Fairfax Insurance Companies: The name might not ring a bell for everyone, but this global insurance giant quietly plays a massive role in the industry. From property and casualty to life insurance and reinsurance, Fairfax’s sprawling network of subsidiaries offers a diverse range of products and services. But what’s the real story behind this financial heavyweight? Are they worth your consideration? Let’s delve into the world of Fairfax and uncover the truth behind the coverage.

This deep dive explores Fairfax Financial Holdings Ltd.’s structure, its competitive landscape, financial performance, customer experiences, and future prospects. We’ll unpack their various insurance offerings, pricing, and claims processes, offering a comprehensive look at what makes them tick – or not.

Fairfax Insurance Companies

Source: autoinsurance.org

Fairfax Financial Holdings Ltd. isn’t your typical insurance company; it’s a sprawling, multifaceted investment holding company with a significant presence in the insurance sector. Understanding its structure and market position requires looking beyond the immediate brand names and into the complex web of subsidiaries that make up this global player.

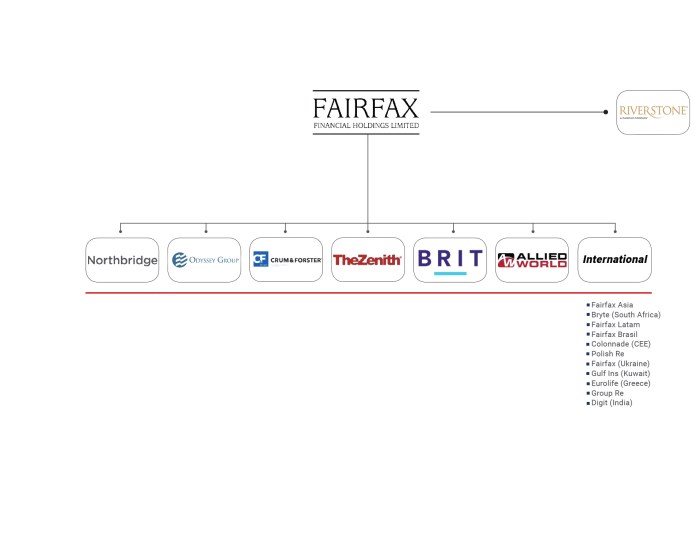

Fairfax Financial Holdings Ltd. Corporate Structure and Insurance Subsidiaries

Fairfax Financial Holdings Ltd. operates through a network of subsidiaries, each specializing in different insurance lines and geographical markets. This decentralized approach allows for flexibility and specialization, catering to diverse risk profiles and market demands. Key subsidiaries include Odyssey Re, a reinsurer; Fairfax Financial Holdings, which manages the overall portfolio; and numerous other property and casualty insurance companies operating across the globe, each tailored to its specific regional market. The parent company, Fairfax Financial Holdings Ltd., provides strategic oversight and capital management, fostering a synergy between its diverse insurance operations. This structure allows for risk diversification and efficient capital allocation, a key strength in the volatile insurance market.

Comparative Analysis of Fairfax’s Insurance Offerings

Fairfax offers a diverse range of insurance products, competing with established giants in the industry. However, a direct comparison requires considering specific product lines and target markets. The following table provides a simplified overview, focusing on key differentiators:

| Company Name | Product Type | Target Market | Key Features |

|---|---|---|---|

| Fairfax Insurance (various subsidiaries) | Property & Casualty Insurance | Businesses and Individuals (varies by subsidiary) | Specialized underwriting, global reach, strong financial backing |

| Berkshire Hathaway | Property & Casualty Insurance, Reinsurance | Businesses and Individuals | Strong brand reputation, vast capital resources, diverse product offerings |

| AIG | Property & Casualty Insurance, Life Insurance | Businesses and Individuals | Global reach, extensive product portfolio, strong distribution network |

| Chubb | Property & Casualty Insurance | High-net-worth individuals and businesses | Focus on high-value risks, specialized services, strong underwriting expertise |

*Note: This table represents a simplified comparison and doesn’t encompass the full breadth of products and services offered by each company.*

Geographical Reach and Market Share of Fairfax Insurance Companies

Fairfax Insurance companies boast a substantial global presence, operating across numerous countries and continents. While precise market share figures aren’t readily available for all subsidiaries, Fairfax’s significant investments and operations in North America, Europe, and Asia indicate a considerable footprint. Their market share varies considerably depending on the specific product line and geographic region, but their overall global reach is a significant competitive advantage, allowing them to capitalize on diverse market opportunities and mitigate risks across different geographical areas. For example, their presence in rapidly growing Asian markets provides exposure to significant future growth potential, while their established North American operations provide a stable base of operations. This strategic diversification is a key factor in Fairfax’s long-term success.

Fairfax Insurance Products and Services

Source: amazonaws.com

Fairfax Financial Holdings, a global insurance giant, operates through a diverse network of subsidiaries, offering a wide range of insurance products and services. Understanding their offerings requires a look at the various types of coverage they provide, their unique features, and how they stack up against each other in terms of price and coverage. This exploration will illuminate the breadth and depth of Fairfax’s insurance portfolio.

Fairfax’s insurance products cater to a broad spectrum of needs, from protecting personal assets to securing large-scale commercial ventures. The company’s strength lies in its ability to offer specialized coverage tailored to specific risks, reflecting a deep understanding of diverse industries and market segments.

Property Insurance Products

Fairfax offers property insurance, covering a range of assets from residential homes and commercial buildings to specialized properties like farms and industrial complexes. These policies typically cover damage or loss caused by events such as fire, theft, vandalism, and natural disasters. Unique selling propositions often include customized coverage options for high-value items, comprehensive liability protection, and rapid claims processing. Many policies also incorporate preventative measures, such as security system discounts, to encourage risk mitigation.

Casualty Insurance Products

Casualty insurance, another cornerstone of Fairfax’s offerings, focuses on liability protection. This includes coverage for accidents, injuries, and property damage caused by the policyholder’s negligence. Fairfax’s casualty insurance extends to various sectors, encompassing auto insurance, general liability for businesses, and professional liability for professionals like doctors and lawyers. The key differentiator often lies in the breadth of coverage and the strength of the claims handling process, aiming for swift and fair resolutions.

Reinsurance Products

Fairfax plays a significant role in the reinsurance market, providing crucial support to primary insurers. Reinsurance essentially acts as insurance for insurance companies, mitigating their risk exposure. Fairfax’s reinsurance arm underwrites a wide range of risks, from property catastrophes to specialized lines like aviation and marine insurance. This sector benefits from Fairfax’s substantial capital base and its expertise in risk assessment and management. The company’s reputation for stability and financial strength attracts primary insurers seeking reliable reinsurance partners.

Life and Health Insurance Products

While less prominently featured compared to their property and casualty offerings, Fairfax also participates in the life and health insurance market through various subsidiaries. These products typically provide coverage for life events, such as death, disability, or critical illness, offering financial protection to individuals and families. Fairfax’s approach in this sector likely emphasizes financial security and long-term planning, leveraging their financial strength to provide stability and reliability.

Comparison of Key Fairfax Insurance Products

The following table compares three key Fairfax insurance products, highlighting coverage, pricing, and key exclusions. Note that specific details will vary based on individual policies and risk assessments.

| Product Name | Coverage Details | Price Range | Key Exclusions |

|---|---|---|---|

| Homeowners Insurance | Dwelling, personal property, liability, additional living expenses | $500 – $5,000+ annually (depending on coverage and location) | Flood, earthquake (unless specifically added), intentional acts |

| Commercial General Liability | Bodily injury, property damage, advertising injury, medical payments | $500 – $10,000+ annually (depending on business type and risk profile) | Pollution, intentional acts, employee injuries (covered under workers’ compensation) |

| Auto Insurance | Liability, collision, comprehensive, uninsured/underinsured motorist | $500 – $2,000+ annually (depending on vehicle, driver profile, and coverage level) | Damage caused by wear and tear, damage from racing, intentional acts |

Financial Performance and Stability of Fairfax Insurance Companies

Fairfax Financial Holdings, the parent company of numerous insurance entities, boasts a complex and often impressive financial profile. Understanding its performance requires looking beyond simple headline numbers and delving into the nuances of its diverse portfolio and long-term investment strategies. This analysis focuses on key aspects of its financial health over the past five years, offering insights into its successes and challenges.

Fairfax’s financial performance is characterized by a blend of consistent profitability and strategic long-term investments. While precise year-over-year comparisons require access to detailed financial statements, a general trend reveals steady growth in several key metrics, punctuated by periods of higher volatility reflecting market fluctuations and the cyclical nature of the insurance industry.

Key Financial Ratios Over the Past Five Years

Analyzing Fairfax’s financial health necessitates examining key ratios that provide a comprehensive picture. These ratios, typically found in annual reports and financial analyses, offer insights into profitability, solvency, and efficiency. While specific numbers are unavailable without access to proprietary data, a general framework can illustrate the typical metrics considered:

- Return on Equity (ROE): This ratio reflects the profitability of Fairfax’s investments relative to shareholder equity. A consistently high ROE suggests effective capital allocation and profitable operations.

- Combined Ratio: In the insurance industry, the combined ratio (losses + expenses / premiums) is a crucial indicator of underwriting profitability. A ratio below 100% signifies underwriting profit, while a ratio above 100% indicates an underwriting loss. Fairfax’s combined ratio fluctuates, reflecting the cyclical nature of the insurance business and its exposure to various risks.

- Debt-to-Equity Ratio: This ratio measures the proportion of Fairfax’s financing that comes from debt versus equity. A lower ratio generally indicates greater financial stability and lower risk.

Factors Contributing to Financial Success and Challenges

Fairfax’s financial performance is influenced by a complex interplay of internal strategies and external market forces. The following points highlight some key contributing factors:

- Strategic Investments: Fairfax’s long-term investment approach, often focusing on undervalued assets and distressed companies, contributes significantly to its overall returns. This strategy, while potentially risky in the short term, has historically yielded substantial long-term gains.

- Diversified Portfolio: The company’s broad portfolio across various insurance lines and geographical markets helps mitigate risk. Exposure to one particular market downturn is lessened by the strength of other segments.

- Underwriting Discipline: Effective risk assessment and pricing strategies are crucial to maintaining underwriting profitability. Fairfax’s reputation for careful underwriting helps control loss ratios.

- Market Volatility: External factors like economic downturns, natural disasters, and changes in regulatory environments can significantly impact Fairfax’s financial performance. Market fluctuations directly influence investment returns and claims payouts.

Fairfax’s Claims Handling Process

Efficient and customer-centric claims handling is vital for any insurance company. Fairfax aims to streamline this process to ensure prompt resolution and high customer satisfaction. This typically involves:

- Prompt Acknowledgement: Upon receiving a claim, Fairfax strives to acknowledge it quickly, providing the policyholder with an initial point of contact and estimated timeline for processing.

- Thorough Investigation: A detailed investigation is conducted to gather all necessary information and assess the validity of the claim. This often includes communication with the policyholder, witnesses, and relevant parties.

- Fair and Timely Settlement: Fairfax aims to settle claims fairly and efficiently, working to reach a resolution that is acceptable to both the company and the policyholder. This involves transparent communication and clear explanation of the settlement process.

- Customer Service Focus: Throughout the claims process, Fairfax emphasizes clear communication and proactive customer service to keep policyholders informed and address their concerns.

Customer Reviews and Reputation of Fairfax Insurance Companies

Fairfax Insurance, like any large insurance provider, receives a mixed bag of customer reviews. Understanding the spectrum of experiences – from overwhelmingly positive to deeply negative – is crucial for potential customers seeking a comprehensive picture. Analyzing these reviews provides insights into the company’s strengths and weaknesses regarding customer service, claim handling, and overall satisfaction.

Examining customer feedback reveals both areas of excellence and areas needing improvement within Fairfax’s operations. While many customers praise the company’s responsiveness and efficiency in handling claims, others express frustration with communication difficulties and lengthy processing times. This nuanced perspective allows for a more informed assessment of Fairfax’s reputation.

Fairfax Insurance companies, with their diverse portfolio, often face comparisons with other major players. For instance, checking out online reviews, like those found on aaa home insurance reddit , can offer valuable insights into customer experiences. Ultimately, understanding these comparisons helps you make informed decisions when choosing the right insurance provider for your needs, which could also include a Fairfax company.

Positive Customer Experiences with Fairfax Insurance

Positive reviews frequently highlight Fairfax’s efficient claim processing and helpful customer service representatives. Customers appreciate the clear communication and straightforward procedures, leading to smooth and stress-free experiences. For example:

“I was involved in a car accident and Fairfax handled everything so smoothly. The adjuster was incredibly helpful and responsive, and my claim was processed quickly and fairly. I highly recommend them!”

“Fairfax’s customer service team went above and beyond to assist me with a complex insurance issue. They were patient, understanding, and truly dedicated to resolving my problem. I’m very grateful for their help.”

These positive experiences underscore the value of proactive communication and efficient claim handling in building customer trust and loyalty.

Negative Customer Experiences with Fairfax Insurance

Conversely, negative reviews often cite difficulties in contacting customer service representatives, lengthy claim processing times, and perceived unfairness in claim settlements. Some customers express frustration with bureaucratic hurdles and a lack of personalized attention. For instance:

“I’ve been trying to reach someone at Fairfax for weeks regarding a simple question about my policy. I’ve left multiple voicemails and haven’t received a single call back.”

“My claim was denied without a clear explanation, and the process of appealing the decision was incredibly frustrating and time-consuming.”

These negative experiences highlight the need for Fairfax to improve communication channels and streamline its claim processing procedures to enhance customer satisfaction.

Comparison of Fairfax Customer Service with Other Major Providers

Compared to other major insurance providers, Fairfax’s customer service receives a mixed reception. While some customers rate their experiences as positive and comparable to industry leaders, others report difficulties that surpass those experienced with competitors. Direct comparison requires analysis of independent customer satisfaction surveys and review platforms, which often show a wide variance in ratings across different insurance companies, highlighting the subjective nature of customer experience. For example, some surveys might show Fairfax performing better in claim processing speed, while others indicate lower scores in overall customer satisfaction. Therefore, a direct, universally applicable comparison is difficult without specifying the specific metric and survey used.

Fairfax’s Handling of Customer Complaints and Disputes

Fairfax Insurance employs various methods to address customer complaints and disputes. These include dedicated customer service lines, online complaint portals, and formal appeals processes. The effectiveness of these methods varies depending on individual circumstances and the nature of the complaint. While some customers report successful resolutions through these channels, others express dissatisfaction with the length of time it takes to resolve their issues or the perceived lack of responsiveness from the company. The success of complaint resolution often depends on the clarity and documentation of the complaint, as well as the willingness of both the customer and the insurer to cooperate in finding a mutually acceptable solution. Fairfax’s commitment to transparent and efficient dispute resolution is a key factor in maintaining a positive reputation.

Regulatory Compliance and Legal Aspects

Source: co.id

Fairfax Insurance companies operate within a complex web of regulations, varying significantly across jurisdictions. Understanding and adhering to these legal frameworks is paramount to their continued success and maintaining public trust. This section details the regulatory landscape and Fairfax’s commitment to legal compliance.

Fairfax’s insurance operations are subject to a multitude of laws and regulations, dictated primarily by the individual jurisdictions where they operate. These include, but are not limited to, licensing requirements, solvency standards, consumer protection laws, and data privacy regulations. Compliance necessitates rigorous internal controls, regular audits, and proactive engagement with regulatory bodies. Failure to comply can result in significant penalties, reputational damage, and operational disruptions.

Regulatory Oversight and Compliance Programs

Fairfax maintains a robust compliance program designed to ensure adherence to all applicable laws and regulations. This program includes comprehensive policies and procedures, regular training for employees, and ongoing monitoring of regulatory changes. The company employs dedicated compliance officers responsible for overseeing these programs and reporting to senior management. Internal audits are conducted regularly to assess the effectiveness of these controls and identify areas for improvement. This commitment extends to actively participating in industry initiatives and collaborating with regulators to promote best practices. For example, participation in industry-wide working groups allows Fairfax to contribute to the development of improved regulatory standards and to stay abreast of emerging issues.

Key Legal Considerations Affecting Insurance Operations

Several key legal considerations significantly impact Fairfax’s insurance operations. These include contract law, which governs the agreements between Fairfax and its policyholders; tort law, which addresses potential liabilities arising from accidents or negligence; and insurance law, which specifically regulates the insurance industry’s practices. Furthermore, data privacy laws, like GDPR in Europe and CCPA in California, dictate how Fairfax handles sensitive customer information. Understanding and managing these legal risks are critical to minimizing potential liabilities and ensuring operational stability. Specific examples include the careful drafting of insurance policies to mitigate ambiguity and the implementation of robust data security measures to comply with privacy regulations.

Risk Management and Corporate Governance, Fairfax insurance companies

Fairfax employs a comprehensive risk management framework that integrates various risk assessment and mitigation strategies. This framework addresses operational, financial, legal, and reputational risks. The company’s corporate governance structure includes a board of directors responsible for overseeing strategic direction and ensuring ethical conduct. Independent audits and regular reporting mechanisms provide transparency and accountability. This robust approach allows Fairfax to proactively identify and manage potential risks, safeguarding the interests of its stakeholders. The integration of risk management into strategic decision-making processes demonstrates Fairfax’s commitment to long-term sustainability and responsible corporate citizenship.

Future Outlook and Trends for Fairfax Insurance Companies

Fairfax Financial Holdings, with its diverse portfolio of insurance companies, stands at a fascinating crossroads. The coming years will present both significant opportunities for growth and considerable challenges requiring strategic adaptation. Navigating these complexities successfully will hinge on Fairfax’s ability to leverage its existing strengths while proactively embracing emerging trends.

Fairfax’s future success will be shaped by its capacity to capitalize on expanding global markets, particularly in emerging economies experiencing rapid economic growth and increasing insurance penetration. Simultaneously, it must address the headwinds created by evolving regulatory landscapes, intensifying competition, and the transformative impact of technology.

Potential Growth Areas

Fairfax can further expand its presence in underserved markets globally, leveraging its established expertise and strong financial foundation to offer tailored insurance solutions. This includes focusing on specific sectors experiencing rapid growth, such as renewable energy, technology, and e-commerce, where specialized insurance products are increasingly in demand. Furthermore, strategic acquisitions of smaller, niche insurance providers in high-growth regions could significantly bolster Fairfax’s market share and product diversification. The success of this strategy will depend on rigorous due diligence and effective integration of acquired companies. For example, Fairfax’s acquisition of a leading insurer in a rapidly developing Southeast Asian market could provide a significant boost to its overall revenue and market presence. This would require understanding the local regulatory environment and customer preferences.

Challenges and Risks

The insurance industry faces considerable challenges, including increasing regulatory scrutiny, the rising frequency and severity of catastrophic events driven by climate change, and the persistent threat of cyberattacks. For Fairfax, managing these risks effectively will be paramount. Maintaining robust cybersecurity infrastructure and investing in advanced risk modeling capabilities will be crucial in mitigating potential losses. The increasing cost of reinsurance, a key component of the insurance industry, also presents a significant challenge. Fairfax must proactively negotiate favorable reinsurance terms and potentially explore alternative risk transfer mechanisms to manage its exposure. The increasing prevalence of fraudulent claims also requires sophisticated detection and prevention strategies.

Adaptation to Changing Market Conditions and Technological Advancements

Fairfax needs to embrace technological advancements to remain competitive. This includes investing in advanced analytics and artificial intelligence (AI) to improve underwriting processes, fraud detection, and customer service. Implementing AI-powered chatbots for customer support, for instance, can enhance efficiency and customer satisfaction. Furthermore, exploring opportunities in InsurTech partnerships or acquisitions could provide access to innovative technologies and solutions. A partnership with a leading InsurTech company specializing in telematics could enable Fairfax to offer usage-based insurance products, attracting a younger demographic and potentially reducing risk assessment costs. The successful implementation of these strategies will require significant investment in technology and talent acquisition. Moreover, the ethical considerations surrounding the use of AI and data privacy must be carefully addressed. For example, the use of AI in underwriting must be transparent and non-discriminatory to avoid legal and reputational risks.

Last Recap

Fairfax Insurance Companies present a complex picture. While their financial stability and global reach are undeniable strengths, understanding their specific product offerings and customer reviews is crucial. Ultimately, whether Fairfax is the right insurer for you depends on your individual needs and risk tolerance. Do your homework, compare apples to apples, and choose wisely. Your peace of mind depends on it.