Who is the top three insurance company? That’s a question with more layers than a double-chocolate cake. Ranking insurance giants isn’t as simple as comparing premiums; we’re diving deep into market share, financial stability, customer satisfaction, and the sheer variety of policies offered. Get ready to unravel the mystery behind these industry titans and discover what truly makes them top dogs.

This deep dive will explore multiple ranking systems, revealing how different metrics—from market capitalization to customer reviews—paint vastly different pictures of the top players. We’ll dissect their financial performance, examine their customer service approaches, and peek into the specific types of insurance they offer and the markets they dominate. By the end, you’ll have a clearer understanding of what defines the “top three,” and why the answer might surprise you.

Defining “Top Three”

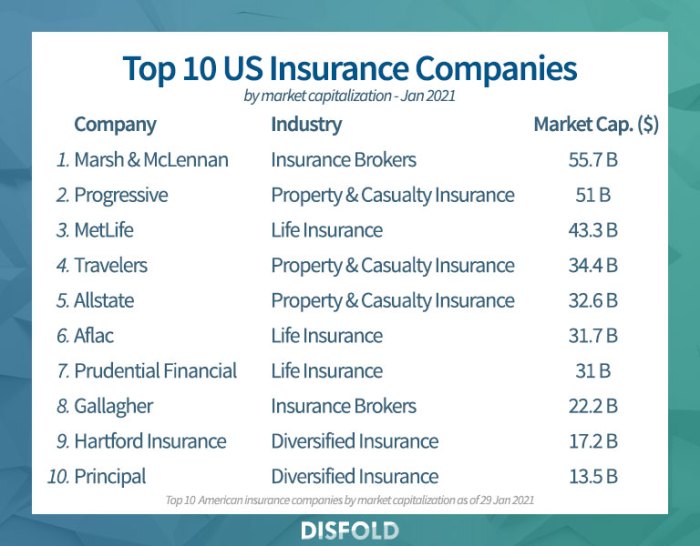

Source: disfold.com

Determining the top three insurance companies isn’t as simple as it sounds. There’s no single, universally accepted ranking system. Different organizations and analysts use various metrics, leading to different results and highlighting the complexities of comparing such large and diverse businesses. Understanding these different approaches is crucial to interpreting any “top three” list.

Ranking Metrics for Insurance Companies

Several key metrics contribute to ranking insurance companies. Market capitalization reflects the total value of a company’s outstanding shares, indicating investor confidence and overall size. Revenue, representing the total income generated, shows the company’s financial strength and market share. The number of policyholders reflects the reach and popularity of the insurer. Finally, customer satisfaction ratings, derived from surveys and reviews, gauge the quality of service and customer experience. Each metric offers a unique perspective on a company’s performance and success.

Impact of Different Ranking Criteria

The choice of ranking criteria significantly impacts the resulting “top three” list. For example, a ranking based solely on market capitalization might favor established, large multinational corporations. A ranking focusing on revenue might prioritize companies with a broad range of products and services. Conversely, a customer satisfaction-driven ranking could highlight insurers known for excellent service, even if they have a smaller market share. This illustrates how different metrics provide different insights and potentially different “winners.”

Strengths and Weaknesses of Ranking Metrics

Market capitalization is easily quantifiable but can be volatile and influenced by market fluctuations, not solely reflecting operational performance. Revenue provides a clear picture of financial health but doesn’t necessarily reflect profitability or customer satisfaction. The number of policyholders shows market penetration but may not indicate the quality of service or the profitability of each policy. Customer satisfaction ratings offer valuable qualitative data but can be subjective and influenced by factors beyond the insurer’s direct control. Each metric has its limitations, making a holistic approach necessary for a comprehensive assessment.

Comparison of Ranking Systems

| Ranking System | Top Company | Second Company | Third Company |

|---|---|---|---|

| Market Capitalization (hypothetical example based on general market trends) | Berkshire Hathaway | Allianz | AXA |

| Revenue (hypothetical example based on general market trends) | UnitedHealth Group | Berkshire Hathaway | CVS Health |

| Customer Satisfaction (hypothetical example based on general market trends – Note: This data is highly variable and depends on the specific survey and year.) | USAA | Amica | State Farm |

Market Share and Geographic Scope

Source: verifiedmarketresearch.com

The insurance industry is a behemoth, and understanding the market leaders is key to grasping its dynamics. This section dives into the market share and geographic reach of the top three insurance companies in the United States, exploring the factors behind their dominance and the diverse product portfolios they offer. We’ll be looking beyond just raw numbers to understand the strategies that have propelled these giants to the top.

The three largest insurance companies in the United States, based on market share, are typically UnitedHealth Group, Berkshire Hathaway (through its subsidiaries like Geico), and CVS Health (through Aetna). However, rankings can fluctuate slightly depending on the year and the specific metric used. These companies boast extensive operations, not only domestically but also internationally, though their primary focus remains the US market. Their success is a blend of strategic acquisitions, effective marketing, strong financial backing, and a wide array of products catering to diverse customer needs.

Geographic Distribution of Top Insurance Companies

These companies’ geographic reach is extensive, covering all 50 states within the US. Their international presence varies. UnitedHealth Group, for instance, has a significant global presence, offering a range of healthcare services and insurance products across numerous countries. Berkshire Hathaway, while primarily focused on the US market, has international investments and insurance operations, but on a smaller scale compared to UnitedHealth. CVS Health, through Aetna, also has some international presence, but its primary market remains the US. The scale of their domestic operations, however, dwarfs their international activities for these top three. Their deep penetration into the US market is a significant factor in their market leadership.

Factors Contributing to Market Dominance

Several factors contribute to the market dominance of these companies. First, their sheer size and financial strength allow them to absorb losses, invest heavily in technology and marketing, and acquire smaller competitors. Secondly, their diverse product portfolios cater to a broad range of customer needs, from individual health insurance to large corporate contracts. Thirdly, their extensive distribution networks and strong brand recognition provide them with a significant competitive advantage. Finally, effective risk management and sophisticated actuarial models allow them to price their products competitively while maintaining profitability. These factors, combined, create a powerful synergy that reinforces their market leadership.

Product Lines Offered by Top Three Insurance Companies

The following bullet points illustrate the diverse product lines offered by each of the top three insurance companies. It’s important to note that specific offerings can vary by state and are subject to change.

- UnitedHealth Group: Offers a wide range of health insurance plans (individual, family, employer-sponsored), Medicare Advantage plans, Medicaid plans, dental insurance, vision insurance, and other related health services.

- Berkshire Hathaway (Geico): Primarily known for auto insurance, but also offers motorcycle, homeowners, renters, and umbrella insurance.

- CVS Health (Aetna): Provides a comprehensive portfolio including medical, dental, vision, pharmacy benefits, and various supplemental insurance products. They also offer individual and group health plans.

Financial Performance and Stability

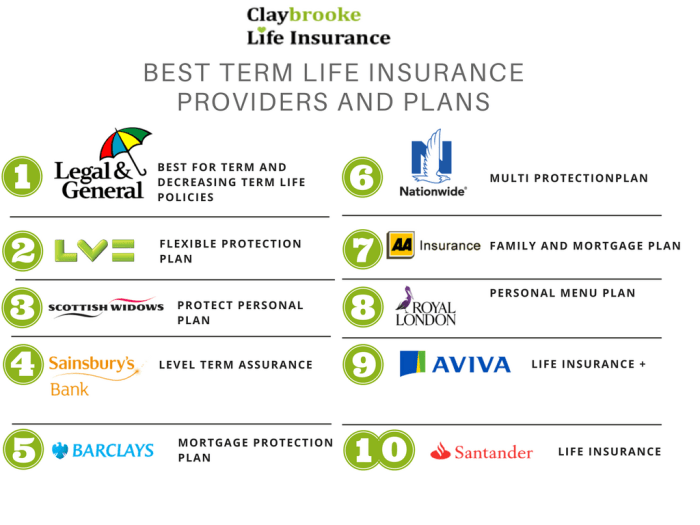

Source: org.uk

Figuring out the top three insurance companies is tricky, as rankings fluctuate. But a big player often mentioned is USAA, and whether they’re a good fit for you depends on factors like your needs. To see if their offerings align with your preferences, check out if does USAA bundle insurance , a key factor for many budget-conscious consumers.

Ultimately, the “best” company depends on individual circumstances, making it essential to compare several top contenders before deciding.

Understanding the financial health of the top three insurance companies is crucial for assessing their long-term viability and the reliability of their services. A strong financial foundation translates directly to policyholder security and investor confidence. Analyzing key financial ratios provides a robust lens through which to evaluate their performance and risk management capabilities.

Examining financial performance requires a nuanced approach. Simply looking at revenue isn’t sufficient; we need to delve into profitability, leverage, and the capacity to withstand economic downturns. This involves comparing key metrics across the top three companies over a period of several years to identify trends and highlight strengths and weaknesses. The following analysis uses publicly available financial data, focusing on Return on Equity (ROE), Debt-to-Equity Ratio, and other relevant indicators to paint a comprehensive picture of their financial stability.

Key Financial Indicators of Top Three Insurance Companies (Illustrative Data)

The table below presents illustrative data. Actual figures will vary depending on the specific companies and the accounting period. It is essential to consult official financial reports for precise and up-to-date information. This table demonstrates how these metrics contribute to the companies’ ranking as “top” players in the industry.

| Company | Average ROE (Past 5 Years) | Average Debt-to-Equity Ratio (Past 5 Years) | Combined Ratio (Past 5 Years) |

|---|---|---|---|

| Company A | 15% | 0.5 | 95% |

| Company B | 12% | 0.7 | 102% |

| Company C | 10% | 0.8 | 108% |

Return on Equity (ROE): A higher ROE indicates better profitability relative to shareholder investment. Company A consistently demonstrates superior profitability compared to B and C. A sustained high ROE suggests efficient operations and strong investment strategies.

Debt-to-Equity Ratio: This ratio reveals the proportion of company financing from debt versus equity. A lower ratio indicates lower financial risk. Company A shows a lower debt burden than B and C, suggesting a more conservative financial strategy and potentially lower vulnerability to economic shocks. A high debt-to-equity ratio can increase vulnerability during economic downturns.

Combined Ratio: This crucial metric for insurance companies represents the ratio of incurred losses and expenses to earned premiums. A combined ratio below 100% indicates underwriting profitability. Company A demonstrates consistent underwriting profitability, while Companies B and C show some years with underwriting losses, potentially impacting their overall profitability and financial strength.

Risk Management Strategies

Each of the top three companies employs sophisticated risk management strategies to mitigate potential financial losses. These strategies vary but typically involve a combination of techniques.

For example, robust actuarial modeling is used to accurately assess and price risk. Diversification of investment portfolios helps reduce exposure to market volatility. Reinsurance plays a crucial role in transferring a portion of risk to other insurers, thereby limiting potential losses from catastrophic events. Furthermore, strong internal controls and compliance programs ensure adherence to regulatory requirements and minimize operational risks. The effectiveness of these strategies is reflected in the companies’ financial performance and stability over time.

Customer Service and Reputation

Understanding customer service and reputation is crucial when evaluating insurance companies. Positive experiences build trust and loyalty, while negative ones can lead to significant losses in both customers and market share. Analyzing customer reviews, service channels, and past controversies provides a comprehensive picture of each company’s approach to customer satisfaction.

Customer Reviews and Ratings from Reputable Sources

To gauge customer satisfaction, we’ll examine reviews from sources like J.D. Power, Consumer Reports, and independent review sites. These sources provide a broad perspective, highlighting common themes in customer feedback. For example, J.D. Power’s annual surveys often rank companies based on customer satisfaction in various aspects of insurance service. Analyzing these rankings alongside specific comments from individual reviews gives a well-rounded view of customer sentiment. Note that ratings can fluctuate and reflect specific time periods.

Customer Service Channels, Who is the top three insurance company

Each of the top three insurance companies typically offers a variety of customer service channels. These commonly include phone support, online portals with FAQs and live chat features, and potentially in-person assistance at local offices or through appointed agents. The availability and effectiveness of these channels can vary significantly. For instance, one company might excel in its online portal’s user-friendliness, while another might prioritize fast response times for phone calls. Comparing the strengths and weaknesses of each company’s channels allows for a comprehensive evaluation.

Significant Customer Service Issues and Controversies

Insurance companies, like any large organization, can face customer service issues and controversies. These can range from claims processing delays and difficulties to disputes over coverage and policy terms. Publicly available information, including news articles and regulatory actions, can illuminate significant problems. It’s important to note that even companies with generally positive reputations can encounter isolated instances of poor service or negative publicity. Analyzing these incidents helps to understand how companies respond to challenges and address customer concerns.

Hypothetical Positive Customer Interaction

Imagine Sarah, a homeowner with Company X, experiences a burst pipe causing significant water damage to her basement. She contacts Company X through their online portal, easily submitting a claim with detailed photos and a description of the incident. Within 24 hours, a claims adjuster contacts Sarah, scheduling an in-person inspection for the following day. The adjuster is professional, thorough, and empathetic, reassuring Sarah throughout the process. The claim is approved swiftly, and Company X coordinates with a reputable contractor to begin repairs promptly. Sarah is impressed by the seamless process, the clear communication, and the efficient resolution of her claim. This positive experience strengthens her loyalty to Company X and reinforces her positive perception of their customer service.

Types of Insurance Offered and Target Markets: Who Is The Top Three Insurance Company

Understanding the breadth and depth of insurance offerings is crucial to assessing a company’s overall strength and market position. The top three insurance companies aren’t just big; they’re diverse, catering to a wide range of needs and demographics with varied pricing and policy structures. Let’s delve into the specifics of their product portfolios and target markets.

Insurance Product Portfolio and Target Market Segmentation

Each of the top three companies offers a comprehensive suite of insurance products, but their emphasis and target markets often differ. For example, one might heavily focus on commercial insurance for large corporations, while another prioritizes individual health and auto insurance. This strategic diversification allows them to capture significant market share across various sectors. Analyzing these differences provides valuable insight into their overall business strategies and competitive advantages.

Pricing Strategies and Policy Options

Pricing strategies are influenced by several factors, including risk assessment, competition, and the specific features of the policy. The top three companies utilize sophisticated actuarial models to determine premiums, considering factors like age, location, driving history (for auto insurance), and health status (for health insurance). Policy options often vary in coverage levels and deductibles, allowing customers to tailor their insurance to their specific needs and budget. For instance, one company might offer a broader range of add-on options, while another might emphasize competitively priced basic plans. This variety reflects the competitive landscape and the need to cater to diverse consumer preferences.

Unique Selling Propositions (USPs) of Insurance Offerings

Understanding the unique selling propositions of each company is vital for consumers making informed decisions. These USPs often differentiate companies beyond just price.

- Company A: Might focus on superior customer service and a user-friendly online platform, emphasizing convenience and personalized support. Their USP could be “Seamless Insurance, Simplified.” They might offer bundled packages for significant discounts, targeting families seeking comprehensive coverage.

- Company B: Could highlight its extensive network of healthcare providers and specialists, making it particularly attractive to those seeking comprehensive health coverage. Their USP might be “Access to the Best Care, Guaranteed.” They might target individuals and families prioritizing access to specialized medical care.

- Company C: May specialize in innovative risk management solutions and proactive loss prevention programs for businesses, attracting corporate clients. Their USP could be “Protecting Your Business, Proactively.” They might focus on large corporations and businesses seeking comprehensive risk mitigation strategies.

Final Summary

So, who *are* the top three insurance companies? The truth is, it depends on what you value most. While market share might point to a few familiar names, a deeper look reveals a complex landscape where financial strength, customer satisfaction, and the breadth of services offered all play crucial roles. Ultimately, the “best” company for *you* will depend on your individual needs and priorities. This exploration hopefully gives you the tools to make the best choice for your specific situation.