Insurance Manhattan KS: Navigating the world of insurance can feel like wading through a swamp of jargon and confusing policies. But finding the right coverage shouldn’t be a headache. This guide cuts through the BS, offering a straightforward look at insurance options in Manhattan, KS, from finding the perfect provider to understanding your policy’s fine print. We’ll help you decode the insurance maze and find the best fit for your needs and budget – no more insurance anxiety!

Whether you’re a seasoned homeowner or a first-time renter, understanding your insurance needs is crucial. This guide breaks down the various types of insurance available in Manhattan, KS, compares providers, helps you get quotes, and explains how to file a claim. We’ll also touch on cost factors, ways to save money, and essential regulations to keep you informed and empowered.

Insurance Types Available in Manhattan, KS

Finding the right insurance in Manhattan, Kansas, means navigating a landscape of options tailored to various needs and budgets. Understanding the different types available and the nuances between providers is key to securing the best protection for your assets and future. This guide breaks down the common insurance types offered in Manhattan, providing insights into coverage and key considerations.

Common Insurance Types in Manhattan, KS

Choosing the right insurance depends on your specific circumstances. Below is a table outlining common insurance types, typical providers, coverage details, and important factors to consider when making your selection. Remember to compare quotes and policies carefully before committing.

| Type of Insurance | Common Providers | Typical Coverage | Key Considerations |

|---|---|---|---|

| Auto Insurance | State Farm, Geico, Progressive, Farmers Insurance, Nationwide | Liability, collision, comprehensive, uninsured/underinsured motorist | Driving record, vehicle type, coverage limits, deductibles. Consider bundling with other insurance types for potential discounts. |

| Homeowners Insurance | State Farm, Allstate, Farmers Insurance, American Family Insurance | Dwelling, personal property, liability, additional living expenses | Home value, location, coverage limits, deductibles. Review coverage for specific items of high value. |

| Renters Insurance | State Farm, Nationwide, Liberty Mutual, Travelers | Personal property, liability, additional living expenses | Value of belongings, liability limits, consider replacement cost vs. actual cash value. |

| Health Insurance | Blue Cross Blue Shield of Kansas, Medica, Aetna, Humana | Doctor visits, hospital stays, prescription drugs, preventative care | Plan type (HMO, PPO, etc.), deductible, copay, out-of-pocket maximum. Consider pre-existing conditions and network providers. |

| Life Insurance | State Farm, Northwestern Mutual, Prudential, MassMutual | Death benefit to beneficiaries | Type of policy (term, whole, universal), death benefit amount, premiums. Consider your family’s needs and financial goals. |

| Business Insurance | Various local and national providers | General liability, professional liability, property insurance, workers’ compensation | Specific business needs, industry regulations, coverage limits, risk assessment. |

Insurance Provider Differences in Manhattan, KS

While many national providers operate in Manhattan, local agents often offer personalized service and a deeper understanding of the community’s specific needs. National providers frequently offer competitive pricing and broader coverage networks, while local agents might provide more customized solutions and faster claims processing. For example, a local agent might be more familiar with the nuances of hail damage claims common in the area, whereas a national provider might have a more streamlined claims process but less localized expertise. The best choice depends on your individual priorities. Consider factors like customer service ratings, claims handling speed, and the specific types of coverage offered when comparing providers. Reading online reviews and obtaining multiple quotes can significantly aid in your decision-making process.

Finding the Right Insurance Provider in Manhattan, KS

Choosing the right insurance provider can feel like navigating a maze, especially with so many options available in Manhattan, KS. Finding the perfect fit depends on your specific needs, budget, and the level of personalized service you desire. This section will guide you through the process, helping you make an informed decision.

Selecting an Appropriate Insurance Provider: A Step-by-Step Flowchart

The process of choosing an insurance provider can be simplified by following a structured approach. Imagine a flowchart, starting with identifying your insurance needs (home, auto, health, etc.). This leads to researching providers in Manhattan, KS, comparing quotes from at least three different companies, reviewing customer reviews and ratings, and finally, selecting the provider that best meets your criteria. The final step involves purchasing the policy and ensuring you understand the terms and conditions. This methodical approach ensures you don’t overlook crucial factors.

Comparison of Insurance Providers in Manhattan, KS

Three hypothetical insurance providers, “Prairie State Insurance,” “Flint Hills Financial,” and “Manhattan Mutual,” will be used for illustrative comparison. Note that specific pricing and service details are subject to change and should be verified directly with the provider.

| Provider | Customer Reviews (Illustrative) | Pricing (Illustrative) | Services (Illustrative) |

|---|---|---|---|

| Prairie State Insurance | Generally positive, praising responsive customer service and clear communication. Some complaints about wait times during peak seasons. | Mid-range pricing, competitive with other providers in the area. Discounts offered for bundling policies. | Offers a wide range of insurance products, including auto, home, renters, and life insurance. Online portal for managing policies. |

| Flint Hills Financial | Mixed reviews. Some customers highlight excellent claims processing, while others express dissatisfaction with the initial quote process. | Slightly higher pricing than average, but often includes additional benefits like roadside assistance. | Strong focus on personalized service and financial planning. May offer more specialized insurance products. |

| Manhattan Mutual | Mostly positive, with many customers emphasizing the local connection and community involvement. Some mention a slightly less user-friendly website. | Lower pricing than average, potentially reflecting a more limited range of services. | Primarily focuses on auto and home insurance. Strong emphasis on quick claims processing. |

Obtaining Quotes from Multiple Insurance Providers

Getting quotes from multiple providers is crucial for finding the best deal. First, identify your insurance needs (e.g., auto insurance with liability coverage of $100,000/$300,000). Next, visit the websites of at least three insurance providers or contact them by phone. Provide them with the necessary information (vehicle details, driving history, address, etc.). Request quotes for comparable coverage levels. Compare the quotes carefully, paying attention to the details of coverage and any additional fees or discounts. Finally, choose the provider that best fits your needs and budget. Remember to read the policy documents thoroughly before signing.

Cost of Insurance in Manhattan, KS

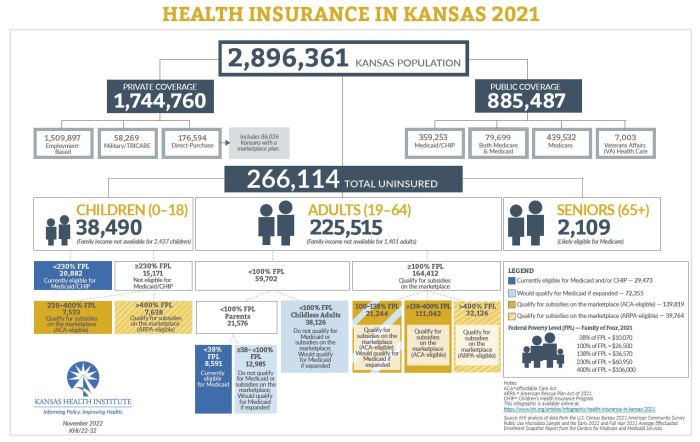

Source: khi.org

Navigating the world of insurance costs can feel like deciphering a secret code. In Manhattan, KS, like anywhere else, the price you pay for your insurance depends on a complex interplay of factors. Understanding these factors empowers you to make informed decisions and potentially save money.

This section breaks down the average costs of different insurance types in Manhattan, KS, explores the elements influencing those costs, and offers practical strategies for keeping your premiums manageable.

Average Insurance Costs in Manhattan, KS

Precise figures for average insurance costs are difficult to pinpoint without access to real-time insurer data. Insurance pricing is dynamic and varies significantly based on individual circumstances. However, we can illustrate the general cost landscape with a hypothetical example, keeping in mind that actual costs will vary depending on the insurer, coverage level, and individual risk profile.

| Insurance Type | Age 25 | Age 35 | Age 50 | Coverage Level (Example) |

|---|---|---|---|---|

| Auto Insurance | $800 – $1200 annually | $900 – $1400 annually | $1100 – $1700 annually | Liability + Comprehensive |

| Homeowners Insurance | $1000 – $1500 annually | $1000 – $1500 annually | $1200 – $1800 annually | $250,000 Coverage |

| Renters Insurance | $150 – $300 annually | $150 – $300 annually | $150 – $300 annually | $10,000 Personal Property |

Note: These are hypothetical ranges and should not be considered exact quotes. Contacting multiple insurance providers for personalized quotes is crucial.

Factors Influencing Insurance Costs

Several key factors contribute to the cost of insurance in Manhattan, KS. Understanding these helps you anticipate and potentially manage your premiums.

Location within Manhattan plays a role; areas with higher crime rates or a greater frequency of accidents may see higher premiums. Demographics, such as age and driving history, significantly impact auto insurance costs. Younger drivers generally pay more due to higher risk profiles. Claims history is another major factor; a history of claims will almost always result in higher premiums. The type of vehicle you own also influences auto insurance costs; more expensive vehicles often mean higher premiums.

Strategies for Reducing Insurance Costs, Insurance manhattan ks

While you can’t control all factors, several strategies can help lower your insurance costs.

Finding the right insurance in Manhattan, KS can be a headache, but managing your policies shouldn’t be. Simplify things by checking your coverage details through my insurance portal , ensuring you’re fully protected. Then, you can get back to focusing on what matters most – life in Manhattan, KS.

Bundling your auto and homeowners or renters insurance with the same provider often results in discounts. Improving your safety measures, such as installing security systems for your home or taking a defensive driving course, can demonstrate lower risk and lead to reduced premiums. Increasing your deductible, while requiring a larger upfront payment in case of a claim, can significantly lower your monthly premiums. Shop around and compare quotes from multiple insurance providers to find the best rates. Finally, maintaining a good credit score can positively impact your insurance rates, as insurers often consider credit history as an indicator of risk.

Understanding Insurance Policies in Manhattan, KS

Source: getsure.org

Navigating the world of insurance can feel like deciphering a foreign language, especially when you’re dealing with the specifics of your policy. Understanding the key terms and conditions, the claims process, and common claim scenarios is crucial to ensuring you’re adequately protected. This section aims to demystify insurance policies in Manhattan, KS, providing clarity and empowering you to make informed decisions.

Key Terms and Conditions in Insurance Policies

Insurance policies, regardless of type, contain specific terminology and conditions that define the agreement between you and the insurer. Familiarizing yourself with these terms is vital for understanding your coverage and rights.

- Policy Period: This specifies the duration of your insurance coverage, typically a year. Renewal options are usually detailed within the policy.

- Premium: The amount you pay to maintain your insurance coverage. Premiums are usually paid periodically, such as monthly or annually.

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums.

- Co-pay: A fixed amount you pay for a covered healthcare service, like a doctor’s visit. This is common in health insurance policies.

- Co-insurance: Your share of the costs of a covered healthcare service, calculated as a percentage of the allowed amount after you’ve met your deductible.

- Exclusions: Specific events or circumstances that are not covered by your insurance policy. Understanding these exclusions is critical to avoiding unexpected costs.

- Limits of Liability: The maximum amount your insurer will pay for a covered claim. This limit varies depending on the type of insurance and the specific policy.

The Claims Process

Filing a claim can be a straightforward process if you understand the necessary steps. However, the specific procedures may vary depending on the type of insurance. Generally, all claims require prompt notification to your insurer.

- Auto Insurance: After an accident, contact the police and your insurer immediately. Gather information from all parties involved, including contact details, license plate numbers, and insurance information. Take photos of the damage to vehicles and the accident scene. Submit a completed claim form with supporting documentation, such as the police report and photos.

- Homeowners Insurance: In case of damage to your property, contact your insurer as soon as possible. Document the damage with photos and videos. Provide a detailed description of the incident and the extent of the damage. You may need to hire professionals for assessments and repairs, depending on the severity of the damage. Submit a claim form with all supporting documentation.

- Health Insurance: When seeking medical care, inform your provider that you have health insurance. Submit claims forms with supporting documentation such as medical bills and receipts.

Common Insurance Claim Scenarios in Manhattan, KS

Understanding how common claims are handled can prepare you for potential situations. Manhattan, KS, experiences various weather events, which can lead to specific claims.

- Hail Damage to Vehicles: Hailstorms are relatively common in Kansas. If your vehicle sustains hail damage, take photos of the damage, report it to your insurer, and follow their claim process. They will likely assess the damage and authorize repairs.

- Water Damage to Homes: Heavy rainfall or burst pipes can cause significant water damage to homes. Document the damage with photos and videos. Contact your insurer immediately, and follow their guidelines for mitigation and repair. You might need to arrange for emergency services to prevent further damage.

- Auto Accident on a Busy Street: Manhattan’s roads can get congested. In case of an accident, contact the police, exchange information with other drivers, and document the scene with photos. Report the accident to your insurer and follow their claim procedures. Depending on liability, your insurer will handle the repair or replacement of your vehicle.

Resources for Insurance Information in Manhattan, KS

Navigating the world of insurance can feel like wading through a swamp of jargon and fine print. Fortunately, several reliable resources exist to help residents of Manhattan, KS, make informed decisions about their insurance needs. These resources offer valuable tools and information to compare policies, understand coverage options, and ultimately, find the best fit for your individual circumstances. Understanding where to look for this information is the first step towards securing the right insurance protection.

Accessing accurate and unbiased information is crucial for making sound insurance choices. The following resources provide a starting point for your research, allowing you to compare different providers and policies effectively.

Reliable Sources for Insurance Information in Manhattan, KS

Several avenues exist for obtaining comprehensive and reliable insurance information in Manhattan, KS. These resources offer a blend of government oversight, consumer advocacy, and independent analysis to ensure you have a well-rounded understanding of your options.

- The Kansas Insurance Department Website: The official website of the Kansas Insurance Department (KID) provides crucial information on licensed insurers, consumer complaints, and policy regulations within the state. It’s a great place to check the legitimacy of an insurer and access helpful guides on various insurance types. You can also file complaints if you experience issues with your insurer.

- The National Association of Insurance Commissioners (NAIC) Website: The NAIC is a resource for comparing insurance regulations and consumer information across different states. While not specific to Kansas, it offers a broader perspective and allows for comparison of insurance practices nationwide, potentially highlighting best practices or areas of concern.

- Consumer Reports: Consumer Reports, a well-respected consumer advocacy organization, regularly publishes articles and ratings on various insurance providers. While their focus is not solely on Manhattan, KS, their independent assessments can offer valuable insights into the reliability and customer service of major insurance companies operating in the area.

- A.M. Best, Standard & Poor’s, and Moody’s: These independent rating agencies assess the financial strength and stability of insurance companies. Checking the ratings of potential insurers through these agencies provides an objective measure of their long-term viability, helping you choose companies less likely to face financial difficulties that could impact your claims.

- Independent Insurance Agents in Manhattan, KS: Local, independent insurance agents often have access to a wider range of insurance products from multiple companies. They can provide personalized guidance and help you compare policies tailored to your specific needs. They act as your advocate, helping you navigate the complexities of insurance selection.

Effectively Utilizing Insurance Information Resources

To maximize the benefit of these resources, a structured approach is recommended. Begin by identifying your insurance needs (auto, home, health, etc.). Then, use the Kansas Insurance Department website to verify the licensing and legitimacy of potential providers. Next, consult independent rating agencies like A.M. Best to assess the financial stability of those providers. Finally, compare policy details and pricing using information from Consumer Reports and, if possible, directly from the insurers themselves or through an independent agent.

Insurance Regulations and Compliance in Manhattan, KS: Insurance Manhattan Ks

Navigating the world of insurance can feel like wading through a swamp of jargon and legalese. But understanding the regulatory landscape is crucial for both consumers and providers in Manhattan, Kansas. This section sheds light on the state and federal rules governing insurance practices in the city, ensuring a fair and transparent marketplace.

The insurance industry in Manhattan, KS, operates under a framework of overlapping state and federal regulations designed to protect consumers and maintain market stability. These regulations cover various aspects, from licensing and solvency requirements for insurers to consumer protection laws safeguarding policyholders’ rights. Understanding these regulations is key to ensuring fair practices and avoiding potential pitfalls.

The Role of the Kansas Department of Insurance

The Kansas Department of Insurance (KDOI) is the primary regulatory body overseeing insurance practices within the state, including Manhattan. The KDOI’s responsibilities encompass licensing and monitoring insurance companies, agents, and brokers operating within Kansas. They ensure these entities maintain adequate financial reserves to meet their obligations to policyholders. Furthermore, the KDOI investigates complaints filed by consumers against insurance companies or agents, mediating disputes and taking enforcement actions when necessary. The KDOI’s website provides resources and information for consumers, including details on licensing requirements for insurance professionals and information about filing complaints. Their proactive approach helps maintain consumer trust and a stable insurance market.

Common Insurance-Related Consumer Protection Laws in Manhattan, KS

Several consumer protection laws are in place to safeguard policyholders’ rights. These laws aim to ensure fair treatment and prevent unfair or deceptive practices by insurance providers. For example, laws regarding prompt claim settlement ensure that insurers process claims efficiently and fairly. Laws prohibiting unfair discrimination in underwriting practices prevent insurers from denying coverage or charging higher premiums based on discriminatory factors. Additionally, regulations regarding policy disclosures ensure consumers receive clear and understandable information about their insurance policies before purchasing them. These protections are crucial for ensuring transparency and accountability within the insurance market, providing a safety net for consumers. Specific examples of such laws, often mirroring federal standards, include those addressing prompt payment of claims and prohibitions against unfair claim settlement practices. The KDOI actively enforces these consumer protection laws, offering avenues for redress to consumers who believe their rights have been violated.

Last Point

Source: khi.org

So, there you have it – your cheat sheet to conquering insurance in Manhattan, KS. Remember, finding the right insurance isn’t about settling for the cheapest option; it’s about finding the coverage that truly protects you and your assets. By understanding your needs, comparing providers, and asking the right questions, you can confidently navigate the insurance landscape and secure your future with peace of mind. Now go forth and conquer that insurance game!