Corporate general liability insurance: It’s the unsung hero of the business world, quietly protecting your company from the unexpected. Think lawsuits from slip-and-falls, damaged property, or even accusations of slander. This isn’t just about ticking a box; it’s about safeguarding your financial future and ensuring your business can weather the storms. We’re diving deep into understanding what it covers, how it works, and why it’s non-negotiable for many businesses.

This crucial insurance policy protects your business from a wide range of potential liabilities, covering everything from bodily injuries sustained on your premises to property damage caused by your operations. Understanding the nuances of corporate general liability insurance is key to protecting your company’s financial stability and reputation. From defining its core components to navigating the claims process, we’ll equip you with the knowledge to make informed decisions about your business’s risk management.

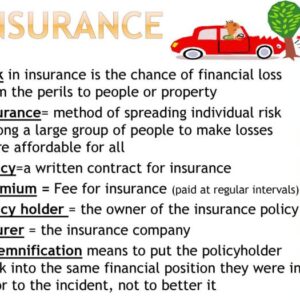

Definition and Scope of Corporate General Liability Insurance

Corporate General Liability (CGL) insurance is a crucial safety net for businesses, protecting them from financial ruin stemming from accidents, injuries, or property damage caused by their operations. It’s a fundamental piece of the risk management puzzle, offering a degree of protection against unforeseen events that could otherwise cripple a company. Think of it as a comprehensive shield against the unexpected.

Core Components of Corporate General Liability Insurance

CGL insurance typically covers three main areas: bodily injury, property damage, and advertising injury. Bodily injury encompasses physical harm to individuals, including medical expenses and potential lawsuits. Property damage covers accidental damage to the property of others. Advertising injury, a less frequently discussed aspect, covers libel, slander, and copyright infringement related to advertising activities. These core components work together to provide a broad spectrum of coverage.

Types of Businesses Requiring CGL Insurance

A wide array of businesses benefit from CGL insurance. From small startups to large corporations, virtually any business that interacts with the public or operates in a physical space should consider it. This includes retailers, restaurants, manufacturers, contractors, and service providers. The level of coverage needed will vary depending on the specific industry and the nature of the business operations, but the underlying principle remains the same: protection against liability.

Examples of Common Covered Incidents

Imagine a customer slipping and falling in your store, sustaining injuries. CGL insurance would likely cover their medical bills and any legal costs associated with a resulting lawsuit. Or perhaps a contractor working on your premises accidentally damages a neighboring building. Again, CGL insurance would step in to cover the repair costs. Other examples include product liability (if your product causes injury), and advertising mistakes that lead to legal action. The coverage extends to a variety of scenarios where your business could be held responsible for damages.

Comparison of CGL Insurance with Other Business Insurance Types

CGL insurance is distinct from other types of business insurance, such as professional liability (errors and omissions insurance) or workers’ compensation. Professional liability insurance protects professionals from claims of negligence or malpractice in their professional services. Workers’ compensation covers medical expenses and lost wages for employees injured on the job. CGL, on the other hand, focuses on liability to third parties (individuals or businesses who are not employees) for bodily injury or property damage caused by the business’s operations. They are complementary, not interchangeable.

Coverage Limits and Exclusions of Various CGL Policies, Corporate general liability insurance

The coverage limits and exclusions can vary significantly between CGL policies. It’s crucial to carefully review the policy wording to understand exactly what is and isn’t covered.

| Policy Type | Coverage Limit (Example) | Common Exclusions | Notes |

|---|---|---|---|

| Basic CGL | $1,000,000 per occurrence | Intentional acts, employee injuries, pollution | Often a starting point for smaller businesses. |

| Broad CGL | $2,000,000 per occurrence, $2,000,000 aggregate | Intentional acts, employee injuries, pollution, contractual liability (unless specifically added) | Offers higher limits and potentially broader coverage. |

| Umbrella Liability | $5,000,000 or more | Exclusions similar to broad CGL, but may have broader coverage for certain situations | Provides excess liability coverage above primary policies. |

| Custom CGL | Variable, tailored to specific needs | Variable, based on negotiated terms | Offers highly customized coverage for businesses with unique risk profiles. |

Key Coverage Areas within a CGL Policy: Corporate General Liability Insurance

Source: slideplayer.com

A Corporate General Liability (CGL) policy is your business’s safety net, protecting against financial losses stemming from accidents or incidents involving your operations. Understanding the key coverage areas is crucial for ensuring adequate protection. This section breaks down the core components of a typical CGL policy, highlighting what’s covered and what’s not.

Bodily Injury Liability

This coverage protects your business against financial responsibility for injuries sustained by third parties due to your business operations. This could range from a customer slipping on a wet floor in your store to an employee injuring themselves while using your company equipment. The policy will typically cover medical expenses, lost wages, and legal defense costs associated with such incidents. For instance, if a client trips over a poorly maintained sidewalk outside your office and suffers a broken leg, your CGL policy would likely cover their medical bills and any legal fees incurred if they sue your company. The amount of coverage is determined by your policy limits.

Property Damage Liability

This part of the policy covers damages to the property of others caused by your business operations. Imagine a scenario where a delivery truck owned by your company accidentally backs into a customer’s car, causing significant damage. Your CGL policy would cover the cost of repairing or replacing the damaged vehicle. Similarly, if a fire originating from your business damages a neighboring building, this coverage would help compensate for the losses. Again, the extent of the coverage is limited by the policy’s terms and conditions.

Personal and Advertising Injury Liability

This less intuitive coverage protects your business against claims of libel, slander, copyright infringement, or other similar offenses related to your advertising or business practices. For example, if your company’s marketing materials falsely accuse a competitor of unethical business practices, leading to a lawsuit, this coverage would help defend you and cover any resulting damages. This section often includes coverage for privacy violations and misappropriation of advertising ideas.

Exclusions and Limitations

It’s crucial to understand that CGL policies aren’t all-encompassing. Common exclusions might include damage to your own property, injuries to your employees (covered under workers’ compensation), intentional acts, and pollution. Policy limits define the maximum amount the insurer will pay for covered claims. Careful review of the policy wording is essential to fully understand these limitations. For instance, a common exclusion involves damage caused by pollution, meaning that if your business causes environmental damage through a spill, this may not be covered.

- Bodily Injury Liability: Covers medical expenses, lost wages, and legal fees for injuries caused to third parties by your business operations. Example: A customer falls in your store and breaks their arm.

- Property Damage Liability: Covers damages to the property of others caused by your business operations. Example: Your delivery truck hits a parked car.

- Personal and Advertising Injury Liability: Covers claims of libel, slander, copyright infringement, or other similar offenses related to your advertising or business practices. Example: Your company’s advertisement contains false statements about a competitor.

The Claims Process and Claim Handling

Source: dreamstime.com

Corporate general liability insurance protects businesses from various risks, ensuring financial stability. But remember, protecting your personal assets is equally crucial, which is why understanding options like home and auto insurance massachusetts is vital. Returning to the business side, comprehensive corporate liability coverage offers peace of mind, shielding your company from potential lawsuits and financial burdens.

Navigating the world of insurance claims can feel like traversing a maze, especially when dealing with something as complex as Corporate General Liability (CGL) insurance. Understanding the claims process is crucial for businesses to protect their interests and ensure a smooth resolution in case of an incident. This section Artikels the steps involved, the roles of both the insured and insurer, common reasons for claim denials, and necessary documentation.

The CGL claims process, while potentially intricate, is fundamentally about reporting, investigating, and resolving incidents that fall under your policy’s coverage. It’s a collaborative effort between you (the insured) and your insurance provider, and a clear understanding of each party’s role is key to a successful outcome.

Filing a CGL Claim

Filing a claim begins immediately after an incident occurs that might lead to a liability claim. This could range from a customer slipping and falling on your premises to a product defect causing injury. Prompt reporting is essential. Delaying notification can jeopardize your coverage. The process typically involves contacting your insurer, providing initial details about the incident, and following their instructions for submitting a formal claim. This often includes completing specific claim forms and providing supporting documentation.

Roles of the Insured and Insurer in the Claims Process

The insured’s role primarily involves promptly reporting the incident, cooperating fully with the insurer’s investigation, providing all requested documentation, and truthfully answering all questions. Failure to cooperate can result in claim denial. The insurer, on the other hand, investigates the claim, assesses liability, negotiates settlements, and defends the insured in legal proceedings if necessary. They are responsible for determining coverage and managing the overall claim process. Effective communication between both parties is vital throughout.

Common Reasons for Claim Denials

Several factors can lead to a CGL claim denial. These include failure to provide timely notification of the incident, lack of cooperation during the investigation, providing false or misleading information, the incident falling outside the policy’s coverage (e.g., intentional acts), or the existence of exclusions within the policy. Understanding your policy’s terms and conditions is crucial to avoid these pitfalls. For instance, a claim for damage caused by a known defect that wasn’t reported might be denied. Similarly, a claim arising from intentional actions by the insured would likely be rejected.

Documentation Required During the Claims Process

Comprehensive documentation is the cornerstone of a successful CGL claim. This typically includes a completed claim form, police reports (if applicable), medical records (for injury claims), witness statements, photographs of the incident scene, repair bills, and any other relevant documents that support the claim. The more detailed and thorough your documentation, the stronger your case will be. Consider keeping a detailed incident report log as a best practice, noting date, time, location, witnesses, and actions taken.

CGL Claims Process Flowchart

Imagine a flowchart visually representing the CGL claims process. It would begin with the “Incident Occurs” box, leading to “Report Incident to Insurer.” This would branch into “Insurer Acknowledges Claim” and “Insurer Begins Investigation.” The investigation phase would involve gathering information from the insured and potentially third parties. Next would be “Liability Assessment” and “Negotiation/Settlement.” If a settlement isn’t reached, the flowchart would proceed to “Legal Action.” Finally, the process concludes with “Claim Resolution,” indicating either settlement or court judgment.

Factors Affecting CGL Insurance Premiums

Understanding the cost of your Corporate General Liability (CGL) insurance is crucial for effective budget planning and risk management. Several factors influence the premiums you’ll pay, impacting your bottom line significantly. Let’s delve into the key elements that determine your CGL insurance costs.

Business Size and Industry

The size and type of your business significantly impact your CGL insurance premiums. Larger businesses, with more employees and operations, generally face higher premiums due to the increased potential for accidents and liability claims. The industry you operate in also plays a crucial role. High-risk industries, such as construction or manufacturing, where the likelihood of accidents and injuries is greater, will typically command higher premiums compared to lower-risk industries like office administration. For example, a large construction firm will pay substantially more than a small accounting firm due to the inherent risks associated with their respective operations. This is because insurers assess the inherent risk profile of each industry, factoring in historical claim data and industry-specific hazards.

Claims History

Your company’s claims history is a major determinant of your CGL premium. A history of frequent or high-value claims will almost certainly lead to higher premiums. Insurers view this as an indicator of increased risk, making them more reluctant to offer favorable rates. Conversely, a clean claims history, demonstrating a strong commitment to safety and risk mitigation, can significantly lower your premiums. Think of it like your credit score – a good record earns you better rates, while a bad one results in higher costs. Insurers use sophisticated actuarial models to analyze claims data and adjust premiums accordingly. A single significant claim can have a lasting impact on your premiums for several years.

Risk Management Practices

Proactive risk management is not just good business practice; it’s also a powerful tool for reducing your CGL insurance premiums. Implementing robust safety protocols, providing employee training, and regularly inspecting your premises can significantly reduce the likelihood of accidents and claims. Insurers often reward businesses with strong risk management programs through discounted premiums. This is because these practices demonstrably lower the insurer’s overall risk exposure. For example, a company with a comprehensive safety program, including regular safety audits and employee training, might qualify for a significant premium reduction compared to a company with lax safety standards.

Premium Pricing Strategies Between Insurers

Different insurance providers employ varying pricing strategies. Some may prioritize low premiums to attract customers, while others might focus on comprehensive coverage and risk assessment. It’s essential to compare quotes from multiple insurers to find the best value for your needs. Factors such as the insurer’s financial strength, claims handling reputation, and the specific coverage offered should all be considered when comparing quotes. Don’t just focus on the price tag; consider the overall value proposition.

| Factor | Impact on Premium | Example |

|---|---|---|

| Business Size | Higher premiums for larger businesses | A large manufacturing plant will pay more than a small retail store. |

| Industry | Higher premiums for high-risk industries | Construction firms typically pay more than office-based businesses. |

| Claims History | Higher premiums for businesses with frequent claims | A company with multiple liability claims will face increased premiums. |

| Risk Management Practices | Lower premiums for businesses with strong safety programs | A company with robust safety training and regular inspections may receive discounts. |

| Insurer’s Pricing Strategy | Varied premiums across different insurers | Comparing quotes from multiple insurers is crucial to find the best rate. |

Importance of Adequate Coverage and Risk Management

Protecting your business from the financial fallout of liability claims is crucial. Inadequate general liability insurance can leave your company vulnerable to crippling debt, potentially leading to closure. Proactive risk management, however, is a powerful tool that can significantly reduce both the likelihood and severity of claims, ultimately saving you money and safeguarding your business’s future.

Financial Implications of Inadequate CGL Coverage

Insufficient CGL coverage can expose your business to devastating financial consequences. Imagine a scenario where a customer slips and falls on your premises, suffering serious injuries. If the resulting lawsuit exceeds your policy limits, you’ll be personally liable for the difference. This could mean depleting personal savings, selling assets, or even facing bankruptcy. The cost of legal defense alone can be substantial, even if you’re ultimately found not at fault. Consider a small business with a $100,000 policy limit facing a $500,000 judgment; the shortfall of $400,000 would represent a catastrophic financial blow. Adequate coverage acts as a financial safety net, protecting your business from such devastating outcomes.

Benefits of Proactive Risk Management Strategies

Proactive risk management isn’t just about avoiding lawsuits; it’s about creating a safer and more efficient work environment. By implementing effective strategies, businesses can minimize the probability of accidents and incidents that could lead to liability claims. This not only reduces insurance premiums but also improves employee morale, enhances productivity, and strengthens the company’s reputation. A proactive approach fosters a culture of safety and responsibility, leading to long-term benefits that extend beyond just insurance savings.

Risk Management Techniques to Reduce Claim Likelihood

Several techniques can significantly reduce the chance of liability claims. Regular safety inspections of the premises, including identifying and rectifying potential hazards, are essential. Comprehensive employee training programs, covering safety protocols and best practices, are crucial. Implementing robust record-keeping systems to document safety measures and training can prove invaluable in defending against claims. Moreover, maintaining updated and appropriate signage to warn of potential dangers contributes to a safer environment. Finally, regular review and updates of safety policies ensure they remain relevant and effective.

How Risk Assessments Inform CGL Policy Decisions

A thorough risk assessment is the cornerstone of informed CGL policy decisions. By identifying potential hazards and assessing their likelihood and potential severity, businesses can accurately determine their level of risk exposure. This assessment informs the selection of appropriate coverage limits, endorsements, and policy features. For example, a high-risk business, such as a construction company, will require significantly higher coverage limits than a low-risk business, like a small retail store. The assessment process should consider factors like the nature of the business, the number of employees, the location of operations, and the types of activities undertaken.

Checklist for Assessing General Liability Risk Exposure

A comprehensive checklist helps businesses systematically assess their risk exposure. This checklist should include:

- Property Inspection: Thorough inspection of the premises to identify potential hazards (e.g., uneven flooring, inadequate lighting, tripping hazards).

- Employee Safety Training: Review of employee training programs and documentation of completed training.

- Safety Procedures: Assessment of existing safety procedures and their effectiveness in preventing accidents.

- Customer Safety: Evaluation of measures in place to ensure customer safety (e.g., clear signage, well-maintained walkways).

- Product Liability (if applicable): Assessment of potential product-related risks and associated safety measures.

- Incident Reporting: Review of the incident reporting process and its efficiency.

- Insurance Coverage Review: Review of current insurance coverage to ensure adequacy and alignment with risk assessment.

Choosing the Right CGL Insurance Provider

Source: finoplus.in

Selecting the right Corporate General Liability (CGL) insurance provider is crucial for protecting your business from potential financial losses. A poorly chosen insurer can leave you vulnerable during a claim, while a well-chosen one provides peace of mind and strong support. The process requires careful consideration of several factors to ensure you secure the best coverage at a fair price.

Different insurance providers offer varying levels of service, coverage options, and claims handling processes. Understanding these differences is paramount to making an informed decision. Factors such as the insurer’s financial stability, claims history, customer service reputation, and the specific terms and conditions of their policies all play a significant role in determining the best fit for your business.

Factors to Consider When Selecting a CGL Insurer

Choosing a CGL insurer involves more than just comparing prices. Several key factors demand careful consideration. A thorough evaluation will help you select a provider that aligns with your business needs and risk profile.

- Financial Strength and Stability: Check the insurer’s ratings from agencies like A.M. Best, Standard & Poor’s, or Moody’s. Higher ratings indicate greater financial stability, ensuring they can pay out claims even in challenging circumstances. For example, an A++ rating signifies exceptional financial strength, offering higher confidence in claim payouts.

- Claims Handling Process and Reputation: Research the insurer’s claims handling process. Look for reviews and testimonials to gauge their responsiveness, efficiency, and fairness in handling claims. A quick and efficient claims process can minimize disruption to your business operations during challenging times.

- Coverage Options and Policy Exclusions: Carefully review the policy wording to understand the extent of coverage provided and any exclusions. Some policies might offer broader coverage than others, including specific endorsements for particular risks relevant to your business. For instance, some policies might cover specific types of professional services, while others might exclude them.

- Customer Service and Accessibility: A responsive and accessible customer service team is vital. Consider how easily you can reach them, the availability of online resources, and their responsiveness to inquiries. A responsive insurer makes navigating policy details and filing claims significantly easier.

- Premium Cost and Value for Money: While cost is a factor, don’t solely focus on the cheapest option. Consider the overall value provided by the insurer, including the breadth of coverage, claims handling process, and customer service. A slightly higher premium might be justified by superior service and broader coverage.

Negotiating Favorable Terms and Conditions

Don’t be afraid to negotiate. Insurance is a competitive market, and insurers are often willing to adjust terms to secure your business. A proactive approach can lead to better coverage at a more favorable price.

- Shop around and compare quotes: Obtain quotes from multiple insurers to compare pricing and coverage options. This allows you to identify the best value for your needs.

- Highlight your risk profile: Present your business’s risk profile accurately. Demonstrating a low-risk profile can often lead to lower premiums.

- Negotiate specific coverage enhancements: If you need specific coverage enhancements, don’t hesitate to request them and negotiate their inclusion in the policy. For instance, you might negotiate broader coverage for specific types of liability.

- Explore bundled discounts: Inquire about bundled discounts if you need other types of insurance, such as workers’ compensation or commercial auto insurance.

Reviewing Policy Details Carefully

Before purchasing a CGL policy, meticulously review all the policy documents. Understanding the terms and conditions is essential to avoid unexpected surprises later.

- Understand the definitions of key terms: Pay close attention to the definitions of key terms within the policy, as these can significantly impact coverage.

- Identify any exclusions or limitations: Carefully review any exclusions or limitations on coverage to ensure the policy adequately protects your business.

- Review the claims process: Understand the steps involved in filing a claim and the insurer’s responsibilities.

- Seek clarification if needed: Don’t hesitate to contact the insurer or an independent insurance agent if you have any questions or require clarification on any aspect of the policy.

Decision-Making Framework for Choosing a CGL Insurer

A structured approach to selecting a CGL insurer ensures a well-informed decision. This framework helps prioritize key factors and facilitates a comparative analysis.

| Factor | Weighting | Rating (1-5) | Weighted Score |

|---|---|---|---|

| Financial Strength | 30% | 4 | 12 |

| Claims Handling | 25% | 5 | 12.5 |

| Coverage Options | 20% | 4 | 8 |

| Customer Service | 15% | 3 | 4.5 |

| Premium Cost | 10% | 3 | 3 |

This example uses a weighted scoring system. Assign weights to each factor based on their importance to your business, and rate each insurer on a scale of 1 to 5 (1 being the lowest and 5 being the highest). Multiply the weighting by the rating to obtain a weighted score. The insurer with the highest total weighted score is likely the best fit for your needs.

Final Review

Securing the right corporate general liability insurance isn’t just about compliance; it’s a strategic move to protect your business’s hard-earned success. By understanding the coverage, claims process, and factors influencing premiums, you can confidently navigate the complexities of risk management. Remember, proactive risk assessment and choosing a reputable insurer are vital steps in building a resilient and thriving business. Don’t let unforeseen events derail your journey – shield your company with the right protection.