Ohio insurance rates: Navigating the world of Ohio car insurance can feel like driving through a blizzard blindfolded. Premiums vary wildly based on factors you might not even know exist, leaving you wondering how to get the best deal. This guide cuts through the confusion, revealing the secrets to understanding and lowering your Ohio car insurance costs. We’ll break down the key factors influencing your rates, compare top insurance providers, and arm you with strategies to save serious cash.

From understanding the impact of your driving record and location to mastering the art of negotiating with insurance companies, we’ll equip you with the knowledge to become a savvy insurance shopper. We’ll also delve into the specifics of different coverage types and help you choose the policy that best fits your needs and budget. Buckle up, because finding affordable car insurance in Ohio is about to get a whole lot easier.

Factors Influencing Ohio Insurance Rates

Source: cloudinary.com

Securing affordable car insurance in Ohio involves understanding the multifaceted factors influencing premiums. Your rates aren’t simply a random number; they’re calculated based on a detailed assessment of your risk profile, as determined by various factors, including your driving history, the type of vehicle you drive, and where you live. Let’s delve into the specifics.

Driver Demographics

Your age, gender, and driving experience significantly impact your insurance rates. Younger drivers, statistically, are involved in more accidents, leading to higher premiums. Similarly, gender can play a role, though this is becoming less pronounced as data shows a convergence in driving habits. Years of driving experience, reflecting a proven safe driving record, generally results in lower rates. Insurance companies use actuarial data to pinpoint these correlations and adjust premiums accordingly. For example, a 20-year-old driver with a clean record will likely pay more than a 40-year-old with 20 years of accident-free driving.

Vehicle Characteristics

The type of vehicle you drive is another crucial factor. Sports cars and luxury vehicles often command higher premiums due to their higher repair costs and greater potential for theft. Conversely, smaller, less expensive vehicles generally attract lower rates. Vehicle safety features, such as anti-lock brakes and airbags, can also influence your premium; vehicles with advanced safety features may receive discounts. Think of it this way: insuring a high-performance sports car is like insuring a higher-risk investment – it costs more.

Driving Record

Your driving history is perhaps the most significant factor determining your Ohio car insurance rates. Accidents and traffic violations dramatically increase premiums. The severity of the accident and the number of tickets accumulated directly correlate with higher costs. A single at-fault accident can raise your premiums for several years, while multiple tickets might even lead to policy cancellation in some cases. Maintaining a clean driving record is crucial for keeping your insurance costs low. For instance, a driver with two speeding tickets and an at-fault accident will pay considerably more than a driver with a spotless record.

Geographic Location

Insurance rates vary considerably across Ohio. Urban areas, with higher traffic density and a greater likelihood of accidents, tend to have higher premiums compared to rural areas. The crime rate in your specific location also plays a role, as higher crime rates increase the risk of theft or vandalism, thus impacting your insurance costs. This is why someone living in Columbus might pay more than someone living in a smaller, quieter town.

Coverage Types

The type and level of coverage you choose significantly affect your premiums. Comprehensive and collision coverage, which protect against damage to your vehicle, are generally more expensive than liability coverage, which only covers damage to other people’s property or injuries to others. Higher coverage limits also result in higher premiums. Choosing the minimum required coverage will result in lower premiums, but leaves you with less financial protection in case of an accident.

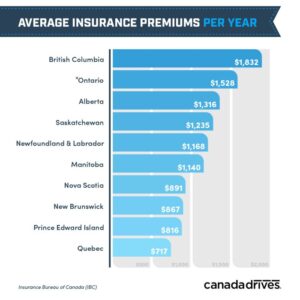

Average Insurance Rates for Different Vehicle Types in Ohio

| Vehicle Type | Average Rate | Factors | Data Source |

| Compact Car | $800 – $1200 (Annual) | Lower repair costs, less theft risk | Statewide Insurance Rate Averages (Hypothetical Example) |

| Sedan | $1000 – $1500 (Annual) | Moderate repair costs, moderate theft risk | Statewide Insurance Rate Averages (Hypothetical Example) |

| SUV | $1200 – $1800 (Annual) | Higher repair costs, moderate theft risk | Statewide Insurance Rate Averages (Hypothetical Example) |

| Sports Car | $1500 – $2500+ (Annual) | High repair costs, high theft risk | Statewide Insurance Rate Averages (Hypothetical Example) |

*Note: These are hypothetical examples and actual rates vary widely based on the factors discussed above. Always obtain quotes from multiple insurers for accurate pricing.*

Comparison of Ohio Insurance Companies

Choosing the right insurance provider in Ohio can feel like navigating a maze. With so many companies vying for your business, understanding their strengths and weaknesses is crucial to securing the best coverage at the most competitive price. This comparison focuses on five major players, offering a snapshot to aid your decision-making process. Remember, rates and offerings can vary based on individual circumstances, so always get personalized quotes.

The following table provides a high-level comparison of five leading insurance companies in Ohio. Note that these are averages and individual experiences may vary. Always check current customer reviews and obtain personalized quotes before making a decision.

| Company | Coverage Options | Customer Service Rating (Average) | Average Premiums (Estimate) |

|---|---|---|---|

| Progressive | Auto, Home, Motorcycle, Boat, Commercial Auto | 4.0 out of 5 stars | $1200 – $1800 annually (Auto) |

| State Farm | Auto, Home, Life, Health, Business | 4.2 out of 5 stars | $1100 – $1700 annually (Auto) |

| GEICO | Auto, Motorcycle, Homeowners, Renters | 3.8 out of 5 stars | $1000 – $1600 annually (Auto) |

| Allstate | Auto, Home, Life, Renters, Business | 4.1 out of 5 stars | $1300 – $1900 annually (Auto) |

| Nationwide | Auto, Home, Life, Farm, Commercial | 4.3 out of 5 stars | $1250 – $1850 annually (Auto) |

Types of Insurance Policies Offered

Major insurance companies in Ohio offer a wide range of insurance policies designed to protect various aspects of your life and assets. Understanding these different policy types is vital for selecting the right coverage.

Common types of insurance policies include:

- Auto Insurance: This covers liability (injury or damage to others), collision (damage to your vehicle), and comprehensive (damage from non-collision events like theft or weather).

- Homeowners Insurance: Protects your home and belongings from damage or loss due to fire, theft, or weather events. Renters insurance provides similar coverage for renters.

- Life Insurance: Provides financial protection for your loved ones in the event of your death.

- Health Insurance: Covers medical expenses, often through employer-sponsored plans or the Affordable Care Act marketplace.

- Commercial Insurance: Protects businesses from various risks, including liability, property damage, and worker’s compensation.

Advantages and Disadvantages of Bundling Insurance

Bundling your auto and home insurance, for instance, is a common strategy employed by many insurance providers. This involves purchasing both types of insurance from the same company.

Let’s examine the pros and cons:

- Advantages: Bundling often leads to significant discounts on premiums. It simplifies billing and management, dealing with a single provider for multiple policies.

- Disadvantages: Less flexibility in choosing individual policy features. If you’re unhappy with one aspect of the bundled service, you may be less inclined to switch providers. You might miss out on potentially better rates from different companies specializing in specific insurance types.

Saving Money on Ohio Insurance: Ohio Insurance Rates

Ohio insurance rates can feel like a punch to the gut, but don’t despair! There are several savvy strategies you can employ to significantly reduce your premiums and keep more money in your pocket. This isn’t about cutting corners; it’s about being a smart consumer and understanding how the system works.

Discounts and Savings Opportunities

Insurance companies in Ohio offer a variety of discounts to incentivize safe driving and responsible behavior. Taking advantage of these discounts can substantially lower your annual costs. These aren’t just gimmicks; they’re real ways to save.

- Bundling Policies: Combining your car insurance with homeowners or renters insurance from the same provider often unlocks significant discounts. Think of it as a loyalty bonus.

- Safe Driver Discounts: Maintaining a clean driving record is crucial. Many insurers reward accident-free driving with lower premiums. This reflects the lower risk you represent.

- Good Student Discounts: High-achieving students often qualify for discounts, recognizing their responsible nature. This is a great incentive for young drivers.

- Vehicle Safety Features Discounts: Cars equipped with anti-theft devices, airbags, and other safety features are often cheaper to insure. It’s a win-win: safer car, lower premiums.

- Defensive Driving Courses: Completing a state-approved defensive driving course can demonstrate your commitment to safe driving and earn you a discount. It’s an investment that pays off.

Comparing Insurance Quotes Effectively

Don’t settle for the first quote you get. Shopping around is crucial for finding the best deal. Here’s a step-by-step guide to effective comparison shopping:

- Gather Information: Collect details about your vehicle, driving history, and desired coverage levels. The more accurate your information, the more accurate the quotes.

- Use Online Comparison Tools: Several websites allow you to compare quotes from multiple insurers simultaneously. This saves time and effort.

- Contact Insurers Directly: While online tools are helpful, contacting insurers directly can sometimes unearth additional discounts or options not immediately apparent online.

- Review Policy Details Carefully: Don’t just focus on the price. Compare coverage limits, deductibles, and other policy details to ensure you’re getting adequate protection.

- Read the Fine Print: Pay close attention to exclusions and limitations within the policy documents to avoid surprises later.

Impact of Credit Scores and Driving History, Ohio insurance rates

Your credit score and driving history are significant factors in determining your insurance premiums. Insurers use these factors to assess your risk profile.

A good credit score generally translates to lower premiums, reflecting a lower perceived risk of claims. Conversely, a poor driving record, including accidents, speeding tickets, or DUIs, will almost certainly lead to higher premiums. These factors are directly tied to your likelihood of filing a claim.

Navigating Ohio insurance rates can be tricky, especially when you consider the potential financial fallout. If your life insurance claim gets denied, the situation becomes even more complicated, requiring the expertise of a denied life insurance claim lawyer to fight for your deserved benefits. Understanding your rights within the complex Ohio insurance landscape is crucial to protecting your financial future.

Negotiating Lower Premiums

Don’t be afraid to negotiate! Insurance companies are businesses, and they often have some flexibility in their pricing.

Here are some negotiation strategies:

- Highlight your clean driving record and good credit score. Emphasize your low-risk profile.

- Inquire about available discounts you may have overlooked. Sometimes, insurers don’t proactively offer all applicable discounts.

- Compare quotes from competitors. Let them know you’re considering switching if they can’t match or beat a competitor’s offer.

- Consider increasing your deductible. A higher deductible typically leads to lower premiums, but make sure you can comfortably afford it.

State Regulations and Insurance in Ohio

Source: ghost.io

Navigating the world of Ohio insurance can feel like driving through a maze, especially when it comes to understanding the role of state regulations. The Ohio Department of Insurance (ODI) acts as the gatekeeper, ensuring fair practices and protecting consumers. This means they have a significant impact on the rates you pay and the coverage you receive.

The ODI’s primary role is to regulate the insurance industry within the state, ensuring solvency of companies and protecting consumers from unfair or deceptive practices. This involves setting minimum standards for coverage, approving insurance rates, and investigating complaints. Their influence permeates every aspect of the insurance market, from the smallest independent agency to the largest national carrier. They strive to maintain a balance between allowing insurers to operate profitably and safeguarding the interests of Ohio’s policyholders.

The Ohio Department of Insurance’s Role in Regulating Insurance Rates and Practices

The ODI possesses considerable power over insurance rates. They review and approve rate filings submitted by insurance companies, ensuring that rates are not excessive, inadequate, or unfairly discriminatory. This process involves a thorough examination of the company’s actuarial data, considering factors like claims experience, operating expenses, and projected losses. The ODI can reject rate increases if they deem them unjustified, a critical function in keeping premiums affordable for Ohioans. Beyond rate regulation, the ODI also monitors insurance company practices, investigates complaints of unfair treatment, and enforces state laws to maintain a level playing field for both insurers and consumers.

Key Regulations Impacting Car Insurance Costs in Ohio

Several key regulations directly influence the cost of car insurance in Ohio. For example, Ohio is an at-fault state, meaning the driver at fault in an accident is responsible for covering the damages. This system can lead to higher premiums for drivers with a history of at-fault accidents. Another significant factor is the state’s minimum liability coverage requirements. While these minimums are relatively low compared to some neighboring states, they still influence the overall cost of insurance. Drivers who choose higher coverage limits will naturally pay more, but also benefit from greater protection in the event of an accident. Finally, the availability and affordability of uninsured/underinsured motorist coverage are heavily regulated and impact premiums, offering consumers additional protection against drivers without sufficient insurance.

State Laws and Consumer Protection in the Ohio Insurance Market

Ohio has enacted various consumer protection laws designed to safeguard policyholders. These laws cover areas such as fair claims handling practices, prohibiting unfair discrimination in pricing, and ensuring access to information about insurance products. The ODI actively enforces these laws, investigating complaints and taking action against insurers that violate them. Consumers have recourse through the ODI to challenge unfair practices, such as delayed or denied claims, or disputes over policy coverage. This regulatory oversight helps to foster trust and transparency in the Ohio insurance market, protecting consumers from potentially exploitative practices.

Comparison of Ohio Insurance Regulations with Neighboring States

Compared to neighboring states like Pennsylvania and Indiana, Ohio’s insurance regulations exhibit some key differences. For instance, Pennsylvania has a more robust system for regulating auto insurance rates, often resulting in lower average premiums. Indiana, on the other hand, allows for greater insurer flexibility in setting rates, potentially leading to wider variations in premiums across different companies. These variations highlight the significant impact state-level regulations have on the insurance market and the costs consumers ultimately bear. The differences are not simply in rate regulation, but also extend to areas like minimum coverage requirements and the availability of certain types of coverage, demonstrating the diverse regulatory approaches across neighboring states.

Understanding Insurance Coverage in Ohio

Navigating the world of car insurance in Ohio can feel like driving through a blizzard without windshield wipers. Understanding your coverage options is crucial to protecting your finances and ensuring peace of mind on the road. This section breaks down the key types of coverage, their costs, and how they can safeguard you from unexpected events.

Ohio, like most states, mandates certain minimum levels of insurance coverage. However, these minimums might not be sufficient to cover all potential losses in the event of an accident. Choosing the right coverage depends on your individual risk tolerance, the value of your vehicle, and your financial situation.

Liability Coverage

Liability insurance covers damages you cause to others in an accident. It pays for the medical bills and property damage of the other driver(s) and passengers involved. Ohio’s minimum liability coverage is 25/50/25, meaning $25,000 per person for injuries, $50,000 total for injuries per accident, and $25,000 for property damage. Higher liability limits provide greater protection if you cause a serious accident. For example, a higher limit might be necessary if you are driving a large vehicle or frequently travel in high-traffic areas.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This is optional coverage, but it’s highly recommended, especially if you have a newer or more expensive car. Imagine a scenario where you’re involved in an accident that’s not your fault, but your vehicle is totaled. Without collision coverage, you’d bear the full cost of replacement or repair.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or falling objects. This type of coverage is also optional but provides a safety net for unforeseen circumstances that aren’t covered by collision insurance. For instance, if a tree falls on your car during a storm, comprehensive coverage would help with the repairs.

Uninsured/Underinsured Motorist Coverage

This crucial coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills and vehicle repairs, even if the other driver is at fault and lacks sufficient insurance. Given the prevalence of uninsured drivers, this coverage is essential for financial protection. Consider a situation where you’re severely injured by an uninsured driver – this coverage could prevent financial ruin.

Illustrative Comparison of Coverage Levels and Costs

Imagine three drivers: Alex, Ben, and Chloe. They all have the same car, but choose different coverage levels.

| Driver | Liability | Collision | Comprehensive | Uninsured/Underinsured | Approximate Monthly Premium (Example) |

|---|---|---|---|---|---|

| Alex | 25/50/25 | No | No | No | $50 |

| Ben | 100/300/100 | Yes | Yes | Yes | $150 |

| Chloe | 50/100/50 | Yes | No | Yes | $100 |

Note: These are example premiums and actual costs will vary based on factors like driving record, age, location, and the specific insurance company.

The Importance of Adequate Insurance Coverage

Adequate insurance coverage acts as a financial shield against the potentially devastating costs associated with car accidents. Medical bills, vehicle repairs, and legal fees can quickly escalate into significant financial burdens. Without sufficient coverage, you could face bankruptcy or crippling debt. The peace of mind that comes from knowing you’re financially protected is invaluable.

Comparing Coverage Options Based on Individual Needs

The best coverage for you depends on your individual circumstances. Factors to consider include: your financial situation, the value of your vehicle, your driving history, and your risk tolerance. Someone with a newer, more expensive car might opt for higher liability and collision coverage, while someone with an older car might choose a more basic plan. A clean driving record typically translates to lower premiums. Understanding your needs and weighing the costs against the potential benefits is crucial in making an informed decision.

Epilogue

Source: forbes.com

So, you’ve learned the ins and outs of Ohio insurance rates, from the factors that influence your premiums to the strategies for securing the best possible deal. Remember, understanding your options and shopping around are key to saving money. Don’t settle for the first quote you get—empower yourself with knowledge, and you’ll be well on your way to driving with peace of mind and a significantly lighter wallet. Happy driving!