Independent car insurance quotes: Navigating the world of car insurance can feel like driving through a minefield. But what if I told you there’s a secret weapon? Independent insurance agents, offering a buffet of quotes from multiple providers, letting you pick the perfect policy without the pressure of a single company’s sales pitch. This isn’t just about saving money; it’s about gaining control over your insurance destiny. Get ready to ditch the confusion and embrace the power of choice.

This guide dives deep into the world of independent car insurance quotes, comparing them to captive agents, revealing the best ways to find the perfect deal, and showing you how to analyze quotes like a pro. We’ll cover everything from the factors influencing your premium to the sneaky hidden fees some companies try to sneak in. Buckle up, because finding the right car insurance is about to get a whole lot easier.

Understanding “Independent Car Insurance Quotes”

Navigating the world of car insurance can feel like driving through a dense fog. Independent car insurance quotes offer a potential solution, providing a clearer view of your options and potentially saving you money. But what exactly are they, and how do they differ from other approaches? Let’s break it down.

Independent car insurance quotes are offers from multiple insurance companies, all presented to you by a single, independent agent. Unlike captive agents who represent only one insurance company, independent agents act as your personal insurance brokers, shopping around for the best rates and coverage from a variety of insurers. This allows you to compare apples to apples, ensuring you find a policy that best suits your needs and budget.

Independent vs. Captive Insurance Agents

The key difference lies in representation. Captive agents, employed by a single insurance company, naturally only offer that company’s products. Their primary goal is to sell you their employer’s policies. Independent agents, on the other hand, work for themselves and represent numerous companies, allowing them to offer a much wider range of choices. This unbiased approach means they can tailor a policy to your specific requirements without being limited to a single insurer’s offerings. Imagine choosing from a single flavor of ice cream versus a whole parlor full – the independent agent provides the parlor experience.

Situations Where Independent Quotes Are Beneficial

Independent quotes shine in several scenarios. For example, if you have a unique driving history (multiple accidents, tickets, etc.), an independent agent can often find a company willing to insure you at a reasonable rate, where a captive agent might struggle. Similarly, if you need specialized coverage for a classic car, a high-value vehicle, or a business vehicle, an independent agent’s broader network is likely to offer more suitable options. Finally, if you simply want to ensure you’re getting the best possible price for your insurance, comparing multiple quotes through an independent agent is a smart strategy.

Advantages and Disadvantages of Using Independent Agents

Using an independent agent offers several advantages. The most significant is access to a wider selection of insurance companies and policies, leading to potentially lower premiums and better coverage. Independent agents also provide personalized service, guiding you through the process and explaining the complexities of different policies. They can handle claims and renewals, acting as your advocate with the insurance company.

However, there are some disadvantages to consider. Finding a reputable independent agent requires research. While some agents are highly skilled and dedicated, others may not be as thorough or attentive. Also, the commission structure might incentivize them to push certain policies, although this is less prevalent than with captive agents. Finally, dealing with multiple companies through a single agent might occasionally lead to slightly longer processing times for certain tasks.

Finding Independent Car Insurance Quotes

Source: bjak.my

Snag the best deals on independent car insurance quotes – comparing prices is key! But just like figuring out if your car insurance covers everything, you might also wonder about other unexpected costs, like healthcare. For instance, finding out if is vision therapy covered by insurance can save you a pretty penny, just as much as finding the right car insurance can.

So, shop around for those independent car insurance quotes and keep your eye on the bigger financial picture!

So, you’re ready to ditch the big insurance companies and explore the world of independent car insurance? Smart move! Independent agents offer a wider range of options, potentially saving you money and hassle. But navigating the process of finding the right quotes can feel a bit overwhelming. Don’t worry, we’ve got you covered. This section will break down the different ways you can find the best independent car insurance quotes, helping you secure the perfect policy for your needs.

Methods for Obtaining Independent Car Insurance Quotes

Finding the right independent car insurance quote involves exploring various avenues. Each method has its own advantages and disadvantages, so understanding these nuances is key to making an informed decision. The table below summarizes the key differences, helping you choose the method that best suits your preferences and circumstances.

| Method | Pros | Cons | Example Websites |

|---|---|---|---|

| Online Comparison Tools | Convenient, quick, allows side-by-side comparison of multiple quotes. | May not include all insurers, results can vary based on the information provided. | The Zebra, NerdWallet, Policygenius |

| Independent Insurance Agents | Personalized service, access to a wider range of insurers, expert advice. | May require more time investment, less convenient than online tools. | (Requires local search; no single website applies) |

| Directly Contacting Insurers | Allows detailed discussion of specific needs. | Time-consuming, requires contacting multiple insurers individually. | (Varies widely by location and insurer; no single website applies) |

| Insurance Brokers | Access to a wide network of insurers, specialized expertise in certain areas (e.g., high-risk drivers). | May charge fees, may not offer the same level of personalized service as an independent agent. | (Requires local search; no single website applies) |

Using Online Comparison Tools

Online comparison tools are a fantastic starting point for your search. These platforms allow you to input your information once and receive quotes from multiple insurers simultaneously, saving you significant time and effort. However, remember that these tools don’t always include every insurer in your area, and the quotes provided are based on the information you supply—inaccuracies can lead to inaccurate quotes.

A Step-by-Step Guide to Using Online Comparison Tools

To maximize your success with online comparison tools, follow these steps:

- Gather Your Information: Before you begin, have all the necessary information ready. This typically includes your driver’s license number, vehicle information (year, make, model), address, driving history (including accidents and violations), and desired coverage levels.

- Choose a Reputable Comparison Website: Research different comparison websites and choose one with a good reputation and a wide range of insurers. Read reviews to ensure they are trustworthy.

- Enter Your Information Accurately: Double-check all the information you enter to ensure accuracy. Inaccurate information can lead to inaccurate or misleading quotes.

- Compare Quotes Carefully: Don’t just focus on the price. Pay attention to the coverage details, deductibles, and any additional fees or limitations.

- Review Policy Details: Once you’ve chosen a quote, carefully review the policy details before you commit. Make sure everything aligns with your needs and expectations.

- Contact the Insurer Directly: If you have any questions or need clarification on a specific aspect of the policy, contact the insurer directly before making a decision.

Factors Affecting Independent Car Insurance Quotes

Getting the best car insurance deal isn’t just about clicking through comparison websites. Understanding the factors that influence your premium is key to saving money. Think of it like this: insurance companies build a profile of you as a driver, and that profile directly impacts how much they charge. Let’s break down the major players.

Driving History

Your driving record is arguably the most significant factor determining your insurance cost. A clean record, boasting years of accident-free driving, will earn you lower premiums. Conversely, accidents, speeding tickets, and even parking violations can significantly increase your rates. Insurance companies see these incidents as indicators of higher risk, leading them to charge more to cover potential future claims. For example, a single at-fault accident could increase your premiums by 20-40% depending on the severity and your insurer. Multiple incidents or a DUI conviction will dramatically inflate your costs.

Vehicle Type and Model

The car you drive plays a crucial role in your insurance premium. Luxury vehicles, sports cars, and high-performance models generally cost more to insure because of their higher repair costs and greater potential for theft. Conversely, smaller, more fuel-efficient cars are often cheaper to insure. Consider this: insuring a brand-new Tesla Model S will be considerably more expensive than insuring a used Honda Civic. This is because of the higher repair costs associated with the Tesla, its higher value, and the increased risk of theft. The safety features of the vehicle also come into play; cars with advanced safety technologies may receive discounts.

Age and Location

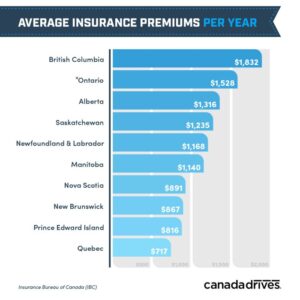

Age is a significant factor. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents, hence higher premiums. As you gain experience and a clean driving record, your premiums typically decrease. Location also matters; insurance rates vary widely based on geographic location. Areas with high crime rates, more accidents, or higher repair costs will usually have higher insurance premiums. Living in a rural area with low crime might get you a better rate than living in a bustling city center. For instance, a 20-year-old living in a high-crime urban area will likely pay significantly more than a 40-year-old living in a quiet suburban neighborhood, even if both have clean driving records and similar vehicles.

Analyzing Independent Car Insurance Quotes

Getting the best car insurance deal isn’t just about finding the lowest initial price; it’s about understanding the entire package. Analyzing multiple independent quotes meticulously is crucial to avoid unexpected costs and ensure you’re getting the coverage you need. This involves comparing different providers, spotting hidden fees, and negotiating effectively.

Comparing quotes from various independent insurance providers reveals a fascinating landscape of pricing and coverage options. It’s not always about the absolute lowest number; sometimes, a slightly higher premium offers significantly better coverage or more comprehensive benefits. This careful comparison allows you to make an informed decision based on your individual needs and risk profile.

Comparison of Independent Insurance Quotes

A side-by-side comparison of quotes is essential. Create a spreadsheet or use a comparison website to list each provider’s premium, deductible options, coverage limits (liability, collision, comprehensive), and any additional features included (roadside assistance, rental car reimbursement). Pay close attention to the type of coverage offered; some providers might offer slightly different levels of coverage under the same policy type. For instance, one provider’s “comprehensive” coverage might include hail damage while another might not.

Identifying Potential Hidden Fees and Additional Charges

Insurance quotes often present a base price, but additional fees can significantly increase the total cost. Look out for things like administrative fees, policy fees, or even charges for payment methods. Carefully examine the policy documents for any fine print outlining such charges. Some providers might also charge extra for specific features or add-ons, such as usage-based insurance programs or driver monitoring systems. Consider whether these added features genuinely benefit you and are worth the extra cost. For example, a young driver might find a telematics program beneficial, but an experienced driver might not.

Checklist for Reviewing and Understanding Car Insurance Quotes

Before committing to a policy, use this checklist to ensure you understand everything:

- Premium Amount: The total cost of the policy per payment period.

- Deductible: The amount you pay out-of-pocket before insurance coverage kicks in.

- Coverage Limits: The maximum amount the insurer will pay for a covered claim (liability, collision, comprehensive).

- Covered Perils: A detailed list of events covered by the policy (accidents, theft, vandalism, etc.).

- Exclusions: Events or situations specifically not covered by the policy.

- Additional Fees: Any extra charges beyond the premium (administrative fees, payment processing fees).

- Discounts: Any discounts applied to the premium (safe driving, bundling policies, etc.).

- Policy Term: The duration of the insurance policy (usually six months or one year).

- Renewal Process: How the policy is renewed and whether the premium will change.

Best Practices for Negotiating Insurance Premiums

Negotiating your car insurance premium isn’t always easy, but it’s worth a try. Start by comparing quotes and highlighting the better offers you’ve received. Explain your commitment to safe driving and any safety features on your vehicle. Inquire about available discounts and bundles (home and auto). Don’t hesitate to ask for a lower premium; sometimes, insurers are willing to adjust their quotes to retain customers. Be polite but firm, and always maintain a professional tone. For example, you could say: “I’ve received a quote from another provider that’s significantly lower, and I’d like to see if we can reach a similar price.”

Illustrative Examples of Independent Car Insurance Quotes

Source: geeksforgeeks.org

Navigating the world of car insurance can feel like driving through a dense fog. Understanding the nuances of independent insurance quotes is key to securing the best possible coverage at a price that works for you. Let’s illuminate this process with some real-world examples.

A Young Driver’s Quote Comparison

Imagine Liam, a 20-year-old college student living in Austin, Texas. He recently purchased a used 2015 Honda Civic. He has a clean driving record, but as a young driver, he anticipates higher premiums. He decides to obtain quotes from three different independent insurance providers. His goal is to compare coverage options and pricing before making a decision.

Hypothetical Independent Insurance Quote

Let’s examine a hypothetical quote from “Liberty Mutual Independent Agent,” one of Liam’s chosen providers. This quote reflects a standard liability policy with additional coverage options.

| Coverage | Cost |

|---|---|

| Liability (Bodily Injury $100,000/$300,000; Property Damage $50,000) | $800/year |

| Collision | $600/year |

| Comprehensive | $400/year |

| Uninsured/Underinsured Motorist | $150/year |

| Rental Reimbursement ($30/day) | $75/year |

| Total Annual Premium | $2025 |

This quote includes several key features. Liability coverage protects Liam if he causes an accident resulting in injuries or property damage to others. Collision coverage covers damage to his vehicle in an accident, regardless of fault. Comprehensive coverage protects against damage from events like theft, vandalism, or hail. Uninsured/Underinsured motorist coverage provides protection if Liam is involved in an accident with an uninsured or underinsured driver. Rental reimbursement helps cover the cost of a rental car while his vehicle is being repaired.

Sample Quote Comparison Table, Independent car insurance quotes

Liam compiled his quotes into a comparison table to easily see the differences.

| Insurance Provider | Liability | Collision | Comprehensive | Uninsured/Underinsured | Total Annual Premium |

|---|---|---|---|---|---|

| Liberty Mutual Independent Agent | $800 | $600 | $400 | $150 | $1950 |

| State Farm Independent Agent | $750 | $550 | $350 | $125 | $1775 |

| Allstate Independent Agent | $900 | $700 | $500 | $175 | $2275 |

This table highlights the variations in pricing among different providers, even for similar coverage levels.

Coverage Options Through Independent Providers

Independent insurance providers offer a wide range of coverage options beyond the basics. These can include roadside assistance, gap insurance (covering the difference between the vehicle’s value and the loan amount after an accident), medical payments coverage, and personal injury protection (PIP). The availability and cost of these options will vary depending on the provider and the specific policy. Liam carefully considered which additional coverages best suited his needs and budget.

Ultimate Conclusion

Source: co.uk

So, you’ve learned the ins and outs of independent car insurance quotes – from comparing apples to oranges (or Geico to Progressive) to spotting those hidden fees that can sting worse than a bee. Remember, securing the best car insurance isn’t a one-size-fits-all deal. It’s a personalized quest for the perfect coverage at the right price. Armed with this knowledge, you’re now equipped to navigate the insurance landscape with confidence and score the best deal. Happy hunting!