Restaurant insurance quote: Navigating the world of restaurant insurance can feel like ordering from a menu with too many options. From protecting your property and precious espresso machine to covering liability claims from a spilled latte incident, the right coverage is crucial. This guide breaks down the essentials, helping you secure the best restaurant insurance quote without getting lost in the fine print.

Understanding your specific needs as a restaurant owner is the first step. Factors like your restaurant’s size, location, type of cuisine, and even your claims history significantly impact your insurance premiums. We’ll walk you through identifying the key risks, comparing coverage options from different providers, and ultimately securing the best policy for your unique situation. Get ready to become a savvy insurance shopper!

Understanding Restaurant Insurance Needs

Navigating the world of restaurant insurance can feel like ordering from a menu with too many unfamiliar options. But understanding your needs is crucial for protecting your business from unexpected setbacks. The right coverage can mean the difference between weathering a storm and closing your doors.

Restaurant Risk Profiles

Different restaurant types face unique challenges. Fine dining establishments, with their high-value inventory and sophisticated equipment, face different risks than a bustling fast-casual joint. Cafes, with their emphasis on ambiance and potentially delicate pastries, have their own set of concerns. Fine dining restaurants might worry more about potential damage to expensive wine cellars or art, while fast-casual places might prioritize slip-and-fall liability due to high foot traffic. Cafes, on the other hand, might focus on protecting their delicate equipment and specialized coffee makers. Understanding these nuances is key to selecting the appropriate insurance.

Common Restaurant Insurance Coverages

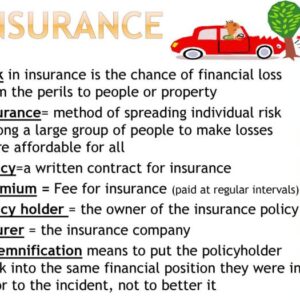

Several key insurance types are essential for most restaurants. Property insurance protects your building, equipment, and inventory against damage from fire, theft, or natural disasters. Liability insurance covers claims of bodily injury or property damage caused by your business operations. Workers’ compensation insurance protects your employees in case of workplace injuries. Additional coverages, such as product liability (for food poisoning claims) and business interruption insurance (to cover lost income during a closure), can also be highly beneficial, especially for larger operations.

Factors Influencing Restaurant Insurance Costs

Several factors significantly impact the cost of your restaurant insurance premium. Location plays a significant role; higher crime rates or areas prone to natural disasters will generally result in higher premiums. The size of your restaurant directly correlates with the amount of coverage needed and, consequently, the cost. The type of cuisine you offer can also influence premiums; restaurants handling raw seafood or other highly perishable items might face higher risks and higher costs. Finally, your claims history is a major factor; a history of claims will likely lead to increased premiums. For example, a restaurant in a high-crime area with a history of break-ins will pay more than a similar restaurant in a safer area with a clean claims record.

Restaurant Insurance Provider Comparison

The following table compares coverage and price ranges from three hypothetical insurance providers. Remember, actual prices will vary based on your specific circumstances.

| Provider | Coverage Types | Price Range (Annual) | Key Features |

|---|---|---|---|

| InsureMyEatery | Property, Liability, Workers’ Compensation, Business Interruption | $1,500 – $5,000 | Online portal, 24/7 claims support |

| Restaurant Shield | Property, Liability, Workers’ Compensation, Product Liability | $2,000 – $6,000 | Dedicated account manager, flexible payment options |

| FoodBizProtect | Property, Liability, Workers’ Compensation, Business Interruption, Cyber Liability | $2,500 – $7,500 | Extensive coverage options, strong reputation |

Obtaining Restaurant Insurance Quotes

Getting the right restaurant insurance can feel like navigating a culinary labyrinth, but don’t worry, we’re here to guide you through the process. Securing multiple quotes is crucial for finding the best coverage at the most competitive price. Think of it as taste-testing different sauces before choosing the perfect one for your dish (your restaurant!).

The process of obtaining quotes involves contacting several insurance providers, outlining your restaurant’s specific needs, and comparing their offerings. This allows you to make an informed decision based on factors like coverage, premiums, and the insurer’s reputation. Remember, you’re not just buying insurance; you’re building a safety net for your business.

Comparing Insurance Quotes Effectively

Comparing quotes isn’t just about finding the cheapest option; it’s about finding the best value for your money. This means carefully analyzing the coverage provided by each insurer, ensuring it aligns with your restaurant’s unique risks and needs. Don’t be swayed solely by the premium; consider the level of protection offered. For instance, a slightly higher premium might offer broader liability coverage, protecting you against costly lawsuits.

Consider these key factors when comparing quotes: the amount of coverage offered for various risks (like property damage, liability, and business interruption), the deductible amount, the policy’s exclusions, and the insurer’s financial stability and customer service ratings. Imagine comparing two quotes: one offering minimal coverage for a low price, and another with comprehensive coverage for a slightly higher premium. The latter might be the wiser investment in the long run, safeguarding your business against significant financial losses.

Completing Insurance Applications Accurately

Accuracy is key when filling out insurance applications. Inaccurate information can lead to claim denials or even policy cancellations. Take your time, and ensure you provide complete and truthful answers to all questions. If you’re unsure about anything, contact the insurer directly for clarification.

A step-by-step approach is recommended: Begin by carefully reading the entire application. Next, gather all the necessary information, including details about your restaurant’s location, size, type of cuisine, number of employees, and annual revenue. Then, accurately complete each section of the application, double-checking for errors before submitting it. Finally, keep a copy of the completed application for your records. Think of this as meticulously preparing a recipe; each ingredient (information) is essential for the final outcome (successful insurance application).

Essential Documents for Restaurant Insurance Application

Having the right documents ready will streamline the application process. This saves time and prevents delays.

The specific documents required may vary depending on the insurer, but here’s a general checklist:

- Proof of business ownership (e.g., articles of incorporation, LLC operating agreement)

- Restaurant’s lease or deed

- Detailed description of your restaurant’s operations

- Financial statements (profit and loss statements, balance sheets)

- Current insurance policies (if any)

- Information about your employees (number of employees, job descriptions)

- Details of any previous insurance claims

Analyzing Insurance Policy Details: Restaurant Insurance Quote

Source: restorapos.com

So you’ve got a few restaurant insurance quotes in hand. Fantastic! But don’t let the excitement cloud your judgment. The real work begins now – dissecting those policies to find the perfect fit for your bustling eatery. This isn’t just about the price tag; it’s about understanding the fine print and ensuring you’re adequately protected.

Policy details can feel like navigating a dense jungle, but with a clear strategy, you’ll emerge victorious. Think of it as a culinary challenge – you wouldn’t serve a dish without knowing the ingredients, right? The same applies here. Understanding the specifics of each policy will determine whether it’s a five-star protection plan or a culinary catastrophe waiting to happen.

Policy Options and Coverage Limits

Different policies offer varying levels of coverage for different risks. For example, one policy might offer higher liability limits for customer injuries, while another might provide more robust coverage for property damage from fire or theft. Comparing these limits side-by-side is crucial. Imagine two policies: Policy A offers $1 million in liability coverage, while Policy B offers only $500,000. If a serious accident occurs, the difference could be significant, potentially leaving you personally liable for substantial costs under Policy B. Carefully review the specific coverage amounts for each potential risk, ensuring they align with your restaurant’s unique needs and potential liabilities.

Understanding Exclusions and Limitations

Every policy has exclusions – specific events or situations that aren’t covered. These can range from damage caused by intentional acts to specific types of equipment malfunctions. Similarly, limitations might restrict the amount paid out for certain claims or impose waiting periods before coverage kicks in. For example, flood damage might be excluded, or coverage for employee theft might have a specific cap. Ignoring these limitations could lead to unexpected out-of-pocket expenses in the event of a claim. Thoroughly review the policy documents to understand what is and isn’t covered to avoid unpleasant surprises later.

Implications of Deductibles

Your deductible is the amount you pay out-of-pocket before your insurance coverage begins. A higher deductible typically results in lower premiums, while a lower deductible means higher premiums. Choosing the right deductible involves balancing cost savings with your financial risk tolerance. A $5,000 deductible might seem attractive for saving on premiums, but could be a significant burden if you face a claim for a smaller incident. Consider your restaurant’s financial stability and the likelihood of needing to file a claim when making this decision. A higher deductible is generally suitable for restaurants with healthy cash flow and a lower risk profile.

Key Policy Features: A Comparison

Understanding the nuances of different policies is key to making an informed decision. Below is a comparison of key features, highlighting their advantages and disadvantages:

- Policy A: Comprehensive Coverage, High Premium

- Advantages: Extensive coverage for various risks, high liability limits, minimal exclusions.

- Disadvantages: Higher monthly premiums.

- Policy B: Basic Coverage, Low Premium

- Advantages: Lower monthly premiums.

- Disadvantages: Limited coverage, higher deductible, more exclusions.

- Policy C: Customized Coverage, Moderate Premium

- Advantages: Tailored to your specific needs, balanced coverage and premiums.

- Disadvantages: Might require more detailed discussions with the insurer to customize.

Remember, this is a simplified comparison. Always carefully review the full policy documents before making a decision. Don’t hesitate to ask your insurance provider for clarification on any points you don’t understand. Protecting your restaurant is an investment, and understanding your policy is the first step to ensuring that investment pays off.

Factors Affecting Quote Prices

Source: com.au

Getting the best restaurant insurance quote isn’t just about clicking “Get a Quote.” Several factors significantly influence the price you’ll pay, and understanding these can save you money and ensure you have the right coverage. Let’s break down the key elements that determine your premium.

Restaurant Location

Your restaurant’s location plays a crucial role in determining your insurance premiums. High-crime areas, areas prone to natural disasters (floods, earthquakes, hurricanes), and regions with higher rates of vandalism or theft will generally command higher premiums. Insurers assess risk based on historical data for specific locations. For example, a restaurant in a bustling city center with a history of break-ins might face higher premiums compared to a similar establishment in a quieter suburban neighborhood with a lower crime rate. The cost of rebuilding or repairing after a disaster also influences premiums; coastal areas with a high risk of hurricanes will likely see higher rates than inland locations.

Restaurant Size and Type of Operations, Restaurant insurance quote

The size of your restaurant directly correlates with the level of risk and therefore the insurance premium. A larger restaurant with more seating, equipment, and inventory will naturally require higher coverage and consequently a higher premium. The type of operations also matters. A fine-dining establishment with expensive equipment and high-value inventory will likely face higher premiums than a casual eatery with simpler operations. Consider a small pizza place versus a large, multi-level restaurant with a bar and outdoor seating – the insurance costs will reflect the differences in scale and complexity.

Restaurant Claims History

Your restaurant’s claims history is a major factor in determining your insurance rates. A history of frequent claims, even for minor incidents, can significantly increase your premiums. Insurers view frequent claims as indicators of higher risk, leading to higher premiums to offset potential future losses. Conversely, a restaurant with a clean claims history, demonstrating responsible risk management, can secure lower premiums as insurers perceive a lower likelihood of future claims. For example, a restaurant with multiple fire-related claims in the past might find it difficult to obtain affordable insurance or face significantly higher premiums.

Visual Representation of Factors and Insurance Costs

Imagine a three-dimensional graph. The X-axis represents restaurant size (small to large), the Y-axis represents location risk (low to high), and the Z-axis represents the insurance premium cost (low to high). The graph would show a rising surface, indicating that as restaurant size and location risk increase, so does the insurance premium. Points on the graph representing restaurants with a history of claims would be elevated further above the surface, illustrating the additional cost associated with a poor claims history. The type of restaurant operation could be represented by different colored points on the surface, showing how different business models (e.g., fine dining vs. fast casual) affect the premium within the same size and location parameters.

Securing the Best Insurance Coverage

Landing the perfect restaurant insurance policy isn’t just about ticking boxes; it’s about safeguarding your culinary dream. It’s about finding the right balance between comprehensive coverage and affordable premiums. This means asking the right questions, negotiating effectively, and meticulously reviewing the fine print. Let’s dive into the nitty-gritty of securing the best possible protection for your business.

Essential Questions for Insurance Providers

Before committing to a policy, a thorough understanding of the coverage offered is paramount. Don’t hesitate to engage in detailed discussions with multiple providers. Clarity is key to avoiding future headaches.

- The specific types of coverage included, such as property damage, liability, and business interruption, should be clearly defined and understood.

- Policy limits and deductibles should be transparent and easily accessible within the policy document.

- The claims process, including required documentation and typical processing times, should be clearly Artikeld.

- Exclusions and limitations within the policy should be carefully examined to understand what is not covered.

- The provider’s financial stability and reputation should be investigated to ensure they can meet their obligations in case of a claim.

Strategies for Negotiating Insurance Premiums

Negotiating insurance premiums might feel intimidating, but it’s a perfectly legitimate and often successful strategy. Remember, you’re a valuable client, and insurers are often willing to work with you.

One effective strategy is to compare quotes from multiple insurers. This allows you to leverage competitive pricing and potentially negotiate a lower premium based on a better offer from a competitor. Another approach is to demonstrate your commitment to risk mitigation. Implementing robust security measures, staff training programs, and regular safety inspections can significantly reduce your perceived risk, potentially leading to lower premiums. Consider bundling policies; some insurers offer discounts when you purchase multiple types of insurance from them (e.g., property and liability).

The Importance of Policy Review

Before signing on the dotted line, take your time to thoroughly read and understand every aspect of the policy document. Don’t hesitate to ask for clarification on anything that seems unclear. A missed clause or misunderstood term could have significant consequences later on. It’s not uncommon to discover a seemingly small detail that could save you significant money or prevent future problems. Imagine, for instance, discovering an exclusion for a specific type of equipment crucial to your business operation. A careful review prevents such surprises.

Filing a Claim: A Step-by-Step Guide

Knowing the claims process beforehand can alleviate stress during an already difficult situation. Most providers have a dedicated claims department, usually reachable by phone or online. It’s generally recommended to report the incident as soon as possible, ideally within the timeframe specified in your policy. Gather all relevant documentation, such as photos, police reports (if applicable), and witness statements. Maintain detailed records of all communication with the insurer, including dates, times, and names of individuals involved. Remember, prompt and accurate reporting significantly streamlines the claims process.

Wrap-Up

Source: central-insurance.com

Securing the right restaurant insurance quote isn’t just about ticking boxes; it’s about safeguarding your business’s future. By understanding the factors influencing premiums, comparing quotes effectively, and asking the right questions, you can confidently choose a policy that offers comprehensive coverage without breaking the bank. Remember, a little preparation goes a long way in protecting your investment and peace of mind. So, grab that metaphorical insurance menu, and let’s find the perfect fit for your culinary empire!