How much is auto insurance in Massachusetts? That’s the burning question for anyone hitting the road in the Bay State. The cost isn’t just a number; it’s a reflection of your driving history, the car you drive, where you live, and even how much coverage you choose. From the bustling streets of Boston to the quieter country roads of Cape Cod, insurance rates fluctuate wildly. This guide breaks down the factors that impact your premium, helping you navigate the sometimes-confusing world of Massachusetts auto insurance and find the best deal for your needs.

We’ll delve into the specifics of age, driving record, vehicle type, and coverage levels, showing you how each element contributes to the final price tag. Geographic location plays a crucial role too – insurance in urban areas often differs significantly from rural rates. We’ll explore the different types of coverage available, explaining the benefits and costs of each. Finally, we’ll offer practical tips on how to snag the most affordable rates, from comparing quotes to bundling policies and adjusting your deductible.

Factors Influencing Auto Insurance Costs in Massachusetts: How Much Is Auto Insurance In Massachusetts

Securing affordable auto insurance in Massachusetts involves understanding the key factors that influence premiums. Several elements contribute to the final cost, ranging from your personal driving record to the type of vehicle you drive. This section will delve into these crucial factors, providing clarity on how they impact your insurance rates.

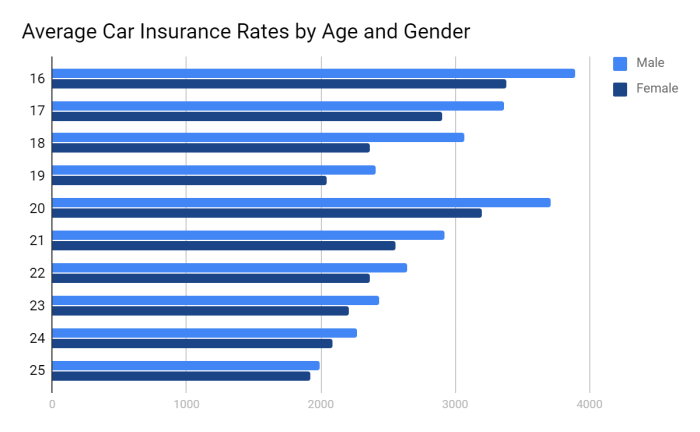

Age and Auto Insurance Premiums

Your age significantly impacts your car insurance rates in Massachusetts. Younger drivers, typically those under 25, are statistically more likely to be involved in accidents. Insurance companies consider this higher risk when setting premiums. Therefore, younger drivers generally pay more for insurance than older, more experienced drivers. As you gain experience and reach your mid-twenties and beyond, your premiums typically decrease, reflecting a lower perceived risk. This reduction continues until a certain age, after which rates may stabilize or slightly increase due to factors like age-related health concerns. For example, a 16-year-old driver will likely pay substantially more than a 35-year-old driver with a clean driving record, even if they drive the same car.

Driving History’s Influence on Insurance Rates

Your driving history is a major determinant of your auto insurance cost. Accidents and traffic violations significantly increase your premiums. A single at-fault accident can raise your rates considerably, while multiple accidents can lead to even higher premiums or even policy cancellations in some cases. Similarly, traffic violations, such as speeding tickets or driving under the influence (DUI), increase your risk profile in the eyes of insurance companies. The severity and frequency of these incidents directly impact your insurance costs. For instance, a DUI conviction will result in a far more significant premium increase than a single speeding ticket.

Vehicle Type and Features

The type of vehicle you drive plays a crucial role in determining your insurance premium. Sports cars and high-performance vehicles are generally more expensive to insure due to their higher repair costs and increased risk of theft. Conversely, smaller, less expensive cars typically have lower insurance premiums. Furthermore, safety features in your vehicle can influence your rates. Cars equipped with advanced safety technologies, such as anti-lock brakes (ABS), electronic stability control (ESC), and airbags, may qualify for discounts as they reduce the likelihood of accidents and the severity of injuries. A luxury SUV will likely cost more to insure than a compact sedan, even with similar safety features.

Comparison of Coverage Levels and Costs

Insurance coverage levels directly correlate with premiums. Liability coverage, which covers damages to others in an accident you cause, is generally the most affordable option. Collision coverage, which covers damage to your vehicle in an accident regardless of fault, and comprehensive coverage, which covers damage from events like theft or vandalism, are additional layers of protection that increase your premiums. Choosing higher coverage limits for liability, collision, and comprehensive will also result in higher premiums. For example, a $100,000 liability limit will cost less than a $500,000 liability limit.

Average Insurance Costs for Various Driver Profiles

| Driver Profile | Age | Driving History | Vehicle Type | Average Annual Premium (Estimate) |

|---|---|---|---|---|

| Young Driver | 20 | Clean Record | Sedan | $2,000 – $3,000 |

| Experienced Driver | 45 | Clean Record | SUV | $1,200 – $1,800 |

| Young Driver with Accidents | 22 | 2 Accidents | Sports Car | $3,500 – $5,000 |

| Experienced Driver with Tickets | 50 | 3 Speeding Tickets | Sedan | $1,500 – $2,500 |

*Note: These are estimated ranges and actual costs can vary significantly based on specific factors and insurance providers.*

Geographic Location and Insurance Rates

Massachusetts, like many states, sees significant variation in auto insurance premiums across its different regions. This isn’t just about random fluctuation; several interconnected factors create a complex pricing landscape. Understanding these influences can help drivers in different parts of the state make informed decisions about their insurance coverage.

Understanding the geographical disparity in Massachusetts auto insurance rates requires examining several contributing factors. These factors often interact, making it difficult to isolate the impact of any single element. For instance, higher population density often correlates with increased accident rates, but it also influences the availability of competitive insurance providers.

Factors Contributing to Geographic Variation in Premiums, How much is auto insurance in massachusetts

Several key elements contribute to the differing insurance costs across Massachusetts counties. These include population density, accident rates, the cost of vehicle repairs, and the prevalence of certain types of claims (e.g., theft vs. collision). Areas with higher traffic congestion and more frequent accidents tend to have higher premiums, reflecting the increased risk insurers face. Similarly, areas with higher costs of living, including auto repair, will see higher premiums.

- Population Density: More densely populated areas, such as Suffolk County (Boston), typically experience higher accident rates and increased claims, leading to higher premiums. The sheer volume of vehicles on the road increases the probability of collisions.

- Accident Rates: Counties with statistically higher accident rates naturally see higher insurance premiums. This is a direct reflection of the increased risk that insurance companies assume in those areas. Detailed accident data from the Massachusetts Department of Transportation would provide a clear picture of this correlation.

- Cost of Vehicle Repairs: Areas with higher labor and parts costs for vehicle repairs will see increased insurance premiums. This is because insurers must factor in the potential expense of covering repairs after an accident.

- Type of Claims: The prevalence of certain types of claims can also influence premiums. For example, areas with higher rates of vehicle theft may have higher premiums than areas with primarily collision-related claims.

Urban vs. Rural Insurance Premiums

The contrast between urban and rural areas in Massachusetts is stark when it comes to auto insurance. Urban centers like Boston and Springfield generally experience significantly higher premiums compared to more rural counties like Berkshire or Nantucket.

- Urban Areas (e.g., Suffolk County): Higher population density, increased traffic congestion, and a higher frequency of accidents translate to higher risk and, consequently, higher insurance premiums. The cost of living and vehicle repairs also tends to be higher in these areas.

- Rural Areas (e.g., Berkshire County): Lower population density, less traffic, and fewer accidents generally result in lower insurance premiums. The lower cost of living and vehicle repairs in these areas also contributes to lower premiums. However, factors like long distances to emergency services might slightly influence premiums.

Illustrative Data on Premium Variations Across Massachusetts Counties

While precise premium data for each county requires accessing individual insurance company data (which is often proprietary), a general trend is observable. For example, anecdotal evidence suggests that drivers in Suffolk County (Boston) might pay significantly more for auto insurance than drivers in Dukes County (Martha’s Vineyard), reflecting the differences Artikeld above. A hypothetical comparison might show a 20-30% difference in average premiums between these two vastly different counties. The exact figures would vary depending on the driver’s profile, vehicle type, and coverage level. This highlights the need for drivers to compare quotes from multiple insurers within their specific county.

Types of Auto Insurance Coverage in Massachusetts

Source: googleusercontent.com

Figuring out how much auto insurance costs in Massachusetts can be a real headache. Factors like your driving record and the type of car you own play a huge role. To get a clearer picture, you might want to compare rates from different providers, including those offered by larger insurance groups like the ones you’ll find if you check out fairfax insurance companies.

Ultimately, understanding the nuances of Massachusetts insurance laws is key to finding the best deal on your auto coverage.

Navigating the world of auto insurance in Massachusetts can feel like driving through a Boston traffic jam – confusing and potentially costly. Understanding the different types of coverage is crucial to ensuring you’re adequately protected without overspending. This section breaks down the key coverages, outlining their benefits and limitations to help you make informed decisions.

Massachusetts, like most states, mandates certain minimum levels of auto insurance coverage. However, choosing the right level and type of coverage depends on your individual needs and risk tolerance. While minimum coverage might seem appealing for its lower cost, it could leave you financially vulnerable in the event of a serious accident. Let’s explore your options.

Liability Coverage

Liability insurance protects you financially if you cause an accident that injures someone or damages their property. It covers the costs of medical bills, lost wages, and property repairs for the other party involved. Massachusetts requires minimum liability coverage, but higher limits are highly recommended. For example, the minimum might cover $20,000 per person injured and $40,000 per accident, but a more substantial accident could easily exceed these limits, leaving you personally responsible for the difference. This could mean selling your house or facing bankruptcy.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This means that even if you cause the accident, your insurance will help cover the cost of fixing your car. It’s a valuable addition, especially if you have a newer vehicle or a loan on your car. The deductible, the amount you pay out-of-pocket before insurance kicks in, significantly impacts the cost of this coverage. A higher deductible means lower premiums, but a higher upfront cost in the event of an accident.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or even hitting a deer. This is often considered optional, but it can provide peace of mind, especially if you live in an area prone to severe weather or have a high-value vehicle. Like collision coverage, the deductible will affect the premium cost.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills and vehicle repairs, even if the other driver is at fault and doesn’t have adequate insurance. Given the prevalence of uninsured drivers, this is a crucial coverage to consider, offering essential protection in a potentially devastating situation. Think about it: an accident with an uninsured driver could leave you with massive medical bills and vehicle repair costs, all out of your pocket.

Cost and Coverage Comparison

| Coverage Type | Cost (Approximate Range) | Coverage Description | Benefits |

|---|---|---|---|

| Liability | $200 – $800+ per year | Covers injuries and damages you cause to others. | Protects you from financial ruin if you cause an accident. |

| Collision | $200 – $1000+ per year | Covers damage to your vehicle in an accident, regardless of fault. | Repairs or replaces your damaged vehicle. |

| Comprehensive | $100 – $500+ per year | Covers damage to your vehicle from non-collision events (theft, fire, etc.). | Protects against a wide range of non-accident damages. |

| Uninsured/Underinsured Motorist | $50 – $200+ per year | Covers injuries and damages caused by an uninsured or underinsured driver. | Protects you from financial losses due to another driver’s lack of insurance. |

Note: The cost ranges provided are approximate and can vary significantly based on factors like your driving record, age, vehicle type, location, and the amount of coverage selected. Always obtain quotes from multiple insurers to compare prices and coverage options.

Finding Affordable Auto Insurance in Massachusetts

Source: ramseysolutions.net

Navigating the world of auto insurance in Massachusetts can feel like driving through a blizzard – confusing and potentially costly. But with the right strategies, you can find affordable coverage without sacrificing essential protection. This section Artikels key steps to securing the best possible rates.

Finding the cheapest car insurance in Massachusetts requires a proactive approach. Don’t just settle for the first quote you get; instead, actively compare options and leverage strategies to lower your premiums. Remember, your insurance rate is a reflection of your risk profile, and by taking control of factors within your power, you can significantly reduce your costs.

Comparing Auto Insurance Quotes

Before you commit to a policy, obtain quotes from multiple insurers. Websites like The Zebra and NerdWallet offer comparison tools, allowing you to input your information once and receive quotes from several companies simultaneously. This saves time and effort, ensuring you get a comprehensive overview of available options. Pay close attention to not only the price but also the coverage details to find the best balance of cost and protection. Consider factors like deductibles, coverage limits, and included services when making your comparisons. A slightly higher premium might be worth it if it provides significantly better coverage in the event of an accident.

Maintaining a Good Driving Record

Your driving history is a major factor in determining your insurance premiums. A clean record, free of accidents and traffic violations, signals low risk to insurers, leading to lower rates. Even minor infractions can lead to significant premium increases. Driving safely and defensively is not just about protecting yourself and others on the road; it’s also a smart financial decision. For example, a driver with a spotless record for five years might qualify for a significant discount compared to someone with multiple speeding tickets or at-fault accidents within the same period. Safe driving habits translate directly into savings.

Bundling Insurance Policies

Many insurers offer discounts for bundling home and auto insurance policies. This is because managing multiple policies for the same customer simplifies administration and reduces the overall risk for the insurance company. These discounts can be substantial, often amounting to 10-20% or more off your total premium. If you own a home, explore the possibility of bundling your insurance policies to see if you can achieve significant cost savings. For example, if your annual auto insurance is $1200 and your home insurance is $800, a 15% bundle discount could save you $270 annually.

Increasing Your Deductible

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Raising your deductible can significantly lower your premium. However, this strategy requires careful consideration. A higher deductible means you’ll pay more if you’re involved in an accident. Weigh the potential savings against your financial ability to handle a larger out-of-pocket expense in the event of a claim. For example, increasing your deductible from $500 to $1000 might result in a substantial premium reduction, but you’ll need to be prepared to cover $1000 in damages before your insurance coverage begins.

Massachusetts State Regulations and Insurance

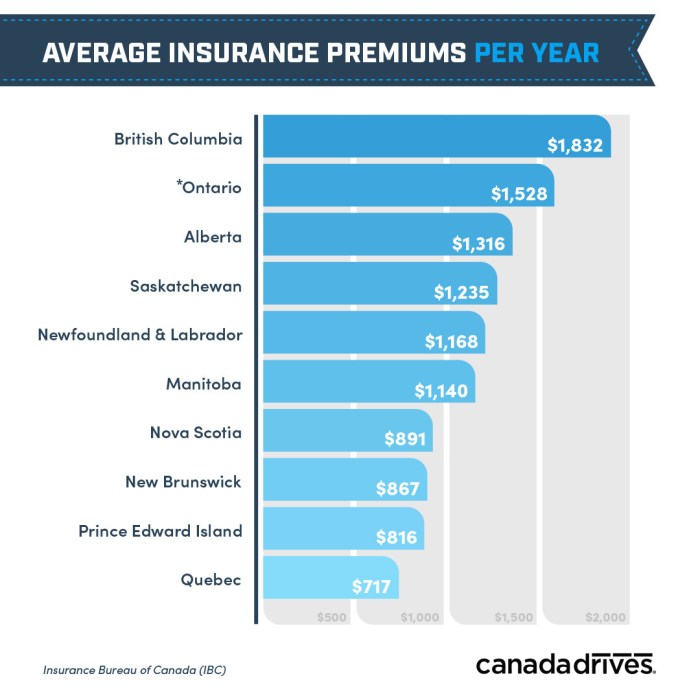

Source: canadadrives.ca

Navigating the world of auto insurance in Massachusetts requires understanding the state’s regulatory framework. The rules and regulations significantly impact what you pay and the coverage you receive. This section delves into the key aspects of Massachusetts’ auto insurance regulations.

The Massachusetts Division of Insurance (DOI) plays a crucial role in overseeing the auto insurance market. Its responsibilities include setting minimum coverage requirements, ensuring insurer solvency, and protecting consumers from unfair or deceptive practices. The DOI actively monitors insurance companies’ rates, investigates consumer complaints, and works to maintain a competitive and fair insurance market within the state. Their influence extends to approving rate increases and ensuring compliance with state laws, ultimately shaping the landscape of auto insurance costs and coverage options for Massachusetts residents.

Mandatory Insurance Requirements in Massachusetts

Massachusetts is a no-fault state, meaning drivers are primarily responsible for their own medical expenses and property damage after an accident, regardless of fault. However, this doesn’t mean insurance is optional. Every driver in Massachusetts is legally required to carry a minimum amount of liability insurance. This protects others in the event you cause an accident. Failure to maintain the legally required minimum insurance coverage can result in significant penalties, including license suspension and hefty fines. The minimum liability coverage typically includes bodily injury and property damage.

Impact of State Regulations on Auto Insurance Affordability

Massachusetts’ regulations significantly influence the affordability of auto insurance. While the no-fault system aims to reduce litigation costs, the mandated minimum coverage levels and other regulatory measures can impact premiums. The DOI’s oversight of rate increases and its efforts to promote competition among insurers aim to keep premiums reasonable, but factors like the overall cost of healthcare and the frequency of accidents also play a substantial role. For example, a high number of accidents in a particular region could lead to increased premiums for drivers in that area, illustrating the interplay between regulations and market forces in determining affordability.

Key State Regulations Affecting Auto Insurance

The following points summarize key regulations affecting auto insurance in Massachusetts:

- Minimum Liability Coverage: Massachusetts mandates minimum bodily injury and property damage liability coverage. These amounts are subject to change and should be verified with the DOI.

- No-Fault System: Massachusetts operates under a no-fault system for personal injury protection (PIP). This means drivers are responsible for their own medical expenses and lost wages, regardless of who caused the accident, up to the policy limits.

- Uninsured/Underinsured Motorist Coverage: This coverage is often recommended, even if not mandatory, to protect drivers in accidents caused by uninsured or underinsured drivers.

- Rate Regulation: The DOI reviews and approves insurance rate increases, attempting to balance insurer profitability with consumer affordability.

- Consumer Protection Laws: Massachusetts has robust consumer protection laws to prevent unfair or deceptive insurance practices.

Illustrative Examples of Insurance Costs

Understanding the cost of auto insurance in Massachusetts requires looking beyond averages. Many factors influence the final premium, making it crucial to examine specific examples to grasp the variability. The following scenarios illustrate how different driver profiles and coverage choices impact insurance costs. Remember, these are fictional examples for illustrative purposes, and actual costs may vary based on the specific insurer and individual circumstances.

Example 1: The Young, Inexperienced Driver

This example features Alex, a 20-year-old college student with a clean driving record. Alex drives a used Honda Civic, a relatively inexpensive and fuel-efficient car. He opts for the state-mandated minimum liability coverage. His annual premium is approximately $1,800. This relatively high cost reflects the higher risk associated with younger drivers, who statistically have more accidents. The type of vehicle, while not high-end, also contributes to the cost. Minimum coverage keeps the premium lower, but leaves Alex with limited protection in the event of an accident.

Example 2: The Experienced Driver with a Clean Record

Sarah, a 45-year-old accountant with a spotless driving record for over 20 years, drives a new Toyota Camry. She chooses comprehensive and collision coverage in addition to liability, wanting maximum protection for her vehicle. Her annual premium is approximately $2,800. The higher cost reflects the more extensive coverage and the value of her newer vehicle. Her clean driving record and age contribute to a lower premium than a younger or less experienced driver would pay.

Example 3: The Driver with a Minor Accident

Mark, a 30-year-old software engineer, drives a used Ford F-150 pickup truck. He has one minor at-fault accident on his record from three years ago. He selects comprehensive and collision coverage. His annual premium is around $3,200. The accident on his record significantly increases his premium. The type of vehicle, a truck, is also considered higher risk and therefore more expensive to insure than a smaller car. The comprehensive and collision coverage adds to the overall cost.

Example 4: The Senior Citizen

Jane, a 70-year-old retiree, drives a small, fuel-efficient Hyundai Elantra. She has a clean driving record and only needs liability coverage. Her annual premium is approximately $1,200. Her age and clean record contribute to a lower premium. The smaller, less expensive vehicle also reduces the insurance cost. The minimal coverage selected further contributes to the lower premium.

Factors Influencing Premium Differences

The examples above highlight the impact of several key factors: age and driving experience, vehicle type and value, coverage level selected, and driving record. Understanding these factors can help drivers make informed decisions about their auto insurance needs and potentially reduce their premiums. For instance, choosing a less expensive vehicle, maintaining a clean driving record, and opting for a lower coverage level can all contribute to significant savings. However, it’s crucial to weigh the cost savings against the level of protection offered.

Last Recap

So, how much *will* auto insurance in Massachusetts cost you? The answer, as we’ve seen, isn’t simple. It’s a personalized equation based on your unique circumstances. But by understanding the factors that influence premiums—your driving history, vehicle choice, location, and coverage preferences—you can make informed decisions and find a policy that fits your budget without sacrificing essential protection. Remember to shop around, compare quotes, and don’t hesitate to ask questions. Driving in Massachusetts shouldn’t break the bank.