Car insurance without inspection? Sounds too good to be true, right? Think again. This surprisingly common option skips the dreaded vehicle check, offering a faster, potentially cheaper route to coverage. But is it all sunshine and roses? Let’s dive into the nitty-gritty, exploring the eligibility, types of policies, application processes, and potential pitfalls of this convenient alternative.

From understanding the eligibility criteria and comparing policy types to navigating the application process and assessing potential risks and benefits, we’ll unpack everything you need to know before you ditch that inspection. We’ll even cover the claims process and offer real-life scenarios to paint a clearer picture. So, buckle up, because this ride’s about to get interesting.

Eligibility Criteria for No-Inspection Car Insurance

Securing car insurance without an inspection sounds like a dream, right? Skip the hassle, get covered quickly. But the reality is, this convenience comes with a set of specific requirements. Not everyone qualifies, and understanding these criteria is crucial before you apply. Let’s dive into the details.

Eligibility for no-inspection car insurance hinges on a variety of factors, primarily focusing on minimizing risk for the insurance company. They’re essentially making a judgment call based on the information you provide, without the visual confirmation of a physical inspection. This means accurate and complete information is paramount.

Factors Considered for Eligibility Without Inspection

Insurance companies use a sophisticated algorithm to assess risk when you apply for a no-inspection policy. This algorithm considers several key factors. These include your driving history (clean record is a big plus!), your credit score (reflecting financial responsibility), your age (younger drivers often face higher premiums), and the type of vehicle you’re insuring (some car models are statistically more prone to accidents). They also examine your address, looking at things like crime rates in your area, which indirectly reflect risk. The length of your driving history plays a significant role, too. A longer history of safe driving can improve your chances of approval.

Comparison of Eligibility Criteria Across Providers

While the core factors remain consistent, individual insurance providers might place different weights on these criteria. For example, one insurer might prioritize credit score heavily, while another might focus more on driving history. Some companies may have stricter requirements for certain vehicle types or age groups. It’s advisable to compare eligibility criteria across multiple providers to find the best fit for your circumstances. For instance, Company A might approve applications with a credit score above 650, while Company B might require a score above 700. This variance highlights the need for thorough research.

Implications of Inaccurate Information

Providing false or misleading information on your application, even unintentionally, can have serious consequences. If the insurer discovers discrepancies later, your policy could be canceled, leaving you without coverage. In some cases, you might even face legal repercussions. Accuracy is not just important; it’s essential. Submitting a truthful application protects you and ensures you receive the coverage you need. For example, failing to disclose a prior accident could result in your claim being denied if you were to be involved in a future accident. The consequences can be significant, both financially and legally.

Types of Car Insurance Policies Offered Without Inspection

Source: nextlaw.ca

Navigating the world of car insurance without inspection can feel like a minefield, especially when comparing options. Understanding the nuances is key, and a good place to start is by checking out reliable reviews, like those found in this insightful piece on three business insurance reviews covemarkets , which highlights the importance of thorough research before committing to any business insurance policy.

This same principle applies when selecting car insurance – don’t rush the process!

Securing car insurance without a vehicle inspection might seem like a magical shortcut, but it’s a legitimate option for certain situations. Understanding the types of policies available and their limitations is key to making an informed decision. Remember, the absence of an inspection often means a slightly higher premium or restricted coverage compared to a full inspection policy.

Liability-Only No-Inspection Policies, Car insurance without inspection

Liability-only insurance, even without an inspection, covers damages you cause to others’ property or injuries you inflict on others in an accident. It won’t cover damage to your own vehicle. This is a bare-bones option, suitable for drivers with older cars or those who primarily rely on public transportation. The premiums are generally lower, but the protection is limited. For example, if you rear-end another car causing significant damage, your liability coverage would pay for the other driver’s repairs and medical bills, but you’d be responsible for fixing your own vehicle.

Limited Comprehensive and Collision No-Inspection Policies

Some insurers offer no-inspection policies with limited comprehensive and collision coverage. This means they provide some protection against damage to your car, but the coverage might be capped at a lower amount or have stricter limitations. For instance, you might only receive coverage for specific types of damage, such as theft or fire, but not for accidents. Deductibles will also likely be higher. This option could work for someone with an older vehicle of low market value where the cost of a full inspection outweighs the benefits of extensive coverage.

State-Specific No-Inspection Options

Certain states have programs or regulations that allow for simplified car insurance applications without mandatory inspections, particularly for older vehicles. These policies often come with specific requirements and limitations, varying significantly from state to state. It’s essential to check with your state’s Department of Insurance to understand the rules and available options. For example, some states might offer a streamlined process for classic cars or vehicles used infrequently.

| Policy Type | Coverage | Premium Range | Deductible Range |

|---|---|---|---|

| Liability-Only | Bodily injury and property damage to others | $200 – $500 per year | $250 – $1000 |

| Limited Comprehensive & Collision | Partial coverage for damage to your vehicle, plus liability | $400 – $800 per year | $500 – $2000 |

| State-Specific Simplified Policy | Varies by state, often limited coverage | $300 – $700 per year | $500 – $1500 |

The Application Process for No-Inspection Car Insurance

Source: inspektlabs.com

Securing car insurance without an inspection can be a surprisingly streamlined process, especially if you leverage online platforms. However, understanding the steps involved and the necessary documentation will ensure a smooth and efficient application. This section details the application process, highlighting the differences between online and in-person methods and potential hurdles you might encounter.

Required Documentation and Information

Applying for no-inspection car insurance requires providing accurate and complete information to the insurer. This typically includes your driver’s license information, vehicle identification number (VIN), vehicle registration details, and your personal contact information. Some insurers may also request details about your driving history, including any accidents or violations. Providing all the necessary information upfront minimizes delays and ensures a quicker processing time. Failure to provide accurate information can lead to application rejection or policy cancellation. For example, providing an incorrect VIN could delay the process significantly as the insurer attempts to verify the vehicle’s details.

Online Application Process

Online applications offer convenience and speed. Most insurers have user-friendly websites with clear instructions and online forms. You typically fill out the form with your details and vehicle information, upload the necessary documents, and submit the application. Instant quotes are often available, allowing you to compare different policies before committing. The entire process can be completed within minutes, and policy documents are often emailed electronically. For instance, a hypothetical insurer, “QuickQuoteCars,” allows you to complete the entire process, from quote to policy confirmation, within 15 minutes, provided you have all necessary documents readily available.

In-Person Application Process

Applying in person involves visiting an insurance agent’s office or a physical branch of the insurance company. You’ll need to bring all the required documents with you and complete the application form at the office. The agent can answer any questions you may have and assist with the application process. While this method offers personalized assistance, it’s generally slower than online applications and requires scheduling an appointment. For example, an appointment with a local insurance agent might take 30-45 minutes, including the time spent discussing policy options and reviewing the paperwork.

Potential Delays and Complications

While applying for no-inspection car insurance is generally straightforward, certain factors can cause delays. Inaccurate or incomplete information is a major cause of delays, as is the inability to verify the provided information. For instance, if the insurer cannot verify your driving history or vehicle information, the application will be held up until the discrepancies are resolved. Technical issues with the online platform, in the case of online applications, or long wait times at physical offices can also contribute to delays. Additionally, some insurers might require additional documentation or verification steps depending on your profile or the vehicle’s details, leading to unexpected delays. A specific example could be a request for additional proof of residency if the provided address doesn’t match the address on file with the DMV.

Factors Affecting Premiums for No-Inspection Car Insurance

Securing car insurance without an inspection can be a convenient option, but the cost can vary significantly. Several factors play a crucial role in determining your premium. Understanding these influences can help you make informed decisions and potentially save money. This section will break down the key elements that impact the price of your no-inspection car insurance.

Driver History’s Influence on Premiums

Your driving record is a major factor influencing your premium. A clean record, free of accidents and traffic violations, will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will significantly increase your premium, reflecting the higher risk you pose to the insurer. Insurance companies use a points system to assess risk; more points mean higher premiums. For instance, a driver with two at-fault accidents in the past three years will likely pay considerably more than a driver with a spotless record.

Age and Premium Correlation

Age is another significant factor. Younger drivers, statistically, are involved in more accidents than older, more experienced drivers. This higher risk translates to higher premiums for younger drivers. As drivers age and gain experience, their premiums tend to decrease, reflecting a lower risk profile. This is a general trend, and individual driving records will still significantly influence the final premium. For example, a 20-year-old driver with a clean record might pay less than a 30-year-old driver with several speeding tickets.

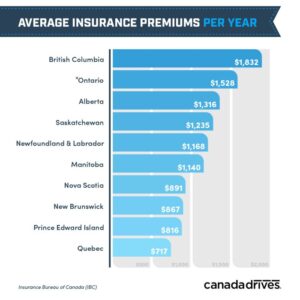

Location’s Impact on Insurance Costs

Your location plays a critical role in determining your premium. Insurers consider the accident rates and crime statistics in your area. Areas with high accident rates or a high incidence of vehicle theft will typically have higher premiums than areas with lower risk profiles. Living in a densely populated urban area with congested roads and higher crime rates will usually lead to higher insurance costs compared to a rural location with fewer vehicles and lower crime. A driver in a high-risk city might pay 20% more than a driver in a smaller, safer town, even with identical driving records and vehicle types.

Vehicle Type and Its Effect on Premiums

The type of vehicle you insure also significantly affects your premium. Higher-value vehicles, sports cars, or vehicles with a history of theft or accidents tend to have higher insurance costs. This is due to the increased repair costs associated with more expensive vehicles and the higher risk of theft or damage. Conversely, insuring a smaller, less expensive, and less commonly stolen vehicle will generally result in lower premiums. For example, insuring a luxury SUV will be considerably more expensive than insuring a compact sedan, even if both drivers have identical driving records.

Comparison of No-Inspection and Inspection-Based Policies

While no-inspection policies offer convenience, they often come with higher premiums compared to policies requiring vehicle inspections. This is because the insurer takes on a higher level of risk without the benefit of a physical assessment of the vehicle’s condition. The absence of an inspection means the insurer relies more heavily on other factors, like driver history and vehicle type, to assess risk, potentially leading to higher premiums to compensate for the increased uncertainty. A hypothetical example: a driver with a clean record insuring a mid-range sedan might pay 10-15% more for a no-inspection policy compared to a policy requiring an inspection.

Hypothetical Premium Calculation Scenario

Let’s consider two drivers, both insuring a 2018 Honda Civic. Driver A is a 35-year-old with a clean driving record living in a suburban area. Driver B is a 22-year-old with two speeding tickets in the past year, living in a major city. Driver A, due to their age, location, and clean record, will likely receive a lower premium for a no-inspection policy. Driver B, on the other hand, will likely pay significantly more due to their age, location, and less favorable driving history. The difference in premiums could easily be several hundred dollars annually, even for the same vehicle.

Potential Risks and Benefits of No-Inspection Car Insurance

Choosing car insurance without an inspection presents a unique set of advantages and disadvantages. It’s a trade-off between convenience and potential cost savings versus the possibility of higher premiums or complications down the line. Understanding both sides of this coin is crucial before making a decision.

Benefits of No-Inspection Car Insurance

The primary appeal of no-inspection car insurance is its convenience. It eliminates the need to schedule an appointment, arrange transportation, and potentially wait for an inspector. This is particularly beneficial for busy individuals or those with limited mobility. The streamlined application process can often lead to quicker policy issuance, getting you covered faster. In some cases, insurers might offer slightly lower premiums to offset the lack of inspection, though this isn’t always the case. For example, a driver with a consistently clean driving record might find that the convenience outweighs any minor premium difference.

Risks and Drawbacks of No-Inspection Car Insurance

While convenient, no-inspection policies carry inherent risks. The most significant is the potential for inaccurate risk assessment. Without a visual inspection, the insurer relies solely on the information you provide about your vehicle’s condition and modifications. Inaccurate or incomplete information could lead to disputes if a claim arises. For instance, if you fail to disclose significant damage and subsequently file a claim, the insurer might deny your claim or significantly reduce the payout. Furthermore, some insurers might apply a higher base premium to account for the increased uncertainty associated with not having inspected the vehicle. This could negate any perceived savings from the streamlined process.

Comparison of No-Inspection and Traditional Policies

Traditional car insurance policies, requiring an inspection, offer a more thorough risk assessment. The inspection allows the insurer to verify the vehicle’s condition, identify potential safety hazards, and accurately assess the risk involved. This usually leads to a more precise premium calculation. However, this process is less convenient and can add time to the application process. No-inspection policies prioritize speed and convenience, trading thoroughness for expediency. The choice depends on individual priorities: a driver prioritizing speed and simplicity might opt for a no-inspection policy, while someone prioritizing accurate risk assessment and potentially lower premiums might choose a traditional policy.

Situations Where No-Inspection Policies are Advantageous or Disadvantageous

A no-inspection policy might be advantageous for someone buying a used car from a private seller and needing quick coverage before completing the sale. The speed of the process is crucial here. Conversely, a no-inspection policy could be disadvantageous for someone with a modified vehicle or one with pre-existing damage. Failing to fully disclose such details could result in claim denials or higher premiums later. Someone with a history of claims might also find that a traditional policy, with its more thorough assessment, offers better long-term value, despite the added inconvenience.

Claims Process for No-Inspection Car Insurance

Source: mozconcepts.com

Securing car insurance without an inspection offers convenience, but it also subtly alters the claims process. The absence of a pre-existing vehicle assessment means the insurer relies more heavily on your account of the incident and supporting documentation. This can lead to both smoother and potentially more complex claims experiences compared to traditional policies.

Claim Reporting and Initial Assessment

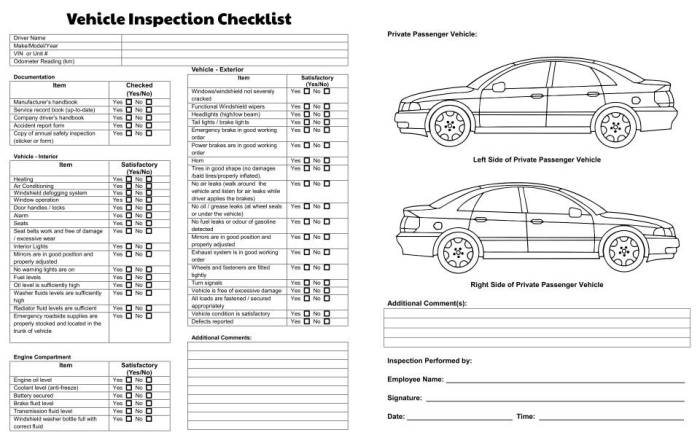

When filing a claim for a no-inspection policy, the initial steps remain largely the same. You’ll typically contact your insurer immediately after the accident, providing details such as the date, time, location, and circumstances of the incident. Crucially, you’ll need to provide comprehensive information about the damage to your vehicle, even without a visual inspection available to the insurer upfront. Accurate and detailed descriptions, accompanied by photographic evidence, become especially important. This detailed reporting forms the basis for the insurer’s initial assessment of your claim.

Documentation Requirements for No-Inspection Claims

The absence of a pre-accident inspection emphasizes the importance of thorough documentation. Beyond the standard police report (if applicable) and contact information of other parties involved, you’ll need to provide compelling visual evidence. High-quality photographs of the damage from multiple angles are essential. Videos capturing the scene and the extent of the damage can further strengthen your claim. Repair estimates from reputable mechanics are also crucial for justifying the costs involved. Consider this your virtual inspection; the more detailed and verifiable the evidence, the smoother the process will be.

Potential Challenges in the Claims Process

While convenient, no-inspection policies can present challenges. Disputes over the extent of pre-existing damage can arise, as the insurer lacks a baseline assessment. For instance, if you claim damage to a bumper, the insurer might question whether that damage pre-dated the accident. Similarly, discrepancies between your description of the damage and the photographic evidence could lead to delays or claim denials. The absence of an independent verification of the vehicle’s condition before the accident makes it crucial to be completely honest and thorough in your documentation.

Step-by-Step Guide to Filing a No-Inspection Claim

- Report the Accident: Immediately contact your insurer to report the accident, providing all relevant details.

- Gather Evidence: Take numerous clear photos and videos of the damage to your vehicle and the accident scene. Obtain a police report if applicable.

- Obtain Repair Estimates: Get at least two estimates from reputable mechanics detailing the necessary repairs.

- Submit Your Claim: Submit your claim online or by mail, including all gathered documentation.

- Cooperate with the Insurer: Respond promptly to any requests for further information from your insurer.

- Review the Settlement Offer: Carefully review the settlement offer from your insurer and negotiate if necessary.

Illustrative Examples of No-Inspection Insurance Scenarios: Car Insurance Without Inspection

Understanding how no-inspection car insurance works in practice can be clearer with real-life examples. These scenarios illustrate different claims and policy coverage situations, highlighting both the benefits and potential limitations of this type of insurance.

Scenario 1: Minor Accident – Fender Bender

Imagine Sarah, a recent college graduate, buys a used car and opts for no-inspection car insurance to save money. One afternoon, while parallel parking, she slightly bumps into another car, causing minor damage to her bumper. The other driver’s car sustains only a small scratch. Both drivers exchange information, and Sarah reports the incident to her insurance company. Since the damage is minor and photographic evidence clearly shows the extent of the damage, her insurer processes the claim efficiently without requiring an inspection. The claim is settled quickly, covering the repair costs for both vehicles. Sarah’s premium might see a small increase, but it remains significantly lower than it would have been with a traditional policy, given the minor nature of the accident.

Scenario 2: Significant Hail Damage

John, a homeowner who uses his truck primarily for hauling supplies for his landscaping business, secures a no-inspection policy for his older vehicle. A severe hailstorm pummels his area, causing significant damage to his truck’s cab and bed. He submits photos and a detailed description of the damage to his insurance provider. The insurer, reviewing the photographic evidence and assessing the reported damage against the policy limits, approves the claim for repairs. While an independent assessment might have been possible, the insurer determines the photographic evidence is sufficient to accurately assess the damage, avoiding the cost and inconvenience of an on-site inspection. The repair costs are covered, and John’s premium increases, but it’s still considered manageable compared to a potentially higher premium from a policy requiring a physical inspection.

Scenario 3: Total Loss Due to Fire

Maria, a busy professional, chooses no-inspection insurance for her older sedan, primarily using it for commuting. One evening, a fire in her garage completely destroys her car. She immediately reports the incident to her insurance company and provides photographic evidence of the total loss. Because the car is completely destroyed, there’s no need for an inspection to determine the extent of the damage. The insurer processes the claim based on the car’s pre-loss value as stated in the policy, and Maria receives a settlement for the car’s total loss. While the claim process is straightforward due to the total loss nature of the event, her premium will likely increase significantly in the next renewal period.

Closing Notes

So, is car insurance without inspection the right choice for you? It depends. Weigh the pros and cons carefully. While the convenience and potential cost savings are alluring, remember that you’re taking on some risk. Understanding the eligibility requirements, policy limitations, and potential claims complications is crucial. Do your homework, compare providers, and make an informed decision that best suits your needs and risk tolerance. Happy driving!