Humana Medicare Supplement Insurance Plans: Navigating the world of Medicare can feel like deciphering ancient hieroglyphs, but understanding supplemental plans doesn’t have to be a headache. This guide cuts through the jargon, offering a clear look at Humana’s offerings, helping you find the perfect fit for your needs and budget. We’ll unpack the different plans, eligibility requirements, costs, and benefits, so you can confidently choose the coverage that best protects your health and wallet.

From comparing Humana’s plans to those of competitors to understanding the claims process and choosing the right level of coverage, we’ve got you covered. Think of this as your personal Medicare Sherpa, guiding you through the sometimes-confusing landscape of supplemental insurance. Get ready to ditch the Medicare mystery and embrace clarity!

Humana Medicare Supplement Plan Overview

Source: buffalohealthyliving.com

Navigating the world of Medicare can feel like traversing a dense jungle, but understanding Humana’s Medicare Supplement plans can significantly simplify the process. These plans, also known as Medigap plans, help cover some of the out-of-pocket costs Medicare doesn’t, providing a crucial safety net for retirees and those on Medicare. This overview will dissect Humana’s offerings, comparing them to other major providers and highlighting key features to help you make an informed decision.

Humana’s Medicare Supplement Plan Options

Humana offers a range of Medigap plans, mirroring the standardized plan letters (A through N) established by federal regulations. Each plan offers a different combination of coverage, influencing the premium cost. While the specific details might vary slightly by state, the core benefits remain consistent across Humana’s offerings. For instance, Plan A typically provides the most basic coverage, while Plan F (no longer available to those newly enrolling in Medicare since 2020) previously offered the most comprehensive coverage. Humana might offer additional benefits or riders depending on the plan and your location. It’s crucial to check the specific details of the plan offered in your area.

Comparison of Humana’s Plans with Other Major Providers

Comparing Humana’s Medicare Supplement plans to those of other major providers like AARP (UnitedHealthcare), Mutual of Omaha, and Blue Shield requires careful consideration of several factors. While the core benefits of each standardized plan letter are the same across providers, premium costs, customer service, and additional benefits can vary significantly. For example, Humana might offer a lower premium for a specific plan in a particular region compared to a competitor, while another provider might excel in customer service ratings. It’s essential to compare quotes from multiple providers, focusing not only on price but also on the overall value and reputation of the company. Factors like network access and claims processing efficiency should also be considered.

Key Features of Humana Medicare Supplement Plans

The following table provides a simplified overview of key features for several common Humana Medicare Supplement plans. Remember that specific details, including premiums, may vary by state and individual circumstances. Always refer to Humana’s official website or contact them directly for the most up-to-date and accurate information.

| Plan Name | Coverage Details | Premium Range (Approximate) | Notable Exclusions |

|---|---|---|---|

| Plan A | Covers Medicare Part A and Part B deductibles and coinsurance. | $100 – $250 per month | Does not cover Part B excess charges. |

| Plan G | Covers Medicare Part B deductibles, coinsurance, and Part A hospice coinsurance. | $200 – $400 per month | Does not cover Part A deductible. |

| Plan N | Covers most Part A and Part B costs, but with a small copay at the doctor’s office and for some services. | $150 – $350 per month | Includes a copay at the doctor’s office and for some services. |

| Plan F (No longer available to those newly enrolling in Medicare since 2020) | Covered nearly all Medicare Part A and Part B costs. | (Historically: $300 – $500 per month) | (Historically: Few exclusions) |

Plan Eligibility and Enrollment

Navigating the world of Medicare Supplement plans can feel like wading through a swamp of jargon. But understanding eligibility and enrollment is key to securing the coverage you need. This section cuts through the confusion, providing a clear path to enrolling in a Humana Medicare Supplement plan.

Humana Medicare Supplement plans are designed to help cover some of the out-of-pocket costs associated with Original Medicare (Part A and Part B). Eligibility hinges primarily on your Medicare status and residency.

Eligibility Requirements

To be eligible for a Humana Medicare Supplement plan, you must be enrolled in both Medicare Part A (hospital insurance) and Part B (medical insurance). You must also be a legal resident of the United States and live in a service area where Humana offers these plans. Specific plan availability varies by state and county. It’s crucial to check Humana’s website or contact them directly to confirm plan availability in your area. Pre-existing conditions are generally covered, although there might be a waiting period before coverage begins for specific conditions. Humana’s website provides details on their specific policies regarding pre-existing conditions.

Enrollment Process

The application process is straightforward, although the required documentation might vary slightly depending on your individual circumstances. Generally, you will need to provide proof of your Medicare enrollment and your identity.

Gathering the necessary documentation beforehand streamlines the application process. This usually includes your Medicare card, a valid driver’s license or other government-issued photo ID, and possibly proof of address. You can typically apply online, over the phone, or through a Humana agent.

Navigating Humana Medicare supplement insurance plans can feel like a maze, but finding the right coverage shouldn’t be a headache. For personalized guidance and plan comparisons in your area, check out choice one insurance lafayette tn to see what options are available. Understanding your Humana Medicare options becomes much simpler with the right local expertise.

Open Enrollment and Special Enrollment Periods

Understanding open enrollment and special enrollment periods is vital for maximizing your options. Open enrollment typically occurs during a six-month period beginning on the first day of the month you turn age 65 and are enrolled in Medicare Part B. During this period, you can enroll in a Medicare Supplement plan without undergoing medical underwriting. This means you won’t be subjected to a health assessment that could impact your eligibility or premiums.

Special enrollment periods offer an opportunity to enroll outside of the open enrollment period. These periods usually arise due to specific circumstances, such as losing other creditable coverage, moving to a new location where a different plan is available, or if your Medicare Part B coverage is changing. It’s important to note that special enrollment periods are not guaranteed for everyone and may have certain conditions that must be met.

Step-by-Step Enrollment Guide

Following these steps ensures a smooth enrollment process:

- Verify Eligibility: Confirm you’re eligible by checking your Medicare status and Humana’s plan availability in your area.

- Choose a Plan: Carefully compare different Humana Medicare Supplement plans to find one that fits your needs and budget. Consider factors such as coverage levels and premiums.

- Gather Documentation: Assemble your Medicare card, photo ID, and proof of address.

- Apply: Apply online through Humana’s website, by phone, or through a Humana agent.

- Review Your Application: Double-check all information for accuracy before submitting.

- Confirm Enrollment: After submitting your application, confirm your enrollment with Humana.

Cost and Coverage Details

Choosing a Medicare Supplement plan involves carefully weighing the costs against the level of coverage. Understanding the factors that influence pricing and the specifics of each plan’s benefits is crucial for making an informed decision that aligns with your individual healthcare needs and budget. Humana offers a range of plans, each with its own premium and out-of-pocket maximums.

Factors Influencing Humana Medicare Supplement Plan Costs

Several key factors determine the monthly premium you’ll pay for a Humana Medicare Supplement plan. Your age is a significant factor; generally, older individuals pay higher premiums. Your location also plays a role, as premiums can vary by state due to differences in healthcare costs and provider networks. Your health status, while not directly used in underwriting for Medigap plans (with a few exceptions for pre-existing conditions), can indirectly influence your choice of plan and therefore the cost – someone anticipating high healthcare expenses might choose a more comprehensive, and thus more expensive, plan. Finally, the specific plan you choose directly impacts the cost; more comprehensive plans naturally carry higher premiums.

Coverage Provided by Humana Medicare Supplement Plans

Humana offers various Medicare Supplement plans, often labeled with letters (e.g., Plan A, Plan F, Plan G). Each plan offers different levels of coverage for Medicare Part A (hospital insurance) and Part B (medical insurance) cost-sharing. For example, Plan A is the most basic, covering only the Medicare Part A and Part B cost-sharing that Medicare doesn’t already cover. Plan F (no longer sold to those newly eligible for Medicare since 2020) covered nearly all out-of-pocket expenses, while Plan G is very similar but requires a Part B deductible payment. It’s vital to carefully review the specific benefits of each plan to understand what expenses will be covered and to what extent. The Summary of Benefits and Coverage provided by Humana for each specific plan is the best source of this information.

Out-of-Pocket Expenses Associated with Humana Medicare Supplement Plans

The out-of-pocket expenses associated with a Humana Medicare Supplement plan depend heavily on the plan type chosen. While a plan like Plan G will still require you to pay the Medicare Part B deductible, many of the other expenses are covered. Conversely, a less comprehensive plan will leave you responsible for a larger portion of your healthcare costs. It’s crucial to consider your anticipated healthcare needs and the potential costs to ensure the chosen plan adequately protects you from significant out-of-pocket expenses. Understanding your potential annual maximum out-of-pocket cost for any given plan is key to financial planning.

Comparison of Humana Medicare Supplement Plan Premiums and Annual Out-of-Pocket Maximums

The following table provides a simplified comparison. Remember that actual premiums and out-of-pocket maximums will vary based on age, location, and specific plan details. This data is for illustrative purposes only and should not be considered a complete or exact representation of current pricing. Always refer to Humana’s official website or a licensed agent for the most up-to-date information.

| Plan Type | Approximate Monthly Premium (Example) | Approximate Annual Out-of-Pocket Maximum (Example) |

|---|---|---|

| Plan A | $150 | Variable, depending on services used |

| Plan G | $250 | Medicare Part B deductible |

| Plan N | $200 | Medicare Part B deductible + co-insurance |

Benefits and Limitations

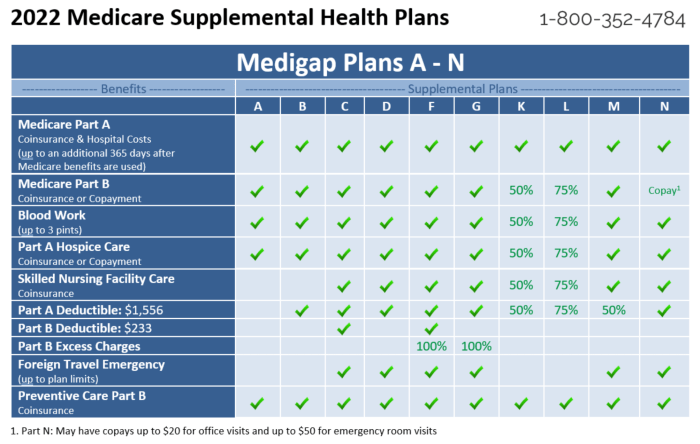

Source: amazonaws.com

Humana Medicare Supplement plans, also known as Medigap plans, offer valuable supplemental coverage to help bridge the gaps in Original Medicare. Understanding both their advantages and limitations is crucial for making an informed decision about your healthcare coverage. This section will Artikel the key benefits, highlight situations where these plans shine, and discuss areas where coverage may be limited.

These plans help cover Medicare’s cost-sharing, such as deductibles, copayments, and coinsurance. They can significantly reduce out-of-pocket expenses associated with hospital stays, doctor visits, and other covered services. However, it’s important to note that Medigap plans don’t cover everything, and certain services may still incur costs even with supplemental coverage.

Key Benefits of Humana Medicare Supplement Plans

Humana Medicare Supplement plans offer several key advantages. They help protect you from potentially high out-of-pocket costs associated with Original Medicare. The plans provide predictable, consistent coverage, making it easier to budget for healthcare expenses. They offer a wide range of coverage options, allowing individuals to choose a plan that best fits their needs and budget. Furthermore, these plans can provide peace of mind knowing that a significant portion of your healthcare expenses will be covered.

Situations Where Humana Medicare Supplement Plans Are Most Beneficial

Humana Medicare Supplement plans are particularly beneficial for individuals who anticipate significant healthcare expenses. For example, someone with a pre-existing condition requiring frequent medical attention or hospitalization will find these plans extremely valuable. Similarly, individuals who anticipate needing extensive medical care in the future, such as those undergoing long-term treatments or facing chronic illnesses, can greatly benefit from the comprehensive coverage offered by these plans. The predictable costs associated with Medigap plans offer budgeting advantages over other Medicare options.

Limitations and Exclusions of Humana Medicare Supplement Plans

While Humana Medicare Supplement plans offer extensive coverage, they do have limitations. They generally don’t cover services not covered by Original Medicare, such as vision, hearing, or dental care. Additionally, pre-existing conditions may be subject to certain limitations or waiting periods. The specific benefits and exclusions vary depending on the chosen plan type (Plan A, Plan B, etc.), so careful review of the plan details is essential. Finally, remember that premiums for these plans can be substantial, varying based on age, location, and the specific plan selected.

Scenarios Illustrating Advantages and Disadvantages

It’s helpful to consider specific scenarios to understand where a Humana Medicare Supplement plan might be advantageous or less so. The following list provides examples:

- Advantageous: A 70-year-old with a history of heart disease requiring frequent hospitalizations and specialist visits would benefit greatly from a Medigap plan to reduce significant out-of-pocket costs.

- Advantageous: A 68-year-old recently diagnosed with type 2 diabetes needing regular medication and doctor visits would appreciate the cost-sharing assistance provided by a Humana Medicare Supplement plan.

- Less Advantageous: A healthy 65-year-old with minimal anticipated healthcare needs might find the premiums for a Medigap plan too expensive compared to the potential savings.

- Less Advantageous: Someone primarily concerned with vision, hearing, or dental coverage might find a standalone plan for these services more cost-effective than a comprehensive Medigap plan that doesn’t fully cover these areas.

Customer Service and Claims Process

Navigating the world of Medicare supplements can feel overwhelming, but understanding Humana’s customer service and claims process can significantly ease the burden. This section provides a clear overview of how to access support and manage your claims efficiently. We’ll cover contact options, the claims submission process, common scenarios, and the steps involved in resolving them.

Humana offers multiple avenues for accessing customer service, ensuring accessibility for all plan members. These options include a dedicated customer service phone line, available 24/7, a user-friendly online portal for managing your account and submitting claims, and a network of local representatives who can provide personalized assistance. The availability of these options ensures that help is readily accessible regardless of your preferred method of communication or location.

Humana’s Customer Service Options and Accessibility

Humana provides several ways to contact them, prioritizing convenience and accessibility. Their 24/7 phone line allows immediate assistance for urgent matters. The online portal offers self-service options, enabling members to check claims status, update personal information, and even submit claims electronically. For those who prefer in-person interaction, Humana maintains a network of local representatives who can provide personalized guidance and support. This multi-faceted approach caters to diverse communication preferences and ensures that help is readily available when needed.

Humana Medicare Supplement Claims Process

Submitting a claim with Humana is generally straightforward. The required documentation typically includes the original claim form completed accurately, a copy of your Medicare card, and any supporting medical documentation, such as explanation of benefits (EOB) from your healthcare provider. Processing times can vary depending on the complexity of the claim, but Humana aims to process most claims within a reasonable timeframe. Delays may occur if additional information is needed or if the claim requires further investigation.

Examples of Common Claim Scenarios and Resolution Steps

Let’s consider some common scenarios. Imagine a member needing to file a claim for a doctor’s visit. They would submit the completed claim form, a copy of their Medicare card, and the doctor’s bill or EOB. Another example involves a claim for a hospital stay. In this case, the member would provide the claim form, their Medicare card, and the hospital’s billing statement, potentially including details of procedures and diagnoses. In both instances, the claim would be reviewed by Humana, and any discrepancies or missing information would prompt a request for clarification. The process generally involves submitting the initial documentation, Humana’s review and potential requests for additional information, and finally, payment or denial with explanation.

Steps in Filing a Claim with Humana

- Complete the Humana claim form accurately and legibly.

- Gather necessary supporting documentation (e.g., doctor’s bills, EOBs, Medicare card).

- Submit the claim form and supporting documents via mail, fax, or the online portal (check Humana’s website for preferred methods).

- Track the claim’s status through Humana’s online portal or by contacting customer service.

- Address any requests for additional information promptly.

Comparing Humana Plans with Other Options: Humana Medicare Supplement Insurance Plans

Choosing the right Medicare plan can feel like navigating a maze. Humana offers a range of Medicare Supplement plans, but how do they stack up against other options, particularly Medicare Advantage plans? Understanding the key differences is crucial for making an informed decision that best suits your individual healthcare needs and budget.

Medicare Supplement vs. Medicare Advantage Plans: A Side-by-Side Look

Medicare Supplement plans (also known as Medigap plans) and Medicare Advantage plans (Part C) offer different approaches to covering Medicare’s gaps. Supplement plans work alongside Original Medicare (Parts A and B), paying for what Medicare doesn’t. Advantage plans, on the other hand, are all-inclusive alternatives to Original Medicare, often including prescription drug coverage (Part D). This fundamental difference leads to significant variations in coverage, cost, and flexibility.

Advantages and Disadvantages of Humana Medicare Supplement Plans

Humana’s Medicare Supplement plans offer the security of knowing Original Medicare will always be your base coverage. This provides predictable out-of-pocket costs, as the supplement plan covers a defined percentage of Medicare-approved charges. However, premiums can be higher than Medicare Advantage plans, and there’s no prescription drug coverage included unless a separate Part D plan is purchased. For instance, a senior with predictable healthcare needs and a preference for broad coverage might find a Humana Supplement plan ideal, while someone seeking lower monthly premiums might lean towards an Advantage plan.

Advantages and Disadvantages of Medicare Advantage Plans

Medicare Advantage plans often offer lower monthly premiums than Medicare Supplement plans, and frequently include prescription drug coverage. Many also provide extra benefits like vision, hearing, and dental coverage, which are not included in Original Medicare or Supplement plans. However, Advantage plans have networks of providers, meaning you’ll generally need to see in-network doctors and specialists to receive full coverage. Out-of-pocket costs can be unpredictable and higher than expected if you require extensive care outside the network. For example, a senior who travels frequently or prefers a wider choice of doctors might find the network restrictions of an Advantage plan limiting.

Illustrative Example: A Comparison Scenario, Humana medicare supplement insurance plans

Imagine two individuals, both 67-year-old retirees named John and Mary. John values predictable costs and the freedom to see any doctor who accepts Medicare. He opts for a Humana Medicare Supplement plan, paying a higher monthly premium but enjoying comprehensive coverage with fewer restrictions. Mary, on the other hand, prioritizes lower monthly costs and is comfortable with a narrower network of providers. She chooses a Medicare Advantage plan, benefiting from lower premiums and additional benefits like dental coverage, but accepting the limitations of network access.

Comparison of Humana and a Leading Competitor’s Medicare Supplement Plans

The following table compares key features of Humana’s Medicare Supplement plans with those offered by AARP (UnitedHealthcare): Note that specific plan details and costs can vary by location and plan type. This is a simplified comparison for illustrative purposes only and should not be considered exhaustive.

| Feature | Humana Medicare Supplement Plan (Example: Plan G) | AARP Medicare Supplement Plan (Example: Plan G) |

|---|---|---|

| Monthly Premium (Estimated) | $150 – $250 | $120 – $220 |

| Coverage of Medicare Part A & B | Covers most gaps in Original Medicare | Covers most gaps in Original Medicare |

| Prescription Drug Coverage | Requires separate Part D plan | Requires separate Part D plan |

| Network Restrictions | None | None |

| Out-of-Pocket Maximum | Varies by plan; potentially high | Varies by plan; potentially high |

Finding the Right Plan

Navigating the world of Humana Medicare Supplement plans can feel overwhelming, but finding the right fit for your needs and budget is entirely achievable. This section will equip you with the tools and knowledge to make an informed decision, ensuring you get the coverage you deserve without breaking the bank. We’ll break down how to assess your needs, leverage Humana’s resources, and make a final selection.

Choosing the right Humana Medicare Supplement plan involves carefully considering your health status, financial situation, and desired level of coverage. It’s not a one-size-fits-all situation; the perfect plan for a healthy 65-year-old might be vastly different from the ideal choice for someone with pre-existing conditions. Understanding your individual needs is the cornerstone of making a sound decision.

Determining the Right Level of Coverage

Assessing your healthcare needs is crucial in selecting a plan. Consider your current health, any pre-existing conditions, and your anticipated healthcare utilization in the coming years. A person with multiple health issues and frequent doctor visits will likely benefit from a plan with more comprehensive coverage, even if it costs more. Conversely, a relatively healthy individual might find a less expensive plan sufficient. Factors such as the frequency of hospitalizations, specialist visits, and prescription medication usage all play a role in this assessment. For example, someone with a history of heart disease might prioritize a plan that offers extensive cardiac care coverage.

Utilizing Humana’s Online Tools and Resources

Humana provides several online tools to simplify plan selection. Their website offers a plan finder tool that allows you to input your zip code, age, and other relevant information to receive a personalized list of available plans in your area. You can then compare plans side-by-side based on cost, coverage details, and benefits. Humana also provides detailed plan brochures and FAQs to address any specific questions you may have. Furthermore, their customer service representatives are available to provide personalized guidance and support throughout the selection process. Using these tools allows for a streamlined and efficient plan comparison.

Decision-Making Flowchart for Humana Medicare Supplement Plan Selection

The process of selecting a Humana Medicare Supplement plan can be visualized as a flowchart. First, assess your health status and anticipated healthcare needs. This includes considering pre-existing conditions, frequency of doctor visits, and medication requirements. Next, determine your budget and the maximum monthly premium you’re willing to pay. Then, use Humana’s online tools to compare plans based on your budget and coverage needs. Finally, review the benefits and limitations of the shortlisted plans and select the plan that best aligns with your individual needs and financial capabilities. This systematic approach ensures a well-informed decision. Consider this a simplified version; a more detailed flowchart would incorporate additional factors and branching paths based on individual circumstances.

Last Point

Source: forbes.com

Choosing the right Medicare Supplement plan is a big decision, but with the right information, it doesn’t have to be overwhelming. Humana offers a range of plans to suit various needs and budgets, and understanding the nuances of coverage, costs, and benefits is key to making an informed choice. Remember to carefully consider your individual healthcare requirements and financial situation before selecting a plan. Don’t hesitate to reach out to Humana directly for personalized guidance and to ensure you’re making the best decision for your health and financial well-being.