Cheap best auto insurance—it sounds like a unicorn, right? Affordable premiums *and* top-notch coverage? Believe it or not, it’s totally achievable. This isn’t about settling for the bare minimum; it’s about smart shopping and understanding what truly matters in an insurance policy. We’re diving deep into how to snag the best bang for your buck, comparing coverage levels, and uncovering hidden ways to slash your premiums without sacrificing peace of mind. Get ready to become an auto insurance ninja!

Finding the right auto insurance can feel like navigating a minefield. Too cheap, and you risk financial ruin in an accident. Too expensive, and you’re throwing money away. This guide cuts through the jargon and empowers you to make informed decisions. We’ll break down the factors influencing your premiums, explore different coverage types, and equip you with the tools to negotiate like a pro. By the end, you’ll be confident in securing cheap best auto insurance tailored to your specific needs.

Defining “Cheap Best Auto Insurance”

Source: lexerudites.com

Finding the perfect auto insurance can feel like navigating a minefield. The terms “cheap” and “best” are often thrown around, but their meanings are surprisingly nuanced and depend heavily on individual circumstances. Simply focusing on the lowest premium might leave you vulnerable, while prioritizing comprehensive coverage could break the bank. Let’s dissect what truly constitutes “cheap best” auto insurance.

“Cheap,” in the context of auto insurance, isn’t solely about the monthly or annual premium. It also encompasses the overall value you receive for your money. A policy might seem inexpensive upfront, but hidden fees, limited coverage, or a difficult claims process could end up costing you significantly more in the long run. True “cheapness” lies in finding a balance between affordability and adequate protection. Consider it a cost-effective solution that doesn’t compromise essential safety nets.

“Best,” on the other hand, encompasses a wider range of factors. It’s not just about the breadth of coverage; it’s also about the quality of customer service, the efficiency of claims processing, and the overall reputation of the insurance company. A “best” policy offers peace of mind, knowing you’re protected by a reliable insurer that will be there for you when you need them most. This includes prompt responses to inquiries, clear communication during the claims process, and fair settlements.

Coverage Levels and Price Points

The relationship between price and coverage is generally direct: higher premiums often equate to more comprehensive coverage. However, the exact relationship varies significantly between insurers and policy types. The table below illustrates this relationship with hypothetical examples. Remember, these are illustrative and actual prices will vary depending on location, driving history, and vehicle type.

| Price Range (Annual Premium) | Liability Coverage | Collision Coverage | Comprehensive Coverage |

|---|---|---|---|

| $500 – $700 | Minimum State Requirements | None | None |

| $700 – $1000 | Higher Liability Limits | High Deductible | None or Low Deductible |

| $1000 – $1500 | High Liability Limits | Medium Deductible | Medium Deductible |

| $1500+ | High Liability Limits | Low Deductible | Low Deductible |

Factors Influencing Auto Insurance Costs

Finding the cheapest car insurance is a quest many of us undertake. But the price you pay isn’t arbitrary; it’s a carefully calculated figure based on several key factors. Understanding these factors can help you navigate the insurance market and potentially save some serious cash. Let’s dive into what influences your premium.

Your car insurance premium is a reflection of your perceived risk to the insurance company. They use a complex algorithm that considers numerous factors to assess how likely you are to file a claim. The higher your perceived risk, the higher your premium will be. This system isn’t perfect, but it’s designed to spread the cost of accidents and claims fairly across all policyholders.

Driving Record

A clean driving record is your best friend when it comes to affordable car insurance. Accidents and traffic violations significantly increase your premiums. For instance, a single at-fault accident could lead to a premium increase of 20-40%, depending on your insurance company and the severity of the accident. Similarly, multiple speeding tickets or a DUI conviction will drastically inflate your costs. Maintaining a spotless record through safe driving practices is the most effective way to keep your premiums low.

Age

Insurance companies view younger drivers as statistically higher risk. Inexperience and a tendency towards riskier driving behaviors contribute to this perception. Premiums are typically highest for drivers under 25 and gradually decrease as you age and gain experience. For example, a 20-year-old driver might pay double what a 40-year-old driver pays for the same coverage, reflecting the higher risk associated with youth.

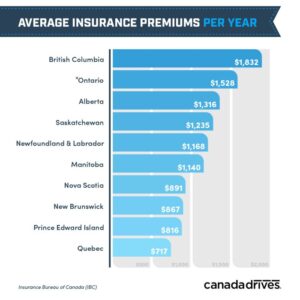

Location

Where you live plays a crucial role in determining your insurance costs. Areas with high crime rates, frequent accidents, and higher car theft rates will generally have higher insurance premiums. Insurance companies consider the likelihood of claims in your specific area when setting rates. For example, living in a bustling city center with heavy traffic might result in a higher premium compared to residing in a quiet suburban neighborhood.

Vehicle Type

The type of car you drive also impacts your insurance costs. Sports cars, luxury vehicles, and vehicles with a history of theft or accidents are generally more expensive to insure. This is because these vehicles are often more expensive to repair or replace, and the risk of theft or damage is higher. For example, insuring a high-performance sports car will be significantly more expensive than insuring a reliable, economical sedan. Consider the insurance costs when choosing your next vehicle.

Strategies to Reduce Premiums

Several strategies can help you lower your car insurance premiums without sacrificing essential coverage. These include maintaining a good driving record (as discussed above), choosing a car with good safety ratings and lower repair costs, increasing your deductible (though this increases your out-of-pocket expenses in case of an accident), bundling your car insurance with other types of insurance (like homeowners or renters insurance), and shopping around for the best rates from multiple insurance providers. Taking advantage of discounts offered by your insurer for things like safe driving courses or anti-theft devices can also contribute to savings. Remember, comparison shopping is key to finding the best deal.

Types of Auto Insurance Coverage

Navigating the world of auto insurance can feel like decoding a secret language. But understanding the different types of coverage is key to finding the “cheap best” policy that truly protects you. Think of it as building your own personalized safety net – the more layers you add, the better protected you are, but the pricier it gets. Let’s break down the essentials.

Choosing the right auto insurance coverage depends heavily on your individual needs and risk assessment. This isn’t a one-size-fits-all situation; what works for a seasoned driver with a spotless record might be completely unsuitable for a new driver or someone with a history of accidents.

Liability Coverage

Liability coverage is the cornerstone of any auto insurance policy. It protects you financially if you cause an accident that injures someone or damages their property. This coverage typically includes bodily injury liability and property damage liability. Bodily injury liability covers medical bills, lost wages, and pain and suffering for those injured in an accident you caused. Property damage liability covers the cost of repairing or replacing the other person’s vehicle or property. The limits of your liability coverage are usually expressed as a three-number set (e.g., 25/50/25), representing thousands of dollars: the first number covers injury per person, the second covers total injury per accident, and the third covers property damage per accident. Higher limits offer greater protection but also come with higher premiums. Think of it as your legal shield in case of a mishap.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This is a crucial component if you have a loan or lease on your car, as the lender will likely require it. While it offers peace of mind, it’s also one of the more expensive types of coverage. Consider your car’s value and your financial situation when deciding if this is a necessary addition to your policy. For instance, if you have an older vehicle, the cost of repairs might exceed the car’s value, making collision coverage less financially beneficial.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage from events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. It’s a valuable layer of protection, especially if you live in an area prone to severe weather or if your car is relatively new. Similar to collision coverage, the cost depends on factors like your car’s value and your location. For older vehicles, the cost might not justify the benefits, as the payout wouldn’t necessarily cover the full repair or replacement cost.

Essential Coverage Types for Different Driver Profiles

Understanding your individual risk profile is essential for choosing the right coverage. Here’s a quick guide:

- New Drivers: Liability coverage is a must, and many insurance companies require it. Consider adding collision and comprehensive coverage, particularly if you’re driving a newer vehicle. New drivers often pay higher premiums due to their lack of experience.

- Experienced Drivers: Experienced drivers with a clean driving record may opt for higher liability limits and potentially drop collision and comprehensive coverage on older vehicles, choosing to self-insure for smaller accidents.

- High-Risk Drivers: High-risk drivers, those with a history of accidents or traffic violations, often need to carry higher liability limits and may find it difficult to obtain collision and comprehensive coverage at reasonable rates. They might explore options like SR-22 insurance to meet state requirements.

Finding Affordable Auto Insurance

Securing affordable auto insurance doesn’t have to be a headache-inducing maze. With a little savvy and strategic planning, you can find a policy that fits your budget without sacrificing essential coverage. This section will equip you with the tools and knowledge to navigate the insurance landscape and find the best deal.

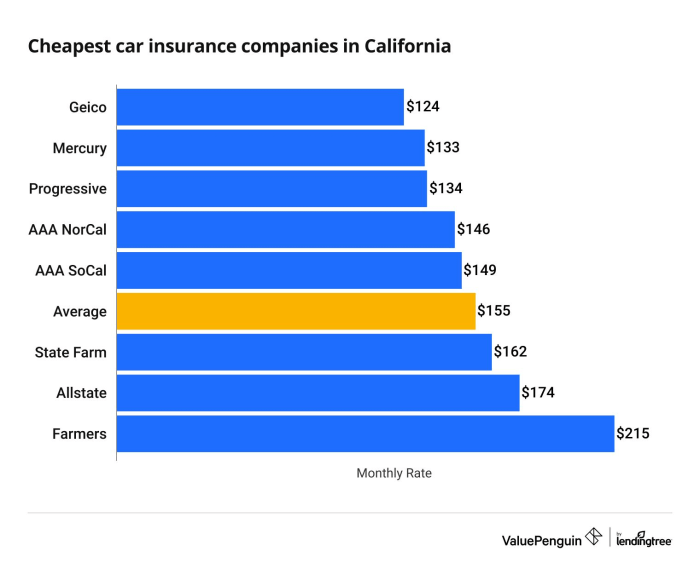

Finding the cheapest car insurance often involves a multi-pronged approach. It’s not just about clicking the first result on a search engine; it’s about actively comparing, negotiating, and understanding your options. Think of it like shopping for a car – you wouldn’t buy the first one you see, would you?

Utilizing Comparison Websites

Comparison websites act as a central hub, allowing you to input your information once and receive quotes from multiple insurers simultaneously. This saves you considerable time and effort. Sites like NerdWallet, The Zebra, and Policygenius provide a streamlined process for comparing prices and coverage options. Remember to input all relevant information accurately to ensure you receive the most accurate quotes. Slight variations in details can lead to significantly different premiums.

Negotiating with Insurers, Cheap best auto insurance

Don’t be afraid to negotiate! Insurers often have some wiggle room in their pricing. Highlight your clean driving record, any safety features in your vehicle, or bundling opportunities (home and auto insurance). Be polite but firm in expressing your desire for a more competitive rate. Sometimes, simply asking for a better deal can yield surprising results. If one insurer refuses, don’t hesitate to use their offer as leverage when negotiating with others.

Obtaining Quotes from Multiple Providers: A Step-by-Step Guide

First, gather all necessary information: your driving history (including accidents and violations), vehicle details (make, model, year), and personal information. Then, visit several comparison websites and enter your data. Carefully review the quotes you receive, paying close attention to the coverage details. Finally, contact the insurers directly to discuss specific aspects of their policies and potentially negotiate a lower price. This methodical approach ensures you’re comparing apples to apples and not just focusing on the bottom-line number.

Essential Questions to Ask Insurance Providers

Understanding the details of your policy is crucial. Asking clarifying questions ensures you’re not paying for unnecessary coverage or overlooking crucial aspects. Examples of pertinent questions include: What specific coverage does this policy offer? What are the deductibles and premiums? What are the circumstances under which my coverage might be denied? Are there any discounts available to me? What is the claims process like? Asking these questions empowers you to make an informed decision and secure the best value for your money.

Understanding Insurance Policies

Source: cloudinary.com

Navigating the world of auto insurance policies can feel like deciphering a foreign language. But understanding the key terms and the claims process is crucial for protecting yourself financially. This section breaks down the essentials, making it easier to understand your coverage and what to do in case of an accident.

Common Terms and Conditions in Auto Insurance Policies

Auto insurance policies are filled with jargon. Knowing the meaning of key terms empowers you to make informed decisions. For example, understanding your policy’s limits (the maximum amount the insurer will pay for a claim), deductible (the amount you pay out-of-pocket before your insurance kicks in), and coverage types (liability, collision, comprehensive) is fundamental. Other important terms include premium (your regular payment for coverage), exclusions (situations not covered by your policy), and subrogation (your insurer’s right to recover losses from a third party). Carefully reviewing your policy’s declarations page, which summarizes your coverage, is essential.

The Auto Insurance Claims Process

Filing a claim can be stressful, but understanding the steps involved simplifies the process. Prompt reporting of the accident to your insurer is key. This typically involves providing details such as the date, time, location, and parties involved. You’ll also need to document the incident with photos and police reports (if applicable). Your insurer will then investigate the claim, assessing liability and damages. Depending on the type of claim and the severity of the damage, this process may involve appraisals, negotiations, and repairs. Accurate and complete documentation is critical to a smooth claims process.

Claim Process Flowchart

Imagine a flowchart depicting the claims process. It begins with the “Accident Occurs” box. An arrow leads to “Report Accident to Insurer,” followed by “Gather Documentation” (police report, photos, witness statements). Next, an arrow points to “Insurer Investigates Claim,” which branches into two paths: “Liability Determined” and “Damages Assessed.” “Liability Determined” leads to “Settlement Offered” or “Claim Denied,” while “Damages Assessed” leads to “Repairs Authorized” or “Settlement Negotiated.” All paths eventually converge at “Claim Resolved.” This visual representation clearly illustrates the steps involved, from initial reporting to final resolution.

Required Documentation for Auto Insurance Claims

The specific documents needed vary depending on the circumstances of the accident and your insurance policy. However, some common documents include a completed claim form, your driver’s license and vehicle registration, details of all involved parties (names, addresses, contact information), police report (if applicable), photos of the damage to your vehicle and the accident scene, and any medical records or bills related to injuries sustained. Maintaining detailed records throughout the process is crucial for a successful claim.

The Importance of Adequate Coverage

Choosing the cheapest auto insurance might seem appealing, but skimping on coverage can lead to devastating financial consequences in the event of an accident. Adequate coverage isn’t just about meeting minimum legal requirements; it’s about protecting your financial well-being and ensuring peace of mind. The seemingly small difference in premium cost between minimal and adequate coverage can pale in comparison to the potential financial burden of an uninsured accident.

The benefits of having adequate coverage extend far beyond simply avoiding legal trouble. It offers crucial financial protection against significant medical bills, repair costs, and potential lawsuits. Even a seemingly minor accident can quickly escalate into a major financial crisis without sufficient coverage. While a higher premium might seem daunting upfront, the long-term financial security it provides far outweighs the short-term expense.

Financial Consequences of Insufficient Coverage

Imagine this scenario: You’re involved in a car accident that’s your fault. Your car sustains $10,000 in damage, and the other driver suffers serious injuries, resulting in $50,000 in medical bills. If you only carry the state-mandated minimum liability coverage (let’s say $25,000), you’ll be personally responsible for the remaining $35,000. This could mean depleting your savings, taking out high-interest loans, or even facing bankruptcy. This is a very real possibility for many people, highlighting the critical need for comprehensive coverage. Conversely, with adequate liability coverage (perhaps $100,000 or more), the insurance company would cover the other driver’s medical expenses and your vehicle repair, leaving you financially unscathed. This illustrates how the extra cost of higher coverage can be a worthwhile investment.

Benefits of Adequate Coverage

Adequate auto insurance offers several key benefits. First, it protects your assets. Without sufficient coverage, a single accident could wipe out your savings and leave you with significant debt. Second, it provides peace of mind. Knowing you’re financially protected in the event of an accident reduces stress and anxiety. Third, it safeguards your credit score. A large, unexpected debt from an accident can severely damage your credit. Finally, adequate coverage ensures that you can focus on recovery, rather than worrying about the financial fallout.

Scenario Illustrating Financial Impact

Let’s compare two scenarios: In Scenario A, a driver has minimum liability coverage of $25,000 and is at fault in an accident causing $50,000 in damages to the other vehicle and $75,000 in medical bills for the other driver. This driver is left with a $100,000 personal debt. In Scenario B, a driver has $250,000 in liability coverage and is at fault in the same accident. Their insurance covers the entire cost, leaving them financially unharmed. The difference in premiums between these two scenarios would likely be relatively small compared to the potential financial devastation in Scenario A. This stark contrast highlights the crucial role of adequate coverage in protecting against financial ruin.

Ultimate Conclusion

Source: slideserve.com

So, the quest for cheap best auto insurance doesn’t have to be a stressful ordeal. By understanding the factors affecting your premiums, comparing coverage options, and utilizing smart shopping strategies, you can find a policy that provides excellent protection without breaking the bank. Remember, it’s not just about the initial price tag; it’s about the overall value, including customer service and claims processing. Armed with this knowledge, you’re ready to conquer the world of auto insurance and drive off into the sunset with confidence (and a lower premium!).