Commute or pleasure car insurance Reddit: Navigating the world of car insurance can feel like driving through a minefield. Are you a daily commuter battling traffic, or a weekend warrior cruising for pleasure? Your driving habits drastically impact your insurance premiums, and Reddit is a treasure trove of real-life experiences and advice. This deep dive explores the Reddit discussions surrounding commute versus pleasure car insurance, uncovering the secrets to finding the best coverage at the best price.

We’ll dissect the factors influencing premiums—from commute distance and vehicle type to your driving history and location. We’ll compare coverage options, sharing insights from Reddit users who’ve navigated the complexities of insurance. Get ready to unlock the knowledge you need to make informed decisions and save money on your car insurance.

Reddit Discussions on Car Insurance Types

Reddit’s a treasure trove of real-world experiences, and car insurance is no exception. Discussions there reveal a fascinating dichotomy between commute and pleasure-use policies, highlighting the often-overlooked nuances in how insurers assess risk. Users frequently share their triumphs and tribulations, offering valuable insights for anyone navigating the world of auto insurance.

Reddit threads often showcase the significant differences in premiums and coverage options based on how you primarily use your vehicle. The debate usually boils down to this: Is it worth paying more for a policy explicitly designed for daily commutes, or is a standard pleasure-use policy sufficient, even with daily driving? The answers, unsurprisingly, are complex and depend on a variety of factors.

Commute vs. Pleasure Insurance Provider Mentions

Redditors frequently mention specific insurers in their discussions, both positive and negative. Positive mentions often revolve around companies perceived as offering competitive rates for commuters, while negative feedback frequently targets insurers seen as inflexible or overly penalizing for minor incidents. For example, companies known for their robust customer service and clear policy explanations often receive praise, while those with complicated claims processes or high deductibles tend to attract criticism. The experience is highly individual, with factors like location and driving history influencing the overall perception of a given provider.

Comparison of Commute and Pleasure Car Insurance Features

The following table summarizes typical features offered by insurers for commute and pleasure car insurance. Keep in mind that these are generalizations, and specific offerings will vary by insurer and individual circumstances.

| Feature | Commute Insurance | Pleasure Insurance | Notes |

|---|---|---|---|

| Coverage | Comprehensive, potentially higher liability limits for accidents during commute | Comprehensive or liability-only; limits may be lower | Commute policies often reflect the increased risk associated with daily driving. |

| Discounts | May offer discounts for low mileage, safe driving record, anti-theft devices | May offer discounts for safe driving, bundling policies, good student status | Discounts vary widely depending on the insurer and individual circumstances. |

| Premiums | Generally higher than pleasure-use policies due to increased risk | Generally lower than commute policies | The difference in premiums can be substantial, especially for long commutes or high-risk areas. |

| Policy Restrictions | May have restrictions on the use of the vehicle outside of commuting | Fewer restrictions on vehicle usage | Carefully review policy terms and conditions to understand limitations. |

Factors Influencing Insurance Premiums: Commute Or Pleasure Car Insurance Reddit

Source: insurancedodo.com

So you’re deep-diving into Reddit threads on commute vs. pleasure car insurance? It’s all about those fine print details, right? Think about it – the level of risk assessment is key, much like choosing the right errors and omissions insurance for bookkeepers protects against financial mishaps. Getting the right coverage for your daily drive is just as crucial; one wrong move and you’re facing a hefty bill.

Back to those Reddit threads – did anyone mention the impact of your driving record?

Getting the best car insurance deal isn’t just about luck; it’s about understanding what factors insurers consider. Your premium isn’t plucked from thin air; it’s a carefully calculated reflection of your risk profile. Let’s break down the key elements that significantly impact your car insurance costs.

Daily Commute Distance

The distance you drive daily directly influences your premium. Insurers understand that the more miles you rack up, the higher the likelihood of an accident. Someone with a short commute of, say, five miles each way is statistically less likely to be involved in a collision than someone who commutes 50 miles daily. This increased exposure to potential accidents translates to a higher premium for longer commutes. Think of it like this: the more time you spend on the road, the greater the chance of encountering unforeseen circumstances. Insurers factor this increased risk into your premium calculation.

Vehicle Type

The type of car you drive plays a significant role in your insurance cost. Generally, SUVs and trucks are more expensive to insure than sedans. This is because they are often more expensive to repair, have higher replacement costs, and statistically have higher rates of accidents and injuries. The increased size and weight of these vehicles contribute to more severe damage in collisions. Even for pleasure use, the inherent risk associated with driving a larger vehicle leads to higher premiums. For commuters, the added wear and tear from daily use further increases the cost. For example, a luxury SUV will cost considerably more to insure than a compact sedan, regardless of usage.

Driving History

Your driving record is arguably the most crucial factor affecting your insurance premiums. Accidents and traffic violations significantly increase your risk profile. A single at-fault accident can drastically raise your premiums for several years, impacting both commute and pleasure use. Similarly, multiple speeding tickets or other moving violations demonstrate a pattern of risky driving behavior, leading to higher premiums. Even minor infractions can add up over time. Conversely, a clean driving record with no accidents or tickets will usually result in lower premiums. Insurers reward safe driving habits with lower rates. A driver with a spotless record for five years will likely see significantly lower premiums compared to someone with several accidents and tickets.

Relative Importance of Factors

Let’s summarize the relative importance of these factors.

- Driving History: This is the most significant factor. Accidents and tickets have the biggest impact on your premium, regardless of commute distance or vehicle type.

- Vehicle Type: The type of vehicle you drive is the second most influential factor, especially for higher-risk vehicles like SUVs and trucks. This impacts both commute and pleasure use.

- Daily Commute Distance: While important, commute distance usually ranks third. Longer commutes increase risk but less dramatically than a poor driving record or driving a high-risk vehicle.

Insurance Coverage Comparisons

Choosing the right car insurance coverage can feel like navigating a minefield, especially when you’re weighing the needs of a daily commute against weekend joyrides. Understanding the differences between liability, collision, and comprehensive coverage is key to finding the sweet spot between protection and affordability.

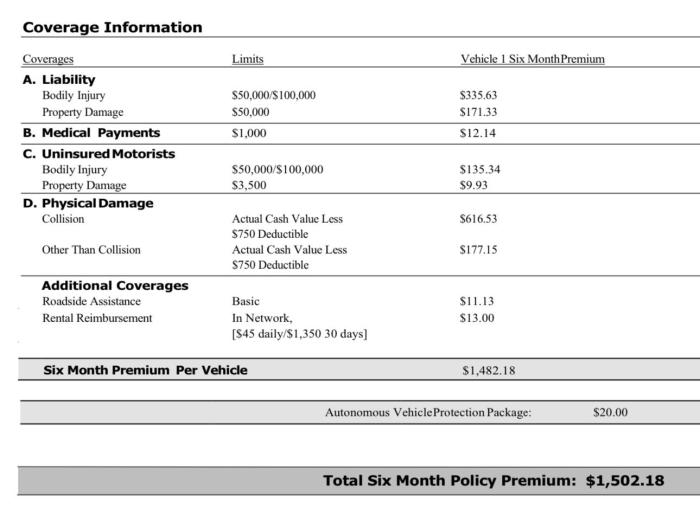

Liability coverage is the bare minimum, legally mandated in most places. It protects you financially if you cause an accident that injures someone or damages their property. Collision coverage, on the other hand, protects *your* vehicle in an accident, regardless of who’s at fault. Comprehensive coverage steps in for damage not caused by a collision, like theft, vandalism, or hailstorms.

Commute vs. Pleasure Driving Coverage Needs

Commuters face a higher risk of accidents simply due to increased time spent on the road. Daily exposure to traffic congestion, rush hour mayhem, and unpredictable weather increases the likelihood of a fender bender or more serious incident. Therefore, commuters generally benefit from more robust coverage, including collision and possibly comprehensive, to safeguard against the increased risk. Pleasure drivers, whose vehicles see less road time, might find that liability-only coverage, or a lower deductible on collision, is sufficient to meet their needs and budget.

Cost Savings Through Coverage Selection

The cost savings associated with choosing specific coverage options can be significant. Liability-only coverage is the cheapest, but offers the least protection. Adding collision and comprehensive coverage increases premiums, but provides a safety net against significant repair or replacement costs. A higher deductible (the amount you pay out-of-pocket before insurance kicks in) will lower your premiums, but you’ll need to be prepared to shoulder more of the cost in case of an accident. For example, a pleasure driver who rarely uses their car might find that a higher deductible on collision and comprehensive is acceptable given the low likelihood of a claim. Conversely, a commuter who relies on their car daily might prefer a lower deductible for quicker recovery after an accident.

Financial Implications of Inadequate Coverage

Imagine this scenario: A commuter, Sarah, only has liability coverage. During her morning commute, she’s rear-ended, totaling her car. While her liability coverage will pay for the other driver’s damages (if she’s at fault), she’s left with a hefty repair bill or the cost of replacing her car entirely – out of her own pocket. If the damage exceeds her savings, she could face significant financial hardship, potentially impacting her ability to get to work and meet other financial obligations. Had she opted for collision coverage, even with a higher deductible, the financial burden would have been significantly reduced. The lesson? The seemingly small cost difference between coverage options can pale in comparison to the potential financial fallout from an accident with inadequate protection.

User Experiences and Advice

Navigating the world of car insurance can feel like driving through a minefield, especially when you’re trying to balance commute and pleasure driving needs. Reddit, with its vast community of drivers, offers a wealth of firsthand experiences and advice that can illuminate the path to finding the right policy at the right price. Let’s delve into some real-world examples and the collective wisdom shared online.

Reddit discussions reveal a spectrum of experiences, from surprisingly positive outcomes to frustratingly negative ones. Understanding these varied perspectives helps prepare you for your own insurance journey and empowers you to make informed decisions.

Positive and Negative User Experiences with Car Insurance

Many Reddit users report positive experiences with specific insurers, often citing competitive pricing, smooth claims processes, and excellent customer service. For example, some praise companies known for their straightforward online portals and personalized quotes, highlighting the ease of obtaining and managing their policies. Conversely, negative experiences frequently involve unexpectedly high premiums, lengthy claims processes filled with bureaucratic hurdles, and unhelpful customer service representatives. Stories abound of drivers facing increased premiums after minor accidents, even with clean driving records, or battling with insurers over coverage disputes. One common complaint centers around the difficulty of accurately comparing policies due to varying coverage details and hidden fees.

Common Advice for Finding Affordable and Suitable Car Insurance

Reddit users consistently emphasize the importance of shopping around and comparing quotes from multiple insurers. This isn’t just about finding the cheapest option; it’s about finding the best coverage for your needs at a price you can afford. Many recommend using online comparison tools, but caution against solely relying on these tools, as they may not always capture every available option. Furthermore, users frequently advise being upfront and honest about your driving habits when applying for insurance. This includes accurately reporting your commute distance, driving frequency, and any past accidents or violations. Failing to do so can lead to policy cancellations or higher premiums later on. Bundling car insurance with other types of insurance, such as homeowners or renters insurance, is another commonly suggested strategy for achieving cost savings.

Importance of Accurate Representation of Driving Habits

Accurately representing your driving habits is paramount when applying for car insurance. Insurers use this information to assess risk, and any discrepancies can lead to serious consequences. For example, underreporting your commute distance could result in a claim being denied or your policy being canceled if an accident occurs during your unreported commute. Similarly, failing to disclose a speeding ticket or previous accident can lead to higher premiums or even policy rejection. Reddit users consistently warn against attempting to manipulate the application process to obtain a lower premium, emphasizing the long-term financial and legal repercussions that can arise from such actions. The consensus is clear: honesty and transparency are crucial for building a positive relationship with your insurer and ensuring you have adequate coverage when you need it.

Impact of Location and Lifestyle

Source: redd.it

Your car insurance premium isn’t just about your driving record; it’s also a reflection of where you live and how you live. Geographic location and lifestyle choices significantly impact the risk insurers assess, leading to variations in your final cost. Understanding these factors can help you make informed decisions and potentially save money.

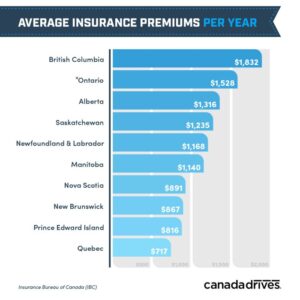

Geographic location plays a crucial role in determining your insurance premiums. Urban areas, for example, typically have higher rates due to increased traffic density, higher accident rates, and a greater chance of theft or vandalism. Conversely, rural areas often boast lower premiums due to lower risk factors. This difference applies to both commute and pleasure driving; a daily commute through a congested city will naturally attract a higher premium than a leisurely weekend drive in the countryside. Furthermore, the specific neighborhood within a city can also influence premiums; areas with high crime rates or a history of frequent accidents will usually command higher rates.

Geographic Location’s Influence on Car Insurance Premiums, Commute or pleasure car insurance reddit

The impact of location extends beyond simple urban versus rural distinctions. Insurers utilize sophisticated actuarial models that consider a multitude of location-specific data points. This includes crime statistics, accident history for specific intersections and roads, even the prevalence of certain types of weather events (like hailstorms or blizzards) in the area. A driver in a high-crime area might face higher premiums due to the increased risk of theft or vandalism, regardless of their driving record. Similarly, a driver in an area prone to severe weather events might face higher premiums due to the increased risk of accidents. Consider two drivers with identical driving records: one living in a quiet suburban town and the other in a bustling city center. The city dweller will almost certainly pay more, reflecting the heightened risk associated with their location.

Lifestyle Factors and Insurance Costs

Your lifestyle choices significantly influence the risk assessment made by insurers. Where you park your car overnight, for instance, can affect your premiums. Parking your car in a garage is generally considered safer than parking it on the street, leading to lower premiums. Driving habits also play a major role. Insurers often reward safe driving behavior with discounts, and conversely, penalize risky behaviors. Factors such as speeding tickets, accidents, and claims history directly impact your premiums. Furthermore, the type of vehicle you drive and its safety features influence the cost. A high-performance sports car will generally be more expensive to insure than a fuel-efficient compact car, reflecting the higher risk associated with the former.

Visual Representation of Location and Lifestyle Impact

Imagine a bar graph. The horizontal axis represents different locations (e.g., Rural Area, Suburban Area, Urban Area – High Crime, Urban Area – Low Crime). The vertical axis represents the annual insurance premium. For each location, two bars are shown: one representing the premium for a commuter driver with a clean driving record and parking their car in a garage, and another representing the premium for a pleasure driver with a few speeding tickets and street parking. The bars for the urban areas, especially the high-crime area, will be significantly taller than those for the rural area, reflecting the higher premiums. Within the urban areas, the bars for the pleasure driver will be taller than those for the commuter driver, highlighting the impact of driving habits. The differences in bar heights visually demonstrate how location and lifestyle significantly influence insurance premiums for both commute and pleasure driving. The graph would clearly illustrate that the combination of an urban location, poor driving habits, and street parking leads to the highest premiums, while a rural location, safe driving, and garage parking results in the lowest.

Final Conclusion

Source: redd.it

So, commute or pleasure? The Reddit community offers a wealth of information to help you navigate the car insurance maze. Remember, honesty is key when declaring your driving habits. By understanding the factors that influence your premiums and carefully comparing coverage options, you can find a policy that suits your needs and your budget. Don’t be afraid to leverage the collective wisdom of Reddit users – their experiences can save you time, money, and headaches down the road.