Purchase E&O insurance; it’s not just about ticking a box, it’s about safeguarding your professional reputation and financial future. Think of it as your ultimate safety net, a cushion against those unexpected lawsuits that can derail even the most successful careers. This guide dives deep into the world of Errors & Omissions insurance, demystifying the process, coverage, and costs involved, so you can make informed decisions and sleep soundly knowing you’re protected.

From understanding the different types of policies available to navigating the claims process, we’ll cover everything you need to know to find the perfect E&O insurance for your specific needs. We’ll also explore real-world scenarios, helping you visualize the impact of having – or lacking – this crucial protection. Get ready to navigate the world of professional liability with confidence!

Understanding E&O Insurance Needs

Source: pcdn.co

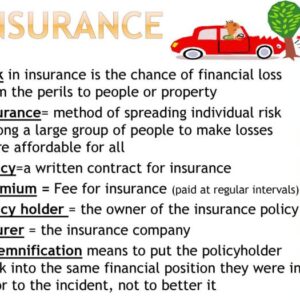

Protecting your professional reputation is crucial, and Errors & Omissions (E&O) insurance is your safety net. This type of insurance covers claims of negligence or mistakes in your professional services, shielding you from potentially devastating financial losses. Understanding your E&O needs involves considering the specific risks associated with your profession and choosing the right policy.

Types of E&O Insurance Policies

Different professions face different risks, requiring tailored E&O insurance policies. For instance, a doctor’s policy will differ significantly from that of a software developer. Medical professionals might need coverage for misdiagnosis or surgical errors, while software developers might need coverage for software bugs causing financial harm to clients. Architects need coverage for design flaws, while financial advisors need protection against investment misguidance. The policy’s scope reflects the specific liabilities inherent to each profession. Broader policies often cover a wider range of potential claims, while more specialized policies focus on specific risks within a niche.

Factors Influencing E&O Insurance Costs

Several factors influence the cost of your E&O insurance premium. Your profession’s inherent risk level plays a significant role; high-risk professions, such as surgeons or financial advisors, generally pay higher premiums. Your claims history is another critical factor; a history of claims will almost certainly increase your premiums. The size and complexity of your business also influence costs; larger businesses with more clients typically pay more. The coverage limits you select also directly impact your premium; higher limits mean higher costs. Finally, your location can influence premiums, as some areas have higher litigation rates than others.

E&O Insurance Coverage Limits and Their Implications

E&O insurance policies offer coverage limits, representing the maximum amount the insurer will pay for a single claim or over a policy period. Choosing the right coverage limit is crucial. A low limit might leave you personally liable for significant costs if a large claim exceeds the coverage. Conversely, a very high limit increases premiums, potentially outweighing the benefits if your risk profile is low. Consider your potential exposure to large claims when selecting coverage limits. For example, a small consulting firm might find a $100,000 limit sufficient, while a large architectural firm might require a $1 million or higher limit.

Comparison of E&O Insurance Providers

Choosing the right provider is as important as choosing the right policy. Here’s a comparison of three hypothetical providers:

| Provider | Coverage Features | Pricing Structure | Additional Benefits |

|---|---|---|---|

| Insurer A | Broad coverage, including regulatory investigations; covers both professional and advertising errors. | Premium based on revenue, claims history, and coverage limit. | 24/7 claims support, risk management resources. |

| Insurer B | Targeted coverage for specific professions; strong focus on cyber liability for tech-related professions. | Premium based on professional experience, revenue, and coverage limit. | Online claim filing, dedicated account manager. |

| Insurer C | Basic coverage, focusing primarily on professional negligence. | Competitive pricing, but limited coverage options. | Simple online application process. |

The Purchase Process

So, you’re ready to protect your business with Errors and Omissions (E&O) insurance. Great move! But navigating the purchase process can feel like wading through treacle. Don’t worry, we’re here to make it smoother than a freshly paved road. This section breaks down the steps, making the whole thing less intimidating and more… manageable.

Getting an E&O insurance quote isn’t rocket science, but it does involve a few key steps. Think of it as a structured conversation with your potential insurer, aimed at understanding your specific needs and risks. The clearer you are, the better the quote you’ll receive.

Obtaining an E&O Insurance Quote

Securing an E&O insurance quote typically begins with an initial inquiry, either online or via phone. You’ll provide basic information about your business, such as its type, size, location, and the services you offer. The insurer will then provide a preliminary assessment and potentially request more detailed information. This initial stage is all about determining your eligibility and getting a ballpark figure. Following this, you’ll likely receive a formal quote detailing coverage options, premiums, and policy terms. Remember, comparing quotes from multiple insurers is crucial to finding the best fit for your business.

Questions Asked During the Application Process

Insurance agents ask a series of questions to assess your risk profile. These aren’t designed to trip you up, but to accurately price your coverage. Expect questions about your business history, the types of services you provide, the number of clients you serve, any past claims or lawsuits, and your professional qualifications. For example, an agent might ask about the size of your team, your revenue, or the specifics of your professional liability exposure. They may also inquire about any significant changes in your business operations or client base in recent years. Thorough and honest answers are paramount to getting appropriate coverage.

Documentation Required for E&O Insurance Application

To finalize your application, you’ll need to provide supporting documentation. This typically includes proof of your business registration, details of your professional licenses and qualifications, and financial statements reflecting your business’s revenue and expenses. You may also be asked to provide details of any previous insurance policies, claims history, and a description of your business operations. The specific documents required will vary depending on the insurer and the nature of your business, but being prepared with this information will streamline the process significantly.

Flowchart Illustrating the Purchase Process

Imagine a flowchart with the following steps:

1. Initial Inquiry: You contact an insurer (online form, phone call, email).

2. Preliminary Assessment: The insurer gathers basic information about your business.

3. Detailed Information Request: The insurer requests further information, including documentation.

4. Application Submission: You submit the completed application and supporting documents.

5. Underwriting Review: The insurer reviews your application and assesses your risk.

6. Quote Provided: You receive a detailed quote outlining coverage, premiums, and policy terms.

7. Policy Acceptance: You review and accept the policy terms.

8. Payment: You make the necessary payment.

9. Policy Issuance: The insurer issues your E&O insurance policy.

This flowchart visually represents the typical steps involved in obtaining E&O insurance, from the initial contact to the final issuance of the policy. Remember, this is a general guideline, and the specific steps might vary slightly depending on the insurer.

Policy Coverage and Exclusions

Understanding what your Errors and Omissions (E&O) insurance policy covers—and, equally importantly, what it *doesn’t*—is crucial for peace of mind. This section breaks down the common scenarios covered, the exclusions you should be aware of, and how coverage can vary between different policies. Navigating this can feel like deciphering a legal document, but we’ll make it straightforward.

E&O insurance is designed to protect professionals from financial losses stemming from mistakes or negligence in their services. Think of it as your professional safety net. But, like any insurance, it has limitations. Knowing these limitations is just as important as understanding the coverage.

Common Scenarios Covered by E&O Insurance

E&O insurance typically covers claims arising from professional services rendered. This includes situations where a professional’s error or omission causes financial harm to a client. For example, an accountant might be covered if they made a mistake in preparing a client’s tax return, leading to an underpayment of taxes and subsequent penalties for the client. Similarly, a lawyer might be covered for a missed deadline that negatively impacts their client’s case. The key is that the claim must result from an error or omission in the professional’s services, not from intentional misconduct or illegal activities. Many policies also cover the costs associated with defending against such claims, even if the claim is ultimately unsuccessful.

Situations Where E&O Insurance Would Not Provide Coverage

While E&O insurance offers significant protection, it’s not a catch-all solution. Several situations are typically excluded from coverage. This often includes claims resulting from intentional acts, criminal activity, or violations of laws and regulations. For example, if a financial advisor knowingly provided misleading investment advice with the intent to defraud a client, that wouldn’t be covered. Similarly, bodily injury or property damage are generally not covered under a standard E&O policy; those typically require separate liability insurance. Many policies also exclude claims arising from work performed prior to the policy’s effective date (retroactive coverage often requires a separate endorsement and additional premium). Specific exclusions vary greatly between policies, so carefully reviewing the policy document is essential.

Comparison of Coverage Provided by Different E&O Insurance Policies

The coverage offered by different E&O insurance policies can vary significantly in several key areas. Policy limits, for instance, dictate the maximum amount the insurer will pay for covered claims. Some policies offer higher limits than others, providing greater protection. Another key difference lies in the definition of “professional services.” Some policies might have broader definitions than others, potentially including more activities under their coverage umbrella. Finally, the cost of the policy itself varies depending on factors like the profession, the size of the business, and the level of risk. It’s crucial to compare quotes from multiple insurers to find the policy that best suits your specific needs and budget. A higher premium might translate to broader coverage and higher policy limits, but a thorough cost-benefit analysis is necessary.

Potential Claims Covered Under a Typical E&O Policy

Understanding the types of claims that might be covered is key to appreciating the value of E&O insurance. Here’s a list of potential scenarios:

- Incorrect financial advice leading to investment losses.

- Missed deadlines resulting in legal penalties for a client.

- Errors in contract drafting causing financial harm to a client.

- Negligent misrepresentation of facts in a professional report.

- Failure to meet professional standards of care, leading to client losses.

It’s important to remember that this is not an exhaustive list, and the specific coverage will depend on the terms and conditions of your individual policy. Always consult your policy document or your insurance broker for clarification.

Claims Process and Procedures

Source: swbc.com

Securing E&O insurance is a smart move for any professional, offering crucial protection against liability claims. Managing your policy details just got easier thanks to the convenient features on my insurance portal , where you can access your policy documents and make changes. So, purchase your E&O insurance with confidence, knowing you have a user-friendly portal to manage it all.

Navigating the world of E&O insurance claims can feel like wading through treacle, but understanding the process can significantly reduce stress and improve your chances of a successful outcome. This section breaks down the steps involved, from initial reporting to final resolution, ensuring you’re equipped to handle any situation.

Filing an E&O claim isn’t something you’ll want to rush into, but acting promptly and methodically is key. Remember, your insurer is there to help, but clear communication and thorough documentation are your best allies.

Filing an E&O Insurance Claim

The first step is to report the potential claim to your insurer as soon as you become aware of a potential error or omission that could lead to a claim. This typically involves contacting your insurance provider via phone or email, providing initial details about the incident. Your insurer will then guide you through the next steps, which often involve completing a claim form providing comprehensive information about the situation. The sooner you report, the sooner your insurer can start investigating and protecting your interests. Delaying reporting can jeopardize your coverage.

Investigating and Resolving an E&O Insurance Claim

Once the claim is filed, your insurer will launch an investigation. This involves gathering information from various sources, including you, the claimant, and any relevant third parties. They’ll review the policy, assess the validity of the claim, and determine the extent of the insurer’s liability. The investigation process can take time, depending on the complexity of the case. During this period, you should cooperate fully with your insurer, providing any requested documents and information promptly. The resolution may involve negotiations, mediation, or even litigation, depending on the circumstances. Your insurer’s legal team will guide you through this process.

Supporting Documentation for E&O Insurance Claims

Adequate documentation is crucial for a successful E&O claim. Think of it as building a strong case. The specific documents required will vary depending on the nature of the claim, but generally include:

- The original contract or agreement related to the service provided.

- Correspondence with the claimant, including emails, letters, and meeting notes.

- Any relevant internal documents, such as project proposals, reports, and presentations.

- Evidence of the error or omission, such as expert opinions or technical reports.

- Details of any attempts to rectify the situation.

- Financial records demonstrating the losses incurred.

Thorough documentation ensures a clear understanding of the situation and strengthens your claim. Keep meticulous records from the outset of any project or engagement.

Best Practices for Handling a Potential Claim

Preparing for the possibility of a claim is proactive risk management. Here’s a list of best practices:

- Maintain detailed records of all projects and client interactions.

- Obtain written agreements outlining the scope of work and responsibilities.

- Regularly review and update your E&O insurance policy to ensure adequate coverage.

- Communicate openly and honestly with clients and your insurer.

- Seek legal counsel early on if you anticipate a potential claim.

- Cooperate fully with your insurer throughout the claims process.

Following these practices will help you navigate the claims process smoothly and efficiently. Remember, proactive preparation is key to minimizing potential disruptions and maximizing the chances of a favorable outcome.

Cost-Benefit Analysis of E&O Insurance

Source: ohioinsuranceagents.com

Protecting your professional reputation and financial stability is paramount, especially in fields prone to errors or omissions. E&O insurance acts as a crucial safety net, mitigating the potentially devastating consequences of professional missteps. Weighing the cost of this insurance against the potential financial burdens of operating without it is a critical business decision.

Financial Risks of Operating Without E&O Insurance

The absence of E&O insurance leaves professionals vulnerable to significant financial losses stemming from lawsuits, settlements, and legal fees. A single claim of negligence or malpractice could easily wipe out personal savings, cripple a business, and severely damage professional credibility. Consider the scenario of a freelance graphic designer who accidentally uses a copyrighted image in a client’s marketing materials. The resulting infringement lawsuit could cost tens of thousands of dollars in legal fees and damages, even if the designer acted unintentionally. Without E&O insurance, the designer would bear the entire financial burden alone. This risk is amplified for businesses with multiple employees, where a single error by one employee could lead to substantial claims against the entire company.

Real-World Examples of E&O Insurance Benefits

E&O insurance has proven invaluable in countless situations. Imagine a financial advisor who mistakenly provided incorrect tax advice to a client, resulting in a significant tax penalty for the client. The client, understandably upset, could sue the advisor. With E&O insurance, the insurance company would cover the legal fees and any settlement or judgment awarded to the client, preventing the advisor from facing financial ruin. Similarly, a medical practice facing a malpractice lawsuit related to a misdiagnosis could rely on their E&O coverage to manage the legal costs and potential settlements, protecting the practice’s financial stability and reputation.

Cost Comparison: E&O Insurance vs. Lawsuit Costs

The cost of E&O insurance is a relatively small investment compared to the potential cost of defending a lawsuit. A modest annual premium for E&O insurance can provide peace of mind and safeguard against potentially catastrophic financial losses. The cost of a lawsuit, on the other hand, can easily run into tens or even hundreds of thousands of dollars, encompassing legal fees, court costs, expert witness fees, and potential settlements or judgments. While the premium for E&O insurance varies based on factors like profession, coverage amount, and risk profile, it’s a fraction of the potential cost of a successful lawsuit.

Potential Cost Savings with E&O Insurance

| Scenario | Cost Without E&O Insurance | Cost With E&O Insurance | Savings |

|---|---|---|---|

| Minor Negligence Claim | $5,000 – $10,000 (Legal Fees, Settlement) | $500 – $1,000 (Premium) | $4,500 – $9,000 |

| Major Negligence Claim | $50,000 – $100,000+ (Legal Fees, Judgment) | $1,000 – $2,000 (Premium) | $48,000 – $98,000+ |

| Multiple Claims | Potentially catastrophic financial loss | Managed costs within policy limits | Potentially unlimited |

Finding the Right E&O Insurance Provider

Choosing the right Errors and Omissions (E&O) insurance provider is crucial for protecting your business from potential financial losses. A poorly chosen provider could leave you with inadequate coverage, a difficult claims process, or even no coverage at all when you need it most. This section will guide you through the key factors to consider when making this important decision.

Factors to Consider When Choosing an E&O Insurance Provider

Selecting the right E&O insurance provider requires careful consideration of several key factors. The ideal provider will offer a balance of comprehensive coverage, competitive pricing, and responsive customer service. Ignoring these factors could lead to regret later.

- Financial Stability: Look for providers with a strong financial rating from agencies like A.M. Best. A high rating indicates the insurer’s ability to pay claims even in challenging economic times. This is paramount; a financially unstable provider might not be there when you need them.

- Coverage Options and Limits: Ensure the provider offers coverage tailored to your specific profession and risk profile. Compare policy limits to determine if they adequately protect your assets from potential lawsuits. Consider coverage for different types of claims and the total amount of coverage offered.

- Claims Process and Customer Service: Investigate the provider’s claims handling process. A straightforward and responsive process is essential. Read reviews to gauge the insurer’s responsiveness and helpfulness in handling claims. A positive experience during a claim is invaluable.

- Policy Exclusions and Limitations: Carefully review the policy exclusions to understand what isn’t covered. Some policies may exclude certain types of claims or activities. Understanding these limitations is vital for avoiding unpleasant surprises.

- Price and Value: While price is a factor, it shouldn’t be the sole determinant. Compare quotes from multiple providers, but prioritize comprehensive coverage and a reputable provider over the cheapest option. A slightly higher premium for superior coverage and service can be a worthwhile investment.

Comparison of E&O Insurance Providers

Large insurers often offer standardized policies and a broad network of agents, making them easily accessible. However, their policies may lack the specialized coverage that niche providers offer. Niche providers, on the other hand, focus on specific industries or professions, offering tailored policies that better address the unique risks within those fields. This specialization can result in more comprehensive coverage and potentially lower premiums for those in specific high-risk professions. For example, a large insurer might offer a generic E&O policy for consultants, while a niche provider specializing in technology consulting might offer broader coverage for software defects or data breaches.

The Importance of Reviewing Customer Reviews and Ratings

Before selecting an E&O insurance provider, thoroughly review customer reviews and ratings from independent sources. These reviews offer valuable insights into the provider’s claims handling process, customer service responsiveness, and overall policyholder experience. Websites like Yelp, Google Reviews, and independent insurance rating agencies provide platforms for customers to share their experiences, both positive and negative. Consider the volume and consistency of reviews; a pattern of negative feedback should raise concerns.

Questions to Ask Potential E&O Insurance Providers

Asking potential providers direct questions helps ensure you understand their offerings and policies completely. This proactive approach minimizes future misunderstandings.

- Detailed Explanation of Policy Coverage: Request a clear explanation of the policy’s coverage, including specific examples of covered and excluded claims.

- Claims Process Details: Inquire about the steps involved in filing a claim, including timelines, required documentation, and contact information for claims adjusters.

- Financial Strength and Stability Information: Ask for proof of their financial stability ratings from reputable rating agencies.

- Policy Renewal Terms and Conditions: Request details about policy renewal, including potential premium increases and changes to coverage.

- Customer Service Availability and Responsiveness: Ask about their customer service channels, response times, and the availability of 24/7 support.

Illustrative Scenarios

Understanding how E&O insurance works in practice is crucial. Let’s explore several scenarios to illustrate its benefits and limitations. These examples highlight the diverse situations where this type of insurance can be a lifeline for professionals.

Scenario: Negligence Leading to a Claim and Insurance Response

Imagine Sarah, a freelance architect, mistakenly omits a crucial structural detail in her blueprints for a new residential building. This oversight leads to significant structural problems during construction, requiring costly repairs. The homeowner sues Sarah for negligence. If Sarah has adequate E&O insurance, her policy will cover the legal defense costs and potentially the settlement or judgment awarded to the homeowner, up to her policy limits. The insurer will investigate the claim, manage the legal process, and negotiate a settlement or defend her in court. The key here is that Sarah’s personal assets are protected from potentially devastating financial losses.

Scenario: E&O Claim Denial and Reasons for Denial

Now, consider David, a financial advisor who provides inaccurate investment advice to a client, resulting in substantial financial losses for the client. The client sues David. However, David’s E&O policy is denied. This could be due to several reasons: David may have failed to disclose a relevant fact during the application process (e.g., a prior disciplinary action); the policy may explicitly exclude the type of advice he provided; or the client’s losses may not be directly attributable to David’s negligence, but rather to market fluctuations outside of his control. Policies often have specific exclusions and require accurate reporting; failure in either area can lead to a denied claim.

Scenario: E&O Insurance Mitigating Financial Losses

Let’s look at Dr. Emily, a physician who incorrectly diagnoses a patient, leading to a delayed and more complex treatment. The patient sues for medical malpractice. Dr. Emily’s E&O insurance covers the legal fees, expert witness costs, and the eventual settlement with the patient. Without this insurance, the costs associated with this lawsuit could easily bankrupt her. The insurer’s financial resources and expertise in handling medical malpractice claims proved invaluable, protecting her career and financial well-being. This illustrates the significant financial protection E&O insurance offers.

Scenario: Importance of Adequate Coverage, Purchase e&o insurance

A small business owner, Mark, operating a web design agency, faces a lawsuit from a client whose website suffered a data breach due to a security vulnerability Mark overlooked. Mark had E&O insurance, but his coverage limit was far too low to cover the extensive costs of the lawsuit, including the client’s financial losses from the data breach and the legal fees. While the insurance covered a portion of the damages, Mark still faced significant out-of-pocket expenses, highlighting the critical importance of obtaining sufficient coverage to match the potential risks and liabilities of his business. He learned a valuable lesson about the need to regularly review and adjust his coverage to reflect the evolving needs of his business.

Outcome Summary: Purchase E&o Insurance

Securing E&O insurance is a strategic move, a proactive step towards protecting your hard-earned reputation and financial stability. While the process might seem daunting at first, understanding the nuances of coverage, claims, and providers empowers you to make informed choices. Remember, it’s not just about the policy itself; it’s about the peace of mind that comes with knowing you’re shielded against the unforeseen. So, take the plunge, explore your options, and secure your future with the right E&O insurance plan.