Humana Health Insurance Medicare Supplement plans: Navigating the world of Medicare can feel like decoding a secret language, but it doesn’t have to be. This guide breaks down Humana’s Medicare Supplement offerings, helping you understand the plans, costs, and what makes them tick. We’ll cover everything from choosing the right plan to maximizing your benefits and understanding those sometimes-confusing policy documents. Get ready to become a Medicare master!

We’ll delve into the specifics of Humana’s various plans, comparing them to competitors and highlighting what sets them apart. We’ll also explore real customer experiences, providing honest insights into what it’s like to be a Humana Medicare Supplement member. By the end, you’ll be armed with the knowledge to make informed decisions about your health insurance.

Humana Medicare Supplement Plan Overview

Source: clipartcraft.com

Navigating the world of Medicare can feel like deciphering a complex code, but understanding Humana’s Medicare Supplement plans can simplify the process. These plans, also known as Medigap plans, help cover some of the out-of-pocket costs Medicare doesn’t pay, providing extra financial protection for your healthcare needs. Let’s break down what you need to know.

Humana Medicare Supplement Plan Types and Coverage

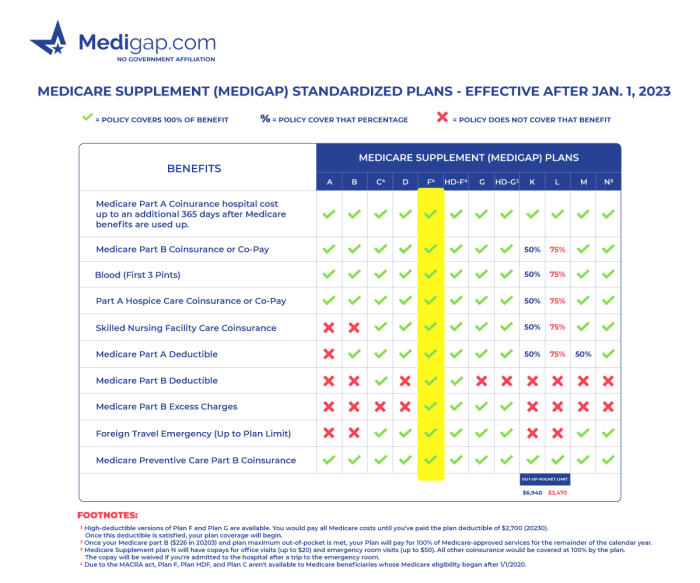

Humana offers several Medigap plans, each designated by a letter (A, B, C, etc.). These plans aren’t standardized across all insurance providers; Humana’s specific plan offerings and their coverage details may vary by state and may change over time. It’s crucial to check the most up-to-date information directly with Humana or a licensed insurance agent. Generally, however, a higher letter designation often indicates broader coverage, though this comes with a higher premium. The plans typically help cover costs like Medicare Part A and Part B deductibles, copayments, and coinsurance. Some plans may also offer additional benefits, such as foreign travel emergency coverage. Always review the specific policy details for your chosen plan to understand exactly what is covered.

Comparison of Humana Medicare Supplement Plans, Humana health insurance medicare supplement

The following table provides a *general* comparison of potential key features. Remember that specific details, including premium costs, are subject to change and will vary based on your location, age, and the specific plan available in your area. This information is for illustrative purposes only and should not be considered a complete or definitive guide. Always consult Humana directly for the most current and accurate information.

| Plan Type | Premium Cost (Example) | Part A Deductible | Part B Coinsurance |

|---|---|---|---|

| Plan A | $100 (Example) | Covered | Covered (up to a limit, check policy details) |

| Plan G | $250 (Example) | Covered | Covered |

| Plan N | $175 (Example) | Covered | Covered (with a copay) |

| Plan F | $300 (Example) | Covered | Covered |

Humana Medicare Supplement Plan Enrollment

Eligibility for Humana Medicare Supplement plans requires that you are enrolled in both Medicare Part A and Part B. You must also be a resident of the state where you are applying for coverage. The application process typically involves contacting Humana directly, either by phone or online. You will need to provide personal information, Medicare details, and answer health questions. Humana may also require a medical exam, depending on the plan and your individual circumstances. It’s essential to thoroughly review the policy documents before enrolling to ensure the plan meets your needs and budget. A licensed insurance agent can also help guide you through the process and answer any questions you may have. Keep in mind that there may be open enrollment periods and special enrollment periods that affect when you can enroll. Understanding these periods is critical to avoid delays or penalties.

Humana’s Network of Providers

Choosing a Medicare Supplement plan often hinges on the breadth and depth of the provider network. Humana, a major player in the Medicare Supplement market, boasts a sizable network, but understanding its intricacies is key to making an informed decision. This section details Humana’s provider network, clarifying in-network and out-of-network access and associated costs.

Knowing whether your doctors and preferred hospitals are in-network is crucial for managing healthcare expenses. While Humana’s network is extensive, it’s not all-encompassing. Understanding how to navigate both in-network and out-of-network care is vital for maximizing your plan’s benefits and minimizing unexpected costs.

In-Network versus Out-of-Network Access

The extent of Humana’s provider network varies by location and specific plan. Generally, Humana contracts with a large number of doctors, hospitals, and other healthcare providers. However, access to specialists, particularly those in highly specialized fields, might be more limited in certain geographical areas. Using out-of-network providers is possible, but it typically results in higher out-of-pocket expenses. Humana’s website and member services can help determine whether a specific provider is in-network.

| Provider Type | In-Network Access | Out-of-Network Access | Cost Implications |

|---|---|---|---|

| Primary Care Physician (PCP) | Generally wide availability, varies by location. | Possible, but higher cost-sharing. | Lower co-pays and deductibles; higher out-of-pocket costs with out-of-network care. |

| Specialists (e.g., Cardiologist, Oncologist) | Availability varies by specialty and location; may require more searching. | Possible, but significantly higher cost-sharing. | Higher co-pays and deductibles; potentially substantial out-of-pocket expenses. |

| Hospitals | Wide availability in most areas, but specific hospitals may not participate. | Possible, but significantly higher cost-sharing. | Lower co-pays and deductibles; potentially very high out-of-pocket expenses. |

| Other Healthcare Providers (e.g., Therapists, Lab Services) | Availability varies; some providers may be exclusively in-network with specific plans. | Possible, with higher cost-sharing and potential for claim denials. | Lower co-pays and deductibles; higher out-of-pocket costs and potential for significant balance billing. |

Finding In-Network Providers

Locating in-network providers is straightforward using Humana’s online resources. Their website features a provider search tool that allows users to search by specialty, location, and other criteria. Members can also contact Humana’s member services department for assistance in finding in-network providers. The website provides detailed information on plan benefits and coverage, including provider directories and explanations of cost-sharing responsibilities. For example, a member seeking a cardiologist in a specific city can easily use the online tool to find a list of in-network cardiologists in that area, along with their contact information and office locations. This proactive approach empowers members to make informed choices about their healthcare providers and manage their costs effectively.

Cost and Value Comparison with Competitors: Humana Health Insurance Medicare Supplement

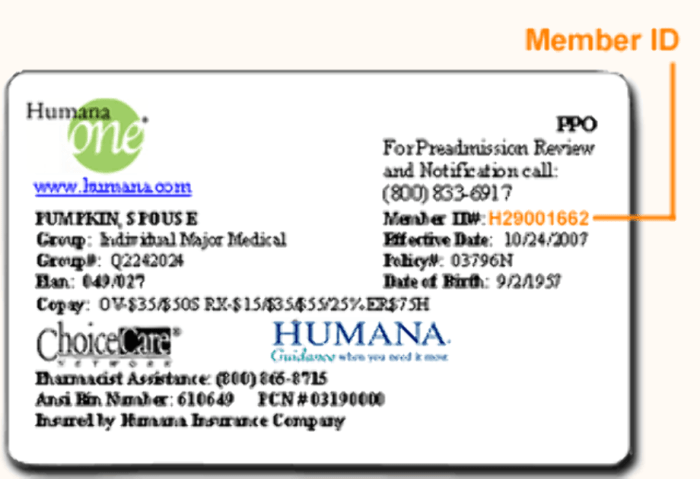

Source: medigap.com

Humana’s Medicare supplement plans offer a wide range of coverage, but navigating the specifics can be tricky. A common question is whether supplemental vision care is included, and that often depends on the specific plan. To find out if your vision needs are covered, you might want to check if is vision therapy covered by insurance , as this can impact your overall Humana plan benefits.

Ultimately, understanding your Humana Medicare supplement’s fine print is key to maximizing your healthcare dollars.

Choosing a Medicare Supplement plan involves careful consideration of both premium costs and the breadth of coverage. While Humana offers competitive plans, understanding how they stack up against other major providers like AARP (UnitedHealthcare), Mutual of Omaha, and Blue Cross Blue Shield is crucial for making an informed decision. This comparison focuses on key factors to help you determine the best fit for your individual needs and budget.

Direct premium comparisons can fluctuate based on location, age, and specific plan details (Plan G vs. Plan F, for example). Therefore, a precise numerical comparison across all providers in a table is impractical without knowing these specific factors. However, we can examine the general cost structure and benefit variations to highlight key differences.

Humana Medicare Supplement Plan Premiums and Benefits Compared to Competitors

| Insurance Provider | Plan Type (Example) | Premium Range (General) | Key Benefit Differences |

|---|---|---|---|

| Humana | Plan G | Moderate to High (varies widely) | Often includes strong provider networks, potentially offering lower out-of-pocket costs within network. May offer additional benefits like telehealth services. |

| AARP (UnitedHealthcare) | Plan G | Moderate to High (varies widely) | Known for extensive provider networks and potentially strong customer service. Specific benefits may vary depending on plan details. |

| Mutual of Omaha | Plan G | Moderate to High (varies widely) | Often emphasizes simplicity and straightforward coverage. May offer strong customer service and claims processing. |

| Blue Cross Blue Shield | Plan G | Moderate to High (varies widely) | Strong local presence in many areas, potentially offering better access to local providers. Specific benefits and premiums can vary significantly by state and plan. |

The table above provides a general overview. Actual premiums and benefits will differ significantly based on individual circumstances. It’s essential to obtain personalized quotes from each provider to compare options accurately.

Key Differentiating Factors in Humana’s Medicare Supplement Plans

While many providers offer similar core Medicare Supplement plan benefits, several factors can differentiate Humana’s offerings. These factors include the extent and accessibility of their provider networks, the availability of additional benefits beyond standard Medicare Supplement coverage (such as telehealth or wellness programs), and the overall customer service experience.

Humana Medicare Supplement Plan Value Proposition: Cost and Coverage

The value of a Medicare Supplement plan from Humana, or any provider, hinges on the balance between premium costs and the level of coverage provided. A higher premium might be justified if it translates to significantly lower out-of-pocket expenses in the event of a major health issue. For example, if a Humana plan offers extensive coverage within a preferred provider network that you frequently utilize, the higher premium might be offset by lower costs for services. Conversely, a lower premium plan with limited network access might lead to higher out-of-pocket costs in the long run. A thorough cost-benefit analysis, factoring in your personal health needs and healthcare utilization patterns, is crucial to determining the best value proposition for your situation. For instance, a person with frequent doctor visits might find a plan with a broader network and potentially higher premium to be more cost-effective than a cheaper plan with limited network access, resulting in higher out-of-pocket expenses for each visit.

Customer Reviews and Experiences

Navigating the world of Medicare supplements can feel like traversing a dense jungle, and understanding the real-world experiences of others is crucial before making a decision. This section dives into the feedback surrounding Humana’s Medicare Supplement plans, offering a balanced perspective gleaned from various customer reviews and testimonials. We’ll examine both the positive and negative aspects, focusing on claims processing and customer service responsiveness to provide a clearer picture.

Humana’s Medicare Supplement plans, like any insurance product, receive a mixed bag of reviews. While many customers praise aspects of the plans, others highlight areas needing improvement. Analyzing this feedback allows for a more informed assessment of the company’s performance and helps potential customers make a more informed decision.

Summary of Customer Reviews

Customer reviews paint a picture of varied experiences with Humana’s Medicare Supplement plans. Positive feedback often centers on the breadth of plan options, the extensive provider network, and the perceived value for the premium paid. Conversely, negative reviews frequently mention difficulties navigating the claims process, lengthy wait times for customer service, and occasional issues with communication. Many reviews emphasize the importance of carefully comparing plans and understanding the specific coverage details before enrollment. A significant number of satisfied customers cite the ease of online account management and the availability of helpful customer service representatives when needed. However, an equally significant portion of dissatisfied customers express frustration with the lack of responsiveness and perceived bureaucratic hurdles in dealing with claims.

Claims Processing Procedures and Customer Service Responsiveness

Understanding how Humana handles claims and responds to customer inquiries is essential. The following examples illustrate the range of experiences reported by customers.

- Positive Experience: “My claim was processed quickly and efficiently. I submitted it online and received payment within a week. The customer service representative I spoke with was friendly and helpful.” This experience highlights the positive aspects of streamlined online processes and efficient claim handling.

- Negative Experience: “I had to call customer service multiple times to follow up on my claim. Each time, I was put on hold for an extended period. The claim ultimately took over a month to process.” This experience contrasts sharply with the previous one, illustrating potential delays and communication issues.

- Mixed Experience: “While the initial enrollment process was smooth, I encountered difficulties when submitting a claim for a specialized procedure. The customer service representative was knowledgeable, but the process itself felt overly complicated.” This experience demonstrates the potential for inconsistencies in service quality depending on the specific circumstances.

Areas for Improvement

Based on the analysis of customer feedback, several areas warrant attention for potential improvement.

- Streamlining Claims Processing: Reducing processing times and simplifying the claims submission process could significantly enhance customer satisfaction. Implementing more user-friendly online tools and providing clearer instructions could alleviate frustration.

- Improving Customer Service Responsiveness: Reducing wait times for customer service calls and improving the efficiency of call handling are crucial. Investing in additional training for customer service representatives to better handle complex issues would also be beneficial.

- Enhancing Communication: Proactive communication with customers regarding the status of their claims and providing regular updates could prevent unnecessary anxiety and frustration. Clearer and more concise explanations of plan benefits and coverage limitations would also be beneficial.

Understanding Humana’s Medicare Supplement Plan Documents

Navigating the world of Medicare supplements can feel like deciphering a secret code, but understanding your Humana plan documents doesn’t have to be a headache. These documents are your roadmap to knowing exactly what coverage you have and what it costs. Taking the time to familiarize yourself with them will empower you to make informed decisions about your healthcare.

Humana’s Medicare Supplement plan documents, including brochures and policy documents, are designed to provide comprehensive information about your plan’s benefits, costs, and limitations. While they can seem dense at first glance, breaking them down into manageable sections makes the process much easier. Think of it like assembling IKEA furniture – one step at a time!

Key Sections and Information in Humana’s Medicare Supplement Plan Documents

Humana’s plan documents typically include several key sections providing essential information. These sections help you understand your coverage, costs, and what to expect from your plan. Understanding these sections empowers you to make informed healthcare decisions.

Each document will vary slightly depending on your specific plan, but common sections include:

- Plan Summary: This provides a concise overview of your plan’s benefits, premiums, and key features. Think of it as the executive summary of your plan.

- Benefits and Coverage: This section details the specific services covered by your plan, including the percentage of costs covered and any limitations or exclusions. This is where you’ll find out what’s covered and what isn’t.

- Exclusions and Limitations: This crucial section clarifies what services or situations are not covered by your plan. Understanding these limitations helps prevent unexpected costs.

- Premium Information: This section details your monthly premium costs, how and when they are due, and any potential increases. Knowing your premium is essential for budget planning.

- Claims Procedures: This section explains how to submit a claim for reimbursement, including required forms and documentation. This section will guide you through the process of receiving payment for covered services.

- Provider Network Information: This section may Artikel Humana’s network of providers, especially for plans that offer additional discounts or benefits for using in-network providers.

- Grievance and Appeals Process: This section explains how to file a grievance or appeal if you disagree with a decision made by Humana regarding your coverage.

Step-by-Step Guide to Navigating Humana’s Plan Documents

Understanding your plan is crucial for maximizing your benefits. Here’s a step-by-step guide to help you navigate the essential components:

Follow these steps to ensure you fully comprehend your Humana Medicare Supplement plan documents:

- Read the Plan Summary First: This gives you a high-level overview before diving into the details.

- Focus on the Benefits and Coverage Section: Carefully review the list of covered services and any limitations. Pay special attention to what’s *not* covered.

- Understand the Exclusions and Limitations: This section is critical for avoiding unexpected out-of-pocket expenses.

- Review Premium Information Carefully: Understand your monthly costs and how they might change over time.

- Familiarize Yourself with the Claims Procedures: Know how to submit a claim and what documentation is needed.

- Check the Provider Network (if applicable): Identify in-network providers to potentially save on costs.

- Understand the Grievance and Appeals Process: Know your rights if you have a dispute with Humana.

Locating Specific Information in Humana’s Plan Documents

The following table illustrates where to find specific information within your Humana Medicare Supplement plan documents. Remember, the exact location might vary slightly depending on the specific plan document version.

| Information Needed | Document Section | Specific Location (Example) | Notes |

|---|---|---|---|

| Monthly Premium | Premium Information | Page 3, Section 2 | May include details on payment methods and due dates. |

| Covered Services (e.g., hospitalization) | Benefits and Coverage | Page 5-10, Table 1 | Look for detailed descriptions and any limitations. |

| Services Not Covered (e.g., cosmetic surgery) | Exclusions and Limitations | Page 12, Section 4 | This is crucial for avoiding unexpected costs. |

| Claim Submission Process | Claims Procedures | Page 15-17 | Includes forms and required documentation. |

Additional Humana Services and Benefits

Source: medicarenationwide.com

Humana doesn’t just offer standard Medicare Supplement plans; they sweeten the deal with a range of extra services designed to improve your overall health and well-being. These added benefits can significantly enhance the value of your plan, providing more than just basic medical coverage. Think of them as the cherry on top of a well-structured healthcare sundae.

These supplemental services are carefully chosen to address the specific needs of seniors, focusing on preventative care, convenient access to healthcare, and managing chronic conditions. The goal is to make navigating the healthcare system easier and more manageable, leading to a better quality of life.

Humana’s Wellness Programs

Humana invests heavily in proactive health management. Their wellness programs are designed to help you stay healthy and prevent future health issues. These programs often involve personalized guidance and support, tailored to your individual needs and preferences. They’re not just about generic advice; they’re about empowering you to take control of your health journey.

- Health Coaching: Personalized guidance from health professionals to help you achieve your health goals.

- Disease Management Programs: Support and resources for managing chronic conditions like diabetes or heart disease.

- Fitness and Nutrition Programs: Resources and incentives to encourage healthy habits, including access to fitness resources and nutritional counseling.

Telehealth Options

Accessing healthcare shouldn’t be a hassle, especially for seniors. Humana’s telehealth options offer convenient and accessible medical care from the comfort of your home. This can be particularly beneficial for individuals with mobility issues or those living in rural areas with limited access to in-person care.

- Virtual Doctor Visits: Consult with doctors online for non-emergency medical needs.

- Remote Monitoring: Track your health metrics remotely and share data with your healthcare provider.

Prescription Drug Coverage Considerations

While Medicare Supplement plans don’t typically include prescription drug coverage (that’s where Medicare Part D comes in), Humana offers resources and information to help you navigate the complexities of Part D and find a plan that works best for you. Understanding your options is key to maximizing your benefits and avoiding unnecessary costs.

- Part D Plan Selection Assistance: Humana provides resources to help you choose a Medicare Part D plan that complements your Medicare Supplement plan.

- Prescription Drug Savings Programs: Humana may offer additional discounts or programs to help lower your prescription drug costs.

Concluding Remarks

Choosing a Medicare Supplement plan is a big decision, but with the right information, it doesn’t have to be overwhelming. Understanding Humana’s offerings, comparing them to other providers, and considering your individual needs are key. Remember to thoroughly review policy documents and don’t hesitate to reach out to Humana directly with any questions. Your health is your wealth, and making informed choices about your insurance is a crucial step in protecting it.