Is proliability good insurance? That’s the million-dollar question, especially since “proliability” sounds like something straight out of a sci-fi novel. Let’s decode this new insurance buzzword. We’ll dissect what it likely covers (hint: think beyond your standard liability), compare it to the usual suspects – liability, property, and casualty – and weigh the pros and cons. Buckle up, because this deep dive into the world of proliability is about to get real.

Imagine a future where risks are hyper-specific, demanding equally hyper-specific insurance. That’s where proliability potentially comes in. This exploration will help you understand if this emerging type of insurance is right for your unique needs, whether you’re a small business owner or a risk-averse individual. We’ll examine potential benefits, costs, and the legal landscape to arm you with the knowledge to make informed decisions.

Defining “Proliability” and Insurance

Let’s face it, the insurance world is a labyrinth of jargon. So, when you stumble upon a term like “proliability,” it’s understandable to feel a little lost. Assuming “proliability” is a newly coined term, let’s dissect its likely meaning within the insurance context. It probably combines “proactive” and “liability,” suggesting an insurance policy that focuses on preventing liabilities rather than just covering them after the fact.

Proliability insurance, therefore, could be interpreted as a type of coverage that emphasizes proactive risk management and loss prevention alongside traditional liability protection. This might involve things like risk assessments, safety training, and even preventative maintenance programs included as part of the policy. Think of it as insurance that’s less about paying out after something goes wrong and more about making sure things go right in the first place.

Proliability Insurance Compared to Other Insurance Types

The following table compares proliability insurance (as we’ve defined it) with established insurance types. Note that the premium and risk profile columns reflect hypothetical scenarios based on the proactive nature of proliability insurance. Actual premiums and risk profiles would vary significantly depending on the specific policy details and the insured’s risk factors.

| Insurance Type | Coverage | Premiums | Risk Profile |

|---|---|---|---|

| Liability Insurance | Covers financial losses caused by the insured’s negligence or actions resulting in injury or damage to others. | Generally moderate to high, depending on risk factors. | Medium to High, depending on the industry and the insured’s history of claims. |

| Property Insurance | Covers damage or loss to the insured’s own property. | Varies depending on the value of the property and location. | Low to Medium, depending on factors such as location and security measures. |

| Casualty Insurance | Broad category covering various unforeseen events, including accidents and injuries. | Wide range, depending on the specific type of casualty coverage. | Varies widely depending on the type of coverage and associated risks. |

| Proliability Insurance (Hypothetical) | Combines liability coverage with proactive risk management services and loss prevention programs. | Potentially higher initially, but potentially lower in the long run due to reduced claims. | Potentially lower than traditional liability insurance due to proactive risk mitigation. |

Benefits and Drawbacks of Proliability Insurance

The potential benefits of proliability insurance, compared to traditional options, are significant. The proactive risk management aspect could lead to fewer accidents, less damage, and lower claims, potentially resulting in long-term cost savings. Businesses could also benefit from improved safety protocols and enhanced reputation through a demonstrated commitment to safety. For example, a construction company with proliability insurance might have access to regular safety audits and training programs, leading to fewer workplace accidents and associated legal costs.

However, the drawbacks are also worth considering. The initial premiums for proliability insurance might be higher than traditional liability insurance due to the added services. Also, the effectiveness of the proactive risk management component depends heavily on the quality of the services provided by the insurer. A poorly implemented program could be ineffective and not justify the higher cost. Furthermore, finding insurers offering this hypothetical “proliability” coverage would be challenging, as it’s not a standard type of insurance currently available.

So, is proliability good insurance? It really depends on your risk profile. Finding the right coverage is key, and that often means looking at local options. For example, if you’re in Lafayette, TN, checking out the specifics of lafayette tn insurance providers could be a smart move to understand what’s available to protect your business. Ultimately, the “goodness” of proliability hinges on its suitability to your individual needs.

Risk Assessment and Proliability

Source: slideplayer.com

Proliability insurance, a specialized niche within professional liability coverage, requires a nuanced approach to risk assessment. Unlike standard liability insurance that focuses on general accidents or injuries, proliability delves into the specific professional risks associated with a particular field. Understanding these risks is crucial for securing appropriate coverage and mitigating potential financial losses.

A comprehensive risk assessment for proliability insurance involves identifying and evaluating potential liabilities stemming from professional errors, omissions, or negligence. This goes beyond simple slip-and-fall incidents and delves into the intricacies of a professional’s work, focusing on the potential for claims arising from their actions or inactions.

Types of Risks Covered by Proliability Insurance

The types of risks covered by proliability insurance are highly dependent on the profession. However, several common scenarios exist across various industries.

- Errors and Omissions: A financial advisor providing incorrect investment advice leading to client losses; a lawyer missing a crucial filing deadline resulting in a case dismissal; a software developer releasing a program with critical bugs causing financial damage to the client.

- Breach of Contract: A consultant failing to deliver on promised services, resulting in a breach of contract claim; a contractor not completing a project to agreed-upon specifications, leading to legal action.

- Negligence: A doctor misdiagnosing a patient, resulting in further health complications; an architect designing a building with structural flaws causing property damage.

- Intellectual Property Infringement: A designer using copyrighted material without permission, leading to a lawsuit; a software company infringing on a patent.

- Data Breaches: A consultant handling sensitive client data experiencing a security breach, leading to legal and financial repercussions.

Differences in Risk Assessment Between Proliability and Standard Liability Insurance

Risk assessment for proliability insurance differs significantly from standard liability insurance in its focus and depth. Standard liability insurance primarily assesses the likelihood and severity of physical injuries or property damage on the premises. Proliability, conversely, focuses on the potential for financial loss resulting from professional errors or negligence. This requires a much more in-depth analysis of the professional’s work processes, client interactions, and potential vulnerabilities.

For instance, a standard liability assessment for a restaurant might focus on slip-and-fall accidents or food poisoning. A proliability assessment for a food consultant, however, would focus on the accuracy of their advice, potential for recipe errors causing harm, and the possibility of providing misleading information leading to financial losses for their clients.

Hypothetical Risk Assessment Questionnaire for Proliability Insurance

A thorough risk assessment questionnaire should be tailored to the specific profession. However, a general framework can be applied across various fields. The following represents a sample questionnaire for a business considering proliability insurance:

| Question | Answer |

|---|---|

| What is your primary business activity? | [Space for answer] |

| Describe your typical client interaction. | [Space for answer] |

| What are the potential consequences of an error or omission in your services? | [Space for answer] |

| What measures do you have in place to prevent errors or omissions? (e.g., quality control procedures, training programs) | [Space for answer] |

| Have you ever faced a professional liability claim? If so, please provide details. | [Space for answer] |

| What is the average value of a single project or service you provide? | [Space for answer] |

| Do you handle sensitive client data? If so, what security measures are in place? | [Space for answer] |

| What is your annual revenue? | [Space for answer] |

| Do you outsource any part of your work? If so, to whom and what are their responsibilities? | [Space for answer] |

| What is your level of professional experience and qualifications? | [Space for answer] |

Policy Features and Considerations

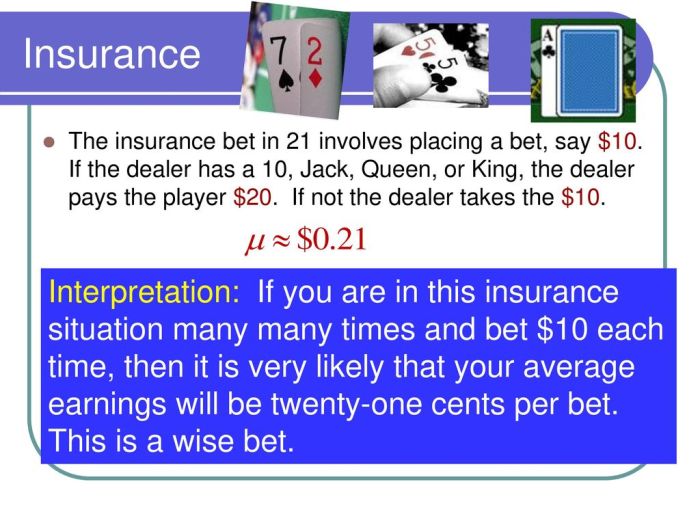

Source: slideplayer.com

Understanding the specifics of a proliability insurance policy is crucial for effective risk management. While the core function is to protect against financial losses stemming from professional negligence, the details within the policy document significantly impact the level of protection offered. This section delves into key features, potential exclusions, and provides a glimpse into what a policy excerpt might look like.

Policy features vary widely depending on the profession, the level of risk involved, and the insurer. However, some common features provide a solid foundation for understanding the scope of coverage.

Key Policy Features

A comprehensive proliability policy typically includes several key features designed to provide robust protection. These features are not always present in every policy, so careful review is essential. The presence or absence of specific features can significantly affect the overall value and effectiveness of the insurance.

- Coverage Limits: This defines the maximum amount the insurer will pay for covered claims during a policy period. For instance, a policy might have a $1 million limit per claim and a $2 million aggregate limit for all claims within the policy year.

- Defense Costs: Many policies cover legal defense costs, even if the claim is ultimately deemed unfounded. This is crucial as legal fees can quickly escalate, regardless of the outcome.

- Claims Handling Services: Reputable insurers provide comprehensive claims handling services, guiding policyholders through the process and representing their interests.

- Policy Territory: This specifies the geographical area where the coverage applies. A policy might only cover professional activities within a specific state or country.

- Retroactive Date: This indicates the earliest date from which incidents are covered. Policies may exclude incidents that occurred before the policy’s inception date, or may offer retroactive coverage for an additional premium.

Policy Exclusions and Limitations

It’s equally important to understand what a proliability policy *doesn’t* cover. Exclusions and limitations are often carefully worded and can significantly restrict the scope of protection. Careful reading of the policy wording is vital to avoid unpleasant surprises.

- Intentional Acts: Most policies exclude coverage for damages resulting from intentional acts or willful misconduct.

- Criminal Acts: Coverage is generally not provided for claims arising from criminal activities.

- Bodily Injury or Property Damage: While some policies may offer limited coverage, proliability insurance primarily focuses on financial losses resulting from professional negligence, not physical harm or property damage.

- Specific Exclusions Related to Profession: Policies often include exclusions tailored to specific professions. For example, a doctor’s policy might exclude coverage for certain surgical procedures deemed high-risk.

- Prior Acts Exclusion (Prior Acts Coverage): This relates to claims arising from incidents that occurred before the policy’s inception date. This can be particularly important for professionals switching insurers.

Sample Proliability Insurance Policy Excerpt, Is proliability good insurance

This policy provides coverage for claims of professional liability arising from the Insured’s professional services rendered during the policy period, from January 1, 2024, to December 31, 2024. Coverage is subject to a limit of $1,000,000 per claim and $2,000,000 aggregate. The insurer agrees to defend the Insured against any covered claim, and to pay damages awarded against the Insured up to the policy limits. This policy specifically excludes coverage for bodily injury, property damage, intentional acts, and claims arising from criminal activities. The insured is responsible for notifying the insurer promptly of any potential claim. This policy is governed by the laws of the State of [State Name].

Cost and Value of Proliability Insurance

The price of proliability insurance, like any insurance, is a balancing act. It’s an investment in protecting your business from potentially devastating financial losses, but the cost itself can be a significant expense. Understanding the cost relative to other insurance types and how that cost changes based on your specific circumstances is crucial for making an informed decision.

Proliability insurance costs are influenced by several key factors, leading to significant variations across industries and businesses. A small bakery will have drastically different premiums than a large construction firm, reflecting the inherent differences in risk profiles. The cost-benefit analysis, therefore, isn’t a one-size-fits-all equation.

Comparison of Proliability Insurance Costs to Other Insurance Options

A hypothetical comparison of annual premiums for a medium-sized business across three different insurance types—proliability, general liability, and commercial auto—might look like this (note: these are illustrative figures and actual costs will vary widely). Imagine a bar chart with three bars representing the annual premium costs. The bar for proliability insurance might be the tallest, representing a cost of $5,000 annually. The general liability insurance bar would be shorter, perhaps $3,000, while the commercial auto insurance bar would be the shortest, at $1,500. This visual representation would highlight the generally higher cost of proliability insurance compared to other common business insurance options. This is because proliability insurance covers a much broader range of potential professional errors and omissions, leading to higher potential payouts.

Value Proposition of Proliability Insurance Across Different Factors

The value of proliability insurance shifts dramatically depending on several key variables. For example, a high-risk industry like medical malpractice or financial consulting would find the value proposition exceptionally strong due to the potential for substantial lawsuits. The cost, while higher, is significantly outweighed by the protection offered against potentially ruinous claims. Conversely, a low-risk business might view the cost as less justifiable, especially if their risk tolerance is high and their financial reserves are substantial. Business size also plays a crucial role; larger businesses with more clients and greater potential for liability face higher risks and consequently higher premiums, making proliability insurance a more critical investment. Conversely, smaller businesses might find the cost less prohibitive and the coverage more valuable.

Cost-Saving Strategies for Proliability Insurance

Businesses can employ several strategies to mitigate the cost of proliability insurance without compromising crucial coverage.

| Strategy | Implementation | Potential Savings |

|---|---|---|

| Improved Risk Management | Implement robust internal controls, conduct regular risk assessments, and provide thorough employee training. | Reduced premiums due to lower risk profile. Potentially 10-20% reduction. |

| Higher Deductibles | Agree to pay a larger amount out-of-pocket before the insurance coverage kicks in. | Significant premium reduction, but requires increased financial reserves. Potentially 20-30% reduction. |

| Bundling Insurance Policies | Combine proliability insurance with other business insurance policies from the same provider. | Potential discounts for bundled coverage. Potentially 5-10% reduction. |

Legal and Regulatory Aspects

Navigating the legal landscape of proliability insurance can be tricky, impacting everything from claim settlements to the overall cost of coverage. Understanding the legal implications and regulatory frameworks is crucial for both businesses seeking protection and insurers offering policies. This section explores the key legal and regulatory aspects that shape the proliability insurance market.

Proliability insurance claims and payouts are governed by contract law and, importantly, the specific wording of the insurance policy. Courts interpret policies strictly, focusing on the defined terms and conditions. A successful claim hinges on proving that the loss falls within the policy’s coverage, that the insured party met all the policy’s requirements (like timely reporting), and that the damages are directly linked to the insured’s proliability. Disputes often arise over the interpretation of policy exclusions, the quantification of damages, and the insured’s level of responsibility. For example, a dispute might center on whether a specific incident falls under the definition of “professional negligence” as Artikeld in the policy. The legal process, including potential litigation, can be lengthy and costly for all parties involved.

Regulatory Frameworks and Proliability Insurance Availability

Regulatory bodies, at both the state and federal levels, significantly influence the proliability insurance market. These regulations impact the availability and pricing of insurance through licensing requirements for insurers, mandates for specific coverages (like medical malpractice insurance in some states), and restrictions on policy exclusions. For instance, regulations might require insurers to offer specific types of proliability coverage to certain professions, leading to increased availability but potentially higher premiums for those professionals. Conversely, strict regulations could limit the number of insurers willing to offer certain types of proliability insurance, thus reducing availability and potentially increasing prices due to less competition. Changes in regulatory environments, such as stricter requirements for proving negligence, can directly impact claim payouts and influence insurance pricing models. Insurers adjust their premiums based on their assessment of risk, which includes factors like the regulatory environment and historical claim data.

Potential Legal Challenges and Disputes

Potential legal challenges related to proliability insurance policies are numerous and often complex. Disputes can arise from disagreements over policy interpretation, coverage limitations, the amount of damages, or the insured’s compliance with policy conditions. For example, a dispute might occur if the insurer argues that the insured’s actions were intentional, thus excluding the claim from coverage, while the insured maintains their actions were negligent. Another common point of contention involves the definition of “professional services” within the policy. The insurer might deny a claim if they argue the services provided didn’t meet the policy’s definition, even if the insured believes they did. These disputes often lead to protracted litigation, with both sides presenting expert testimony and legal arguments to support their positions. The outcome depends heavily on the specific details of the case and the interpretation of the court.

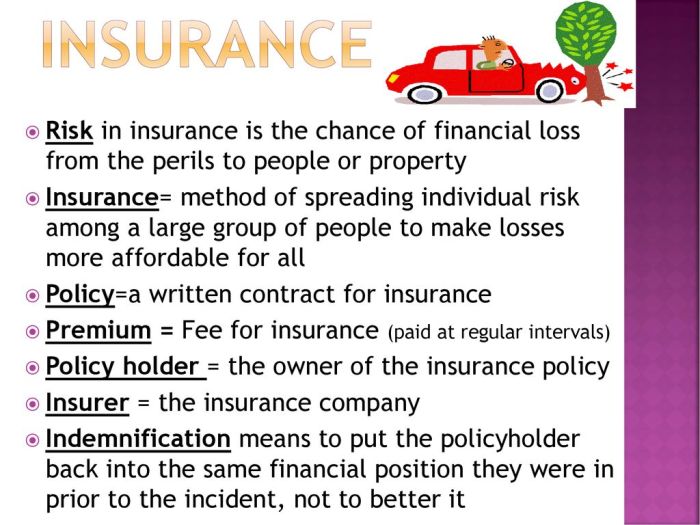

Summary: Is Proliability Good Insurance

Source: slideplayer.com

So, is proliability good insurance? The answer, like most things in life, is “it depends.” While the concept of hyper-specific insurance offers intriguing possibilities, the ultimate value depends on your individual risk profile, industry, and risk tolerance. By carefully weighing the potential benefits against the costs and navigating the legal intricacies, you can determine if proliability insurance is the right fit for you. Don’t just blindly follow the hype; understand the nuances before you commit.