My Insurance Portal: Imagine a world where managing your insurance is as easy as scrolling through your favorite app. No more digging through paperwork, frantic phone calls, or confusing policy jargon. This is the promise of a well-designed insurance portal, a digital hub that puts you in control of your coverage. We’ll dive into what makes a great portal tick, from intuitive design and robust security to personalized customer support that actually understands your needs.

This deep dive explores the key elements of a successful My Insurance Portal, covering everything from user experience and functionality to security, privacy, and customer support integration. We’ll examine best practices, compare different approaches, and ultimately show you what it takes to build a portal that’s not just functional, but truly user-friendly and empowering.

User Experience on “My Insurance Portal”

Navigating the world of insurance can feel like traversing a dense jungle. But a well-designed insurance portal can transform that experience into a smooth, straightforward stroll. Our goal is to create a “My Insurance Portal” that prioritizes user experience, making managing your insurance simple and intuitive. This section details our approach to user-centered design, focusing on user flow, comparative interface analysis, and accessibility features.

User Flow Diagram: Accessing Policy Details

A clear and efficient user flow is crucial for a positive user experience. The following table Artikels a typical user journey, from login to viewing policy details. Each step is designed to be simple and self-, minimizing user frustration and maximizing efficiency.

| Step | Action | Expected Outcome | Potential Issue (and Solution) |

|---|---|---|---|

| 1 | User navigates to “My Insurance Portal” website or app. | Landing page displays login options. | Slow loading time; Solution: Optimize website/app performance. |

| 2 | User enters login credentials (username/email and password). | Successful login redirects to dashboard. | Incorrect credentials; Solution: Clear error message and password reset option. |

| 3 | User selects “My Policies” from the dashboard menu. | List of active policies displays. | Policy list is not easily searchable; Solution: Implement robust search functionality. |

| 4 | User selects a specific policy from the list. | Detailed policy information displays. | Information is not clearly presented; Solution: Use clear headings, concise language, and visual aids. |

Comparative Analysis of Insurance Portal User Interfaces

To ensure our portal stands out, we analyzed the user interfaces of three leading insurance providers: InsureCo, SecureLife, and ProtectAll. The following points highlight key differences in navigation and ease of use.

The analysis focuses on the clarity of information architecture, intuitive navigation, and overall ease of use, comparing the three leading providers against best practices in user interface design.

- InsureCo: Cluttered dashboard, difficult to locate specific information. Navigation relies heavily on nested menus, leading to multiple clicks to access desired information. Search functionality is limited.

- SecureLife: Clean and organized dashboard. Intuitive navigation with clear labeling and visual cues. Offers a robust search function with filtering options. However, some features are buried deep within the menu structure.

- ProtectAll: Modern and visually appealing design. Navigation is streamlined and intuitive. Provides quick access to key information. Search and filtering are excellent. However, the design might be overwhelming for less tech-savvy users.

Accessibility Features

Inclusivity is paramount. “My Insurance Portal” will incorporate several accessibility features to cater to users with disabilities, ensuring equal access to information and services.

Accessibility features will adhere to WCAG (Web Content Accessibility Guidelines) standards to ensure usability for individuals with visual, auditory, motor, and cognitive impairments.

- Screen Reader Compatibility: All content will be compatible with screen readers, ensuring blind or visually impaired users can access all information. This includes proper use of headings, labels, and alternative text for images.

- Keyboard Navigation: The entire portal will be fully navigable using only a keyboard, enabling users with motor impairments to interact seamlessly.

- Color Contrast: Sufficient color contrast will be maintained between text and background to ensure readability for users with low vision.

- Customizable Font Sizes: Users will be able to adjust font sizes to their preference, accommodating various visual needs.

- Closed Captions/Transcripts: For any video content, closed captions and transcripts will be provided, catering to deaf or hard-of-hearing users.

Functionality and Features of “My Insurance Portal”

Navigating the world of insurance can feel like wading through a swamp of jargon and paperwork. But what if managing your policies was as easy as scrolling through your favorite app? That’s the promise of a well-designed insurance portal, and here’s what makes it tick. A user-friendly portal should empower you to take control of your insurance, providing quick access to information and streamlining essential tasks.

A comprehensive insurance portal should offer a suite of features designed to simplify your insurance experience. This goes beyond simply viewing your policy details; it’s about proactive management and seamless interaction with your insurer. Think of it as your personal insurance command center, accessible anytime, anywhere.

Essential Features and User Benefits

The core functionality of a robust insurance portal centers around providing users with quick and easy access to their policy information, claims management tools, and communication channels. Features should be intuitive and clearly labeled, minimizing the need for extensive navigation. Imagine a clean, modern dashboard presenting all the key details at a glance. This immediate access to information reduces stress and saves valuable time. For example, users can instantly view their policy summary, coverage details, and upcoming renewal dates, eliminating the need to search through emails or physical documents.

Mobile vs. Desktop Functionality

The functionality of a mobile-optimized app versus a desktop version should be largely similar, but the user experience is tailored to the specific device. Both versions offer the same core functionality – viewing policy information, submitting claims, and communicating with customer service. However, the mobile app prioritizes speed and ease of access for on-the-go users, while the desktop version allows for a more detailed and comprehensive view of information.

- Similarities: Both versions allow users to view policy details, manage claims, make payments, access documents, and contact customer service.

- Differences: The mobile app prioritizes a streamlined, touch-friendly interface with simplified navigation. The desktop version often offers more advanced features and detailed reporting, such as downloadable policy documents in various formats or the ability to compare multiple policies side-by-side.

User Notification and Alert System

Effective communication is key to a positive user experience. A well-designed notification system keeps users informed about important events and deadlines related to their insurance policies. This system should utilize multiple channels to ensure users receive timely alerts, regardless of their preferred communication method. Consider the diverse preferences of your users; some might prefer email, while others might prefer the immediacy of an SMS message or an in-app notification.

Policy Renewal Reminder: Your policy #12345 will renew on October 26th. Click here to review your options and renew online.

Claim Update: Your claim #67890 is currently being processed. We’ll notify you of any updates.

Important Message: There is a scheduled system maintenance on November 1st, from 11 PM to 1 AM. Some features may be unavailable during this time.

Payment Due: Your payment of $XXX is due on November 15th. Click here to pay online.

Security and Privacy on “My Insurance Portal”

Source: website-files.com

Your peace of mind is our priority. We understand that entrusting your personal and financial information requires a high level of security and transparency. This section details the robust measures we’ve implemented to protect your data and maintain your privacy on our My Insurance Portal. We’re committed to adhering to the highest industry standards and relevant regulations.

Data Security Measures

Protecting your information is paramount. We employ a multi-layered approach to security, incorporating robust authentication, authorization, and encryption protocols. This ensures only authorized individuals can access your data, and that all data transmitted is protected from unauthorized access.

Our authentication system utilizes strong password requirements and multi-factor authentication (MFA) options, such as one-time passwords (OTPs) sent via SMS or email, or authenticator apps. This significantly reduces the risk of unauthorized logins, even if your password is compromised. Authorization controls restrict access to specific data based on your user role and permissions. For instance, only you can view your personal policy details, while authorized representatives may have access to specific claims information.

All data transmitted between your device and our servers is encrypted using industry-standard protocols like HTTPS and TLS. This ensures that your data remains confidential even if intercepted during transmission. Furthermore, data stored on our servers is encrypted at rest using advanced encryption techniques. Regular security audits and penetration testing are conducted to identify and address potential vulnerabilities proactively.

Privacy Policy

We are committed to transparently outlining how we collect, use, and protect your data. Our privacy policy complies with all relevant data protection regulations.

| Data Collected | Purpose of Collection | Data Protection Measures |

|---|---|---|

| Personal Information (Name, Address, Date of Birth, etc.) | To identify you, process your insurance applications, and manage your policy. | Stored securely, encrypted both in transit and at rest. Access is restricted to authorized personnel only. |

| Financial Information (Bank details, Payment information) | To process payments and manage your insurance premiums. | Processed through secure payment gateways with PCI DSS compliance. Not stored directly on our servers. |

| Policy Information (Policy number, coverage details, claims history) | To manage your insurance policy and provide you with relevant information. | Stored securely, with access controlled by user roles and permissions. |

| Communication Data (Email addresses, phone numbers) | To communicate with you regarding your policy, claims, or other important updates. | Used only for legitimate communication purposes. You can opt out of certain communications. |

Data Breach Handling Procedures

In the unlikely event of a data breach, we have established a comprehensive incident response plan to minimize the impact and ensure the safety of your information.

Our response plan prioritizes the immediate containment of the breach and investigation into its cause. This involves collaborating with cybersecurity experts and relevant authorities.

- Immediate Containment: Isolate affected systems to prevent further data compromise.

- Investigation and Root Cause Analysis: Determine the extent of the breach and identify its source.

- Notification: Notify affected users and relevant regulatory bodies within the legally mandated timeframe.

- Remediation: Implement measures to prevent future occurrences and restore affected systems.

- Post-Incident Review: Conduct a thorough review of the incident to identify areas for improvement in our security protocols.

Content and Information Architecture of “My Insurance Portal”

Navigating the world of insurance can feel like wading through treacle, right? Our goal with the “My Insurance Portal” is to make that experience as smooth and intuitive as possible. We’ve meticulously crafted the information architecture to ensure you can quickly find what you need, whether you’re a seasoned policyholder or just starting out. This means a clear structure, easily accessible information, and a design that prioritizes user-friendliness.

The following sitemap illustrates how we’ve organized the portal’s content and features, creating a logical flow that guides users effortlessly through the various sections.

Sitemap of “My Insurance Portal”

| Section | Subsections |

|---|---|

| Home | Welcome message, quick links to key features (e.g., view policy, file a claim) |

| My Policy | Policy details, coverage summary, documents, payment history, upcoming renewals |

| Claims | File a new claim, track claim status, claim FAQs, claim forms |

| Payments | Make a payment, view payment history, payment methods, manage autopay |

| Account | Profile information, contact details, security settings, communication preferences |

| Help & Support | FAQs, contact us (phone, email, chat), helpful resources, tutorials |

Frequently Asked Questions (FAQs)

We understand that insurance jargon can be confusing. To help you navigate common questions, we’ve compiled a comprehensive FAQ section. Here are a few examples:

- Q: Where can I find my policy number? A: Your policy number is located on your policy documents, which can be accessed by logging into your account and going to the “My Policy” section.

- Q: How do I file a claim? A: To file a claim, go to the “Claims” section, select the type of claim, and follow the step-by-step instructions. You’ll need to provide relevant information and supporting documentation.

- Q: What payment methods are accepted? A: We accept payments via credit card, debit card, and electronic bank transfer. Details on how to make a payment are available in the “Payments” section.

- Q: How can I contact customer support? A: You can contact our customer support team via phone, email, or live chat. Contact details are available in the “Help & Support” section.

Presenting Complex Insurance Information Clearly

Making complex insurance information digestible for everyone, regardless of their financial literacy, is crucial. Here’s how we achieve this:

- Use plain language: Avoid jargon and technical terms. If you must use technical terms, define them clearly.

- Visual aids: Charts, graphs, and infographics can make complex data easier to understand. For example, a pie chart could illustrate the breakdown of coverage percentages within a policy.

- Step-by-step instructions: Break down complex processes, like filing a claim, into simple, easy-to-follow steps.

- Real-life examples: Illustrate concepts with relatable scenarios. For instance, explain deductibles with an example of a car accident and the resulting out-of-pocket expenses.

- Interactive tools: Consider tools like calculators that allow users to estimate costs or coverage amounts based on their specific circumstances. For example, a car insurance calculator that estimates premiums based on car details and driver profiles.

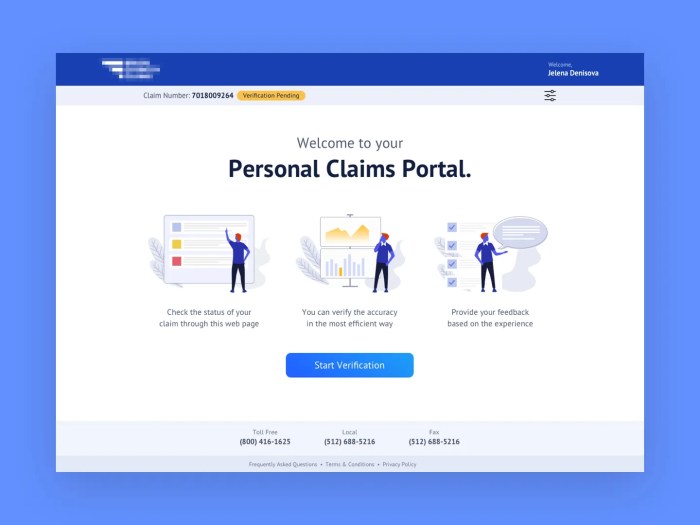

Customer Support Integration within “My Insurance Portal”

Source: behance.net

Seamless customer support is no longer a nice-to-have; it’s a must-have for any successful online insurance portal. Frustrated customers are lost customers, and a clunky support system can quickly erode trust. Integrating multiple support channels directly into your portal creates a frictionless experience, boosting user satisfaction and loyalty. This section explores how to design a robust and user-friendly customer support system within your portal.

Integrating various support channels directly within the “My Insurance Portal” improves user experience significantly. By offering immediate access to assistance, users can resolve issues quickly and efficiently, fostering a sense of security and confidence in the platform. This proactive approach strengthens the customer relationship and enhances brand loyalty. Let’s dive into the specifics of effective integration.

Chatbot Implementation and Responses, My insurance portal

A well-designed chatbot can handle a significant volume of common queries, freeing up human agents to focus on more complex issues. The key is to create a chatbot that understands natural language and provides accurate, helpful responses. Here are some examples of effective chatbot responses:

- User: “What is my policy number?” Chatbot: “Your policy number is [Policy Number]. Is there anything else I can help you with today?”

- User: “I need to file a claim.” Chatbot: “I can guide you through the claims process. Please click here to begin.” (link to claims portal)

- User: “When is my next payment due?” Chatbot: “Your next payment is due on [Date]. You can view your payment details and make a payment here: [link to payment portal]”

- User: “I can’t log in.” Chatbot: “I understand. Let’s try to reset your password. Please click here [link to password reset]. If you continue to experience issues, please select ‘Contact an Agent’ below.”

Personalized Customer Support Methods

Providing personalized support goes beyond simply addressing individual queries. It involves leveraging user data to anticipate needs and proactively offer assistance. Several methods can achieve this:

Using user interaction history and behavior, the portal can offer tailored support. This proactive approach builds trust and strengthens the customer relationship.

- Proactive Chat Invitations: If a user is spending a significant amount of time on a specific page related to a complex feature (e.g., filing a claim), the system can proactively offer a live chat invitation. “Looks like you’re having trouble filing a claim. Would you like assistance from one of our agents?”

- Personalized Email Notifications: Based on policy type, upcoming renewal dates, or recent activity, the portal can send targeted emails providing relevant information or offering support. For example, an email reminding a user of an upcoming payment due date, or offering assistance with a recent claim submission.

- Contextual Help and FAQs: Displaying relevant FAQs or help articles based on the user’s current location within the portal. For instance, if a user is viewing their policy details, display FAQs related to policy coverage or amendments.

- User Segmentation and Targeted Support: Grouping users based on demographics, policy type, or interaction history to offer customized support channels or content. For instance, offering a dedicated phone line for high-value customers or providing simplified FAQs for users with limited technical proficiency.

Ending Remarks

Source: dribbble.com

Ultimately, a successful My Insurance Portal is more than just a digital repository for your policy information; it’s a proactive tool that simplifies insurance management and fosters a stronger connection between you and your provider. By prioritizing user experience, robust security, and personalized support, insurance companies can transform their customer interactions and build a more loyal and engaged user base. So, ditch the dusty policy folders and embrace the digital age of insurance management – your peace of mind is just a click away.