Insurance claim check customer service number: Navigating the often frustrating world of insurance claims can feel like a wild goose chase. Lost checks, delayed payments, and confusing processes are common complaints. This isn’t just about getting your money; it’s about the stress and anxiety of dealing with a system that should be supporting you during a difficult time. We’ll dive into the nitty-gritty of customer service numbers, exploring what works, what doesn’t, and how to make the whole process smoother.

From understanding the typical customer frustrations to exploring how technology can improve the experience, we’ll unpack everything you need to know about getting the help you deserve when it comes to your insurance claim check. We’ll examine effective communication channels, analyze the efficiency of different customer service numbers, and offer practical tips for resolving issues quickly. Get ready to conquer the claim check chaos!

Understanding Customer Service Needs Related to Insurance Claim Checks

Source: imimg.com

Navigating the insurance claim process can be a stressful experience, especially when dealing with the crucial final step: receiving your claim check. Many factors can contribute to delays, misunderstandings, and overall frustration, leading customers to seek assistance from customer service representatives. Understanding these common pain points is key to providing effective and empathetic support.

The complexities of insurance claim check processing often leave customers feeling lost and bewildered. They are dealing with potentially significant financial losses, and the process itself can be opaque and slow. This leads to a need for clear, concise, and readily available information.

Typical Customer Frustrations with Claim Check Processing

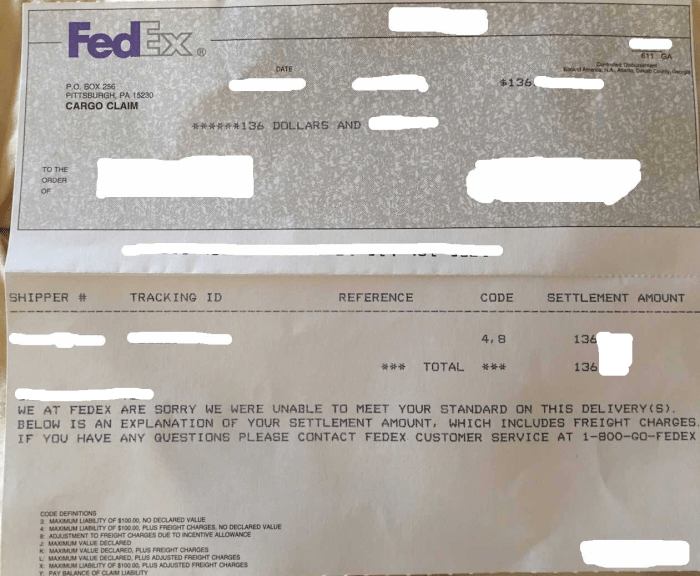

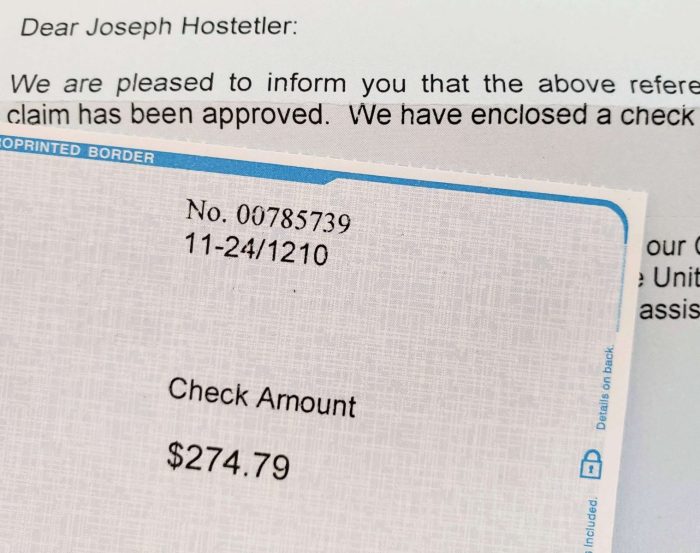

Delays in receiving claim checks are a major source of frustration. Customers may experience unexpected setbacks, such as missing documentation, processing errors, or internal communication breakdowns within the insurance company. These delays can lead to financial hardship and a sense of helplessness. Furthermore, unclear communication about the status of their claim adds to the anxiety. A lack of proactive updates, or difficulty reaching a representative to get an update, amplifies these feelings. Finally, discrepancies between the expected amount and the actual amount received on the check can lead to significant confusion and necessitate further investigation. For example, a customer expecting a $5,000 check for a totaled car might receive a check for $4,500, requiring them to contact customer service to understand the discrepancy.

Reasons for Contacting Customer Service Regarding Claim Checks

Customers contact customer service for a variety of reasons, primarily revolving around the status of their claim check. This includes inquiries about processing delays, missing or incorrect information on the check, questions about the payment amount, and requests for clarification on specific deductions or adjustments. They might also need help with lost or stolen checks, or require assistance with reissuing a check. Finally, some customers may simply need confirmation that their claim check has been processed and is on its way. For instance, a customer might call to inquire about a delay, expecting their check within 7-10 business days, but it has been 14 days with no update.

Information Customers Require About Their Claim Checks

Customers often require several pieces of information related to their claim checks. This includes the expected date of arrival, the exact amount of the check, an explanation of any deductions or adjustments made to the initial claim amount, and the check number for tracking purposes. They may also need to know the payment method (e.g., mailed check, direct deposit) and confirmation of the recipient’s information to ensure the check is sent to the correct address. For example, a customer may need a breakdown of how their $10,000 claim was reduced to $9,000 to understand any applicable deductibles or other factors.

Preferred Communication Channels for Claim Check Inquiries, Insurance claim check customer service number

Customers generally prefer multiple communication channels for interacting with customer service regarding their claim checks. While phone calls remain a popular option for immediate assistance and personalized support, many appreciate the convenience of email for non-urgent inquiries. An online portal, providing real-time updates and self-service options, is increasingly popular, allowing customers to track their claim status and access relevant documents independently. The availability of a live chat function on the company website also offers a quick and easy way to address immediate questions. The preference often depends on the urgency of the situation and the customer’s technological comfort level. For example, a customer needing immediate clarification on a discrepancy might prefer a phone call, while a customer seeking a simple status update might use the online portal.

Analyzing the Customer Service Number’s Effectiveness

Source: becomethesolution.com

Getting your insurance claim check shouldn’t feel like navigating a maze. A well-designed customer service number is crucial for a smooth claims process, minimizing frustration and ensuring customer satisfaction. This section dives into analyzing the effectiveness of different customer service approaches for insurance claim checks.

The efficiency of a customer service number hinges on several factors, including wait times, agent knowledge, and the overall ease of the process. Comparing dedicated claim check lines with general inquiry lines reveals key differences in effectiveness. Dedicated lines often offer shorter wait times and specialized agent expertise, leading to faster resolution. General inquiry lines, while convenient for broader questions, can lead to longer hold times and potential misdirection, especially when dealing with complex claim check issues.

Comparison of Dedicated and General Inquiry Lines

A dedicated claim check line allows for quicker resolution of issues because agents are specifically trained to handle those inquiries. They possess the expertise to address specific problems related to claim check processing, payment delays, and other related queries. This specialized knowledge leads to more efficient problem-solving and reduces the need for transfers or lengthy explanations. In contrast, a general inquiry line, while accessible for a broader range of questions, often results in longer wait times due to higher call volume and the need for agents to handle diverse inquiries. This can be particularly frustrating for customers seeking urgent information regarding their claim checks.

Examples of Effective and Ineffective Customer Service Interactions

Effective interactions involve prompt answering, empathetic agents, clear communication, and efficient problem resolution. For example, a positive experience might involve a quick connection, a friendly agent who readily accesses the claimant’s information, and a clear explanation of the claim check’s status or any necessary next steps. Conversely, an ineffective interaction might involve lengthy hold times, unhelpful or rude agents, difficulty accessing information, and a lack of follow-up.

Navigating the labyrinth of insurance claim check customer service numbers can be a real headache, especially when dealing with complex situations. For instance, understanding coverage intricacies, like those related to nys spousal car insurance , often requires a direct call to clarify policy details. Therefore, having that customer service number readily available is key to a smooth claims process, saving you time and frustration.

Imagine a customer calling about a delayed check. An effective interaction would involve the agent quickly locating the claim, explaining the reason for the delay (e.g., missing documentation), and providing a concrete timeline for resolution. An ineffective interaction would involve repeated transfers, being put on hold for extended periods, and receiving conflicting information or no clear resolution.

Measuring Customer Satisfaction

A robust system for measuring customer satisfaction is vital. This involves collecting data through various channels, including post-call surveys, online feedback forms, and social media monitoring. Surveys should focus on key aspects like wait times, agent helpfulness, resolution time, and overall satisfaction. Analyzing this data provides valuable insights into areas for improvement.

Data Required for Performance Assessment

To accurately assess the performance of the customer service number, several key metrics need to be tracked and analyzed. This data allows for a comprehensive understanding of customer experience and identifies areas requiring attention. Regular monitoring and analysis of these metrics ensure continuous improvement in service delivery.

| Metric | Target | Actual | Variance |

|---|---|---|---|

| Average Call Handling Time | <3 minutes | 3.5 minutes | +0.5 minutes |

| Customer Satisfaction Score (CSAT) | 90% | 85% | -5% |

| First Call Resolution Rate | 80% | 75% | -5% |

| Average Wait Time | <1 minute | 1.2 minutes | +0.2 minutes |

Improving the Customer Experience with Claim Check Inquiries: Insurance Claim Check Customer Service Number

Frustrated customers calling about their insurance claim checks are a drain on resources and a hit to your company’s reputation. A smooth, efficient process is key to happy customers and a more profitable bottom line. By proactively addressing potential issues and empowering customers with self-service options, you can significantly reduce call volume and improve overall satisfaction.

Streamlining the Claim Check Process to Reduce Customer Service Calls

Reducing the number of customer service calls related to claim checks requires a multi-pronged approach focusing on efficiency and transparency. This involves analyzing the current process to identify bottlenecks and areas for improvement. For example, automating data entry, implementing electronic signatures, and using faster payment processing methods can significantly reduce processing time. A streamlined workflow, coupled with clear communication at each stage, will lead to fewer inquiries. Consider implementing a system that automatically sends email or SMS updates at each stage of the claim process, such as “Claim received,” “Claim processed,” “Check mailed,” etc. This keeps customers informed and reduces their need to contact customer service to check on the status.

Proactive Communication Improves Customer Satisfaction During the Claim Check Process

Proactive communication is crucial for managing customer expectations and preventing unnecessary calls. Instead of waiting for customers to contact you, provide regular updates throughout the claim process. This could include automated emails or text messages confirming receipt of the claim, providing estimated processing times, and notifying customers when their check has been mailed. Consider incorporating a tracking number that allows customers to monitor the status of their check online. For example, an email could say, “Your claim is being processed. We estimate your check will be mailed within 7 business days. You can track its progress here: [link to tracking page].” Personalized communication, acknowledging the customer’s specific situation, further enhances the experience.

Designing User-Friendly Self-Service Tools for Accessing Claim Check Information

A well-designed self-service portal allows customers to access information quickly and easily without needing to call customer service. This portal should provide a clear and intuitive interface, allowing customers to track their claim status, view payment details, and download documents. Features like a frequently asked questions (FAQ) section and a comprehensive search function can also significantly reduce call volume. The design should be mobile-responsive, ensuring accessibility across various devices. Think of it like a well-organized online banking portal—easy to navigate and providing all the necessary information at a glance. For example, a clear visual progress bar showing the claim’s stage would be very helpful.

Step-by-Step Guide for Resolving Common Claim Check Issues Without Customer Service

Providing clear, step-by-step instructions for resolving common issues empowers customers to find solutions independently. This reduces the burden on customer service representatives and increases customer satisfaction.

- Check your claim status online: Log into your online account and review your claim’s status. Many issues can be resolved by simply checking the current stage of processing.

- Review your claim documents: Ensure all required documents were submitted accurately and completely. Missing information is a common cause of delays.

- Verify your mailing address: Confirm that the address on file is correct to prevent delivery issues. Incorrect addresses are a leading cause of customer service inquiries.

- Check your spam folder: Important emails, including claim updates, might end up in your spam folder.

- Contact your insurance agent: If you’re still unable to resolve the issue after following these steps, contact your insurance agent for assistance. They are often able to provide quicker resolutions than the main customer service line.

The Role of Technology in Claim Check Customer Service

The insurance industry, traditionally reliant on paper processes and phone calls, is undergoing a digital transformation. Technology is no longer a luxury but a necessity for providing efficient and satisfying customer service, especially when it comes to the often-stressful process of receiving insurance claim checks. This section explores how various technological advancements are reshaping the claim check customer service landscape.

Integrating AI-powered chatbots and virtual assistants offers significant benefits. These tools provide 24/7 availability, instantly answering frequently asked questions about claim status, required documentation, and processing times. This immediate access to information reduces customer frustration and frees up human agents to handle more complex issues. The cost savings associated with reduced agent workload are also substantial.

AI-Powered Chatbots and Virtual Assistants in Claim Check Inquiries

AI-powered chatbots offer several advantages. They can handle a high volume of inquiries simultaneously, providing consistent and accurate information regardless of the time of day. Furthermore, these chatbots can be programmed to learn from past interactions, continuously improving their ability to understand and respond to customer queries. For example, a chatbot could be trained to recognize common phrases related to claim check delays and offer proactive solutions or explanations based on the company’s policies. This personalized approach significantly enhances the customer experience.

Automated Phone Systems versus Live Agents in Handling Claim Check-Related Calls

Automated phone systems, or Interactive Voice Response (IVR) systems, offer a cost-effective way to handle high call volumes. They can route calls efficiently based on customer needs, providing self-service options for simple inquiries. However, complex issues often require the intervention of a live agent. A well-designed system should seamlessly transition the caller to a live agent when necessary, minimizing wait times and ensuring a smooth customer journey. For instance, a system could identify calls regarding disputed claims or unusual circumstances and automatically direct them to a specialized agent. The optimal approach often involves a hybrid model, leveraging the efficiency of automation while retaining the personal touch of human interaction.

Challenges in Implementing New Technologies for Claim Check Customer Service

Implementing new technologies presents certain challenges. The initial investment in software, hardware, and training can be significant. Furthermore, integrating new systems with existing infrastructure can be complex and time-consuming. Data security and privacy are also paramount concerns. Robust security measures must be in place to protect sensitive customer information. Finally, ensuring the accuracy and reliability of AI-powered systems is crucial. Thorough testing and ongoing monitoring are necessary to minimize errors and maintain customer trust. A phased implementation approach, starting with a pilot program, can help mitigate risks and identify potential issues before a full-scale rollout.

Using Data Analytics to Improve Claim Check Customer Service Efficiency and Effectiveness

Data analytics plays a vital role in optimizing claim check customer service. By analyzing call logs, chatbot interactions, and customer feedback, companies can identify areas for improvement. For example, data analysis might reveal that a particular step in the claim process is causing frequent delays or customer dissatisfaction. This information can then be used to streamline the process, improve training for agents, or refine the chatbot’s responses. Real-time dashboards can provide insights into key performance indicators (KPIs), such as average handling time, customer satisfaction scores, and the number of unresolved issues. This allows for proactive monitoring and adjustments to ensure optimal performance. For instance, a spike in call volume during a particular time of day might indicate a need for additional staffing or improved self-service options.

Visualizing Customer Journey for Claim Check Inquiries

Understanding the customer journey is crucial for optimizing the insurance claim check process. By mapping out the typical steps a customer takes, we can identify pain points and improve the overall experience. This visualization helps us see where friction occurs and where improvements can be made to streamline the process and enhance customer satisfaction.

The customer journey for a claim check inquiry can be visualized as a series of interconnected touchpoints, from the initial claim filing to receiving the check. Each touchpoint presents an opportunity to either delight or frustrate the customer.

Claim Check Inquiry Process Flowchart

The following flowchart illustrates a typical customer journey when inquiring about a claim check:

1. Claim Filed: Customer submits a claim (online, phone, mail).

2. Claim Processed: Insurance company processes the claim, verifying information and assessing damages.

3. Check Issued: Once approved, a check is issued and sent to the customer.

4. Inquiry Initiated: Customer contacts customer service (phone, email, online chat) to inquire about the status of their check.

5. Inquiry Received: Customer service representative receives the inquiry and accesses the customer’s claim information.

6. Information Provided: Representative provides the customer with the status of their check (e.g., issued, mailed, tracking information).

7. Issue Resolution (if needed): If there’s an issue (e.g., check lost, delayed), the representative assists in resolving it.

8. Inquiry Closed: The customer’s inquiry is resolved, and the interaction concludes.

Customer Touchpoints During Claim Check Inquiry

Customers interact with various touchpoints during the claim check inquiry process. These touchpoints include the initial claim filing method (online portal, phone call, mail), the customer service channels used for inquiries (phone, email, online chat), and the communication methods used to receive updates (email, phone call, mail).

Potential Pain Points in the Customer Journey

Common pain points include long wait times on hold, difficulty navigating the company’s website or phone system, receiving conflicting information from different representatives, experiencing delays in check processing or delivery, and a lack of clear communication regarding the status of their claim. Frustration mounts when customers feel their inquiries are not being addressed promptly or efficiently, leading to negative brand perception and potential churn.

Further pain points arise from unclear instructions, complicated online forms, and inconsistent information across different communication channels. The lack of proactive updates from the insurance company adds to the customer’s anxiety and uncertainty. A poorly designed self-service portal can also be a significant source of frustration.

Positive Customer Experience Visualization

Imagine a scenario where the customer submits their claim online and receives an immediate acknowledgement. Regular email updates are sent, providing the status of their claim and estimated delivery date of the check. When the customer calls to inquire, they are connected to a friendly and knowledgeable representative immediately. The representative provides clear and concise information, resolving any concerns efficiently and professionally. The entire process is seamless, transparent, and reassuring, leaving the customer feeling valued and satisfied.

Closing Summary

Source: millionmilesecrets.com

Successfully navigating the insurance claim check process shouldn’t feel like scaling Mount Everest. While there are inherent complexities, understanding the system and knowing how to access the right resources—especially that crucial customer service number—can significantly reduce stress and improve your experience. By leveraging technology, streamlining processes, and fostering proactive communication, insurance companies can create a more efficient and supportive system for their policyholders. Remember, you deserve a smooth and hassle-free claim process.