OCP insurance definition: Ever felt like you’re walking a tightrope, professionally? One wrong step, and BAM! A lawsuit. That’s where OCP insurance, or professional liability insurance, swoops in like a superhero. It’s your safety net against those unexpected claims of negligence or mistakes in your professional practice. Think of it as the ultimate peace of mind for professionals who want to focus on their work, not worry about potential legal battles. This guide breaks down everything you need to know about OCP insurance, from its core definition to navigating the claims process.

We’ll explore what it covers, who needs it, and how much it costs. Get ready to ditch the worry and embrace the professional protection you deserve. Because let’s be real, nobody wants a surprise lawsuit ruining their day (or career!).

Defining OCP Insurance

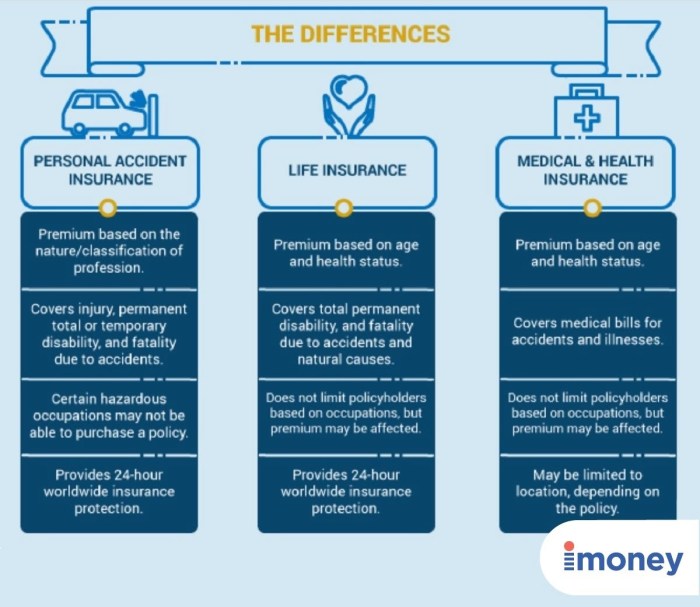

Source: imoney.my

Understanding OCP insurance definition often involves navigating the complexities of employer-sponsored plans. For small businesses, this can be particularly challenging, especially in states like Idaho. Securing affordable and comprehensive coverage is crucial, and finding the right plan can feel overwhelming. That’s where researching options like idaho small business health insurance becomes essential. Ultimately, a thorough grasp of OCP insurance definition empowers you to make informed decisions about your employee benefits.

OCP insurance, or Owners’ Controlled Property insurance, might sound like something only property moguls need to worry about. But in reality, it’s a crucial type of coverage that protects a business owner’s investment in their own property. Think of it as a specialized safety net for the risks unique to owning and operating a business from a building you own. It’s less about the everyday stuff and more about the big, potentially devastating events.

OCP insurance is a type of commercial property insurance designed to cover losses to buildings and other structures owned by the business. It’s specifically tailored for businesses that own the property they operate from, providing protection against damage or loss due to various perils. Unlike other policies, it combines property coverage with liability protection relevant to business operations on that owned property.

Key Features of OCP Insurance

OCP insurance distinguishes itself from other insurance types through its comprehensive approach to protecting business owners’ investments. It’s not just about the building itself; it also accounts for the business operations within it. This means it covers a broader spectrum of potential risks compared to, say, a renter’s insurance policy. It often includes coverage for things like fire, theft, vandalism, and even certain types of weather damage. Crucially, many OCP policies also incorporate liability coverage, protecting the business owner from lawsuits arising from accidents or injuries on their property.

Examples of OCP Insurance Applicability, Ocp insurance definition

Imagine a small bakery that owns the building where it operates. An OCP policy would protect the building itself from fire damage, but it would also cover the loss of baking equipment and inventory if a fire were to occur. Similarly, if a customer slips and falls on the bakery’s premises and sues, the liability portion of the OCP policy would help cover legal costs and potential settlements. Consider a larger example: a car dealership that owns its expansive showroom and service center. OCP insurance safeguards not only the building but also the valuable vehicles on the premises against fire, theft, or damage from a storm. In the case of a customer’s car being damaged during service, the liability coverage kicks in. Essentially, any business that owns the property where it operates would benefit from OCP insurance, regardless of size or industry.

Coverage and Exclusions of OCP Insurance

OCP insurance, or Owners’ Control Protection insurance, is designed to shield business owners from the financial fallout of claims related to their professional activities. Understanding the specifics of what’s covered and what’s excluded is crucial for choosing the right policy and ensuring adequate protection. This section delves into the nuances of OCP insurance coverage and exclusions, comparing different providers and illustrating the typical structure of a policy.

Typical Coverage Offered Under OCP Insurance

OCP insurance policies typically offer a range of coverages designed to protect professionals from various liability risks. These coverages vary depending on the specific profession and the insurer, but common elements include coverage for claims of negligence, errors, omissions, and breaches of professional duty. This could encompass financial losses suffered by clients due to professional mistakes, legal defense costs associated with defending against such claims, and any resulting settlements or judgments. Many policies also include coverage for regulatory investigations and disciplinary proceedings. For example, a financial advisor who mistakenly provides incorrect investment advice leading to client losses might be covered under their OCP policy.

Common Exclusions in OCP Insurance Policies

While OCP insurance offers broad protection, it’s vital to understand its limitations. Many policies exclude coverage for intentional acts, criminal acts, and fraudulent behavior. Coverage is often also excluded for claims arising from situations where the professional acted outside the scope of their professional practice or failed to comply with relevant laws and regulations. Additionally, exclusions frequently apply to claims arising from bodily injury or property damage, unless specifically included as an extension. For instance, a lawyer facing a lawsuit for knowingly providing false testimony would likely not be covered. Similarly, a doctor’s liability for a patient’s injury caused by intentional malpractice would be excluded.

Comparison of Coverage Across OCP Insurance Providers

Different OCP insurance providers may offer varying levels of coverage and different types of exclusions. Some insurers may offer broader coverage for specific professional activities or include additional coverages such as cyber liability or data breach protection. Others may have stricter exclusions or higher premiums. For example, one provider might offer a higher limit of liability for claims related to financial advice, while another might offer more comprehensive coverage for regulatory investigations. A thorough comparison of policy documents is crucial before selecting an OCP insurance provider. It’s recommended to carefully review policy wordings and seek clarification on any ambiguous clauses.

Hypothetical OCP Insurance Policy: Coverage and Exclusions

The following table presents a hypothetical example of an OCP insurance policy, illustrating the typical coverage and exclusions. Remember, specific coverage and exclusions will vary depending on the provider and the individual policy.

| Coverage | Exclusion | Coverage | Exclusion |

|---|---|---|---|

| Negligence, Errors, and Omissions | Intentional Acts | Legal Defense Costs | Claims arising from criminal acts |

| Regulatory Investigations | Bodily Injury (unless specifically included) | Settlements and Judgments | Property Damage (unless specifically included) |

| Disciplinary Proceedings | Claims outside the scope of professional practice | Loss of income due to suspension | Fraudulent behavior |

Who Needs OCP Insurance?

Source: unitrustib.com

OCP insurance, or Owners’ and Contractors’ Protective Liability insurance, isn’t for everyone. It’s a specialized policy designed to safeguard specific individuals and organizations against the unique risks associated with their professional activities. Understanding who benefits most from this coverage is crucial for effective risk management.

OCP insurance becomes particularly vital when your work involves a significant degree of control over a project or property, potentially exposing you to liability for damages or injuries. This is especially true when working on projects for others, where your actions could lead to financial losses for the client. The higher the potential financial impact of a mistake, the greater the need for robust OCP insurance coverage.

Professionals and Industries Commonly Using OCP Insurance

The need for OCP insurance often aligns with professions and industries where significant responsibility and potential liability are inherent. Consider the potential for significant financial consequences if a project goes wrong, resulting in property damage, injuries, or delays.

- General Contractors: These professionals oversee numerous subcontractors and manage complex projects, making them highly susceptible to liability claims.

- Construction Managers: Similar to general contractors, construction managers face substantial liability risks due to their oversight responsibilities.

- Architects and Engineers: Design flaws or errors can lead to costly repairs, delays, or even structural failures, highlighting the need for robust liability protection.

- Property Developers: Large-scale projects undertaken by developers present substantial financial and legal risks, making OCP insurance a necessity.

- Subcontractors: While often covered under the general contractor’s policy, subcontractors may benefit from supplemental OCP insurance for additional protection.

Examples of Potential Risks

Imagine a general contractor overseeing the construction of a high-rise building. A subcontractor’s negligence leads to a structural defect, resulting in significant repair costs and potential injury to workers. The general contractor, even without direct fault, could face substantial liability claims without adequate OCP insurance. Similarly, an architect whose design flaw causes a building collapse would likely face devastating financial consequences. The cost of legal defense and potential settlements could easily bankrupt an individual or small firm without the proper insurance coverage. A property developer, responsible for a large-scale housing project, could face numerous claims if defects emerge, leading to significant financial repercussions. OCP insurance helps mitigate these potential catastrophes, providing a financial safety net against such unforeseen circumstances.

The Claims Process for OCP Insurance

Navigating the claims process for Owners’ and Contractors’ Protective (OCP) insurance can feel like wading through a swamp, but understanding the steps involved can significantly ease the burden. This section Artikels the process, required documentation, common reasons for claim denials, and presents a simplified flowchart to guide you. Remember, always refer to your specific policy documents for the most accurate and up-to-date information.

The OCP claims process typically involves several key steps, from initial notification to final settlement. A prompt and accurate response is crucial for a smooth claim resolution. Failing to follow the Artikeld procedures can lead to delays or even denial of your claim.

Required Documentation for OCP Insurance Claims

Supporting your claim with comprehensive documentation is essential for a successful outcome. Insufficient or missing documentation is a frequent cause of delays and claim denials. The specific documents required will vary depending on the nature of the claim, but generally include:

- Completed Claim Form: This form, provided by your insurer, requires detailed information about the incident, including dates, times, and involved parties.

- Police Report (if applicable): For incidents involving theft, vandalism, or accidents, a police report is usually required as evidence of the event.

- Photographs and Videos: Visual evidence documenting the damage or loss is invaluable. These should clearly show the extent of the damage and the context of the incident.

- Witness Statements: If there were witnesses to the incident, their statements can strengthen your claim. These statements should include contact information and a detailed account of the events.

- Repair or Replacement Estimates: For damage claims, obtain detailed estimates from qualified professionals for repairs or replacements. These estimates should specify the cost of labor and materials.

- Medical Records (if applicable): In cases involving injuries, comprehensive medical records documenting the extent of injuries and treatment are crucial.

- Contracts and Agreements: Relevant contracts or agreements related to the project or property involved in the claim should be included.

Common Reasons for OCP Insurance Claim Denials

While OCP insurance provides crucial protection, understanding common reasons for claim denials can help you avoid pitfalls. Proactive measures and careful documentation can significantly improve your chances of a successful claim.

- Failure to provide timely notice: Most policies have a time limit for reporting claims. Missing this deadline is a common cause of denial.

- Insufficient documentation: As mentioned earlier, incomplete or missing documentation can lead to delays and denials. Ensure you gather all necessary supporting materials.

- Exclusions in the policy: Carefully review your policy to understand what is and isn’t covered. Claims for excluded events will be denied.

- Fraudulent claims: Attempting to defraud the insurance company will result in immediate denial and potentially legal repercussions.

- Violation of policy terms: Failing to comply with the terms and conditions of your policy can lead to claim denial. For example, not maintaining proper safety procedures on a construction site.

- Pre-existing conditions: Damage or loss that existed before the policy’s effective date may not be covered.

OCP Insurance Claim Process Flowchart

The following flowchart illustrates a typical OCP insurance claim process. Remember, the specific steps and timelines may vary depending on your insurer and the specifics of your claim.

- Incident Occurs: The event causing the damage or loss takes place.

- Report the Claim: Immediately notify your insurance company of the incident, usually within a specified timeframe.

- Gather Documentation: Collect all necessary documents to support your claim (as listed above).

- Submit the Claim: Submit the completed claim form and all supporting documentation to your insurer.

- Claim Investigation: The insurance company investigates the claim, which may involve inspections, interviews, and reviews of documentation.

- Claim Adjustment: The insurer assesses the claim and determines the amount to be paid.

- Payment: If the claim is approved, the insurer pays the agreed-upon amount.

- Claim Denial (if applicable): If the claim is denied, the insurer will provide a reason for the denial. You may have the right to appeal the decision.

Cost and Factors Affecting OCP Insurance Premiums

OCP insurance premiums, like any insurance policy, aren’t a one-size-fits-all price. Several factors intertwine to determine the final cost, making it crucial for businesses to understand these influences to secure the most appropriate and cost-effective coverage. This section will delve into the key elements impacting premium calculations and provide a clearer picture of what to expect.

OCP insurance premiums are calculated based on a complex risk assessment process. Insurers analyze various aspects of a business to gauge its potential liability. This analysis directly impacts the final premium, with higher-risk businesses naturally facing higher costs. Understanding this process allows businesses to proactively mitigate risks and potentially lower their premiums.

Factors Influencing OCP Insurance Premiums

Several key factors contribute to the final cost of OCP insurance premiums. These include the size and nature of the business, its operational history, the industry it operates in, and the specific coverage levels selected. A larger business with a complex operational structure, for instance, will generally command a higher premium than a smaller, simpler operation. Similarly, industries with inherently higher risk profiles, such as construction or manufacturing, will often face steeper premiums than those in less hazardous sectors. The level of coverage chosen also plays a significant role; more comprehensive coverage naturally translates to higher premiums.

Pricing Structures of Different OCP Insurance Providers

Different OCP insurance providers employ varied pricing structures. Some may base their premiums primarily on the business’s revenue, while others might focus on the number of employees or the specific risks associated with the business’s operations. It’s vital to compare quotes from multiple providers to find the most competitive pricing that aligns with the specific needs and risk profile of the business. Factors such as the provider’s financial stability and claims handling reputation should also be considered alongside price comparisons.

Risk Assessment and OCP Insurance Premiums

Risk assessment forms the cornerstone of OCP insurance pricing. Insurers use sophisticated models to evaluate the likelihood and potential severity of claims arising from the insured business’s operations. This assessment considers factors such as the business’s safety record, its compliance with relevant regulations, and the potential for accidents or incidents leading to liability claims. Implementing robust safety protocols, maintaining detailed records, and demonstrating a commitment to risk management can significantly influence the risk assessment and, consequently, the premium.

Hypothetical Premium Costs Based on Risk Profiles

The following table illustrates hypothetical premium costs for OCP insurance based on different risk profiles. These are illustrative examples and actual premiums will vary significantly depending on the specific circumstances of each business and the insurer’s pricing model.

| Risk Profile | Annual Revenue | Number of Employees | Estimated Annual Premium |

|---|---|---|---|

| Low Risk (e.g., small office, low-risk industry) | $100,000 | 5 | $1,500 |

| Medium Risk (e.g., medium-sized business, moderate risk industry) | $500,000 | 20 | $5,000 |

| High Risk (e.g., large construction firm, high-risk industry) | $2,000,000 | 100 | $20,000 |

| Very High Risk (e.g., large manufacturing plant with history of incidents) | $5,000,000 | 250 | $50,000+ |

OCP Insurance and Legal Considerations

Navigating the world of professional indemnity insurance, especially understanding its legal ramifications, is crucial for both professionals and insurance providers. The legal landscape surrounding OCP insurance is complex, impacting everything from contract formation to dispute resolution. This section delves into the key legal aspects you need to be aware of.

Legal Implications of OCP Insurance Coverage

Having OCP insurance offers significant legal protection. In the event of a claim alleging professional negligence, the insurer typically covers legal fees, court costs, and any awarded damages, up to the policy’s limit. This protection significantly reduces the financial burden and potential career-damaging consequences of a lawsuit. Conversely, lacking OCP insurance leaves professionals personally liable for all costs associated with defending against and settling claims. This could lead to substantial financial losses, reputational damage, and even bankruptcy. The absence of insurance can make a professional a far less attractive candidate for future projects or employment.

Legal Responsibilities of OCP Insurance Providers

OCP insurance providers have several key legal responsibilities. They are obligated to act in good faith, fairly assessing claims and providing timely payouts within the terms of the policy. Failure to do so can lead to legal action against the insurer. Providers must also adhere to all relevant regulations and legislation governing insurance practices in their jurisdiction. This includes transparency in policy wording, clear explanation of coverage and exclusions, and adherence to fair claims handling procedures. Breaching these responsibilities can result in significant fines and reputational damage for the insurance company.

Legal Disputes Related to OCP Insurance Claims

Disputes over OCP insurance claims are common. These often arise from disagreements over whether an incident falls within the policy’s coverage, the extent of the insurer’s liability, or the adequacy of the settlement offered. Common points of contention include the definition of “professional negligence,” the existence of exclusions in the policy, and the causal link between the alleged negligence and the resulting damages. Such disputes may lead to arbitration or litigation, further increasing the legal costs and complexities involved.

Examples of Relevant Legal Cases or Precedents

While specific case details are often confidential, legal precedents in similar professional liability cases highlight the importance of clear policy wording and proper claims handling. For example, cases involving ambiguous policy language have resulted in court decisions favoring the insured party due to the insurer’s failure to clearly define exclusions or coverage limits. Conversely, cases demonstrating clear negligence and a direct causal link between the negligence and the claimant’s losses have resulted in successful claims and payouts by the insurer. These precedents underscore the importance of both clear policy documentation and thorough investigation of claims by both the insured and the insurer. Accessing legal databases specializing in insurance law can provide further examples of relevant case law in specific jurisdictions.

Illustrative Scenarios

Understanding when OCP insurance is beneficial, and equally important, when it’s not, requires examining real-world situations. Let’s explore scenarios where this type of insurance shines and where it falls short.

OCP Insurance: Beneficial Scenarios

These examples highlight situations where OCP insurance provides crucial financial protection.

Scenario 1: The Negligent Architect

Imagine Sarah, an architect, mistakenly designs a building’s foundation, leading to structural damage and significant repair costs for the client, a major corporation. The corporation sues Sarah for negligence, claiming substantial financial losses due to project delays and remediation work. Without OCP insurance, Sarah would be personally liable for the entire cost of the lawsuit and any resulting damages, potentially leading to bankruptcy. With OCP insurance, however, her policy would cover legal fees, court costs, and any awarded damages, protecting her personal assets. The outcome with insurance is a manageable financial burden; without it, the financial consequences could be devastating.

Scenario 2: The Software Glitch

Consider David, a software developer, who releases a new app with a critical bug. This bug causes significant data loss for several clients, resulting in substantial financial losses and reputational damage for David’s company. The clients file lawsuits, claiming damages resulting from the faulty software. With OCP insurance, David’s company is protected from potentially crippling financial repercussions. Legal costs, settlements, and damages would be covered by the policy. Without insurance, the company might face insolvency, whereas with insurance, they can continue operating, albeit with a financial setback that is significantly mitigated.

OCP Insurance: Non-Applicable Scenarios

It’s equally crucial to understand when OCP insurance won’t provide coverage.

Scenario 3: Intentional Misconduct

Suppose a consultant knowingly provides false information to a client, resulting in significant financial losses. OCP insurance typically excludes coverage for intentional acts of wrongdoing. In this scenario, the consultant would be personally liable for the damages, regardless of having OCP insurance. The outcome is the same with or without insurance: the consultant faces full responsibility for their intentional actions.

Scenario 4: Employee Theft

A small business owner discovers that an employee has embezzled a substantial amount of money. While the business owner might have general liability insurance, OCP insurance wouldn’t cover this type of loss. This is because OCP typically focuses on professional negligence, not employee criminal activity. The outcome remains the same with or without OCP insurance; the business owner must pursue legal action and potentially bear the financial losses themselves. They should explore options like fidelity bonds or employee theft insurance for such circumstances.

Summary: Ocp Insurance Definition

Source: co.uk

So, there you have it – a comprehensive look at OCP insurance. Understanding its nuances can be the difference between smooth sailing and a legal storm. Remember, proactive protection is key. By understanding the definition of OCP insurance and its implications, you can safeguard your professional reputation and future. Don’t wait for a crisis to hit; arm yourself with the knowledge to navigate the world of professional liability with confidence. Because let’s face it, peace of mind is priceless.