USAA home and auto insurance quote: Sounds boring, right? Wrong! Getting the best deal on your insurance shouldn’t feel like navigating a minefield. This isn’t your grandpa’s insurance guide; we’re diving deep into USAA’s offerings, uncovering hidden discounts, and demystifying the entire quote process. Prepare to become a savvy insurance shopper, armed with the knowledge to snag the perfect policy for your needs – and your wallet.

We’ll break down USAA’s home and auto coverage options, comparing them to other major players. Learn how bundling can save you serious cash, discover those sneaky discounts you might be missing, and master the art of comparing quotes. We’ll even walk you through filing a claim, because let’s face it, accidents happen. This isn’t just about numbers; it’s about empowering you to make informed decisions and protect what matters most.

USAA Home Insurance Coverage Options

USAA, known for its strong military affiliation and member-centric approach, offers a range of home insurance coverage options designed to protect your most valuable asset. Understanding these options and how they compare to other insurers is crucial for securing the right level of protection at a competitive price. This detailed look at USAA’s offerings will help you navigate the complexities of home insurance and make an informed decision.

USAA Home Insurance Policy Levels

USAA’s home insurance policies aren’t explicitly categorized into “levels” with distinct names like “Basic,” “Standard,” and “Premium.” Instead, coverage is customized based on your specific needs and the characteristics of your home. The actual coverage offered depends on factors such as your location, the age and condition of your home, and the value of your belongings. You’ll work with a USAA agent to determine the appropriate coverage limits for your dwelling, personal property, and liability. This personalized approach contrasts with some insurers who offer pre-packaged policies with less flexibility.

Comparison with Other Major Insurers

While a direct comparison of specific policy details across all major insurers would be extensive, a general comparison can highlight USAA’s strengths. USAA often receives high marks for customer service and claims handling, a significant factor when you need assistance after a disaster. Some competitors might offer lower initial premiums, but USAA’s reputation for fair and efficient claims processing could prove more valuable in the long run. Features like discounts for bundling home and auto insurance are common across many insurers, including USAA. However, USAA’s focus on its members and streamlined claims process often distinguishes it from competitors.

Perils Covered Under USAA Home Insurance Plans

USAA’s home insurance policies typically cover a broad range of perils, including fire, wind, hail, lightning, vandalism, and theft. Specific coverage details will be Artikeld in your policy documents. It’s important to note that some perils, such as floods and earthquakes, may require separate endorsements or riders, potentially increasing your premium. Understanding these exclusions is vital to avoid unexpected costs in the event of a claim. For example, while standard policies usually cover damage from a burst pipe, you might need additional coverage for sewer backups. Carefully reviewing your policy is crucial to fully grasp what is and isn’t covered.

USAA Home Insurance Deductible Options and Premium Impact

Choosing the right deductible significantly affects your premium. A higher deductible means lower premiums but also a larger out-of-pocket expense if you file a claim. Conversely, a lower deductible results in higher premiums but lower out-of-pocket costs. The optimal balance depends on your risk tolerance and financial situation.

| Deductible | Estimated Premium Impact | Out-of-Pocket Expense (Example Claim) | Considerations |

|---|---|---|---|

| $500 | High | $500 + any costs exceeding coverage | Best for those who prioritize lower out-of-pocket costs |

| $1,000 | Moderate | $1,000 + any costs exceeding coverage | A balance between premium cost and out-of-pocket expense |

| $2,500 | Low | $2,500 + any costs exceeding coverage | Best for those comfortable with higher out-of-pocket costs to lower premiums |

Note: Premium impact and example claim costs are illustrative and will vary based on individual factors like location, coverage amounts, and credit score. Contact USAA directly for personalized quotes and detailed information.

USAA Auto Insurance Coverage Options

USAA, known for its member-centric approach, offers a robust suite of auto insurance coverage options designed to cater to diverse needs and risk profiles. Understanding these options is crucial for securing the right level of protection and managing your premiums effectively. This section delves into the specifics of USAA’s auto insurance offerings and the factors that determine your cost.

USAA Auto Insurance Coverage Options Explained

USAA provides a comprehensive range of coverage options, allowing members to customize their policy to match their individual requirements. These options typically include liability coverage (which protects you financially if you cause an accident), collision coverage (which covers damage to your vehicle regardless of fault), comprehensive coverage (which covers damage from non-collision events like theft or vandalism), uninsured/underinsured motorist coverage (protecting you if you’re involved in an accident with a driver lacking sufficient insurance), medical payments coverage (covering medical expenses for you and your passengers regardless of fault), and personal injury protection (PIP) (covering medical expenses and lost wages for you and your passengers). Specific limits and deductibles are customizable within each coverage type.

Factors Influencing USAA Auto Insurance Premiums

Several key factors contribute to the final cost of your USAA auto insurance premium. These include your driving record (accidents and traffic violations significantly impact premiums), your vehicle’s make, model, and year (more expensive or higher-risk vehicles typically command higher premiums), your location (areas with higher accident rates generally have higher premiums), your age and driving experience (younger, less experienced drivers often pay more), and the amount and type of coverage you select (higher coverage limits and comprehensive coverage will increase your premium). Credit history may also play a role in premium determination, although this practice varies by state. For example, a driver with multiple speeding tickets and a history of accidents will likely face significantly higher premiums than a driver with a clean record driving a less expensive vehicle in a low-risk area.

Examples of Different Coverage Levels

Consider these scenarios: A young driver with a new sports car might benefit from comprehensive coverage to protect against theft and vandalism, in addition to liability and collision coverage. An older driver with a reliable, older vehicle might find that liability coverage, along with collision and comprehensive coverage with a higher deductible, provides adequate protection at a lower cost. A driver who frequently travels in areas with a high number of uninsured motorists should strongly consider purchasing uninsured/underinsured motorist coverage. The choice of coverage level depends on individual risk tolerance and financial resources.

Filing a Claim with USAA Auto Insurance

The process of filing a claim with USAA is generally straightforward.

- Report the accident to the authorities (police) if required.

- Contact USAA immediately to report the claim. You can typically do this through their mobile app, website, or by phone.

- Provide all necessary information, including details of the accident, the other driver’s information, and any witness information.

- Cooperate fully with USAA’s investigation.

- Follow USAA’s instructions regarding repairs or replacement of your vehicle.

Obtaining a USAA Home and Auto Insurance Quote

Source: quote.com

Getting a USAA home and auto insurance quote is a smart first step, but don’t stop there! Consider broadening your search to explore other options, like checking out the comprehensive coverage offered by ovid insurance , before making your final decision. Comparing quotes from different providers, including USAA and others, is key to finding the best fit for your needs and budget.

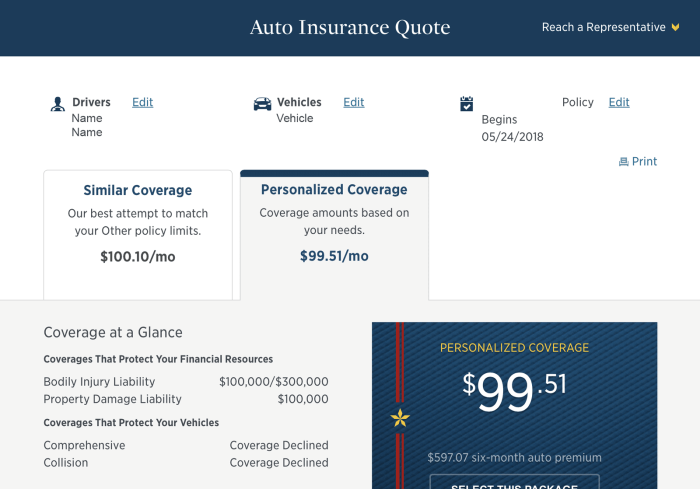

Getting a quote for both your home and auto insurance from USAA is surprisingly straightforward, especially if you’re already a member. USAA prioritizes a streamlined process, making it easy to compare coverage options and find the best fit for your needs and budget. This process typically involves providing some key information and then comparing your options.

The process of obtaining a USAA home and auto insurance quote involves several steps, each designed to ensure you receive a personalized and accurate estimate. Providing comprehensive and accurate information is key to getting the most reliable quote.

USAA Quote Acquisition Methods

USAA offers several convenient ways to obtain a quote. You can access their online quoting tool directly through their website, providing a quick and easy way to get an estimate at your convenience. Alternatively, you can contact USAA directly via phone, speaking with a representative who can guide you through the process and answer any questions you may have. Finally, if you prefer a more personalized approach, you can schedule an appointment with a local USAA agent.

Information Required for an Accurate Quote

To receive an accurate quote, USAA will need specific information about your home and your vehicle(s). For your home insurance quote, this includes details such as your address, the year your home was built, its square footage, the type of construction, and any security features you have installed. For your auto insurance quote, you’ll need to provide information about your vehicles, including make, model, year, and VIN, as well as your driving history, including any accidents or violations. Providing accurate information upfront will avoid delays and ensure you get the most appropriate quote.

Comparing USAA Quotes with Other Providers

Once you’ve received your USAA quote, comparing it to quotes from other insurance providers is a crucial step in ensuring you’re getting the best possible deal. This involves obtaining quotes from other companies, ideally using similar levels of coverage, and then comparing the total premiums. Consider factors beyond just the premium, such as the level of coverage, deductibles, and customer service reputation when making your final decision. A simple spreadsheet or comparison tool can help you organize the different quotes and highlight key differences.

USAA Discounts and Bundling Options: Usaa Home And Auto Insurance Quote

Bundling your USAA home and auto insurance can significantly reduce your overall premium costs. USAA also offers a wide array of discounts, further enhancing your savings potential. Understanding these options is key to maximizing your insurance value.

USAA’s bundling strategy leverages the combined risk assessment of your home and auto policies. By insuring both with them, USAA simplifies administration and potentially reduces their overall risk exposure, leading to lower premiums for you. This is a common practice across many insurance providers, but USAA’s reputation for competitive pricing makes their bundling option particularly attractive.

Bundling Savings

Bundling your home and auto insurance with USAA often results in a substantial discount on your combined premiums. The exact amount varies depending on your individual circumstances, such as the value of your home, the type of car you drive, and your driving history. However, you can expect a noticeable reduction compared to purchasing separate policies. For instance, a homeowner with a standard home and a mid-range vehicle might see a 10-15% reduction in their total premiums by bundling. A higher-value home and multiple vehicles could yield even greater savings.

USAA Home and Auto Insurance Discounts

USAA offers a variety of discounts designed to reward safe driving practices, responsible homeownership, and loyalty. These discounts can significantly reduce your premium costs, further adding to the savings from bundling.

Examples of Eligible Discounts and Criteria

Several factors can influence eligibility for USAA discounts. These factors include but are not limited to:

| Discount Type | Description | Eligibility Criteria | Example Savings |

|---|---|---|---|

| Bundling Discount | Insuring both your home and auto with USAA. | Must have both a USAA home and auto policy. | 5-20% depending on policy details. |

| Safe Driver Discount | Rewarding safe driving habits. | Clean driving record (no accidents or violations within a specified period). | Up to 15%. |

| Home Security Discount | Incentivizing home security measures. | Installation of security systems (alarm, monitored security). | Up to 10%. |

| Multi-Policy Discount | Discount for insuring multiple vehicles or other insurance products with USAA. | Must have more than one USAA insurance policy. | Variable, depends on the number of policies. |

Potential Savings from Bundling and Discounts

The table below illustrates potential savings based on a hypothetical scenario. Remember that actual savings will vary based on individual circumstances and policy details.

| Scenario | Annual Premium (Separate Policies) | Annual Premium (Bundled with 15% Discount) | Annual Savings |

|---|---|---|---|

| Standard Home & Auto | $2,000 | $1,700 | $300 |

| High-Value Home & Multiple Vehicles | $4,500 | $3,825 | $675 |

Understanding USAA’s Claims Process

Navigating the insurance claims process can feel overwhelming, but understanding the steps involved can significantly reduce stress. USAA, known for its member-centric approach, aims to make the claims experience as smooth as possible. This section details the process for both home and auto insurance claims, highlighting key similarities and differences.

Filing a Home Insurance Claim with USAA

To initiate a home insurance claim, USAA members typically begin by contacting their claims department via phone or the USAA mobile app. After reporting the incident, a claims adjuster will be assigned to assess the damage. This assessment might involve an on-site inspection, depending on the nature and severity of the claim. Documentation, such as photos and receipts for repairs, will be crucial throughout the process. USAA will then provide an estimate of the covered repairs and coordinate with contractors, if necessary. The final step involves the disbursement of funds, often directly to the contractor or to the member for reimbursement. The entire process can take several weeks, depending on the complexity of the claim and the availability of contractors. For example, a minor roof leak might be resolved within a few weeks, while a major fire could take months.

Filing an Auto Insurance Claim with USAA

The auto insurance claims process with USAA generally starts similarly. Members report the incident, providing details of the accident, including date, time, location, and any involved parties. If the accident involves another driver, obtaining their information is essential. A claims adjuster will be assigned to investigate the claim, possibly requesting police reports or witness statements. Depending on the damage, the vehicle might need to be taken to an approved repair shop for assessment. USAA will then determine liability and coverage, and the repair process will commence. Payment will be made directly to the repair shop or reimbursed to the member, depending on the chosen method. Timelines for auto claims vary widely, from a few days for minor repairs to several weeks for significant damage requiring extensive work. For instance, a simple fender bender might be resolved within a week, while a totaled vehicle could take considerably longer due to the vehicle appraisal and settlement processes.

Comparing Home and Auto Insurance Claims Processes

Both home and auto insurance claims processes with USAA share a common thread: a focus on efficient communication and prompt resolution. However, the specifics differ based on the nature of the claim. Home claims often involve more complex assessments of damage, requiring detailed inspections and potentially involving contractors for repairs. Auto claims, while also requiring investigation, often focus on vehicle repair or replacement. While both processes involve documentation, the types of documents differ; home claims might require receipts for repairs, while auto claims may necessitate police reports and witness statements. The timelines also differ, with home claims potentially taking longer due to the complexity of repairs.

What to Expect During the USAA Claims Process

Members should expect clear and consistent communication throughout the claims process. USAA typically provides regular updates on the claim’s progress, either via phone, email, or the mobile app. Expect to provide necessary documentation promptly, as this can expedite the process. While USAA strives for swift resolution, delays can occur due to factors beyond their control, such as contractor availability or the need for extensive investigation. Maintaining open communication with the assigned claims adjuster is key to a smooth experience. In situations involving significant damage, it’s advisable to maintain detailed records of all communication and documentation. For instance, a detailed log of all phone calls with timestamps and summaries of conversations can prove valuable. Furthermore, keeping copies of all submitted documents can assist in tracking the progress and addressing any discrepancies.

USAA Customer Service and Support

USAA’s reputation isn’t built solely on competitive insurance rates; it’s deeply rooted in its commitment to exceptional customer service. For a membership-based organization, providing readily accessible and effective support is paramount, and USAA consistently strives to meet, and often exceed, those expectations. This section explores the various avenues available to USAA members seeking assistance and examines the experiences shared by those who have utilized these services.

USAA offers a multi-faceted approach to customer support, ensuring members can access help through their preferred channel. This accessibility is a cornerstone of their customer-centric philosophy, aiming to provide swift and efficient resolutions to any issues or queries. Positive customer experiences are frequently highlighted, contributing to USAA’s strong brand loyalty.

Contacting USAA: Multiple Avenues for Assistance, Usaa home and auto insurance quote

Members can reach USAA through several channels, each designed to cater to different preferences and urgency levels. Phone support remains a popular choice for immediate assistance, offering direct interaction with a representative. Email provides a convenient option for non-urgent inquiries or detailed questions requiring written responses. The online chat function offers a quick and efficient way to address straightforward queries without the need for a phone call. Finally, the USAA mobile app provides a centralized hub for managing policies, submitting claims, and accessing support resources.

Customer Reviews and Testimonials: A Reflection of USAA’s Service

Numerous online reviews and testimonials consistently praise USAA’s customer service. Common themes include the responsiveness of representatives, the helpfulness of the support staff, and the efficiency of the claims process. Many members highlight the personalized service they receive, often emphasizing the feeling of being valued as a member rather than just a customer. While some negative reviews exist, they are generally outnumbered by positive feedback, indicating a high overall satisfaction rate among USAA members. For example, many testimonials on independent review sites praise the speed and efficiency of resolving claims, particularly after natural disasters. These positive experiences contribute significantly to USAA’s strong reputation for customer care.

USAA Customer Support Channels: A Detailed Overview

- Phone Support: This offers immediate assistance with a wide range of issues, from policy inquiries to claim submissions. Representatives are generally knowledgeable and readily available to provide guidance and support. The phone system is often praised for its ease of navigation and quick connection times.

- Email Support: For less urgent matters, email provides a convenient way to contact USAA. Members can expect a timely response, with most inquiries resolved within a reasonable timeframe. This channel is particularly useful for complex issues requiring detailed explanations or documentation.

- Online Chat: This offers a fast and efficient way to address simple questions or obtain quick information. The chat function is readily accessible through the USAA website and mobile app, providing a convenient alternative to phone or email support. It is especially helpful for immediate clarification or quick problem-solving.

Contacting USAA Customer Support: A Flowchart

Imagine a flowchart. At the top is a box labeled “Issue Encountered?”. This branches into two boxes: “Urgent?” and “Non-Urgent?”.

The “Urgent?” branch leads to a box: “Call USAA Phone Support”. This box points to a final box: “Issue Resolved?”.

The “Non-Urgent?” branch leads to two boxes: “Need Detailed Response?” and “Simple Question?”.

The “Need Detailed Response?” box points to a box: “Send Email to USAA”. This box points to the final box: “Issue Resolved?”.

The “Simple Question?” box points to a box: “Use USAA Online Chat”. This box points to the final box: “Issue Resolved?”.

The final “Issue Resolved?” box points to a box: “End”. If the issue isn’t resolved, the process loops back to the beginning. This flowchart visually represents the decision-making process for contacting USAA based on the urgency and complexity of the issue.

Illustrative Scenarios

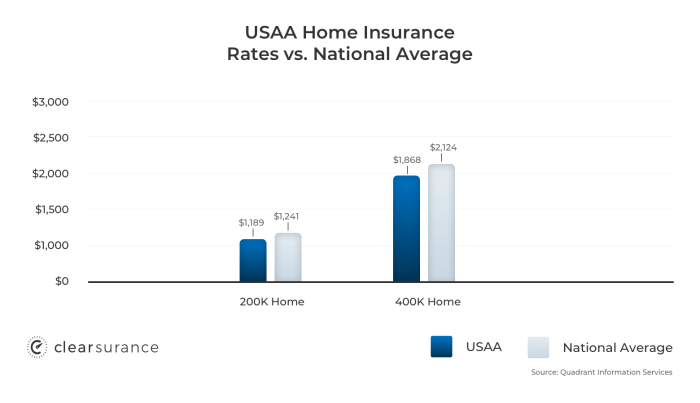

Source: clearsurance.com

Understanding how USAA processes claims is crucial for peace of mind. Let’s examine real-world scenarios to illustrate their handling of home insurance claims. These examples aren’t exhaustive, but they showcase common situations and USAA’s typical response.

Home Fire Claim

Imagine a family living in a suburban home insured by USAA. A kitchen fire, sparked by a faulty appliance, rapidly spreads, causing significant damage to the structure and contents. The family escapes unharmed, but their home is uninhabitable. They immediately contact USAA to report the incident. A claims adjuster is dispatched promptly to assess the damage. The adjuster documents the extent of the fire damage, taking photographs and interviewing the family. USAA then works with the family to arrange temporary housing while repairs are undertaken. The claim process involves detailed documentation of losses, including receipts for damaged belongings and estimates for repairs or replacement costs. The payout covers the cost of repairs or rebuilding the home, as well as replacement of damaged possessions, up to the policy limits. The process might involve dealing with contractors chosen by USAA or working with the family’s preferred contractors, depending on the specifics of the policy. The entire process, from initial report to final settlement, could take several weeks or months, depending on the complexity of the damage and the availability of contractors.

Severe Weather Damage Claim

A powerful hurricane ravages a coastal community, causing widespread damage. A homeowner with USAA home insurance experiences significant damage to their property – roof damage, broken windows, and water intrusion. The homeowner immediately contacts USAA, providing photos and videos of the damage. A USAA claims adjuster is sent to assess the situation, carefully documenting the damage and its extent. The adjuster considers factors like wind speed, the type of damage, and the age and condition of the home to determine the appropriate payout. The assessment includes determining the cost of repairs or replacement, considering the homeowner’s policy coverage limits. The payout may cover roof repairs, window replacements, water damage mitigation and remediation, and potentially temporary living expenses if the home is uninhabitable. The process might include working with approved contractors for repairs to ensure quality and adherence to building codes. The homeowner may receive a partial payment upfront for immediate needs while the rest is paid out as repairs are completed. The claim process, from reporting to final settlement, could be lengthy due to the scale of damage and potential delays in obtaining materials and contractors.

Theft or Vandalism Claim

A homeowner returns home to discover their property has been burglarized. Valuables, including jewelry, electronics, and furniture, are missing. The homeowner immediately reports the crime to the police and then contacts USAA. They provide a detailed list of stolen items, including purchase receipts or appraisals where available. USAA may require a police report as part of the claims process. A claims adjuster may visit the property to assess the damage and verify the reported losses. The payout is determined based on the value of the stolen items, considering depreciation and the policy’s coverage limits. If there’s vandalism in addition to theft, such as damage to doors or windows, those costs are also covered under the policy. The homeowner may need to provide additional documentation, such as photos of the damaged property and receipts for replacing stolen items. The process might involve working with a forensic specialist to assess the value of stolen items if receipts are unavailable. The claim settlement depends on the value of the stolen or damaged property and the specifics of the policy.

Illustrative Scenarios

Understanding how USAA handles claims is crucial for peace of mind. These scenarios illustrate the process for common auto insurance events. Remember, specific details of your claim will depend on your policy and the circumstances of the incident.

Car Accident Claim Process

Let’s imagine Sarah, a USAA member, is involved in a rear-end collision. Another driver runs a red light and hits her car. Sarah is thankfully unharmed but her vehicle sustains significant damage to the rear bumper and taillights. Following the accident, Sarah immediately calls the police to file a report, documenting the incident, the other driver’s information (license, insurance details), and obtaining witness statements if available. She then contacts USAA to report the accident, providing her policy number and a detailed account of the events. USAA guides her through the next steps, which may include arranging for a vehicle inspection by a preferred repair shop, managing communication with the other driver’s insurance company, and ultimately processing her claim for repairs. USAA’s claims adjusters will review the police report, photos of the damage, and any other supporting documentation to assess the extent of the damage and determine liability. Depending on the findings, Sarah’s repairs may be covered completely or partially, potentially subject to her deductible. Throughout the process, Sarah receives regular updates from her assigned claims adjuster.

Car Theft Claim Process

Consider another USAA member, Mark, who discovers his car stolen from his driveway. Mark immediately reports the theft to the local police department, obtaining a police report number. He then contacts USAA to report the theft, providing the police report number, his vehicle identification number (VIN), and details about the vehicle. USAA will initiate an investigation to verify the theft and assess the value of the vehicle. Depending on Mark’s policy coverage and the terms of his agreement, USAA may offer to reimburse him for the value of his stolen vehicle, potentially subject to a deductible. The reimbursement may be based on the vehicle’s actual cash value (ACV) at the time of the theft. USAA may also cover any associated expenses, such as towing fees or temporary rental car costs, depending on his policy.

Natural Disaster Damage Claim Process

Imagine a severe hailstorm damages Jessica’s car, causing significant dents and damage to the paintwork. Jessica takes photos and videos of the damage to her vehicle and the surrounding area to document the extent of the hail damage. She reports the damage to USAA immediately, providing detailed information about the incident, including the date, time, and location. She also provides the police report number if one was filed. USAA will then assess the damage based on the provided documentation and may arrange for an inspection of her vehicle. Similar to other claims, USAA will review the claim based on her policy coverage and may authorize repairs at a preferred repair shop. The extent of coverage and any applicable deductibles will determine the final amount reimbursed to Jessica for the hail damage repairs.

Epilogue

Source: autoinsuranceez.com

So, there you have it – your cheat sheet to conquering the world of USAA home and auto insurance quotes. Remember, securing the right coverage isn’t just about ticking boxes; it’s about finding a policy that aligns with your lifestyle and budget. By understanding the nuances of USAA’s offerings and utilizing the tips and tricks we’ve shared, you’re well-equipped to navigate the process with confidence and secure the best possible protection for your home and your wheels. Now go forth and conquer those insurance quotes!