Trustage Auto Insurance Personal Invitation Number: Ever wondered about the secret code unlocking your personalized car insurance journey? This unique number acts as your key to accessing Trustage’s services, a crucial piece in the application process. But what happens if it falls into the wrong hands? We’ll dive into the world of Trustage, exploring the perks, the pitfalls, and everything in between—from its customer service to the security measures surrounding this special number. Get ready to unravel the mystery!

This deep dive will explore Trustage’s offerings, comparing them to competitors and analyzing their marketing strategies. We’ll also examine the crucial role of the personal invitation number, highlighting security protocols and potential risks associated with its misuse. Understanding these aspects is key to navigating the world of auto insurance and ensuring your personal information remains protected.

Trustage Auto Insurance

Trustage Auto Insurance aims to provide affordable and reliable car insurance to a specific segment of the market. Understanding their target audience and unique selling points is key to appreciating their place in the competitive insurance landscape.

Trustage Auto Insurance’s Target Audience

Trustage likely targets budget-conscious drivers who value straightforward, no-frills coverage. This could include young adults entering the workforce, individuals with older vehicles, or those prioritizing affordability over extensive coverage options. They may be less interested in bundled packages or extensive add-ons, focusing instead on the core necessities of liability and collision coverage. This contrasts with insurers who cater to high-net-worth individuals or those seeking luxury add-ons.

Trustage Auto Insurance’s Unique Selling Propositions

Trustage’s success hinges on its ability to differentiate itself in a crowded market. Key selling propositions likely include competitive pricing, streamlined online processes, and a focus on clear, easy-to-understand policy options. This contrasts with insurers who emphasize personalized service or extensive add-on packages. Their USP may be efficiency and affordability rather than extensive customization.

Comparison of Trustage with Major Competitors

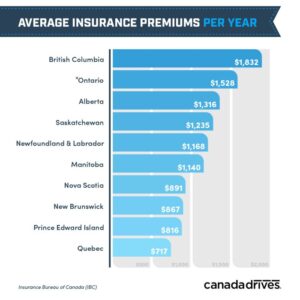

Trustage competes with established players like Geico, Progressive, and State Farm. While a direct comparison requires access to specific policy details, we can illustrate a potential comparison based on typical offerings. Trustage might offer a simpler, more streamlined approach, potentially sacrificing some bells and whistles for lower premiums. Major competitors often offer a broader range of coverage options and add-ons, catering to a wider customer base with varying needs and budgets.

Comparison Table: Trustage vs. Competitors

| Feature | Trustage | Geico | Progressive | State Farm |

|---|---|---|---|---|

| Liability Coverage (minimum) | $25,000/$50,000/$10,000 (example) | $25,000/$50,000/$10,000 (example) | $25,000/$50,000/$10,000 (example) | $25,000/$50,000/$10,000 (example) |

| Collision Deductible (example) | $500 | $500 – $1000+ | $500 – $1000+ | $500 – $1000+ |

| Comprehensive Deductible (example) | $500 | $500 – $1000+ | $500 – $1000+ | $500 – $1000+ |

| Uninsured/Underinsured Motorist Coverage | Available (limits vary) | Available (limits vary) | Available (limits vary) | Available (limits vary) |

| Roadside Assistance | May be offered as an add-on | Often included in packages | Often included in packages | Often included in packages |

*Note: The figures in this table are examples and may not reflect actual policy offerings. Contact each insurer directly for current rates and coverage details.*

The “Personal Invitation Number”

Source: georgiasown.org

Your personal invitation number is more than just a string of digits; it’s your unique key to accessing Trustage Auto Insurance’s special offer. Think of it as a VIP pass, granting you access to exclusive rates and streamlined application processes not available to the general public. This number ensures that your application is properly linked to the invitation and allows us to track the success of our outreach programs.

This number plays a crucial role in verifying your eligibility for the special offer and ensures a smooth and efficient application process. It acts as a digital handshake, confirming your connection to the invitation and allowing our system to automatically apply the relevant discounts and benefits. Without this number, your application might be processed as a standard application, potentially missing out on the significant savings and benefits offered through this invitation.

Security Measures Protecting the Personal Invitation Number

Trustage Auto Insurance employs robust security measures to protect your personal invitation number and safeguard your information. These measures include encryption protocols during transmission, secure storage in encrypted databases, and multi-factor authentication for access to sensitive data. We regularly monitor our systems for any unauthorized activity and employ advanced fraud detection technologies to identify and prevent potential breaches. Your privacy is our utmost priority.

Consequences of Sharing or Misusing the Invitation Number

Sharing your personal invitation number with unauthorized individuals could lead to several serious consequences. Firstly, it could compromise your personal information, potentially leading to identity theft or fraudulent activities. Secondly, it could result in the loss of the exclusive benefits associated with the invitation. Someone else could use your number to secure the discounted rates intended for you, leaving you without access to those savings. Finally, misuse of the number could violate Trustage’s terms of service, potentially resulting in the cancellation of your application or even legal action.

Hypothetical Scenario Illustrating Risks

Imagine Sarah receives a personal invitation number for a discounted auto insurance rate. Excited about the savings, she casually mentions the number to a friend at a coffee shop. Unbeknownst to Sarah, this friend has malicious intentions. They use Sarah’s number to apply for insurance under a false identity, securing the discounted rate for themselves. Sarah is left without the promised discount, and her personal information is potentially at risk due to the unauthorized use of her number. This illustrates the importance of keeping your personal invitation number confidential and secure.

Customer Experience and Communication: Trustage Auto Insurance Personal Invitation Number

Source: peopledrivencu.org

Trustage Auto Insurance’s success hinges on its ability to provide a seamless and positive customer experience. Effective communication is key, and understanding how customers interact with the company, both positively and negatively, is crucial for continuous improvement. This section delves into Trustage’s customer service channels and analyzes their effectiveness.

Positive experiences often revolve around swift claim processing and helpful, knowledgeable agents. For example, many customers praise Trustage’s efficient online portal for managing policies and submitting claims. Conversely, negative experiences frequently center around long wait times on the phone, difficulties navigating the website, or feeling dismissed by customer service representatives. One recurring complaint mentions a lack of proactive communication regarding claim updates, leaving customers feeling frustrated and in the dark.

Snagging that Trustage auto insurance personal invitation number is key for sweet deals, right? But before you dive in, checking out online reviews, like those on aaa home insurance reddit , can give you a broader sense of insurer reputations. This helps you compare and choose the best fit, ultimately making that Trustage number even more valuable in the long run.

Trustage’s Customer Service Channels

Trustage offers a variety of ways for customers to connect: phone, email, and an online portal. Each channel has its strengths and weaknesses.

The following list details the advantages and disadvantages of each customer service option, allowing for a comprehensive understanding of the customer journey.

- Phone:

- Advantages: Immediate assistance, ability to clarify complex issues verbally, personal interaction.

- Disadvantages: Potential for long wait times, limited availability (operating hours), reliance on agent knowledge and availability.

- Email:

- Advantages: Provides a written record of communication, allows for considered responses, accessible 24/7.

- Disadvantages: Slower response times compared to phone, less personal interaction, potential for miscommunication due to lack of verbal cues.

- Online Portal:

- Advantages: 24/7 accessibility, convenient self-service options (policy management, claim updates), efficient for simple tasks.

- Disadvantages: Can be challenging to navigate for less tech-savvy users, limited assistance for complex issues, lack of immediate human interaction.

Marketing and Sales Strategies

Trustage Auto Insurance’s success hinges on a robust and targeted marketing strategy that effectively communicates its value proposition, particularly the unique benefit of the Personal Invitation Number. This strategy needs to resonate with the target demographic and drive customer acquisition.

Trustage likely employs a multi-channel approach, leveraging both digital and traditional methods to reach its potential customer base. The effectiveness of these channels varies, depending on the target audience segment and the overall marketing budget allocation.

Primary Marketing Channels

Trustage’s marketing likely incorporates a mix of digital channels such as targeted online advertising (Google Ads, social media campaigns on platforms like Facebook and Instagram), search engine optimization () to improve organic search ranking, and email marketing to nurture leads and engage existing customers. Traditional channels may include print advertising in local newspapers or magazines, radio spots, and potentially television commercials in specific geographic areas. The effectiveness of each channel is continuously measured and adjusted based on performance data, such as click-through rates, conversion rates, and return on investment (ROI). For example, a highly successful Facebook campaign might lead to a reallocation of budget from underperforming print advertisements.

Effectiveness of Marketing Channels, Trustage auto insurance personal invitation number

The effectiveness of Trustage’s marketing channels is dependent on various factors. Digital channels generally offer better targeting capabilities, allowing Trustage to reach specific demographics and interests with tailored messaging. This precision increases the likelihood of converting leads into paying customers compared to broader reach channels like television advertising. However, traditional channels might still be valuable in reaching older demographics who may be less active online. Effective measurement and analysis of campaign performance across all channels are crucial for optimizing the marketing mix and maximizing ROI. For example, A/B testing different ad creatives on social media can reveal which messaging resonates best with the target audience, leading to improved conversion rates.

Mock Advertisement

Headline: Get the Best Rate with Your Personal Invitation Number!

Image: A smiling family sitting in a new car, clearly enjoying a road trip. The image is bright, clean, and evokes feelings of happiness and security.

Body Copy: Tired of overpaying for auto insurance? Use your Personal Invitation Number and unlock exclusive discounts from Trustage! Get a personalized quote today and see how much you can save. It’s quick, easy, and secure. Visit our website or call us at [phone number] to get started. Don’t miss out – your savings await!

Call to Action: Get your personalized quote now! [website link]

Improving Marketing Strategies

Trustage could enhance its customer acquisition by implementing several strategies. Firstly, leveraging user-generated content (UGC) by encouraging satisfied customers to share their positive experiences on social media could significantly boost brand credibility and trust. Secondly, partnering with complementary businesses, such as car dealerships or auto repair shops, could expand reach and generate leads. Thirdly, refining the personalization of marketing messages based on individual customer data (with appropriate privacy measures in place) would enhance engagement and conversion rates. Finally, investing in advanced analytics and data-driven decision-making to continuously optimize campaigns would yield better ROI and improve overall marketing effectiveness. For instance, analyzing customer demographics and driving habits could allow Trustage to create more tailored insurance packages and targeted marketing campaigns.

Data Privacy and Security Concerns

Source: cuanswers.com

Trustage Auto Insurance understands that your personal information is valuable, and we’re committed to protecting it. We employ robust security measures to safeguard your data, particularly the sensitive Personal Invitation Number (PIN) used for accessing your policy information. Our commitment extends beyond mere compliance; we strive to exceed industry best practices to ensure your peace of mind.

Your data security is paramount. We have implemented multiple layers of protection to ensure the confidentiality and integrity of your information. This includes stringent access controls, data encryption both in transit and at rest, and regular security audits to identify and address vulnerabilities. The PIN itself is a critical component of this security system, acting as a crucial gatekeeper to your personal details.

Trustage’s Data Protection Policies and Procedures

Trustage adheres to a comprehensive data protection policy that aligns with relevant regulations like GDPR and CCPA. This policy dictates how we collect, use, store, and protect your personal information. Specific procedures are in place to manage data access, ensuring that only authorized personnel with a legitimate business need can access your information. These procedures are regularly reviewed and updated to reflect evolving security threats and best practices. We also conduct regular employee training sessions on data security awareness and best practices. Failure to adhere to these policies results in disciplinary action, up to and including termination.

Confidentiality of Customer Information, Particularly the Personal Invitation Number

The Personal Invitation Number (PIN) is a unique identifier designed to enhance security. It is not directly linked to any personally identifiable information within our database. Instead, it acts as a key to access a secure, encrypted data segment containing your policy details. Access to this segment is further restricted by multi-factor authentication protocols, requiring not only the PIN but also other verification steps. This layered approach significantly reduces the risk of unauthorized access, even if the PIN were somehow compromised. Furthermore, any attempt to access your information is logged and monitored, providing an audit trail for security analysis.

Comparison of Trustage’s Data Security Practices with Industry Best Practices

Trustage’s data security practices are benchmarked against industry leaders and comply with or exceed the standards set by organizations such as NIST (National Institute of Standards and Technology). We employ advanced encryption techniques, regularly update our security software, and conduct penetration testing to proactively identify and mitigate potential vulnerabilities. Our infrastructure is hosted on secure, cloud-based servers with robust physical and network security measures. This proactive approach, combined with our commitment to ongoing improvement, ensures we maintain a high level of data security. For example, unlike some competitors who only conduct annual security audits, Trustage conducts quarterly audits to ensure ongoing protection.

Data Flow and Security Measures Related to the Personal Invitation Number

The following illustrates the data flow and security measures related to the Personal Invitation Number (PIN):

[Imagine a flowchart here. The flowchart would start with a customer attempting to access their account using their PIN. This would then lead to a verification step, perhaps involving a second factor authentication. Successful verification would grant access to an encrypted data segment containing policy details. The flowchart would clearly show the encryption at various points, the logging of access attempts, and the restricted access controls. Failure at any verification step would result in access denial. The entire process would be shown within a secure network perimeter, clearly delineated.]

Potential for Fraud and Misuse

The implementation of a personal invitation number system, while offering benefits like targeted marketing and improved customer experience, introduces inherent vulnerabilities that could be exploited for fraudulent activities. Understanding these potential weaknesses and proactively implementing mitigation strategies is crucial for Trustage Auto Insurance to maintain its reputation and protect its customers. Failure to do so could lead to significant financial losses, reputational damage, and legal repercussions.

The primary concern revolves around the potential for unauthorized access and use of these unique numbers. This could involve malicious actors obtaining numbers through data breaches, phishing scams, or insider threats. Once obtained, these numbers could be used to create fraudulent insurance policies, file false claims, or gain unauthorized access to customer information. The consequences of such breaches extend beyond immediate financial losses; they can erode customer trust and damage the company’s brand image.

Vulnerabilities and Mitigation Strategies

Several vulnerabilities exist within a personal invitation number system. For instance, a weak password policy or insufficient data encryption could allow hackers to gain access to the database containing these numbers. Similarly, a lack of robust monitoring and detection systems could allow fraudulent activities to go unnoticed for extended periods. To mitigate these risks, Trustage should implement multi-factor authentication, strong encryption protocols, and real-time fraud detection systems. Regular security audits and penetration testing are also essential to identify and address potential weaknesses before they can be exploited. Furthermore, employee training programs focusing on data security and fraud awareness should be a priority. A robust incident response plan, detailing steps to be taken in the event of a data breach or fraudulent activity, is also critical. For example, a compromised database might require immediate password resets for all affected users and a thorough investigation to identify the source of the breach.

Legal and Ethical Implications

Fraudulent activities involving personal invitation numbers carry significant legal and ethical implications. Depending on the jurisdiction, such actions could lead to criminal charges, civil lawsuits, and hefty fines. Trustage has a legal and ethical responsibility to protect its customers’ data and prevent fraudulent activities. Failing to do so could result in legal action from affected customers and regulatory bodies. Ethically, Trustage has a duty to act with transparency and accountability, ensuring that its systems are secure and that appropriate measures are in place to prevent fraud. The company’s reputation is intrinsically linked to its ability to protect customer data and maintain ethical business practices. A significant breach could lead to a loss of customer trust, irreparable damage to the company’s reputation, and a substantial decrease in business.

Preventative Measures

Implementing a comprehensive set of preventative measures is crucial for minimizing the risk of fraud.

- Implement multi-factor authentication for all access points to the database containing personal invitation numbers.

- Employ robust encryption protocols to protect the confidentiality and integrity of the data.

- Establish a real-time fraud detection system capable of identifying and flagging suspicious activities.

- Conduct regular security audits and penetration testing to identify and address vulnerabilities.

- Develop and implement a comprehensive employee training program on data security and fraud awareness.

- Create a detailed incident response plan to effectively manage and mitigate the impact of security breaches.

- Establish a clear and accessible reporting mechanism for customers to report suspicious activity.

- Regularly review and update security policies and procedures to adapt to evolving threats.

- Partner with reputable cybersecurity firms for ongoing security assessments and threat intelligence.

- Implement data loss prevention (DLP) measures to prevent sensitive data from leaving the company’s controlled environment.

Conclusive Thoughts

So, there you have it – the inside scoop on Trustage Auto Insurance and its personal invitation number. From understanding its significance to navigating potential security concerns, we’ve covered the essentials. Remember, your personal invitation number is a valuable asset; treat it with the care it deserves. By understanding the system and being proactive, you can ensure a smooth and secure experience with Trustage. Drive safe, and drive informed!