Three commercial insurance types are crucial for safeguarding your business. Understanding these – general liability, commercial property, and commercial auto – is key to navigating the complexities of risk management. Each offers unique coverage, protecting your assets and operations from various unforeseen events. This guide breaks down the essentials, helping you choose the right mix for your specific needs and budget.

We’ll explore the core differences in coverage, examine factors influencing costs (like business size and risk profile), and walk you through the claims process. We’ll also look at selecting the right insurer, considering factors like customer service and policy terms. By the end, you’ll be equipped to make informed decisions about protecting your business’s future.

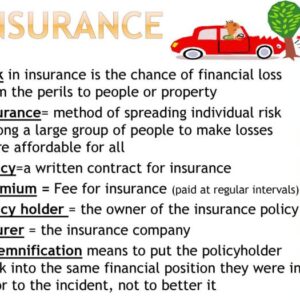

Types of Commercial Insurance

Source: slideserve.com

Navigating the world of commercial insurance can feel like wading through a swamp of jargon. But understanding the basics is crucial for protecting your business from unforeseen financial setbacks. This breakdown simplifies the three main categories, highlighting their key differences and helping you choose the right coverage for your specific needs.

Commercial insurance policies are designed to safeguard businesses of all sizes and across diverse industries. They offer protection against a wide array of risks, from property damage to liability claims. The specific type of coverage a business needs depends heavily on its operations, size, and potential exposure to risk.

Property Insurance

Property insurance covers physical damage to a business’s buildings, equipment, and inventory. This includes damage caused by fire, theft, vandalism, or natural disasters. Think of it as a safety net for your physical assets. A bakery, for example, would need property insurance to protect its ovens, mixers, and the building itself. A tech startup might need coverage for their servers and office equipment. The policy typically Artikels the insured value of the property and the coverage limits in case of loss or damage. Different policies offer varying levels of coverage, from basic protection against fire and theft to more comprehensive coverage encompassing a wider range of perils.

Liability Insurance

Liability insurance protects businesses against financial losses resulting from claims of bodily injury or property damage caused by their operations. This is particularly crucial as it covers legal fees and settlements associated with lawsuits. A coffee shop, for instance, might face a liability claim if a customer slips and falls on a wet floor. A construction company could face liability for injuries sustained by a worker on a job site. Different types of liability insurance exist, including general liability, professional liability (errors and omissions), and product liability, each tailored to specific business risks.

Business Interruption Insurance

Business interruption insurance covers the loss of income a business experiences due to unforeseen events that disrupt operations. This could include natural disasters, fires, or even a major power outage. This type of insurance helps bridge the gap in revenue during the period of recovery. A restaurant forced to close due to a fire would be covered for lost revenue during the time it takes to rebuild and reopen. A manufacturing plant shut down due to a hurricane would be compensated for lost production and sales. The policy typically covers expenses like rent, utilities, and employee salaries during the interruption period.

| Type of Insurance | Key Features | Benefits | Potential Drawbacks |

|---|---|---|---|

| Property Insurance | Covers physical damage to buildings, equipment, and inventory; various coverage levels available. | Protects valuable business assets; minimizes financial losses from damage; provides peace of mind. | May not cover all potential perils; deductibles can be substantial; premiums can be high depending on risk factors. |

| Liability Insurance | Covers legal costs and settlements from claims of bodily injury or property damage; various types available (general, professional, product). | Protects against costly lawsuits; mitigates financial risk associated with accidents or negligence; essential for many businesses. | Premiums can be significant; policy exclusions may limit coverage; may not cover intentional acts. |

| Business Interruption Insurance | Covers loss of income due to disruptions in operations; often covers ongoing expenses during downtime. | Maintains financial stability during disruptions; enables business continuity; helps with recovery. | Requires careful assessment of potential risks; premiums can be substantial; may have specific exclusions regarding certain causes of interruption. |

Factors Influencing Commercial Insurance Costs

Securing the right commercial insurance is crucial for any business, but understanding the factors that determine your premium is equally important. It’s not just about ticking a box; it’s about finding the best coverage at a price that fits your budget. Let’s delve into the key elements that influence how much you’ll pay for your commercial insurance.

The cost of your commercial insurance premium isn’t arbitrary; it’s a carefully calculated reflection of your business’s risk profile. Several interconnected factors play a significant role, and understanding these can help you make informed decisions to potentially lower your costs. These factors interact in complex ways, meaning a change in one area can significantly impact the overall premium.

Business Size

Business size directly correlates with risk exposure and, consequently, insurance premiums. Larger businesses typically have more employees, handle higher volumes of transactions, and own more assets. This translates to a greater potential for accidents, lawsuits, and property damage, all of which increase the insurer’s potential payout. For example, a large manufacturing plant will naturally command a higher premium than a small home-based consultancy, due to the significantly greater potential for workplace accidents and property damage. Insurers assess the scale of operations and the potential financial impact of claims to determine the appropriate premium. Smaller businesses often benefit from lower premiums due to their comparatively smaller risk profiles.

Industry Type

The nature of your business plays a crucial role in determining insurance costs. High-risk industries, such as construction or manufacturing, inherently face greater potential for accidents and injuries. These industries typically require specialized insurance policies and often attract higher premiums to reflect the increased risk the insurer assumes. Conversely, businesses in lower-risk industries, such as administrative services or software development, may qualify for lower premiums due to their generally lower risk profiles. Consider a construction company versus a software development firm; the construction company faces significantly higher risks associated with workplace accidents and property damage, leading to a higher premium.

Risk Profile

Your business’s risk profile is a comprehensive assessment of your vulnerability to various types of loss. This involves examining factors like safety procedures, claims history, and the inherent hazards associated with your operations. A business with a strong safety record, comprehensive risk management strategies, and a history of few claims will generally receive more favorable rates. Conversely, a business with a history of accidents, safety violations, or numerous claims will likely face higher premiums. For instance, a restaurant with a robust safety program and a clean inspection record will likely secure a lower premium compared to a restaurant with repeated health code violations and a history of customer injury claims.

Claims History and Safety Measures

A clean claims history is a significant factor in determining insurance premiums. Businesses with few or no past claims demonstrate a lower risk profile, making them more attractive to insurers. Conversely, a history of frequent or significant claims will likely result in higher premiums, reflecting the increased risk the insurer is taking on. Implementing robust safety measures not only protects your employees and assets but also demonstrates a commitment to risk mitigation, potentially leading to lower insurance costs. Investing in safety training, implementing preventative measures, and maintaining detailed records of safety procedures can significantly influence your insurance premium.

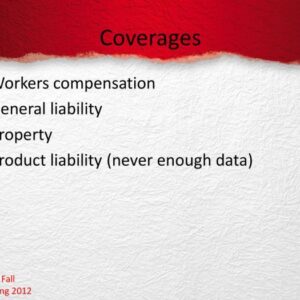

Coverage Options within Commercial Insurance

Source: insurigoinc.com

Navigating the world of commercial insurance can feel like wading through a swamp of jargon. But understanding your coverage options is crucial for protecting your business from unforeseen events. Choosing the right coverage isn’t just about ticking boxes; it’s about strategically safeguarding your assets and future. This section breaks down three common coverage options, highlighting their benefits, limitations, and suitability for different business types.

General Liability Insurance

General liability insurance protects your business from financial losses stemming from bodily injury or property damage caused by your operations or employees. Think of a customer slipping on a wet floor in your store, or an employee accidentally damaging a client’s property. This coverage helps cover medical bills, legal fees, and settlements. It’s a cornerstone of most commercial insurance policies, offering a crucial safety net against common accidents.

Examples of situations where general liability insurance is beneficial include a customer suing your business after falling on your premises, or a contractor damaging a client’s property while working on a project for your company. Limitations typically include intentional acts, employee injuries (covered under workers’ compensation), and damage to your own property. Exclusions vary widely depending on the policy, so careful review of the policy wording is essential.

Commercial Property Insurance

Commercial property insurance safeguards your business’s physical assets, such as buildings, equipment, and inventory, from various perils. This includes fire, theft, vandalism, and even natural disasters like floods or hurricanes (depending on the policy). The level of protection offered depends on the specific policy, but it generally covers the cost of repairing or replacing damaged property. This insurance is critical for maintaining business operations and preventing financial ruin following a significant event.

An example of a beneficial situation would be a fire destroying a significant portion of your office space and inventory. Commercial property insurance would cover the costs of rebuilding and replacing the damaged assets. Limitations might include specific exclusions like flood damage (unless explicitly added as an endorsement) or acts of war. Again, carefully examine the policy details to understand what’s covered and what isn’t.

Business Interruption Insurance

Business interruption insurance, often called Business Income Insurance, steps in when an insured peril forces your business to temporarily close its doors. This isn’t about physical damage; it’s about the loss of income during the period of disruption. A fire, a natural disaster, or even a major power outage could trigger a claim. This coverage helps compensate for lost revenue, continuing expenses, and other costs incurred while your business is unable to operate normally. It’s a vital safety net to ensure your business can weather the storm and recover quickly.

For example, a severe storm causing a power outage could shut down your restaurant for several days. Business interruption insurance would help cover lost revenue during the closure. Limitations often involve the length of the interruption and the specific cause of the disruption. Some policies have waiting periods before coverage kicks in, and certain events, like gradual deterioration, are usually excluded.

Cost-Effectiveness and Risk Mitigation Comparison

| Coverage Type | Cost-Effectiveness | Risk Mitigation Potential | Suitable for | Unsuitable for |

|---|---|---|---|---|

| General Liability | Moderate cost, high potential return (avoiding large lawsuits) | High for businesses interacting with the public or employing others | Retail stores, restaurants, service businesses, contractors | Businesses with minimal public interaction |

| Commercial Property | Cost varies widely based on property value and risk; high potential return (protecting physical assets) | High for businesses with significant physical assets | Retail stores, manufacturers, offices with significant equipment | Businesses operating primarily online with minimal physical assets |

| Business Interruption | Higher cost, but crucial for recovery and business continuity | High for businesses with high operating costs and potential for significant revenue loss during downtime | Restaurants, hotels, manufacturing plants | Businesses with low operating costs and high resilience to downtime |

Claims Process for Commercial Insurance

Navigating the claims process for your commercial insurance can feel like wading through a swamp, but understanding the steps involved can significantly ease the burden. A smooth and efficient claims process is crucial for minimizing disruption to your business operations and ensuring you receive the financial compensation you’re entitled to. This section Artikels the typical steps, required documentation, and effective communication strategies to help you navigate this crucial aspect of commercial insurance.

The claims process generally involves several key stages, from initial reporting to final settlement. Each stage requires specific actions from the insured business, and effective communication with your insurance provider is paramount throughout the entire process. Remember, the quicker and more accurately you provide information, the smoother the claims process will be.

Three commercial insurance types—property, liability, and workers’ compensation—protect businesses from various risks. Understanding these is crucial, but it’s equally important to grasp the basics of personal insurance, which covers individual risks. To get a clearer picture of what that means, check out this helpful resource on personal insurance meaning. Knowing the difference between commercial and personal insurance is key to securing the right coverage for your specific needs, whether you’re a business owner or an individual.

Documentation Required for a Commercial Insurance Claim

Submitting a complete and accurate claim requires meticulous documentation. Missing or incomplete information can significantly delay the process. Essential documents typically include the insurance policy itself, detailed descriptions of the loss or damage, supporting evidence such as police reports (in case of theft or vandalism), repair estimates, invoices, and photographs of the damaged property or equipment. For employee injury claims, medical reports, witness statements, and payroll records might also be required. Keeping meticulous records throughout the year is crucial; this will make filing a claim significantly less stressful. Imagine trying to recall the details of an incident months after it occurred – having comprehensive records is invaluable.

The Insured Business’s Role in the Claims Process

The insured business plays a pivotal role in a successful claim. Your responsibilities include promptly reporting the incident to your insurance provider, cooperating fully with the investigation, providing all necessary documentation in a timely manner, and accurately answering all questions posed by the insurance adjuster. Failing to cooperate or providing inaccurate information can jeopardize your claim. Consider appointing a dedicated point of contact within your business to manage the claims process. This ensures consistent communication and avoids potential confusion. This dedicated person can collect necessary documents and communicate effectively with the insurance provider, streamlining the process.

Effective Communication with the Insurance Provider

Open and proactive communication is essential. Maintain detailed records of all communication, including dates, times, and the names of individuals you’ve spoken with. Clearly articulate the facts of the incident, avoiding speculation or exaggeration. Be responsive to requests for additional information, and promptly address any questions or concerns raised by the adjuster. Regularly follow up on the progress of your claim to ensure it remains on track. Consider using email for important communications to maintain a written record of your interactions. This allows for easy referencing should any disputes arise.

Step-by-Step Guide to Handling a Commercial Insurance Claim

Successfully navigating the claims process requires a systematic approach. Following these steps will significantly increase your chances of a smooth and efficient resolution.

- Report the incident promptly: Contact your insurance provider as soon as possible after the incident occurs, following the instructions Artikeld in your policy.

- Gather necessary documentation: Collect all relevant documents, including the insurance policy, police reports, repair estimates, invoices, photographs, and any other supporting evidence.

- Complete the claim form accurately: Fill out the claim form thoroughly and accurately, providing all requested information.

- Cooperate with the investigation: Fully cooperate with the insurance adjuster’s investigation, providing any requested information or documentation promptly.

- Maintain detailed records: Keep records of all communication, including dates, times, and names of individuals involved.

- Follow up on the progress of your claim: Regularly check the status of your claim and address any questions or concerns promptly.

Choosing the Right Commercial Insurance Provider

Selecting the right commercial insurance provider is crucial for safeguarding your business against unforeseen risks. A poorly chosen provider can leave your business vulnerable, while a well-chosen one offers peace of mind and robust protection. This decision shouldn’t be taken lightly; it requires careful consideration of several key factors.

Key Factors in Selecting a Commercial Insurance Provider

Businesses should prioritize three key aspects when choosing an insurance provider: financial stability, the breadth and depth of coverage offered, and the quality of customer service. Financial stability ensures the provider can pay out claims when needed. Comprehensive coverage protects your business from a wide range of potential risks. Excellent customer service guarantees a smooth claims process and responsive support when you need it most. Ignoring any of these could have significant consequences.

National vs. Regional Insurers: A Comparison

The choice between a large national insurer and a smaller, regional provider often comes down to individual business needs and preferences. National insurers typically offer broader coverage options and a more established reputation, but they may also come with higher premiums and less personalized service. Regional providers, on the other hand, often provide more localized expertise and potentially lower premiums, but their coverage options might be more limited, and their financial stability may not be as readily apparent.

The Importance of Policy Review and Customer Service Ratings, Three commercial insurance

Before signing any contract, thoroughly review the policy terms and conditions. Pay close attention to exclusions, deductibles, and the claims process. Don’t hesitate to ask clarifying questions; it’s your business’s future at stake. Furthermore, checking independent customer service ratings from sources like the Better Business Bureau or independent review sites provides valuable insight into the provider’s responsiveness and reliability in handling claims and addressing customer concerns. Negative reviews can be a red flag, indicating potential problems down the line.

Provider Type Comparison

| Provider Type | Pros | Cons | Example |

|---|---|---|---|

| Large National Insurer | Broad coverage options, established reputation, significant financial strength. | Higher premiums, less personalized service, potentially slower claims processing. | A large, well-known company like Liberty Mutual or State Farm. |

| Smaller Regional Insurer | Potentially lower premiums, more personalized service, localized expertise. | More limited coverage options, potentially less financial strength, potentially less established reputation. | A smaller, regional insurance company with a strong presence in a specific geographic area. |

| Specialized Insurer | Deep expertise in specific industries or risk types, tailored coverage options. | Higher premiums than general insurers, limited scope of coverage outside of their specialization. | A company specializing in insuring technology businesses or medical practices. |

| Online Insurer | Convenience, often competitive pricing, quick quotes and application process. | Limited personal interaction, potential difficulty resolving complex claims, may lack the established reputation of traditional insurers. | An online-only insurance provider that uses technology to streamline the insurance process. |

Illustrative Scenarios of Commercial Insurance Applications: Three Commercial Insurance

Source: ferguson-alliance.com

Understanding how commercial insurance works is best done through real-world examples. These scenarios illustrate the vital role insurance plays in protecting businesses from significant financial losses. Each example highlights a specific type of coverage and the potential devastation of lacking it.

Scenario 1: The Coffee Shop Spill

Imagine a bustling coffee shop, “The Daily Grind,” where a barista accidentally spills a vat of scalding hot coffee on a customer, causing severe burns. This results in significant medical expenses for the customer and potential legal action against the coffee shop for negligence. The coffee shop’s General Liability insurance policy would cover the customer’s medical bills, legal fees, and any potential settlement or judgment. Without this coverage, The Daily Grind could face crippling debt, potentially leading to business closure. The financial consequences of not having adequate liability insurance could easily reach hundreds of thousands of dollars, depending on the severity of the injury and the legal proceedings. This scenario demonstrates the importance of comprehensive general liability coverage, protecting businesses from claims arising from bodily injury or property damage caused by their operations.

Scenario 2: The Tech Startup’s Data Breach

“InnovateTech,” a rapidly growing tech startup, experiences a significant data breach, exposing sensitive customer information. This leads to a massive loss of customer trust, regulatory fines from data protection agencies (like the GDPR in Europe or CCPA in California), and costly legal battles to mitigate the damage. InnovateTech’s Cyber Liability insurance policy would cover the costs associated with notifying affected customers, hiring cybersecurity experts to investigate and rectify the breach, legal fees for regulatory compliance, and potential lawsuits from customers. Without cyber liability insurance, InnovateTech could face millions of dollars in fines, legal costs, and reputational damage, potentially leading to bankruptcy. This underscores the critical need for cyber liability insurance in today’s digital age, especially for businesses handling sensitive customer data. The potential financial impact of a data breach without insurance is practically immeasurable, considering the legal, reputational, and financial ramifications.

Scenario 3: The Construction Company’s Accident

“BuildStrong Construction,” a medium-sized construction firm, is working on a large-scale project when a worker falls from scaffolding, sustaining serious injuries. This results in significant medical expenses for the worker, lost wages, and potential workers’ compensation claims. BuildStrong’s Workers’ Compensation insurance policy covers the injured worker’s medical expenses, lost wages, and rehabilitation costs. Furthermore, the policy protects the company from potential lawsuits from the worker or their family. Without workers’ compensation insurance, BuildStrong would be directly liable for all these costs, potentially facing substantial financial ruin. The financial consequences in this scenario could be catastrophic, encompassing not only the immediate medical and legal costs but also potential long-term disability payments and legal battles. This highlights the critical importance of workers’ compensation insurance for businesses employing others, protecting both the employees and the company itself.

Ultimate Conclusion

Protecting your business from financial ruin requires a proactive approach to insurance. Understanding the three main types of commercial insurance—general liability, commercial property, and commercial auto—is just the first step. By carefully considering your specific risks, comparing coverage options, and choosing a reliable insurer, you can build a robust safety net for your business. Don’t let unforeseen events derail your success; arm yourself with the right insurance coverage.