NYS spousal car insurance: It’s a topic that might seem dry, but trust us, it’s way more interesting than you think. Adding your spouse to your car insurance policy in New York isn’t just about ticking a box; it’s a financial decision with real-world implications. This guide dives deep into the specifics, breaking down the legalities, the cost factors, and how to snag the best deal for your situation. We’re talking premium breakdowns, coverage comparisons, and savvy strategies to save you some serious dough.

From understanding New York’s specific requirements to navigating the application process and finding ways to lower your premiums, we’ve got you covered. Whether your spouse has a spotless driving record or a few bumps in the road, we’ll help you find the right coverage at the right price. Get ready to become a car insurance pro – because knowledge is power (and saves money!).

Understanding New York Spousal Insurance Requirements

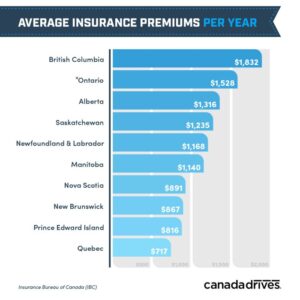

Source: newyorkmotorinsurance.com

Adding a spouse to your car insurance policy in New York isn’t just about sharing coverage; it’s about understanding the legal implications and financial aspects. New York, like most states, doesn’t mandate spousal coverage in the same way it mandates coverage for drivers within your household. However, the decision to include your spouse significantly impacts your premiums and your protection.

Legal Requirements for Adding a Spouse

New York’s legal requirements center around the state’s minimum insurance coverage laws. While you aren’t legally *required* to add your spouse to your policy, if they drive your car, they need to be covered under *someone’s* policy that meets the state’s minimum liability requirements. Failing to do so could result in significant financial repercussions in case of an accident. Essentially, the law focuses on ensuring that drivers are adequately insured, not necessarily on the specific structure of the insurance policy.

Factors Influencing Spousal Insurance Costs

Several factors influence how much adding your spouse to your car insurance policy will cost. These include your spouse’s driving history (accidents, tickets, DUI convictions), age, driving experience, the type of vehicle they drive (if different from yours), and your overall insurance history. A spouse with a clean driving record and a safe driving history will likely result in a lower increase in premiums compared to a spouse with multiple accidents or violations. Location also plays a role; premiums in more densely populated or high-risk areas tend to be higher. The type of coverage chosen (liability only, comprehensive, collision) also affects the cost.

Situations Where Spousal Coverage Is Mandatory or Optional

Spousal coverage is technically optional, but practically mandatory if your spouse regularly drives your vehicle. It’s optional if your spouse has their own vehicle and their own separate insurance policy that adequately covers them. However, adding your spouse to your policy can sometimes be more cost-effective than maintaining two separate policies, particularly if your spouse has a less-than-perfect driving record or if you’re bundling other insurance policies. Conversely, if your spouse has an exemplary driving record and low-risk profile, maintaining separate policies might be a more financially viable option.

Comparison of Spousal Coverage Options

It’s difficult to provide exact pricing, as rates vary significantly based on individual circumstances. However, a general comparison of different providers’ approaches is possible. Note that these are examples and actual prices will differ based on individual risk profiles.

| Provider Name | Coverage Options | Price Range (Annual Estimate) | Customer Reviews (Summary) |

|---|---|---|---|

| Geico | Liability, Comprehensive, Collision | $500 – $1500 | Generally positive, known for competitive pricing. |

| State Farm | Liability, Comprehensive, Collision, Uninsured/Underinsured Motorist | $600 – $1800 | Strong customer service reputation, but prices can vary. |

| Progressive | Liability, Comprehensive, Collision, various add-ons | $450 – $1600 | Known for personalized pricing and online tools. |

| Allstate | Liability, Comprehensive, Collision, multiple package options | $700 – $2000 | Wide range of coverage options, but prices may be higher. |

Factors Affecting Spousal Car Insurance Premiums in NY: Nys Spousal Car Insurance

Source: tlcautotruck.com

Adding a spouse to your car insurance policy in New York can significantly impact your premiums, sometimes in unexpected ways. Several factors beyond simply adding another driver come into play, influencing the final cost. Understanding these factors can help you budget effectively and potentially find ways to save money.

Driving History’s Impact on Premiums

Your spouse’s driving record is arguably the most significant factor affecting your combined insurance premium. Insurance companies meticulously analyze driving history, considering the number of accidents, traffic violations, and even the severity of those incidents. A clean record, characterized by no accidents or tickets in several years, will generally result in lower premiums. Conversely, a history marred by accidents, speeding tickets, or worse, DUIs, will dramatically increase the cost of insurance. The more serious the infractions, the higher the premium increase. For example, a single DUI conviction could lead to a premium increase of hundreds of dollars annually, depending on the insurer and other factors.

Age and Premium Correlation

Age is another crucial factor. Statistically, younger drivers, particularly those under 25, are considered higher risk due to their inexperience and tendency towards riskier driving behaviors. Adding a young spouse to your policy might lead to a noticeable premium increase. Conversely, adding an older spouse with a clean driving record could potentially lower your overall premium, as they’re statistically less likely to be involved in accidents. This effect is often more pronounced if the older spouse is replacing a younger, higher-risk driver on the policy.

Vehicle Type and Insurance Costs

The type of vehicle your spouse drives also matters. Sports cars and luxury vehicles are generally more expensive to insure than sedans or smaller vehicles. This is because these vehicles are often more expensive to repair and replace, and they are sometimes associated with more aggressive driving styles. Adding a spouse who drives a high-performance vehicle will likely result in a higher premium compared to adding a spouse who drives a more economical car.

Discounts for Safe Driving and Good Student Status

Several discounts can mitigate the impact of adding a spouse to your policy. Many insurance companies offer safe driver discounts for those with clean driving records spanning several years without accidents or violations. Similarly, good student discounts are often available to spouses who are full-time students maintaining a certain GPA. These discounts can significantly reduce the overall premium, sometimes offsetting the cost increase associated with adding another driver. Eligibility criteria vary by insurer, so it’s important to check with your provider for specifics. For example, a safe driver discount could reduce your premium by 10-20%, while a good student discount might provide an additional 5-15% reduction.

Choosing the Right Coverage for Your Spouse

Source: toccilaw.com

Protecting your spouse in the event of a car accident is crucial, and choosing the right car insurance coverage is a key step in ensuring their financial well-being. Understanding the different types of coverage available and their implications can significantly impact your family’s preparedness for unforeseen circumstances. This section will break down the essential coverages and help you determine the best fit for your needs.

Liability Coverage

Liability coverage protects you and your spouse financially if you cause an accident that injures someone or damages their property. It covers the costs of medical bills, legal fees, and property repairs for the other party involved. In New York, carrying minimum liability coverage is mandatory, but it’s crucial to consider higher limits to safeguard against potentially catastrophic costs. For example, if your spouse causes an accident resulting in serious injuries, minimum coverage might not be enough to cover the substantial medical expenses and legal settlements. Higher liability limits provide a greater safety net, reducing your personal financial risk.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This is particularly beneficial if your spouse drives an older vehicle, or a vehicle with a higher value, as it ensures that you’re covered for repairs even if the accident is your spouse’s fault. For instance, if your spouse’s car is totaled in a collision, collision coverage will compensate you for the car’s actual cash value, minus your deductible. Without it, you would be responsible for all repair or replacement costs.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage from events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. This type of coverage is particularly useful for protecting newer or more valuable vehicles from damage caused by non-accident related events. Imagine your spouse’s car is damaged in a hailstorm; comprehensive coverage would cover the cost of repairs. Without it, you’d be responsible for the expenses.

Uninsured/Underinsured Motorist Coverage

This coverage protects you and your spouse if you’re involved in an accident caused by an uninsured or underinsured driver. Given the prevalence of uninsured drivers, this is a vital protection. If an uninsured driver causes an accident that injures your spouse, this coverage will help pay for their medical bills and other related expenses. It’s a critical component of a comprehensive insurance plan, offering peace of mind in situations where other driver’s insurance may be insufficient.

Coverage Comparison Chart

| Coverage Type | Advantages | Disadvantages | Scenario Example |

|---|---|---|---|

| Liability | Protects you financially if you cause an accident. | Doesn’t cover your vehicle’s damage. Minimum coverage may be insufficient. | Spouse causes an accident, injuring another driver. Liability coverage pays for their medical bills and property damage. |

| Collision | Covers your vehicle’s damage in an accident, regardless of fault. | Requires a deductible. | Spouse’s car is damaged in a collision. Collision coverage pays for repairs, minus the deductible. |

| Comprehensive | Covers damage from non-collision events (theft, fire, hail). | Requires a deductible. | Spouse’s car is damaged in a hailstorm. Comprehensive coverage pays for repairs, minus the deductible. |

| Uninsured/Underinsured Motorist | Protects you if involved in an accident with an uninsured or underinsured driver. | May require a higher premium. | Spouse is injured by an uninsured driver. This coverage helps pay for medical expenses. |

Navigating the Insurance Application Process with a Spouse

Adding your spouse to your existing car insurance policy in New York might seem daunting, but with a clear understanding of the process, it can be straightforward. This section provides a step-by-step guide, tips for accurate information, and advice on comparing quotes for the best deal. Remember, accuracy is key to securing the most appropriate and cost-effective coverage.

Adding a spouse to your car insurance policy requires careful attention to detail and a proactive approach to comparing quotes. Failing to provide accurate information can lead to delays or even policy rejection. By following these steps and tips, you can ensure a smooth and efficient process.

Adding a Spouse to an Existing Policy

The process of adding your spouse to your existing car insurance policy typically involves contacting your insurance provider directly. You’ll need to provide your insurer with your spouse’s driving history, including their driver’s license number, date of birth, and any past accidents or violations. Your insurer will then update your policy to include your spouse, recalculate your premium based on their driving record and the vehicles covered, and issue a revised policy document. This often involves completing an online form or speaking with a customer service representative. Be prepared to answer questions about your spouse’s driving experience, vehicle usage, and other relevant details.

Step-by-Step Guide to Applying for Spousal Coverage

- Contact your insurer: Reach out to your current insurance provider via phone, email, or their online portal. Inform them of your intention to add your spouse to your policy.

- Gather necessary information: Collect your spouse’s driver’s license, date of birth, driving history (including accidents and violations), and details about the vehicle(s) they will be driving. Accurate information is crucial for a smooth process.

- Complete the application: Your insurer will likely provide an application form, either online or via mail. Complete this form accurately and thoroughly. Any inaccuracies could lead to delays or policy rejection.

- Review the updated policy: Once your insurer processes the application, review the updated policy carefully to ensure the coverage, vehicles, and drivers are all correct and that the premium reflects the added coverage.

- Make payment: Pay the updated premium as instructed by your insurer to activate the updated policy including your spouse.

Ensuring Accurate and Complete Information

Providing accurate and complete information is paramount. Inaccuracies can lead to higher premiums or even policy cancellation. Double-check all information before submitting your application. If unsure about anything, contact your insurer for clarification. For instance, accurately reporting your spouse’s driving history, including any accidents or violations, is critical. Omitting this information could lead to problems later on. Also, ensure you accurately report the vehicle your spouse will be driving, including its year, make, and model.

Comparing Quotes from Multiple Insurance Providers, Nys spousal car insurance

Before adding your spouse to your existing policy, it’s wise to compare quotes from multiple insurance providers. This allows you to find the best value and coverage for your needs. Several online comparison tools are available, or you can contact insurers directly to request quotes. For example, comparing quotes from Geico, State Farm, and Allstate might reveal significant differences in premium costs for the same coverage. Remember to compare not only price but also the coverage offered by each provider to ensure you’re getting the best value for your money. Consider factors such as deductibles, coverage limits, and additional benefits when comparing quotes. This comparative analysis helps in securing the optimal insurance plan tailored to your family’s requirements.

Potential Savings and Cost-Effective Strategies

Adding a spouse to your car insurance policy in New York doesn’t automatically mean a hefty increase in premiums. In fact, with smart planning and a few strategic moves, you can often find ways to keep costs manageable or even lower your overall insurance bill. This section explores various cost-effective strategies to help you navigate the complexities of spousal car insurance in the Empire State.

Several factors influence the final cost of your insurance, and understanding these factors empowers you to make informed decisions. By strategically adjusting your coverage, driving habits, and payment plans, you can significantly impact your premiums. Let’s delve into specific strategies to achieve substantial savings.

Bundling Policies

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, is a common and effective way to reduce your overall premium. Many insurance companies offer discounts for bundling policies, recognizing the reduced risk associated with insuring multiple products with a single provider. For example, a couple bundling their car insurance with a homeowners policy might see a 10-15% discount, depending on the insurer and the specific policies. This discount can significantly offset the added cost of including a spouse on the policy.

Increasing Deductibles

Raising your deductible—the amount you pay out-of-pocket before your insurance coverage kicks in—can lower your premium. A higher deductible means a lower monthly payment, but you’ll pay more if you file a claim. Carefully weigh the risk of needing to pay a higher deductible against the potential savings on your premiums. For instance, increasing your deductible from $500 to $1000 could result in a noticeable reduction in your monthly payments. However, this strategy is most effective for drivers with a strong driving record and a low risk of accidents.

Improving Driving Habits and Defensive Driving Courses

Your driving record plays a crucial role in determining your insurance premium. Maintaining a clean driving record, avoiding accidents and traffic violations, and practicing safe driving habits are essential for keeping premiums low. Furthermore, completing a defensive driving course can demonstrate your commitment to safe driving and may earn you a discount on your insurance. Many insurers offer discounts to drivers who complete approved defensive driving courses, potentially leading to significant savings over time.

Long-Term Cost Implications of Coverage Options and Premium Payment Plans

Choosing the right coverage level and payment plan is another crucial aspect of managing costs. While comprehensive coverage offers more protection, it generally comes with higher premiums. Conversely, liability-only coverage is cheaper but provides less protection in case of an accident. Similarly, paying your premiums annually, rather than monthly, can often result in a lower overall cost due to reduced administrative fees. Consider your individual risk tolerance and financial situation when choosing the most cost-effective combination of coverage and payment plan. For example, a couple with older, less valuable vehicles might find liability-only coverage sufficient, allowing them to save on premiums while still meeting minimum state requirements.

Tips for Minimizing Spousal Car Insurance Costs

Implementing the strategies discussed above, along with these additional tips, can help significantly reduce your spousal car insurance costs:

- Shop around and compare quotes from multiple insurers.

- Maintain a good credit score, as this can influence your premium.

- Consider adding safety features to your vehicles, as some insurers offer discounts for cars with anti-theft devices or other safety features.

- Keep your driving record clean to avoid surcharges.

- Ask about any available discounts offered by your insurer (e.g., good student, multiple car discounts).

Understanding Policy Exclusions and Limitations

Navigating the world of car insurance can feel like deciphering a secret code, especially when it involves adding a spouse to your policy. While spousal coverage offers peace of mind, it’s crucial to understand the fine print – the exclusions and limitations that might leave you unexpectedly uncovered. Knowing these potential pitfalls can save you from costly surprises down the road.

Understanding what’s *not* covered is just as important as understanding what *is* covered. Many policies contain exclusions that limit liability or deny coverage altogether under specific circumstances. These exclusions are often detailed in the policy document, but their implications might not be immediately obvious. This section will illuminate some common exclusions and how to navigate potential ambiguities.

Common Exclusions in Spousal Car Insurance Policies

Policy exclusions vary widely depending on the insurer and the specific policy details. However, some common exclusions you should be aware of include driving under the influence (DUI) or driving without a valid license. Coverage might also be limited or excluded for accidents occurring outside of the geographical area specified in the policy, or for damages resulting from intentional acts. Additionally, certain types of vehicles might be excluded, or coverage may be limited for specific types of accidents, like those involving uninsured motorists. For instance, a policy might offer limited liability coverage for accidents caused by a spouse driving a vehicle not listed on the policy. This could leave you responsible for significant out-of-pocket expenses in the event of an accident.

Situations Where Coverage Might Not Apply to a Spouse

A spouse might find their coverage limited or nonexistent in various scenarios. If your spouse is driving a vehicle not listed on the policy, they might not be fully covered in case of an accident. Similarly, if they’re driving without a valid driver’s license or under the influence of drugs or alcohol, the insurance company might deny the claim. Using a vehicle for commercial purposes when the policy only covers personal use could also void coverage for your spouse. Finally, if your spouse intentionally causes damage or injury, the policy’s liability coverage will likely not apply.

Addressing Concerns and Ambiguities in Policy Wording

Insurance policies are notoriously dense and filled with legal jargon. If you encounter any unclear or ambiguous wording, don’t hesitate to contact your insurance provider directly. Clarify any doubts regarding exclusions or limitations before an incident occurs. Ask for specific examples of situations where coverage would and would not apply to your spouse. Keeping detailed records of your conversations with your insurance provider can be invaluable if disputes arise later. Consider consulting with an independent insurance professional for an unbiased review of your policy to ensure it adequately meets your needs and understand the full extent of your coverage.

Closure

So, there you have it – navigating the world of NYS spousal car insurance doesn’t have to be a headache. By understanding the factors that influence premiums, choosing the right coverage, and employing smart strategies, you can ensure you and your spouse are protected without breaking the bank. Remember to shop around, compare quotes, and don’t hesitate to ask questions. Happy driving (and saving!).