What to do if car insurance company denies your claim? It’s a nightmare scenario, right? You’re already dealing with the stress of an accident, and now your insurance company is refusing to pay. Don’t panic! This isn’t the end of the road. Understanding your policy, meticulously gathering evidence, and knowing how to appeal are your best weapons. This guide walks you through every step, from deciphering that confusing denial letter to potentially taking your case to a higher authority. Get ready to fight for what’s rightfully yours.

This article breaks down the process of handling a denied car insurance claim into manageable steps. We’ll cover everything from understanding the clauses in your policy that might lead to denial, to navigating the appeals process and even exploring external assistance if needed. We’ll arm you with the knowledge and strategies to effectively challenge a denial and potentially secure the compensation you deserve. Let’s get started.

Understanding Your Policy

Source: dawsonandrosenthal.com

Navigating the complexities of a car insurance claim denial can feel like driving through a fog. Understanding your policy is the first step towards clearing the haze and potentially getting the compensation you deserve. Knowing the specific clauses and common reasons for denial empowers you to build a stronger case.

Your car insurance policy is a legally binding contract. It Artikels the terms and conditions under which the insurance company agrees to cover your losses. Crucially, it also specifies situations where they *won’t* cover you. These exclusions are often the root cause of claim denials.

So, your car insurance company rejected your claim? Don’t freak out! First, meticulously review the denial letter, then gather all supporting documentation. If you’re in Bradford, PA, finding a reliable insurer like those listed at auto insurance bradford pa for future reference might be a smart move. Next, appeal the decision formally, stating your case clearly and concisely, and consider seeking legal counsel if needed.

Remember, persistence pays off!

Policy Clauses Related to Claim Denials

Several clauses within a typical car insurance policy can lead to claim denials. These clauses often revolve around the specifics of the accident, your actions, and the coverage you purchased. Commonly, these include clauses relating to driving under the influence of alcohol or drugs, failure to comply with policy terms (like not reporting an accident promptly), and pre-existing damage to your vehicle. Furthermore, clauses defining covered perils (e.g., collision vs. comprehensive) will directly influence whether your claim is eligible for compensation.

Common Reasons for Claim Denials

Insurance companies deny claims for a variety of reasons, many stemming from a misinterpretation of the policy or a failure to meet specific requirements. Common reasons include: driving without a valid license, providing false information on your application, failing to maintain proper vehicle upkeep (contributing to the accident), driving a vehicle not listed on your policy, or exceeding the policy’s coverage limits. For example, a comprehensive policy may not cover damages from wear and tear, while a collision policy might not cover damages if you were at fault in a parking lot incident.

Examples of Policy Wording Justifying a Denial

Policy wording is often meticulously crafted to limit liability. Here are examples of how policy language might be used to justify a denial:

“This policy does not cover losses resulting from driving under the influence of alcohol or controlled substances.”

This clause clearly excludes coverage if the accident was caused by intoxicated driving.

“The insured must report any accident to the company within 24 hours of the incident.”

Failure to meet this deadline could result in a claim denial.

“This policy only covers damages to the insured vehicle resulting from a collision with another vehicle or object.”

This excludes damage caused by events not involving a collision, such as vandalism.

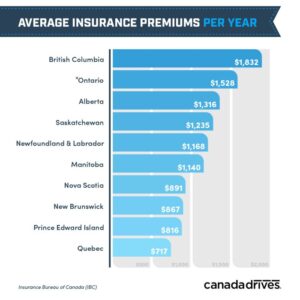

Policy Types and Claim Denial Scenarios

The type of insurance policy you hold significantly impacts the likelihood of a claim denial and the reasons behind it.

| Policy Type | Common Denial Reason | Policy Wording Example | Action to Take |

|---|---|---|---|

| Liability Only | Damage to your own vehicle | “This policy only covers bodily injury and property damage to third parties.” | Consider purchasing collision and comprehensive coverage. |

| Collision | Damage from a non-collision event (e.g., vandalism) | “Coverage applies only to damage resulting from a collision with another vehicle or object.” | Review policy details and ensure the incident meets the definition of a collision. |

| Comprehensive | Wear and tear or mechanical failure | “This policy does not cover damage resulting from normal wear and tear or mechanical breakdown.” | Consult a mechanic for proof of damage unrelated to wear and tear. |

| Uninsured/Underinsured Motorist | Lack of proof of the other driver’s lack of insurance | “Coverage applies only if the at-fault driver is uninsured or underinsured and liability is proven.” | Gather all necessary documentation to prove the other driver’s insurance status. |

Reviewing the Denial Letter

Source: eclaimstatus.com

So, your car insurance claim got denied. Ouch. That stings. Before you throw your hands up in the air and accept defeat, take a deep breath and carefully review the denial letter. This document is your roadmap to understanding why your claim was rejected and, more importantly, how you might be able to challenge it. It’s a legal document, so treat it as such.

A formal claim denial letter should contain several key elements. Missing these could indicate a poorly constructed argument from the insurance company, giving you grounds to appeal.

Key Elements of a Claim Denial Letter

A proper denial letter will clearly state the claim number, the date of the incident, the policyholder’s name and policy number, and the specific reason(s) for the denial. It should also include contact information for appealing the decision and outlining the appeals process, including deadlines. The letter should be written in clear and concise language, avoiding jargon or ambiguous terms. Crucially, it should reference specific clauses or sections of your insurance policy that support their decision.

Examples of Unclear or Misleading Language

Insurance companies sometimes use vague language to justify denials. For example, phrases like “failure to cooperate” can be incredibly broad and lack specifics. Similarly, “pre-existing damage” might be used without evidence or clear explanation of how the alleged pre-existing damage relates to the current claim. Another common tactic is referencing policy exclusions in a way that’s difficult to understand or that misinterprets the actual wording of the policy. Imagine a letter stating your claim was denied due to “policy violation,” without specifying which policy was violated or how. This vagueness necessitates further clarification.

Interpreting the Reasons for Claim Denial

Once you’ve identified the reason for the denial, carefully examine your policy to see if the insurer’s interpretation aligns with the policy’s wording. Often, the insurer might misinterpret a clause or apply it incorrectly. If you find discrepancies, gather all supporting documentation, such as photos, repair estimates, police reports, and witness statements, to build a strong case for your appeal. Remember, the burden of proof lies with the insurance company to justify their denial.

Sample Response Letter to the Insurance Company

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Insurance Company Name]

[Insurance Company Address]

Subject: Appeal of Claim Denial – Claim Number [Your Claim Number]

Dear [Insurance Adjuster Name],

This letter is to formally appeal the denial of my claim, number [Your Claim Number], dated [Date of Denial Letter]. I disagree with the reasons provided for the denial, specifically [Clearly state the reason(s) for denial].

I have attached [List attached documents: photos, repair estimates, police reports, etc.]. These documents clearly demonstrate [Explain how the documents support your claim]. I believe the denial is based on a misinterpretation of my policy, specifically [Reference the policy section].

I request a thorough review of my claim, considering the additional evidence provided. I expect a response within [Number] days outlining the next steps in the appeals process. If the denial is not overturned, I will consider further action.

Sincerely,

[Your Signature]

[Your Typed Name]

Gathering Supporting Evidence

So, your insurance company denied your claim. Don’t panic! A strong appeal hinges on compelling evidence. Think of it like building a case – you need solid proof to convince them to reconsider. The more detailed and comprehensive your evidence, the better your chances of a successful appeal.

This section details the types of evidence that can bolster your claim and guides you through the process of gathering and organizing it effectively. Remember, accuracy and thoroughness are key.

Types of Supporting Evidence

Gathering the right evidence is crucial. Think of it like assembling puzzle pieces – each piece contributes to the complete picture. A combination of different evidence types strengthens your case significantly more than relying on a single piece of information. Here are some key pieces of the puzzle:

- Police Reports: If the incident involved an accident, a police report is a cornerstone of your evidence. It provides an official record of the event, including details like the time, location, and descriptions of the vehicles involved and any witness accounts recorded at the scene. A police report carries significant weight with insurance companies.

- Witness Statements: Eyewitness accounts can be incredibly valuable. If anyone witnessed the incident, obtain written statements from them. These statements should include their name, contact information, and a detailed description of what they saw. The more specific and unbiased the statement, the better. For example, instead of “The other car was going too fast,” a better statement would be “The blue sedan, license plate ABC-123, was traveling at an estimated 50 mph in a 30 mph zone when it collided with the claimant’s vehicle.”

- Photographs and Videos: Visual evidence speaks volumes. Take clear photos of the damage to your vehicle, the accident scene (if safe and possible), and any other relevant details. If you have dashcam footage or videos from other sources, include these as well. High-resolution images showing the extent of the damage and the surrounding environment are more impactful than blurry or poorly lit pictures.

- Medical Records: If the incident caused injuries, comprehensive medical records are essential. These include doctor’s notes, diagnoses, treatment plans, and bills. These documents prove the extent of your injuries and the related medical expenses.

- Repair Estimates: Obtain detailed repair estimates from reputable mechanics. These estimates should clearly Artikel the necessary repairs and their associated costs. This demonstrates the financial impact of the incident.

Gathering and Organizing Supporting Documentation

Effective organization is just as important as gathering the right evidence. A chaotic jumble of papers is less convincing than a well-presented, easy-to-understand case.

- Create a File: Designate a specific file (physical or digital) to store all your documentation related to the claim. This keeps everything together and easily accessible.

- Document Everything: Maintain a detailed record of every interaction with the insurance company, including dates, times, names of individuals contacted, and summaries of conversations. Keep copies of all correspondence, whether it’s emails, letters, or text messages.

- Organize Chronologically: Arrange your documents in chronological order, starting with the earliest evidence and progressing to the most recent.

- Label Clearly: Clearly label each document with a brief description of its content. For example, “Police Report – Accident on June 15, 2024,” or “Witness Statement – John Doe.”

- Make Copies: Always keep copies of all original documents for your records. This protects you from losing crucial evidence.

Checklist of Necessary Documents for Appeal

Before submitting your appeal, review this checklist to ensure you’ve included all essential documents:

- Copy of the original claim

- Insurance policy details

- Denial letter from the insurance company

- Police report (if applicable)

- Witness statements (if applicable)

- Photographs and videos of the damage and accident scene (if applicable)

- Medical records (if applicable)

- Repair estimates

- Any other relevant documentation

Filing an Appeal

Source: petrarcalaw.com

So, your car insurance claim got denied. Don’t throw in the towel just yet! Many insurance companies have a formal appeals process, giving you a second chance to get the compensation you deserve. Understanding this process and presenting your case effectively is crucial.

Appealing a denied car insurance claim involves formally requesting a review of the initial decision. This usually involves submitting a detailed appeal letter outlining why you believe the denial was incorrect and providing additional evidence to support your claim. The specifics of the appeals process will vary depending on your insurance company and the specifics of your policy, so always refer to your policy documents and contact your insurer for clarification. Remember, persistence and clear communication are key to a successful appeal.

The Formal Appeals Process

The appeals process typically begins with a written appeal letter. This letter should clearly state your disagreement with the initial denial, referencing the claim number and the specific reasons for the denial. It’s a formal process, so maintaining a professional tone throughout is essential. After submitting your appeal, the insurance company will review your case again, potentially involving a different adjuster or a higher-level review team. They may request additional information or documentation. You’ll receive a decision in writing within a specified timeframe, which is usually detailed in your policy or communicated by the insurer. If the appeal is still denied, you may have further options, such as mediation or litigation, but these are usually last resorts.

Effective Communication Strategies for Appealing a Denial

Presenting your case effectively is paramount. Avoid emotional language and stick to facts. Use clear, concise language, and organize your appeal logically. For example, instead of writing “They’re being unfair!”, try “The initial assessment failed to consider the independent witness statement included in my initial claim submission.” Highlight any inconsistencies in the initial assessment, and directly address the reasons provided for the denial. Providing supporting evidence such as photos, police reports, medical bills, and witness statements in a well-organized manner strengthens your appeal significantly. If you’ve had prior positive interactions with the company, mentioning those could subtly improve the perception of your case.

Information to Include in an Appeal Letter

Your appeal letter should include several key pieces of information. First, clearly state your intent to appeal the claim denial, referencing the claim number and the date of the initial denial letter. Then, reiterate the details of your claim, briefly summarizing the incident and the damages incurred. Next, directly address each reason given for the denial in the initial letter, providing counterarguments and evidence to refute their claims. Include all supporting documentation, clearly labeled and referenced within your letter. Finally, state your desired outcome, such as full or partial reimbursement, and include your contact information.

Steps Involved in Filing an Appeal

Following a clear, structured approach is vital. Here’s a step-by-step guide:

- Carefully review the denial letter, noting the reasons for denial.

- Gather all supporting documentation: photos, police reports, medical records, repair estimates, witness statements, etc.

- Draft a well-written appeal letter addressing each point of denial, providing counterarguments and evidence.

- Organize all documentation and attach it to your appeal letter.

- Submit your appeal letter and supporting documentation via the method specified by your insurance company (mail, online portal, etc.).

- Keep a copy of your appeal letter and all supporting documents for your records.

- Follow up with the insurance company within the timeframe specified to inquire about the status of your appeal.

Seeking External Assistance: What To Do If Car Insurance Company Denies Your Claim

Navigating a denied car insurance claim can feel like wading through quicksand. If you’ve exhausted all internal appeals processes and still find yourself at an impasse, seeking external assistance might be your next best step. This involves exploring options beyond direct communication with your insurance company, leveraging the expertise of professionals or the power of regulatory bodies to advocate on your behalf.

Mediators and arbitrators play crucial roles in resolving insurance disputes outside of court. These individuals act as neutral third parties, facilitating communication and helping both sides reach a mutually agreeable settlement. They don’t impose a decision; instead, they guide the negotiation process.

Mediation and Arbitration in Insurance Disputes

Mediation is a less formal process where a mediator helps both parties communicate and find common ground. The mediator doesn’t decide the outcome; instead, they help the parties reach a compromise. Arbitration, on the other hand, is more formal. An arbitrator hears evidence from both sides and makes a binding decision, which is usually final. Think of it as a simplified court proceeding without the same level of formality or expense. For example, if your claim denial is based on a technicality in your policy wording that you believe is unfair, mediation could help clarify the misunderstanding and lead to a settlement. Conversely, if the insurer’s refusal is based on demonstrably false information, arbitration might be more appropriate to obtain a fair resolution.

Legal Representation for Denied Claims, What to do if car insurance company denies your claim

Hiring a lawyer to handle a denied claim can be a significant investment, but it can also be a powerful tool. A lawyer specializing in insurance law possesses the knowledge to navigate complex policy language, identify legal loopholes, and build a strong case. They can negotiate with the insurance company on your behalf, and, if necessary, file a lawsuit to pursue your claim. However, legal representation comes with fees, which can be substantial depending on the complexity of the case and the lawyer’s hourly rate. Weighing the potential financial recovery against the legal costs is crucial. For instance, a lawyer might be particularly helpful if your claim involves a substantial amount of money or if the insurance company is demonstrably acting in bad faith.

Comparison of Dispute Resolution Methods

Several methods exist for resolving insurance disputes outside of court. These include mediation, arbitration, and, as a last resort, litigation. Mediation is the least formal and often the most cost-effective, aiming for a negotiated settlement. Arbitration offers a more structured approach with a binding decision from a neutral party. Litigation, involving a formal lawsuit, is the most expensive and time-consuming option, requiring court appearances and legal representation. Choosing the right method depends on the complexity of the case, the amount of money involved, and your personal preferences. A smaller claim with a clear misunderstanding might benefit from mediation, while a larger claim involving significant damages might necessitate arbitration or litigation.

Consumer Protection Agencies and Insurance Disputes

Consumer protection agencies, such as your state’s Department of Insurance, play a vital role in resolving insurance disputes. They investigate complaints against insurance companies, ensuring compliance with state regulations. These agencies can mediate disputes, impose penalties on insurers for unfair practices, and even help consumers file lawsuits. They act as a check on the power of insurance companies and provide a valuable resource for consumers facing claim denials. For example, if you suspect your insurer is engaging in deceptive practices or violating state regulations regarding claim handling, filing a complaint with your state’s Department of Insurance can initiate an investigation and potentially lead to a favorable outcome.

Preventing Future Denials

Navigating the world of insurance claims can feel like a minefield. A denied claim is frustrating, but understanding how to prevent them in the future empowers you to protect yourself and your assets. Proactive steps, clear communication, and meticulous record-keeping can significantly reduce the risk of future claim denials.

Proactive measures before, during, and after an incident are crucial. Thoroughly understanding your policy, documenting everything meticulously, and maintaining open communication with your insurer are key elements in this preventative strategy. Failing to do so can lead to unnecessary delays and potential denials.

Understanding Your Policy

Before any incident occurs, take the time to truly understand the nuances of your car insurance policy. This includes not only the coverage limits but also the specific exclusions, deductibles, and the claims process itself. Read the fine print; don’t just skim it. Pay particular attention to sections detailing what constitutes a covered event and what might lead to a denial. For example, if your policy has a clause about maintaining proper vehicle maintenance, ensure you have records of regular servicing. A thorough understanding of your policy will prevent misunderstandings and potential disputes later.

Maintaining Thorough Documentation

Meticulous record-keeping is paramount. This extends beyond simply having your policy documents readily available. In the event of an accident, immediately document everything: take photos of the damage to your vehicle, the other vehicle(s) involved, the accident scene itself (including road signs, traffic conditions, and any visible injuries), and obtain contact information from all parties involved, including witnesses. Keep a detailed account of the incident, including the date, time, location, and a description of what happened. If you have dashcam footage, preserve it as evidence. This comprehensive documentation provides concrete evidence to support your claim.

Best Practices for Interacting with Your Insurance Company

Effective communication is key to a smooth claims process. When reporting an accident, be clear, concise, and accurate in your description of events. Respond promptly to all requests for information from your insurer. Keep a record of all communications, including dates, times, and the names of individuals you spoke with. If you disagree with a decision made by the insurance company, express your concerns calmly and professionally. Maintain a polite and respectful tone in all interactions, even when frustrated. Remember, a positive and collaborative approach is more likely to lead to a successful outcome.

Preventative Measures to Minimize Claim Denials

A proactive approach is the best defense against claim denials. Here are some preventative measures to consider:

- Regularly review your policy to ensure it still meets your needs and understand any changes.

- Maintain a comprehensive vehicle maintenance record, including regular servicing and repairs.

- Drive defensively and avoid risky behaviors that could increase the likelihood of an accident.

- Keep your insurance information up-to-date, including address and contact details.

- Understand your policy’s requirements for reporting accidents and claims promptly.

- Always obtain a police report in case of a significant accident, even if there are no injuries.

Implementing these steps will not guarantee that you’ll never face a claim denial, but it will significantly reduce the likelihood and make navigating the process smoother should a claim arise.

Wrap-Up

Facing a denied car insurance claim can feel incredibly frustrating, but remember you’re not alone. By understanding your policy, meticulously documenting evidence, and strategically navigating the appeals process, you significantly increase your chances of a successful resolution. Don’t hesitate to seek professional help if needed – a mediator, arbitrator, or lawyer can be invaluable allies in this fight. Ultimately, armed with knowledge and a proactive approach, you can turn a potentially devastating situation into a victory. Remember, you deserve fair treatment.