be a headache, especially when unexpected issues arise. If you’re facing a similar struggle with insurance, remember that navigating a denied life insurance claim requires expert help, like that offered by a denied life insurance claim lawyer. Understanding your rights in both situations is key to securing the coverage you deserve, so don’t hesitate to seek professional guidance for either your workers’ comp or your life insurance needs.

Workers’ compensation insurance is a crucial safety net for employees injured on the job. It’s a no-fault system, meaning you can receive benefits regardless of who was at fault for the accident. This system ensures injured workers receive medical care and wage replacement, while protecting employers from potentially crippling lawsuits.

Purpose of Workers’ Compensation Insurance

The primary purpose of workers’ compensation insurance is to provide financial and medical assistance to employees who suffer work-related injuries or illnesses. This includes covering medical expenses, lost wages, and rehabilitation costs. The system aims to prevent financial hardship for injured workers and their families, while also offering employers a degree of legal protection. It fosters a safer work environment by incentivizing employers to prioritize workplace safety.

Types of Workplace Injuries Covered

Workers’ compensation typically covers a wide range of workplace injuries and illnesses. This includes injuries resulting from accidents, such as slips, trips, falls, and machinery malfunctions. It also extends to illnesses caused or aggravated by work conditions, like carpal tunnel syndrome from repetitive movements or respiratory problems from exposure to hazardous materials. Cumulative trauma injuries, which develop over time due to repeated stress on the body, are also often covered.

Examples of Workers’ Compensation Applicability

Consider a construction worker falling from a scaffold, fracturing their leg. This is a clear case for workers’ compensation. Similarly, an office worker developing carpal tunnel syndrome due to prolonged computer use could also file a claim. A nurse contracting Hepatitis B while treating a patient would likely be covered as well. Even a stress-related heart attack suffered by a manager facing intense workplace pressure might qualify, depending on the specific circumstances and state regulations.

Exclusions and Limitations of Workers’ Compensation Coverage

While workers’ compensation offers broad coverage, there are some exclusions and limitations. Injuries resulting from an employee’s willful misconduct or intoxication are often excluded. Injuries sustained during a personal errand unrelated to work are generally not covered. The benefits provided may also be limited by state regulations, which vary in terms of maximum weekly benefit amounts and the duration of coverage. Furthermore, some pre-existing conditions may not be fully covered if aggravated by a work injury.

Hypothetical Workers’ Compensation Claim Scenario

Imagine Sarah, a waitress at a busy restaurant, slips on a wet floor and sprains her ankle. She seeks medical attention, incurring expenses for doctor visits, physical therapy, and medication. Due to her injury, she is unable to work for four weeks, resulting in lost wages. Sarah files a workers’ compensation claim with her employer’s insurance provider. The insurer investigates the claim, reviewing medical records and witness statements. If approved, Sarah receives reimbursement for her medical expenses and a portion of her lost wages during her recovery period.

Understanding General Liability Insurance

General liability insurance is your business’s safety net against financial ruin caused by accidents or injuries that occur on your property or as a result of your business operations. It protects you from lawsuits stemming from bodily injury, property damage, or advertising injury, ensuring your business can weather unforeseen events without facing crippling debt. Think of it as a crucial shield against the unpredictable world of business risks.

Purpose of General Liability Insurance

The primary purpose of general liability insurance is to protect your business from financial losses resulting from third-party claims of bodily injury or property damage. This coverage extends to situations where your business’s operations or products cause harm to others, shielding you from potentially devastating legal costs and settlements. It’s designed to cover the expenses associated with defending lawsuits and paying out settlements or judgments.

Incidents Covered by General Liability Insurance

General liability insurance typically covers a broad range of incidents. This includes bodily injury caused by a slip and fall on your business premises, property damage resulting from a faulty product you sold, or even reputational damage caused by advertising errors. Specific coverage details vary depending on the policy, but most policies provide protection for accidents occurring during business hours and in locations related to your business operations.

Situations Where General Liability Insurance is Crucial

Imagine a customer slipping on a wet floor in your store and breaking their leg. The resulting medical bills and potential lawsuit could bankrupt your small business. Or consider a manufacturing error leading to property damage for a client. General liability insurance is crucial in these scenarios, covering the costs of medical expenses, legal fees, and potential settlements, preventing you from shouldering these burdens alone. For businesses that interact with the public or handle products, this type of insurance is practically indispensable. Even a small café could face significant costs from a spilled coffee incident.

Common Exclusions or Limitations of General Liability Coverage

While general liability insurance offers broad protection, it does have limitations. Common exclusions include intentional acts, employee injuries (covered by workers’ compensation), damage to your own property, and certain types of professional services (requiring professional liability insurance). Understanding these exclusions is crucial to ensure you have adequate coverage. Policies often have specific limits on the amount they will pay out for any one incident or over the policy period. It’s vital to discuss these limitations with your insurance provider to tailor the policy to your specific business needs.

Comparison of Workers’ Compensation and General Liability Insurance

| Feature | Workers’ Compensation Insurance | General Liability Insurance |

|---|---|---|

| Coverage | Medical expenses, lost wages, and rehabilitation costs for employees injured on the job. | Bodily injury, property damage, and advertising injury caused by your business to third parties. |

| Exclusions | Injuries resulting from intentional acts by the employee, injuries occurring outside of work, pre-existing conditions (often). | Intentional acts, employee injuries, damage to your own property, certain professional services. |

| Typical Policy Costs | Varies greatly based on industry, number of employees, and claims history; generally higher for high-risk industries. | Varies based on industry, business size, and risk assessment; typically lower premiums for low-risk businesses. |

Finding Local Insurance Providers: Workers Comp And General Liability Insurance Near Me

Securing the right Workers’ Compensation and General Liability insurance is crucial for any business. Finding the right provider, however, requires a strategic approach. This section Artikels effective methods for locating local insurance providers and factors to consider when making your selection.

Finding the perfect insurance provider involves more than just a quick Google search. It’s about understanding your needs, comparing options, and ultimately choosing a provider that offers the best balance of cost, coverage, and reliability.

Methods for Locating Local Insurance Providers

Three primary methods exist for identifying insurance providers in your area: online search engines, insurance brokers, and direct contact with insurance companies. Each method offers unique advantages and disadvantages.

- Online Search Engines: Using search engines like Google, Bing, or DuckDuckGo allows for quick searches based on location (zip code, city, state). You can refine your search by adding s like “workers’ compensation insurance,” “general liability insurance,” and your specific industry. The benefit is immediate access to a wide range of options. However, the drawback is the potential for overwhelming results, including those from less reputable providers, and a lack of personalized guidance.

- Insurance Brokers: Brokers act as intermediaries, connecting businesses with multiple insurance providers. They can provide personalized recommendations based on your specific needs and risk profile. The benefit is their expertise and access to a broader market of insurers. The drawback is that brokers typically charge a commission, which may slightly increase your overall cost.

- Direct Contact with Insurance Companies: Many large insurance companies maintain a national presence with local agents. Contacting them directly allows for a more controlled and focused approach. The benefit is a direct relationship with the insurer, often simplifying claims processes. The drawback is that it might involve more legwork to contact and compare multiple companies.

Factors to Consider When Selecting an Insurance Provider

Choosing the right provider requires careful consideration of several key factors. A poorly chosen provider can lead to inadequate coverage or unexpectedly high costs.

- Cost (Premium): The premium is the amount you pay for the insurance policy. Consider the premium in relation to the coverage offered; a lower premium might mean less comprehensive coverage.

- Coverage: The policy’s coverage Artikels what events or losses are covered. Carefully review the policy wording to understand the extent of protection. For example, ensure your general liability policy covers product liability or professional services if relevant to your business.

- Reputation and Financial Stability: Research the insurer’s reputation by checking online reviews and ratings from independent agencies like A.M. Best. A financially stable company is more likely to pay claims promptly and reliably.

- Claims Process: Understand how the insurer handles claims. Look for a company with a straightforward and efficient claims process, including clear communication and timely resolution.

- Customer Service: Good customer service is essential. Choose a provider known for its responsiveness and helpfulness.

The Importance of Comparing Quotes from Multiple Providers

Comparing quotes is paramount. Different providers offer varying premiums and coverage options. By comparing at least three quotes, you can ensure you’re getting the best value for your money. Don’t solely focus on the premium; consider the overall coverage and the insurer’s reputation.

Interpreting Key Terms in Insurance Policy Documents

Understanding key terms in your policy document is vital to avoid misunderstandings and disputes.

- Premium: The amount you pay regularly (monthly, quarterly, or annually) for your insurance coverage.

- Deductible: The amount you pay out-of-pocket before the insurance coverage kicks in. A higher deductible usually means a lower premium.

- Coverage Limits: The maximum amount the insurer will pay for a covered loss. For example, a general liability policy might have a coverage limit of $1 million per occurrence.

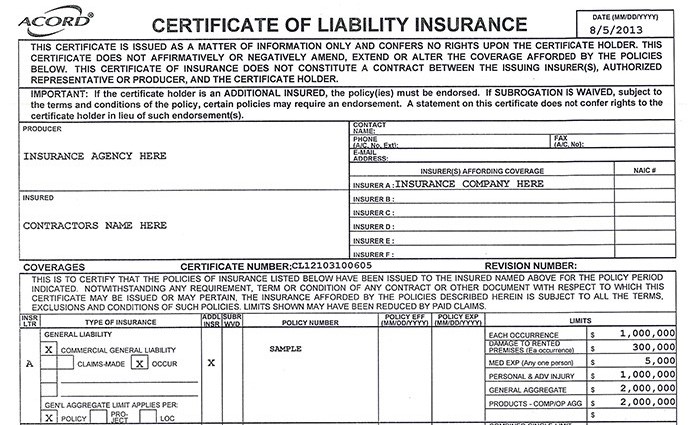

Policy Details and Coverage Limits

Source: cloudinary.com

Navigating the world of workers’ compensation and general liability insurance can feel like deciphering a secret code. Understanding your policy’s details, especially the coverage limits, is crucial for protecting your business and your employees. These limits determine how much your insurer will pay out in the event of a claim, so knowing what they are is essential.

Understanding coverage limits is key to avoiding nasty surprises. Think of it like this: your policy is your financial safety net, and the coverage limits are the size of that net. A smaller net might leave you hanging if a large claim arises, while a larger one provides more comprehensive protection. Let’s dive into the specifics.

Per Occurrence Limit and Aggregate Limit, Workers comp and general liability insurance near me

These two terms are fundamental to understanding your liability coverage. The per occurrence limit refers to the maximum amount your insurer will pay for a single incident or accident. For example, if a customer slips and falls in your store, injuring themselves, the per occurrence limit dictates the maximum payout for medical bills, legal fees, and any settlement related to that specific incident. The aggregate limit, on the other hand, represents the total amount your insurer will pay out during the entire policy period, regardless of the number of incidents. So, if you have multiple claims throughout the year, the aggregate limit caps the total amount your insurer will cover. Let’s say your policy has a $100,000 per occurrence limit and a $500,000 aggregate limit. If you have two separate incidents costing $75,000 and $150,000, the insurer will pay $75,000 for the first and $350,000 for the second (to reach the $500,000 aggregate limit). Any additional costs exceeding this would be your responsibility.

Coverage Limits Impact on Claims Payouts

Coverage limits directly affect how much you receive after a claim. Consider a scenario where a construction worker suffers a serious injury on a job site. If the workers’ compensation policy has a low coverage limit, it might not cover the extensive medical expenses and lost wages. Similarly, a general liability policy with low limits could leave a business financially vulnerable if a significant lawsuit arises from a customer injury. Adequate coverage limits provide peace of mind, ensuring that you are protected from potentially crippling financial losses. Conversely, insufficient limits can expose you to significant personal liability.

Types of General Liability Policies

Choosing the right general liability policy is vital. Different policies offer varying levels of protection.

- Claims-Made Policies: These policies only cover claims made during the policy period, regardless of when the incident occurred. If an incident happens before the policy starts, but the claim is made during the policy period, it’s covered. Conversely, if an incident happens during the policy period, but the claim is made afterward, it’s not covered. This often necessitates purchasing “tail coverage” to extend protection beyond the policy’s term.

- Occurrence Policies: These policies cover incidents that occur during the policy period, regardless of when the claim is made. This provides broader protection, as claims can be filed even after the policy expires.

Understanding the nuances of these policies is crucial for selecting the one that best suits your business’s needs and risk profile. A claims-made policy might be more affordable initially, but the cost of tail coverage can significantly increase the overall cost over time.

Filing a Workers’ Compensation and General Liability Claim

The claims process varies slightly between workers’ compensation and general liability, but both involve timely reporting and documentation.

For workers’ compensation, reporting an injury should happen immediately. Notify your employer and file a claim with your insurer promptly. This typically involves completing forms and providing details about the injury, medical treatment, and lost wages. Your insurer will then investigate the claim and determine the benefits you are entitled to.

For general liability, reporting an incident to your insurer is equally important. This includes providing details of the incident, any injuries sustained, and any potential witnesses. Your insurer will investigate the claim, and depending on the situation, this might involve negotiating settlements, defending lawsuits, or paying out damages.

Claims Process Flowchart

Imagine a flowchart with two branches: one for workers’ compensation and one for general liability.

Workers’ Compensation Claim Process:

1. Injury Occurs: Employee is injured on the job.

2. Report Injury: Employee reports the injury to their employer immediately.

3. Claim Filed: Employer files a claim with the workers’ compensation insurer.

4. Investigation: Insurer investigates the claim.

5. Benefits Awarded (or Denied): Insurer approves or denies benefits based on the investigation.

6. Payment of Benefits: If approved, benefits are paid to the injured worker.

General Liability Claim Process:

1. Incident Occurs: An incident (e.g., customer injury) happens on your premises.

2. Report Incident: You report the incident to your general liability insurer.

3. Investigation: Insurer investigates the claim.

4. Settlement Negotiations (or Legal Defense): Insurer negotiates a settlement or provides legal defense if a lawsuit is filed.

5. Claim Payment (or Legal Outcome): Insurer pays out a settlement or the case proceeds through the courts.

Cost Considerations and Budgeting

Securing the right insurance coverage is crucial for any business, but understanding the associated costs is equally important. Ignoring this aspect can lead to financial strain and even jeopardize your business’s future. This section dives into the factors that influence workers’ compensation and general liability insurance premiums, providing strategies for effective budgeting and highlighting the risks of inadequate coverage.

Factors Influencing Insurance Costs

Several key factors significantly impact the cost of your workers’ compensation and general liability insurance premiums. These factors interact in complex ways, so it’s essential to understand their individual contributions. A thorough understanding allows for better financial planning and potentially lower premiums.

Business Size and Industry

The size of your business directly correlates with your insurance premiums. Larger businesses generally employ more people and have higher payrolls, leading to higher workers’ compensation premiums. The industry you operate in also plays a crucial role. High-risk industries, such as construction or manufacturing, tend to have more workplace accidents, resulting in higher premiums compared to lower-risk industries like office administration. For example, a large construction company will pay significantly more for workers’ compensation than a small bakery. Similarly, a chemical plant will likely face higher general liability premiums than a bookstore due to the inherent risks associated with their operations.

Claims History

Your company’s claims history is a major determinant of your insurance costs. A history of frequent or high-value claims will almost certainly lead to higher premiums in the future. Insurance companies use this data to assess risk, and businesses with a clean claims history are often rewarded with lower premiums. Conversely, a history of numerous accidents or lawsuits can significantly increase your premiums, potentially making insurance unaffordable. For instance, a trucking company with a history of accidents will likely face substantially higher premiums than one with an excellent safety record.

Cost-Saving Strategies

Implementing effective cost-saving strategies can significantly reduce your insurance expenses. These strategies often involve proactive measures to mitigate risk and improve workplace safety.

| Strategy | Workers’ Compensation | General Liability | Impact |

|---|---|---|---|

| Invest in Safety Training | Reduces workplace accidents, lowering claims. | Demonstrates commitment to safety, potentially lowering premiums. | Lower premiums, reduced claims costs. |

| Implement Safety Programs | Creates a safer work environment, minimizing injuries. | Reduces the likelihood of accidents and incidents. | Lower premiums, improved workplace morale. |

| Regular Equipment Maintenance | Reduces the risk of equipment-related injuries. | Minimizes the risk of property damage or injury from faulty equipment. | Lower premiums, reduced downtime. |

| Thorough Risk Assessments | Identifies potential hazards and allows for proactive mitigation. | Highlights potential liabilities and allows for preventative measures. | More accurate risk assessment, potentially lower premiums. |

Financial Consequences of Inadequate Coverage

Inadequate insurance coverage can lead to devastating financial consequences for businesses. A single significant accident or lawsuit could bankrupt a company without sufficient coverage. This includes not only the direct costs of medical expenses, legal fees, and settlements but also the indirect costs such as lost productivity, damage to reputation, and potential business closure. For example, a small business facing a multi-million dollar lawsuit with minimal liability coverage could face immediate financial ruin.

Budgeting for Insurance Premiums and Potential Claims

Budgeting for insurance premiums requires careful consideration of several factors. Start by obtaining quotes from multiple insurers to compare pricing and coverage options. Factor in not only the annual premiums but also the potential costs of claims, setting aside a contingency fund for unexpected expenses. Regularly review your insurance policies and coverage levels to ensure they align with your business’s evolving needs and risk profile. A proactive approach to budgeting and risk management can significantly reduce the financial burden of unexpected events.

Legal and Regulatory Compliance

Navigating the legal landscape of workers’ compensation and general liability insurance can feel like wading through a swamp, but understanding the rules is crucial for protecting your business. Failure to comply can lead to significant financial penalties and legal repercussions, impacting your bottom line and your company’s reputation. This section clarifies key legal requirements and resources to ensure your business remains on the right side of the law.

State regulations governing workers’ compensation and general liability insurance vary significantly. For example, in California, employers are mandated to carry workers’ compensation insurance covering employee injuries sustained on the job, regardless of fault. Failure to do so results in hefty fines and potential criminal charges. Similarly, general liability insurance requirements can differ; some states may require specific minimum coverage amounts for certain businesses or industries, while others may only mandate it under specific circumstances, such as contracting work on public property. It’s essential to research your specific state’s laws and regulations to ensure full compliance.

Penalties for Non-Compliance

Penalties for non-compliance with workers’ compensation and general liability insurance regulations can be severe. These can range from substantial fines and back-payments for uninsured claims (in the case of workers’ compensation) to legal action and significant financial losses if you’re found liable for damages in a lawsuit you’re not adequately insured against (general liability). In some cases, non-compliance could even lead to business license suspension or revocation. For instance, a construction company in Texas operating without the required workers’ compensation insurance could face fines exceeding $10,000 per employee and potential criminal prosecution. The severity of penalties is often determined by factors like the nature of the violation, the extent of the harm caused, and the business’s history of compliance.

Resources for Obtaining Accurate and Up-to-Date Information

Staying informed about insurance laws is paramount. Reliable resources include your state’s Department of Insurance website, which usually provides comprehensive guides, FAQs, and updated regulations. The National Association of Insurance Commissioners (NAIC) also offers valuable information and resources on insurance regulations across different states. Consulting with legal professionals specializing in insurance law can provide personalized guidance and ensure compliance with complex regulations. Additionally, professional insurance organizations often publish articles and updates on changes in the law, keeping you informed of relevant changes.

The Role of Insurance Agents and Brokers in Ensuring Compliance

Experienced insurance agents and brokers play a critical role in ensuring compliance. They possess in-depth knowledge of state and federal regulations, helping businesses select the appropriate coverage levels and ensuring all necessary documentation is filed correctly. They can also advise on risk management strategies to minimize the likelihood of claims, further contributing to compliance and cost savings. Choosing a reputable and knowledgeable agent or broker is an investment in your business’s peace of mind and legal protection. They act as a liaison between you and the insurance company, helping navigate the complexities of policy selection and regulatory compliance.

Obtaining Necessary Certifications and Licenses Related to Insurance

While obtaining certifications and licenses is typically required for insurance professionals (agents and brokers), not for the businesses themselves purchasing the insurance, understanding the licensing process helps in assessing the credentials of those advising you. Insurance agents and brokers must meet specific educational and examination requirements set by their state’s Department of Insurance before obtaining a license to sell insurance products. These licenses demonstrate their competency and adherence to ethical standards within the industry. Verifying the licenses of your chosen agent or broker is a crucial step in ensuring you are receiving professional and compliant advice.

Concluding Remarks

Source: slideplayer.com

Navigating the world of workers’ compensation and general liability insurance can feel like decoding a secret language, but it doesn’t have to be. By understanding the core differences between these crucial coverages, researching local providers, and carefully reviewing policy details, you can effectively protect your business and your employees. Remember, the right insurance isn’t just about ticking a box; it’s about building a strong foundation for your company’s future. So, ditch the insurance anxiety and embrace the power of preparedness. Your business (and your peace of mind) will thank you for it.