John Hancock Annual Travel Insurance: ditch the travel worries, embrace the adventure. This isn’t your grandma’s travel insurance; we’re talking comprehensive coverage for the modern explorer. From unexpected medical emergencies to those pesky flight cancellations, we’ll break down everything you need to know about securing your wanderlust with John Hancock’s annual plans. Get ready to travel smarter, not harder.

We’ll dive deep into the different plan options, comparing benefits, costs, and the fine print so you can choose the perfect fit for your globetrotting lifestyle. We’ll also guide you through the application process, claims procedures, and everything else you need to know before you book that next flight. Think of us as your travel insurance Sherpas, guiding you to a stress-free adventure.

Understanding John Hancock Annual Travel Insurance Plans

John Hancock offers a range of annual travel insurance plans designed to provide peace of mind for frequent travelers. These plans differ from single-trip policies, offering broader coverage for multiple trips throughout the year, making them a cost-effective option for those who travel often. Understanding the nuances of each plan is crucial to selecting the best fit for your individual needs and travel style.

John Hancock Annual Travel Insurance Plan Types and Coverage

John Hancock’s annual travel insurance plans typically fall into different tiers, each offering varying levels of coverage. While specific plan names and details may change, the core components usually include medical expense coverage, trip cancellation/interruption protection, and emergency assistance services. Higher-tier plans often provide increased coverage limits, broader benefits, and more comprehensive emergency assistance. For example, a basic plan might cover medical expenses up to a certain limit, while a premium plan could offer significantly higher limits and potentially include coverage for pre-existing conditions (subject to specific terms and conditions). Emergency assistance services usually encompass 24/7 access to help with things like medical evacuation, lost luggage assistance, and repatriation. Trip cancellation/interruption coverage typically reimburses for non-refundable trip costs if your trip is cancelled or interrupted due to covered reasons, such as illness or unforeseen events.

Comparison of John Hancock Annual Plans with Other Providers

Comparing John Hancock’s annual plans with those from other providers requires careful consideration of several factors. While John Hancock might offer competitive pricing on certain plans, other providers may excel in specific areas like coverage for adventure activities or pre-existing conditions. Some providers might have more robust emergency assistance networks or offer more flexible cancellation policies. It’s crucial to compare coverage limits, exclusions, and the overall value proposition before making a decision. For instance, while John Hancock might offer excellent medical coverage, another provider could offer superior coverage for lost luggage or trip delays. The best plan depends on your individual travel patterns, risk tolerance, and budget.

Key Features Comparison of Three John Hancock Annual Travel Insurance Plans (Illustrative Example)

The following table provides a simplified comparison of three hypothetical John Hancock annual travel insurance plans. Remember that specific plans and their features are subject to change, so it’s essential to check the current offerings and policy details directly with John Hancock. This table should be used for illustrative purposes only and does not represent current John Hancock offerings.

| Plan Name | Medical Expense Coverage | Trip Cancellation/Interruption | Annual Premium (Example) |

|---|---|---|---|

| Explorer Basic | $100,000 | $5,000 | $200 |

| Explorer Plus | $250,000 | $10,000 | $350 |

| Explorer Premium | $500,000 | $20,000 | $600 |

Eligibility and Application Process

So, you’re ready to explore the world with the peace of mind that John Hancock Annual Travel Insurance provides? Fantastic! But before you start packing your bags, let’s navigate the eligibility requirements and the application process. Understanding these steps will ensure a smooth and efficient experience.

Eligibility Criteria for John Hancock Annual Travel Insurance

John Hancock’s annual travel insurance isn’t a one-size-fits-all solution. Specific eligibility criteria ensure the policy aligns with your individual needs and risk profile. While the exact requirements may vary depending on the specific plan you choose, some common factors include age, residency, and health status. Generally, applicants must be residents of the United States and fall within a specified age range (typically up to a certain age, perhaps 75 or 80, depending on the plan). Pre-existing conditions may be considered, and full disclosure during the application process is crucial. Applicants with serious pre-existing conditions might face limitations or higher premiums, or even be ineligible for certain coverage options.

Application Procedure

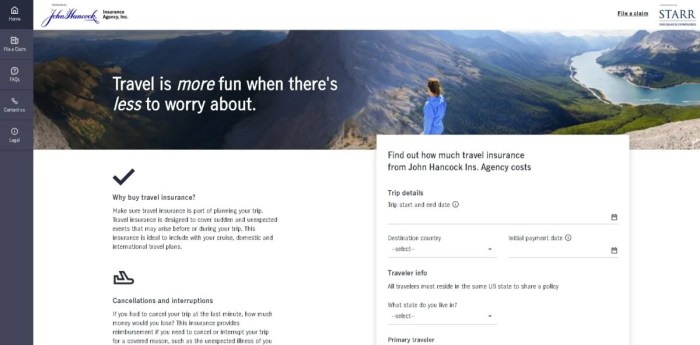

Applying for John Hancock Annual Travel Insurance is a straightforward process, generally involving online applications or working with an insurance broker. The steps usually include providing personal information, selecting your coverage options, and submitting the required documentation. Let’s break it down step-by-step.

- Gather Required Documents: Before starting the application, collect necessary documents such as your passport, driver’s license, and any relevant medical information. Having these readily available will streamline the process.

- Complete the Application Form: Carefully fill out the online application form or provide the necessary information to your broker. Accuracy is paramount here; providing false information can lead to policy denial or complications later.

- Select Your Coverage: Choose the coverage level that best suits your travel plans and risk tolerance. Consider factors like trip duration, destination, and the activities you plan to engage in.

- Pay the Premium: Once you’ve selected your plan, you’ll need to pay the premium. Payment options may vary, but most insurers offer secure online payment methods.

- Review and Submit: Before submitting, carefully review all the information you’ve provided to ensure accuracy. Once submitted, you’ll usually receive a confirmation email or notification.

Underwriting and Waiting Periods

After submitting your application, John Hancock will review your information through an underwriting process. This involves assessing your risk profile to determine your eligibility and the appropriate premium. This process may involve reviewing your medical history and potentially requesting additional information or medical documentation. Depending on the plan and your individual circumstances, there might be a waiting period before certain coverages become effective. For example, there might be a waiting period before coverage for pre-existing conditions kicks in. It’s essential to carefully read the policy documents to understand any waiting periods that apply to your specific situation.

Application Process Flowchart

Imagine a flowchart. It begins with “Start Application,” branching to “Gather Documents” and “Complete Application Form.” Both paths converge at “Select Coverage,” which then leads to “Pay Premium.” From there, the process moves to “Underwriting Review,” where it branches into two possibilities: “Approved” leading to “Policy Issued,” and “Denied” leading to “Reasons for Denial Provided.” The flowchart ends with “End.”

Claim Procedures and Customer Support

Navigating the sometimes-tricky world of travel insurance claims doesn’t have to be a headache. John Hancock aims to make the process as smooth as possible, offering various support channels and clear guidelines. Understanding the procedure and what’s needed beforehand can significantly reduce stress should you need to file a claim.

Filing a claim with John Hancock travel insurance involves a straightforward process designed for efficiency. The key is to act promptly and gather all the necessary documentation. The quicker you submit your claim, the faster you can get back to enjoying your trip (or recovering from an unexpected event!).

Claim Filing Process, John hancock annual travel insurance

To initiate a claim, you’ll typically need to contact John Hancock directly through their designated customer service channels (details below). They will guide you through the specific steps, which generally involve completing a claim form and providing supporting documentation. This might involve providing a copy of your insurance policy, details of the incident, and any relevant medical bills or receipts. Remember to keep all original documents for your records. A dedicated claims representative will then review your submission and contact you with updates on the progress.

Required Documentation

Supporting your claim with the correct documentation is crucial for a swift resolution. This typically includes a copy of your insurance policy, a completed claim form (provided by John Hancock), and evidence related to the covered event. For medical claims, this might mean doctor’s notes, hospital bills, and receipts for prescribed medications. For lost luggage claims, you’ll likely need a police report and receipts for the lost items. Detailed documentation minimizes delays and ensures a smoother claims process. If the claim relates to trip cancellation or interruption, documentation supporting the reason for cancellation (like a doctor’s note for illness or a flight cancellation confirmation) is essential.

Claim Processing Timeframe and Payment

The time it takes to process a claim varies depending on the complexity of the case and the availability of all necessary documentation. John Hancock aims to process most straightforward claims within a few weeks. More complex cases, such as those involving significant medical expenses or legal issues, may take longer. Once your claim is approved, payment will be processed according to the terms Artikeld in your policy. Payment methods might include direct deposit or check, depending on your preference and John Hancock’s procedures. Always refer to your policy for specific details regarding payment timelines and methods.

Customer Support Channels and Operating Hours

John Hancock offers several convenient ways to access customer support. These typically include a dedicated phone number for claims inquiries, a secure online portal for managing your policy and submitting claims, and an email address for less urgent inquiries. The operating hours for phone support and online portal access will be clearly stated on their website and policy documents. It’s advisable to check their website for the most up-to-date contact information and operating hours, as these may be subject to change. Remember to keep your policy number handy when contacting customer support to ensure a quicker response.

Cost and Value Comparison: John Hancock Annual Travel Insurance

Choosing the right travel insurance can feel like navigating a minefield of premiums and policies. Understanding the cost of John Hancock’s annual travel insurance relative to competitors is crucial for making an informed decision. This section compares John Hancock’s pricing with similar plans, exploring the factors that influence the final premium.

Factors Affecting Premium Costs

Several factors significantly influence the cost of your annual travel insurance premium. These include your age, your chosen destination, and the level of coverage you select. Older travelers generally face higher premiums due to increased health risks. Destinations with higher healthcare costs or greater risk of natural disasters will also command a higher price. Finally, a comprehensive plan with extensive coverage will naturally cost more than a basic plan.

Premium Cost Comparison Table

This table provides a hypothetical comparison of premiums for various profiles. Remember that actual premiums can vary based on specific policy details and the insurer’s current pricing. These figures are for illustrative purposes only and should not be considered definitive quotes.

| Profile | Age | Destination | Coverage Level | John Hancock (Estimated) | Competitor A (Estimated) | Competitor B (Estimated) |

|---|---|---|---|---|---|---|

| Young Traveler | 25 | Europe | Basic | $250 | $220 | $280 |

| Young Traveler | 25 | Southeast Asia | Comprehensive | $500 | $450 | $600 |

| Older Traveler | 65 | Europe | Basic | $400 | $380 | $450 |

| Older Traveler | 65 | South America | Comprehensive | $800 | $750 | $900 |

Note: Competitor A and Competitor B are placeholder names representing generic competitors in the travel insurance market. The estimated premium costs are illustrative examples and do not reflect actual pricing from any specific company. Always obtain quotes directly from insurers for accurate pricing.

Terms and Conditions, Exclusions, and Limitations

Understanding the fine print is crucial when it comes to travel insurance. John Hancock’s annual travel insurance, while offering comprehensive coverage, has specific exclusions and limitations you need to be aware of before you book that dream vacation. Failing to understand these terms could leave you footing the bill for unexpected events.

Key Exclusions and Limitations

John Hancock’s annual travel insurance, like most policies, won’t cover everything. Certain activities and circumstances are explicitly excluded from coverage. These exclusions are designed to manage risk and prevent the insurance company from covering events that are inherently difficult to predict or control. Knowing these limitations beforehand is essential for informed decision-making.

- Pre-existing conditions: Many policies, including John Hancock’s, often have limitations on coverage for pre-existing medical conditions. This means if you have a health issue before purchasing the policy, treatment related to that condition might not be covered during your travels. The specifics of how pre-existing conditions are handled vary depending on the policy and the specific condition.

- Activities considered high-risk: Coverage may be denied or limited for injuries or illnesses resulting from activities deemed inherently risky, such as extreme sports (bungee jumping, skydiving), dangerous wildlife encounters, or participation in illegal activities.

- Acts of war or terrorism: Claims resulting from war, terrorism, or civil unrest are typically excluded. These events are usually considered uninsurable due to their unpredictable and widespread nature.

- Self-inflicted injuries: Injuries intentionally caused by the insured person are usually not covered. This includes situations where alcohol or drug use plays a significant role.

Examples of Denied Claims

Let’s illustrate these exclusions with some real-life scenarios. Imagine someone with a known heart condition travels without disclosing it and suffers a heart attack abroad. Their claim might be denied or partially covered, depending on the policy’s specific wording regarding pre-existing conditions. Similarly, a traveler participating in an unsanctioned mountain climbing expedition who suffers an injury might find their claim rejected because of the inherent risk involved. Finally, someone injured during a bar fight would likely see their claim denied due to involvement in an illegal activity.

Pre-existing Conditions and Coverage

Pre-existing conditions represent a significant factor influencing coverage. A pre-existing condition is any medical condition diagnosed or treated within a specified period before the policy’s effective date (this period varies by policy). While some policies offer limited coverage for pre-existing conditions after a waiting period, many do not cover treatment related to these conditions at all. It’s crucial to carefully review the policy documents and understand how pre-existing conditions are handled before purchasing the insurance. Full disclosure of pre-existing conditions during the application process is paramount to avoid potential claim denials.

Appealing a Claim Denial

If your claim is denied, John Hancock typically Artikels a clear appeals process within their policy documents. This usually involves submitting additional documentation to support your claim and potentially speaking with a claims adjuster to clarify any misunderstandings. The process and timeframe for appeals will be specified in the policy’s terms and conditions. Understanding the appeals process beforehand can help you navigate a potential claim denial more effectively and increase your chances of a successful appeal. It’s recommended to keep all relevant documentation, including medical records and receipts, organized and readily available.

Illustrative Scenarios and Case Studies

Source: viatravelers.com

So, you’re all set with your John Hancock annual travel insurance, ready for that epic adventure? But before you hit the road, remember to secure your new ride with equally solid coverage. Check out the options for new car insurance online to ensure your investment is protected. Then, back to that John Hancock policy – make sure you’ve got all your travel documents in order!

Real-life examples often paint a clearer picture than abstract explanations. Let’s explore how John Hancock’s Annual Travel Insurance has helped travelers navigate unexpected situations. These scenarios highlight the coverage provided and the claims process.

Medical Evacuation Coverage

Imagine Sarah, a seasoned hiker, enjoying a trek through the remote mountains of Nepal. During a sudden blizzard, she suffers a severe leg injury, making it impossible for her to walk. Local medical facilities are inadequate to handle her injury. Thanks to her John Hancock Annual Travel Insurance, she’s able to initiate a medical evacuation. The insurance company coordinates her transport via helicopter to a hospital in Kathmandu with appropriate facilities, covering all associated costs including the helicopter transfer, medical treatment at the better-equipped hospital, and her subsequent repatriation flight back to the US. The entire process, from initial contact to final settlement, was handled smoothly by John Hancock’s dedicated claims team. Sarah’s quick recovery is a testament to the value of comprehensive travel insurance.

Trip Cancellation Due to Unforeseen Circumstances

David, a family man, had meticulously planned a dream vacation to Europe for his family. Just days before their departure, his mother suffers a serious medical emergency requiring immediate hospitalization and round-the-clock care. Unable to leave his mother’s side, David had to cancel the entire trip. His John Hancock Annual Travel Insurance policy covered the non-refundable flight and accommodation costs, alleviating a significant financial burden during an already stressful time. The claims process was straightforward; David submitted the necessary documentation, and the reimbursement was processed quickly and efficiently. The insurance provided peace of mind during a difficult situation.

Claim Denial

Mark purchased John Hancock’s Annual Travel Insurance but neglected to read the fine print. While on a skiing trip, he suffered a minor injury. However, his claim for medical expenses was denied. Upon review, it was discovered that Mark’s policy explicitly excluded pre-existing conditions, and his injury was directly related to a pre-existing knee problem he failed to disclose during the application process. This highlights the importance of thoroughly reviewing the policy’s terms and conditions and accurately disclosing all relevant medical information during the application process. Understanding exclusions and limitations is crucial for maximizing the benefits of your travel insurance.

Overall Assessment of John Hancock Annual Travel Insurance

Source: finisterra.ca

John Hancock’s annual travel insurance offerings present a mixed bag for travelers. While they provide decent coverage for various travel-related mishaps, a thorough evaluation reveals both strengths and weaknesses that potential customers should carefully consider before committing. A comparative analysis against competitors is crucial for making an informed decision.

Strengths of John Hancock Annual Travel Insurance

John Hancock’s annual plans offer comprehensive coverage, including medical emergencies, trip cancellations, and lost luggage. Their plans often include features such as 24/7 emergency assistance, which can be invaluable in stressful situations. The availability of different coverage levels allows travelers to tailor their protection to their specific needs and budget. Many customers report a relatively straightforward claims process, although experiences can vary. The reputation of John Hancock as a well-established financial institution provides a degree of confidence for some consumers.

Weaknesses of John Hancock Annual Travel Insurance

While John Hancock offers solid coverage, some customers report higher premiums compared to competitors offering similar benefits. The breadth of their coverage may not be as extensive as some specialized travel insurance providers, particularly in niche areas like adventure sports or extreme activities. Customer service experiences, while generally positive for many, have seen some reports of delays or difficulties in certain cases. Specific exclusions and limitations within the policy documents require careful review to avoid unexpected gaps in coverage.

Comparative Analysis with Competitors

Direct comparison with competitors like Allianz, Travel Guard, or World Nomads requires a detailed look at specific plan features and pricing. For example, Allianz might offer more extensive coverage for adventure activities, while World Nomads might be more competitively priced for younger travelers. Travel Guard might offer superior customer service ratings based on independent reviews. Ultimately, the “best” choice depends on individual needs and priorities, requiring a side-by-side comparison of policy details and costs. Factors like age, destination, travel style, and pre-existing conditions significantly impact the best fit.

Recommendations for Travelers Considering John Hancock

Travelers should carefully compare John Hancock’s plans to those offered by leading competitors before making a purchase. It’s essential to read the policy document thoroughly to understand the coverage details, exclusions, and limitations. Consider your travel style, destination, and budget when choosing a plan. If you anticipate engaging in high-risk activities, ensure the policy adequately covers those risks. Checking independent reviews and ratings of customer service can provide valuable insights into potential experiences. Don’t hesitate to contact John Hancock directly with specific questions about coverage or the claims process. Finally, weigh the cost versus the level of coverage and compare it to competing offers.

Epilogue

Source: onovoinfo.com

So, is John Hancock Annual Travel Insurance right for you? The answer, like the perfect travel destination, depends on your individual needs. Weighing the coverage, cost, and ease of use against other providers is key. But with a clear understanding of the plans, the application process, and what’s covered (and what’s not), you’re empowered to make the best choice for your next big trip. Happy travels!