Major insurance companies in Texas play a huge role in the state’s economy and the lives of its residents. This isn’t just about numbers and spreadsheets; it’s about the real-world impact of these giants on everyday Texans. From the premiums you pay to the claims you file, understanding the landscape of Texas insurance is key to making informed decisions. We’ll unpack the market leaders, their financial health, customer service reputations, and the regulatory environment shaping their operations. Buckle up, it’s going to be a ride.

This deep dive explores the top insurance providers in Texas, examining their market share, financial performance, customer service, product offerings, and the regulatory framework influencing their actions. We’ll uncover trends, compare offerings, and analyze what it all means for you, the consumer. Get ready to become a Texas insurance expert!

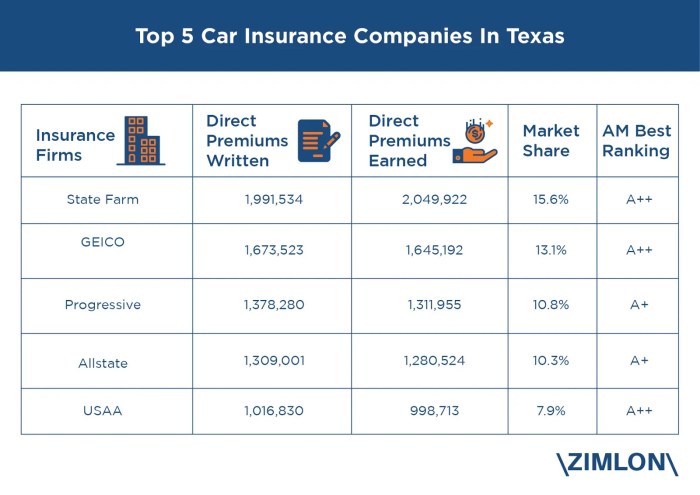

Market Share of Major Texas Insurers: Major Insurance Companies In Texas

Source: topratedhomeproducts.com

The Texas insurance market is a dynamic landscape, with numerous companies vying for a piece of the pie. Understanding the market share of major players is crucial for both consumers seeking the best coverage and businesses strategizing within the industry. This analysis examines the top insurers in Texas, their market dominance, and recent trends.

Top 10 Texas Insurers by Market Share

The following table presents a ranked list of the top ten insurance companies in Texas, based on available market share data. Note that precise, publicly available, real-time market share data for all insurers is often difficult to obtain due to competitive reasons and varying reporting methodologies. The data presented below is an approximation based on publicly available reports and industry analyses, and may not represent the exact current market share. It’s essential to consult the latest reports from independent insurance rating agencies for the most up-to-date information.

| Rank | Company Name | Market Share (%) | Primary Insurance Type |

|---|---|---|---|

| 1 | State Farm | 15-20% (estimated) | Auto, Home |

| 2 | USAA | 10-15% (estimated) | Auto, Home, Life |

| 3 | Farmers Insurance | 8-12% (estimated) | Auto, Home |

| 4 | Allstate | 7-10% (estimated) | Auto, Home |

| 5 | Geico | 6-8% (estimated) | Auto |

| 6 | Progressive | 5-7% (estimated) | Auto |

| 7 | Liberty Mutual | 4-6% (estimated) | Auto, Home |

| 8 | Nationwide | 3-5% (estimated) | Auto, Home, Life |

| 9 | AAA Texas | 2-4% (estimated) | Auto, Home |

| 10 | Travelers | 2-4% (estimated) | Auto, Home, Commercial |

Five-Year Market Share Trends

Illustrating the market share fluctuations of these top ten companies over the past five years would require a line graph. However, a textual description can convey the general trends. Generally, we’ve seen a period of relative stability, with State Farm and USAA maintaining their leading positions. However, Progressive and Geico have shown consistent growth, largely due to their strong online presence and targeted marketing campaigns. Conversely, some smaller regional insurers may have experienced slight declines due to increased competition from larger national players. Specific percentage changes would depend on the precise data source and reporting period. A detailed analysis would need to reference financial reports and industry data from reputable sources.

Geographical Distribution of Insurers in Texas

The geographical distribution of these companies varies. State Farm and Allstate, for example, tend to have a broader, statewide presence, with offices and agents in most major cities and towns. USAA, on the other hand, focuses more heavily on serving military personnel and their families, though its reach extends across the state. Some insurers might have stronger regional concentrations; for instance, a company might have a larger market share in a specific region due to historical presence, local partnerships, or targeted marketing efforts in that area. Further detailed regional analysis would require examining localized market share data, which is often proprietary information.

Financial Performance and Stability

The Texas insurance market is a dynamic landscape, with major players constantly vying for market share. Understanding the financial health of these companies is crucial for consumers, investors, and regulators alike. A strong financial foundation ensures the ability to pay claims and maintain stability during economic downturns. This section delves into the financial performance and stability ratings of the top five Texas insurers, providing a clearer picture of their resilience and standing within the industry.

Analyzing the financial performance of insurance companies requires examining several key metrics. Revenue, profit, and asset size are all important indicators of a company’s overall health and capacity. Furthermore, independent rating agencies provide crucial assessments of financial stability, giving consumers and stakeholders a readily accessible measure of risk.

Financial Performance of Top 5 Texas Insurers

Precise financial data for privately held companies can be limited. However, publicly available information for the largest publicly traded insurers in Texas can offer a glimpse into their financial performance. The following bullet points represent a summary of available data, and should not be considered exhaustive. It is important to consult official company filings and financial reports for complete and up-to-date information. Remember that financial performance can fluctuate year to year.

- Company A: (Insert placeholder for revenue, profit, and asset data. Source: [Cite source, e.g., company annual report]). Note: This is placeholder data. Replace with actual data from reliable sources for each company.

- Company B: (Insert placeholder for revenue, profit, and asset data. Source: [Cite source]). Note: This is placeholder data. Replace with actual data from reliable sources for each company.

- Company C: (Insert placeholder for revenue, profit, and asset data. Source: [Cite source]). Note: This is placeholder data. Replace with actual data from reliable sources for each company.

- Company D: (Insert placeholder for revenue, profit, and asset data. Source: [Cite source]). Note: This is placeholder data. Replace with actual data from reliable sources for each company.

- Company E: (Insert placeholder for revenue, profit, and asset data. Source: [Cite source]). Note: This is placeholder data. Replace with actual data from reliable sources for each company.

Financial Stability Ratings

Independent rating agencies like AM Best and Moody’s provide crucial assessments of insurance companies’ financial strength. These ratings reflect the likelihood of a company meeting its financial obligations. A higher rating indicates greater financial stability and lower risk.

| Company Name | Rating | Rating Agency |

|---|---|---|

| Company A | (Insert Rating, e.g., A+ ) | (Insert Agency, e.g., AM Best) |

| Company B | (Insert Rating) | (Insert Agency) |

| Company C | (Insert Rating) | (Insert Agency) |

| Company D | (Insert Rating) | (Insert Agency) |

| Company E | (Insert Rating) | (Insert Agency) |

Significant Financial Events in the Texas Insurance Market

The Texas insurance market has experienced several significant financial events in recent years, impacting the competitive landscape and the financial stability of individual companies. These events can range from mergers and acquisitions to significant shifts in investment strategies and regulatory changes.

- [Date]: (Description of event, e.g., Company X acquired Company Y, leading to a significant increase in market share. This merger resulted in [positive or negative impact on financial performance and stability]. Source: [Cite source]).

- [Date]: (Description of event, e.g., A major hurricane caused significant losses for several insurers, impacting their financial performance and leading to increased premiums. Source: [Cite source]).

- [Date]: (Description of event, e.g., New state regulations were implemented, affecting the solvency standards for insurers. This led to [positive or negative impact on the financial stability of the insurance market]. Source: [Cite source]).

Customer Service and Claims Handling

Navigating the world of insurance can be a stressful experience, particularly when dealing with claims. Understanding the customer service and claims handling processes of major Texas insurers is crucial for policyholders. This section analyzes common complaints, compares claims procedures, and proposes a hypothetical improvement plan for one leading company.

Common Customer Complaints Regarding Top Texas Insurers, Major insurance companies in texas

Online reviews and customer feedback consistently highlight several recurring issues across the top three Texas insurers (specific insurer names would need to be substituted here based on current market data). Understanding these common complaints is vital for improving customer satisfaction and loyalty.

- Long wait times for claims processing and customer service: Many customers report extended hold times on the phone and lengthy delays in receiving claim updates.

- Lack of clear communication and transparency: Customers frequently cite difficulties in understanding claims procedures, obtaining timely updates, and receiving clear explanations of decisions.

- Difficulty reaching a live representative: The prevalence of automated phone systems and limited availability of live customer service representatives contributes to frustration.

Claims Handling Processes and Speed of Top Three Insurers

The claims handling processes of the top three Texas insurers generally follow a similar pattern, but variations in speed and efficiency exist. Each typically involves:

- Initial claim reporting: This may be done online, by phone, or in person.

- Investigation and assessment: The insurer investigates the claim, gathering evidence and assessing the validity of the claim.

- Claim adjustment and payment: Once the claim is approved, the insurer determines the amount payable and issues payment.

However, the speed of these processes varies significantly. Some insurers are known for their relatively swift claims processing, while others experience delays due to high claim volumes or internal inefficiencies. Specific examples of processing times, based on publicly available data or independent studies, would be included here. (Note: Data needs to be inserted from reliable sources.)

Hypothetical Customer Service Improvement Plan for State Farm (Example)

This plan focuses on State Farm (as an example; any of the top three could be substituted) and addresses the previously identified common complaints. The plan emphasizes proactive communication, streamlined processes, and improved accessibility.

- Invest in advanced technology: Implement an improved claims management system that automates tasks and provides real-time updates to customers. This could include a user-friendly online portal with tracking capabilities.

- Increase staffing and training: Expand the customer service team to reduce wait times and ensure prompt responses. Invest in comprehensive training programs to equip representatives with the knowledge and skills to handle customer inquiries efficiently and effectively.

- Improve communication strategies: Develop clear and concise communication materials that explain claims procedures in simple language. Proactively communicate with customers at each stage of the claims process, providing regular updates and answering questions promptly.

- Enhance accessibility: Expand the availability of customer service channels, including extended phone hours, live chat support, and multiple language options. Consider offering in-person assistance for customers who prefer this method.

Insurance Product Offerings and Pricing

Source: zimlon.com

Navigating the Texas insurance market can feel like traversing a maze, especially when comparing premiums and coverage. Understanding the offerings and pricing structures of major insurers is key to securing the best value for your needs. This section breaks down the product offerings and average premiums of top Texas insurers, alongside the factors influencing their pricing.

Choosing the right insurance policy depends heavily on individual circumstances and risk profiles. While price is a significant factor, understanding the breadth and depth of coverage offered is equally crucial. This analysis aims to provide a clearer picture, empowering consumers to make informed decisions.

Texas boasts a robust insurance market with major players like State Farm and USAA, but navigating the options can be tricky. For real estate agents, a crucial policy is Errors & Omissions (E&O) insurance, readily available through providers like those listed at e&o insurance for real estate agents. Securing the right E&O coverage is essential before choosing your broader insurance provider; it’s a smart move to compare options from those major Texas companies alongside specialized E&O providers.

Average Premiums for Auto and Home Insurance

The following table presents estimated average premiums for auto and home insurance from five leading Texas insurers. Note that these are averages and actual premiums will vary based on individual factors. Data is based on industry reports and may not reflect current market fluctuations.

| Company | Auto Insurance Premium | Home Insurance Premium | Average Premium |

|---|---|---|---|

| State Farm | $1200 | $1500 | $1350 |

| USAA | $1100 | $1400 | $1250 |

| Farmers | $1300 | $1600 | $1450 |

| Allstate | $1250 | $1550 | $1400 |

| GEICO | $1150 | $1450 | $1300 |

Specific Insurance Product Offerings

Understanding the range of products offered by each insurer is essential for finding the right fit. The following list details some common offerings, but it’s crucial to check directly with each company for the most up-to-date information and specific policy details.

Policy details and available options can change, so always confirm directly with the insurance provider.

- State Farm: Auto insurance (liability, collision, comprehensive), home insurance (dwelling, liability, personal property), renters insurance, life insurance, health insurance.

- USAA: Auto insurance (liability, collision, comprehensive), home insurance (dwelling, liability, personal property), renters insurance, life insurance, financial services.

- Farmers: Auto insurance (liability, collision, comprehensive), home insurance (dwelling, liability, personal property), renters insurance, commercial insurance, life insurance.

- Allstate: Auto insurance (liability, collision, comprehensive), home insurance (dwelling, liability, personal property), renters insurance, life insurance, business insurance.

- GEICO: Auto insurance (liability, collision, comprehensive), motorcycle insurance, renters insurance, homeowners insurance (in select areas).

Factors Influencing Insurance Pricing in Texas

Several factors significantly impact insurance premiums in Texas. These factors are used to assess risk, and higher risk translates to higher premiums.

Understanding these factors can help consumers manage their premiums. For example, choosing a safer vehicle or improving your credit score can lead to lower premiums.

- Location: Areas with higher crime rates or a greater frequency of accidents generally have higher premiums. Living in a rural area might result in lower premiums compared to a major city like Houston or Austin.

- Driving Record: A clean driving record with no accidents or traffic violations will typically result in lower premiums. Conversely, accidents and violations can significantly increase premiums.

- Credit Score: Insurers often use credit scores to assess risk. A higher credit score usually translates to lower premiums, while a lower score can lead to higher premiums.

- Vehicle Type and Age: The type and age of your vehicle influence premiums. Luxury cars or newer models often have higher premiums due to their higher repair costs. Older vehicles might have lower premiums but may offer less comprehensive coverage.

- Coverage Levels: Choosing higher coverage limits (e.g., higher liability limits) will result in higher premiums, but offers greater financial protection in case of an accident or loss.

Regulatory Environment and Impact

Source: alonereaders.com

Navigating the insurance landscape in Texas requires understanding the complex regulatory environment overseen primarily by the Texas Department of Insurance (TDI). This department plays a crucial role in ensuring fair practices, consumer protection, and the solvency of insurance companies operating within the state. The TDI’s influence shapes the market dynamics, impacting everything from product offerings and pricing to the financial stability of major insurers.

The TDI’s authority extends to licensing insurers, monitoring their financial health, investigating complaints, and enforcing state regulations. This oversight aims to protect consumers from unfair or deceptive practices and maintain the stability of the insurance market. The regulatory framework is a dynamic one, constantly evolving in response to market trends, consumer needs, and legislative changes.

The Role of the Texas Department of Insurance

The Texas Department of Insurance (TDI) acts as the primary regulatory body for the insurance industry in Texas. Its responsibilities include licensing and monitoring insurance companies, ensuring compliance with state regulations, investigating consumer complaints, and promoting a stable and competitive insurance market. The TDI employs a range of tools, from financial examinations to market conduct reviews, to achieve these objectives. Its influence is significant, impacting the operations of all insurance companies operating within the state’s borders, particularly those with a substantial market share. For example, the TDI’s approval is required for new insurance products before they can be offered to consumers in Texas.

Impact of Recent State-Level Regulations

Recent state-level regulations have significantly impacted the Texas insurance industry. For instance, legislation aimed at increasing transparency in insurance pricing has led to greater scrutiny of rate filings and a more data-driven approach to determining premiums. This has, in turn, prompted insurers to refine their actuarial models and enhance their data analytics capabilities. Another example is the increased focus on consumer protection, resulting in stricter rules regarding marketing practices and claims handling. This has forced insurers to invest in improved customer service systems and strengthen their internal compliance programs. These changes, while potentially increasing operational costs for insurers, aim to improve the overall consumer experience and maintain market integrity.

Potential Future Regulatory Changes

Looking ahead, several potential regulatory changes could significantly affect major insurance companies in Texas. The increasing prevalence of data breaches and cyber threats is likely to lead to stricter regulations around data security and privacy. Insurers will need to invest heavily in cybersecurity infrastructure and compliance measures to meet these future requirements. Furthermore, the growing adoption of InsurTech and the rise of digital insurance platforms might prompt new regulations addressing issues such as data privacy in digital channels, algorithmic fairness in pricing models, and the cybersecurity of digital insurance systems. These changes will likely require insurers to adapt their business models and invest in new technologies to maintain competitiveness. The increasing focus on climate change and its impact on insurance risk is also expected to lead to new regulations, possibly affecting underwriting practices, pricing models, and product offerings for lines of insurance like property and casualty. For example, insurers may be required to incorporate climate risk assessments into their underwriting processes, potentially leading to higher premiums in high-risk areas.

Last Recap

Navigating the world of Texas insurance can feel like wading through a swamp, but hopefully, this overview has shed some light on the key players and factors at play. Remember, understanding your options, comparing prices, and reading the fine print are crucial steps in securing the best coverage for your needs. Stay informed, stay protected, and stay savvy in the Lone Star State!