Car insurance lawsuit – sounds scary, right? But navigating the legal waters after a car accident doesn’t have to be a total nightmare. This isn’t your grandpa’s insurance claim; we’re talking about understanding your rights, knowing what evidence matters, and ultimately, getting the compensation you deserve. Whether it’s a fender bender or a serious crash, knowing the ropes of a car insurance lawsuit can be the difference between settling quickly and fighting for what’s rightfully yours.

From understanding the different types of claims – bodily injury, property damage, even uninsured/underinsured motorist – to mastering the claims process and building a rock-solid legal case, we’ll break down everything you need to know. We’ll explore the roles of insurance adjusters, the importance of evidence (think police reports, medical bills, witness statements – the whole shebang!), and the strategies employed by both plaintiffs and defendants. Think of this as your ultimate cheat sheet to winning the car insurance game.

Types of Car Insurance Lawsuits

Navigating the world of car insurance lawsuits can feel like driving through a dense fog. Understanding the different types of claims and the legal grounds involved is crucial for both policyholders seeking compensation and insurance companies defending against claims. This section breaks down the common types of car insurance lawsuits, providing examples and highlighting the relevant legal frameworks.

Bodily Injury Claims

Bodily injury claims arise when someone is injured in a car accident caused by another driver’s negligence. These lawsuits seek compensation for medical expenses, lost wages, pain and suffering, and other related damages. The legal basis for these claims typically rests on negligence, meaning the at-fault driver owed a duty of care to the injured party, breached that duty, and the breach directly caused the injuries. State laws vary, but generally, proving negligence requires demonstrating the driver acted carelessly or recklessly, violating traffic laws or established safety standards.

Property Damage Claims

Property damage claims focus on the repair or replacement costs of a vehicle damaged in an accident. These lawsuits aim to recover the financial losses associated with vehicle repairs, diminished value (loss of resale value), and potentially rental car expenses. Similar to bodily injury claims, the legal foundation is typically negligence. The claimant needs to prove the at-fault driver’s negligence directly caused the property damage. Appraisals and repair estimates are critical evidence in these cases.

Uninsured/Underinsured Motorist Claims

Uninsured/underinsured motorist (UM/UIM) claims arise when an accident is caused by a driver without insurance or with insufficient coverage to compensate for the injuries or damages sustained. Your own insurance policy’s UM/UIM coverage steps in to cover your losses in these situations. The legal basis for these claims is similar to other car accident lawsuits, focusing on proving the other driver’s negligence. However, the claim is directed against your own insurance company, not the at-fault driver.

Wrongful Death Claims, Car insurance lawsuit

In cases where a car accident results in a fatality, wrongful death lawsuits can be filed by the deceased’s family members. These claims seek compensation for the loss of companionship, financial support, and other damages resulting from the death. The legal basis typically involves proving negligence and demonstrating a causal link between the negligent act and the death. These cases often involve complex legal procedures and require demonstrating the economic and non-economic losses suffered by the surviving family members.

| Type of Lawsuit | Common Causes | Legal Basis | Example Case Summary |

|---|---|---|---|

| Bodily Injury | Rear-end collision, intersection accidents, drunk driving accidents | Negligence, breach of duty of care | A driver rear-ends another car at a stoplight, causing whiplash and other injuries to the other driver. The injured driver sues the at-fault driver’s insurance company for medical bills, lost wages, and pain and suffering. |

| Property Damage | Side-swipe accidents, collisions at low speeds, parking lot accidents | Negligence, proximate cause | Two cars collide in a parking lot, causing damage to both vehicles. One driver’s insurance company refuses to pay for repairs, claiming the other driver was at fault. The damaged driver sues for the cost of repairs. |

| Uninsured/Underinsured Motorist | Accidents involving a hit-and-run driver, accidents with a driver with insufficient liability coverage | Negligence, UM/UIM policy coverage | A driver is injured in an accident caused by an uninsured driver. The injured driver files a claim under their own uninsured motorist coverage to recover damages. |

| Wrongful Death | Fatal car accidents caused by reckless driving, drunk driving, or distracted driving | Negligence, proximate cause, demonstrating loss to survivors | A family member files a wrongful death lawsuit against the driver who caused a fatal accident, seeking compensation for the loss of their loved one’s financial support and companionship. |

The Claims Process and its Legal Ramifications

Navigating the world of car insurance claims after an accident can feel like traversing a minefield. Understanding the process, the roles of key players, and your legal recourse is crucial to securing a fair settlement. This section Artikels the steps involved in filing a car insurance lawsuit and the potential legal pitfalls along the way.

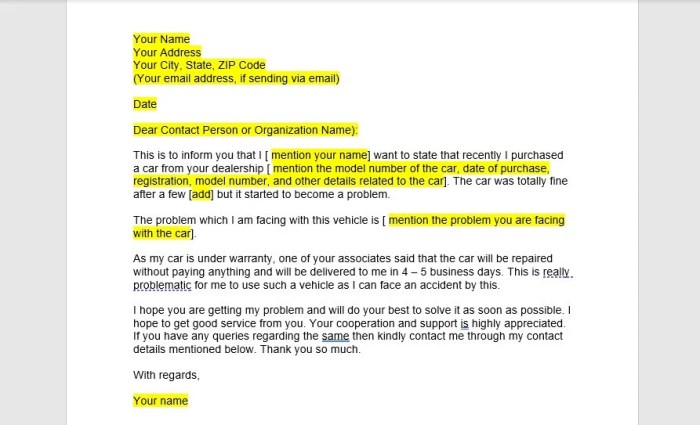

Filing a Car Insurance Lawsuit: A Step-by-Step Guide

The process begins with reporting the accident to the police and your insurance company. Next, you’ll need to gather evidence, including police reports, photos of the damage, medical records, and witness statements. Submitting a formal claim to your insurer initiates the claims process. The insurer will then assign an adjuster to investigate the claim. If the claim is denied or the settlement offered is unsatisfactory, you may need to consult an attorney to pursue legal action. This could involve filing a lawsuit, engaging in negotiations, and potentially going to trial. The entire process can be lengthy and complex, often taking months or even years to resolve.

The Role of Insurance Adjusters

Insurance adjusters are crucial figures in the claims process. Their primary role is to investigate the accident and determine the liability and damages. They assess the extent of injuries and vehicle damage, and they negotiate settlement amounts. Adjusters work for the insurance company, so their goal is to minimize payouts. Their assessment of liability and damages can significantly impact the outcome of a lawsuit. A skilled adjuster might identify weaknesses in your claim or find ways to reduce the compensation offered. Conversely, a less thorough adjuster might overlook important evidence or undervalue your claim. Therefore, documenting your claim thoroughly is essential to counter any potential biases.

Reasons for Insurance Claim Denials and Legal Recourse

Insurance companies often deny claims for various reasons. Common reasons include insufficient evidence, failure to meet policy requirements (like timely reporting), or disputes over liability. If your claim is denied, you have several legal options. You can appeal the denial to the insurance company, providing additional evidence to support your claim. If the appeal fails, you can consult with a lawyer to explore options such as filing a lawsuit against the insurance company for breach of contract or bad faith. In some cases, mediation or arbitration might be considered as alternatives to litigation. The success of these options depends heavily on the strength of your evidence and the specifics of your policy and the applicable state laws.

Comparison of Claims Processes for Different Insurance Types

The claims process varies depending on the type of insurance coverage involved. A collision claim, covering damage to your vehicle in an accident regardless of fault, generally involves providing the insurance company with information about the accident and the cost of repairs. A liability claim, covering damages you cause to another person or their property, involves a more complex investigation of fault and damages. Personal Injury Protection (PIP) claims, covering medical expenses and lost wages regardless of fault (in states with PIP coverage), usually involve submitting medical bills and wage statements. Each type of claim has its own specific requirements and timelines, so understanding the nuances is vital for a successful outcome. For example, failing to promptly report a collision claim could lead to a denial, whereas a liability claim may require a detailed investigation of fault before settlement.

Evidence and Legal Strategies in Car Insurance Lawsuits

Source: slingshotlaw.com

Navigating a car insurance lawsuit can be a total headache, especially when dealing with hefty medical bills and legal fees. But before you even think about filing, consider this crucial question: can you cancel your claim, as outlined in this helpful guide can you cancel claim car insurance ? Understanding this might actually save you from a legal battle down the road, influencing the entire outcome of your car insurance lawsuit.

Winning a car insurance lawsuit hinges on presenting a compelling case supported by strong evidence. The right evidence, strategically presented, can significantly impact the outcome, leading to a favorable settlement or jury verdict. This section explores the crucial evidence types and effective legal strategies employed in these cases.

Key Evidence in Car Insurance Lawsuits

The foundation of a successful car insurance lawsuit rests on a robust collection of evidence. This evidence helps establish liability, the extent of damages, and ultimately, the amount of compensation the plaintiff deserves. Failing to gather and present compelling evidence can significantly weaken the case. Examples of critical evidence include:

- Police Reports: Official police reports provide an unbiased account of the accident, including details like the location, time, contributing factors, and witness statements. These reports are often considered highly credible in court.

- Medical Records: Detailed medical records, including doctor’s notes, diagnostic tests, and treatment plans, document the plaintiff’s injuries and the ongoing medical care required. This evidence directly links the accident to the plaintiff’s physical and emotional suffering.

- Witness Testimonies: Eyewitness accounts can corroborate the plaintiff’s version of events, providing crucial support for their claim. Credible witness testimonies can significantly strengthen the case, especially if they contradict the defendant’s account.

- Photographs and Videos: Visual evidence, such as photos of the accident scene, vehicle damage, and injuries, can powerfully illustrate the severity of the accident and the extent of the damages. Dashboard camera footage or security camera recordings can be particularly impactful.

- Repair Bills and Estimates: Documentation of vehicle repair costs provides concrete evidence of financial losses incurred due to the accident. These bills and estimates serve as tangible proof of damages.

Effective Legal Strategies for Plaintiffs and Defendants

Plaintiffs and defendants employ different strategies to build their cases and achieve favorable outcomes. Understanding these strategies is crucial for navigating the complexities of a car insurance lawsuit.

- Plaintiff Strategies: Plaintiffs often focus on proving negligence, establishing the extent of their damages (both economic and non-economic), and demonstrating the defendant’s liability. This may involve presenting expert witness testimony on medical issues or accident reconstruction, emphasizing the severity of injuries, and highlighting lost wages or diminished earning capacity.

- Defendant Strategies: Defendants may attempt to minimize their liability by challenging the plaintiff’s version of events, questioning the extent of their injuries, or arguing contributory negligence. They may present evidence suggesting the plaintiff was partially at fault for the accident, thus reducing the amount of compensation owed.

Methods of Gathering and Presenting Evidence

Effective evidence gathering and presentation are paramount to a successful lawsuit. A systematic approach is essential.

- Gathering Evidence: This involves obtaining police reports, medical records, witness statements, photographs, videos, and repair bills. Preserving evidence is crucial, and this includes proper storage and chain of custody documentation. Plaintiffs should seek legal counsel early in the process to ensure proper evidence gathering.

- Presenting Evidence: Evidence is presented in court through witness testimony, exhibits (documents and photos), and expert witness testimony. A skilled attorney will strategically present the evidence to build a compelling narrative and support the client’s claims. Effective presentation involves clear organization, logical flow, and persuasive arguments.

Building a Strong Legal Case

Constructing a robust legal case requires meticulous attention to detail and a strategic approach.

- Thorough Investigation: A comprehensive investigation is the cornerstone of a strong case. This involves gathering all relevant evidence, interviewing witnesses, and consulting with experts as needed.

- Expert Witness Testimony: Expert witnesses, such as accident reconstruction specialists or medical professionals, can provide crucial insights and analysis, bolstering the plaintiff’s claims and strengthening the overall case.

- Clear and Concise Documentation: Maintaining meticulous records of all communications, meetings, and evidence gathered is essential for effective case management and presentation.

- Legal Counsel: Engaging a skilled and experienced attorney is crucial. An attorney will guide you through the legal process, advise on strategy, and represent your interests in court.

Damages Awarded in Car Insurance Lawsuits

Winning a car insurance lawsuit doesn’t just mean proving the other driver was at fault; it’s about securing fair compensation for your losses. The amount you receive depends on various factors, and understanding these is crucial for a successful claim. This section breaks down the types of damages awarded and the elements influencing the final payout.

In car accident lawsuits, damages are broadly categorized as economic and non-economic. Economic damages are easily quantifiable financial losses, while non-economic damages are harder to put a precise price tag on, relating more to pain and suffering.

Types of Damages

Economic damages cover readily calculable expenses stemming from the accident. This includes medical bills (hospital stays, doctor visits, physical therapy), lost wages (current and future income), property damage (car repairs or replacement), and other related expenses like home modifications for accessibility needs. Non-economic damages, on the other hand, compensate for intangible losses such as pain and suffering, emotional distress, loss of consortium (loss of companionship), and disfigurement. These are often determined by the severity of the injuries and their lasting impact.

Factors Influencing Damage Awards

Several factors significantly impact the amount of damages awarded. The severity of injuries plays a major role; more serious and permanent injuries generally result in higher awards. The extent of liability also matters; if the other driver is found to be 100% at fault, the compensation will likely be higher than if fault is shared. The plaintiff’s past medical history, pre-existing conditions, and mitigation of damages (efforts to minimize losses) are also considered. Furthermore, jurisdiction matters; different states have varying laws and precedents influencing damage awards. Finally, the plaintiff’s credibility and the strength of the evidence presented significantly influence the outcome.

Hypothetical Scenario and Damage Assessment

Let’s consider a hypothetical case: Sarah was involved in a car accident where the other driver ran a red light. Sarah sustained a broken leg, requiring surgery and months of physical therapy. She missed three months of work, earning $5,000 per month. Her medical bills totaled $20,000, and her car was totaled, costing $15,000 to replace. She also experienced significant pain and suffering due to her injury and ongoing physical limitations.

In this scenario, Sarah’s economic damages would be $45,000 ($20,000 medical + $15,000 car + $10,000 lost wages). The non-economic damages would be more subjective, but considering the severity of the injury and the lasting impact, a judge or jury might award anywhere from $20,000 to $100,000 or more, depending on the specifics of the case and the jurisdiction. The total damage award could therefore range from $65,000 to $145,000 or more.

Examples of Successful Car Insurance Lawsuits

The following table showcases examples of successful car insurance lawsuits and the associated damages. Note that these are illustrative examples and specific amounts can vary widely depending on the specifics of each case. These figures are estimations based on publicly available information and should not be considered definitive legal precedents.

| Case Name | Damages Awarded | Type of Damages | Justification |

|---|---|---|---|

| Doe v. Insurance Company X | $75,000 | Economic and Non-Economic | Serious injuries (broken bones, concussion) requiring extensive medical treatment and resulting in lost wages and ongoing pain and suffering. |

| Smith v. Driver Y | $150,000 | Primarily Non-Economic | Severe emotional distress and PTSD following a traumatic accident, even with relatively minor physical injuries. |

| Jones v. Auto Insurance Z | $25,000 | Primarily Economic | Significant vehicle damage and medical expenses, but relatively minor and quickly resolved physical injuries. |

| Garcia v. Reckless Driver A | $500,000 | Economic and Non-Economic | Catastrophic injuries leading to permanent disability, significant medical expenses, substantial lost wages, and extensive pain and suffering. |

Role of Attorneys in Car Insurance Lawsuits

Source: thejusticeattorneys.com

Navigating the complex world of car insurance lawsuits can be daunting, even more so when dealing with significant injuries or property damage. This is where the expertise of a qualified attorney becomes invaluable, acting as a crucial guide through the legal maze. Attorneys play distinct roles depending on whether they represent the plaintiff (the injured party) or the defendant (the insurance company).

Attorneys representing plaintiffs and defendants have significantly different responsibilities.

Responsibilities of Attorneys Representing Plaintiffs

Plaintiffs’ attorneys are tasked with aggressively pursuing compensation for their clients’ injuries, losses, and damages resulting from a car accident. This involves investigating the accident, gathering evidence, negotiating with insurance companies, and, if necessary, litigating the case in court. They must meticulously document medical expenses, lost wages, pain and suffering, and other damages to build a strong case for their client. A key aspect of their role is to ensure their client’s rights are protected throughout the process. For instance, they’ll advise on settlement offers, ensuring the client receives a fair and just amount reflecting the full extent of their losses. They might also utilize expert witnesses, such as accident reconstruction specialists or medical professionals, to strengthen their case. Successful representation hinges on skillful negotiation and, if negotiations fail, effective courtroom advocacy.

Responsibilities of Attorneys Representing Defendants

Defendants’ attorneys, typically representing insurance companies, work to minimize the financial liability of their clients. Their responsibilities include investigating the accident to determine liability, reviewing medical records and other evidence, and negotiating with the plaintiff’s attorney to reach a settlement. If a settlement can’t be reached, they will build a defense strategy for trial, presenting evidence that challenges the plaintiff’s claims or minimizes the extent of their damages. This could involve arguing that the plaintiff was partially at fault for the accident, or contesting the amount of medical expenses or lost wages claimed. They might also employ expert witnesses to counter the plaintiff’s experts and support their defense. Their primary goal is to protect their client’s financial interests by securing the most favorable outcome possible, whether through settlement or a verdict in court.

Importance of Legal Representation in Car Insurance Litigation

The legal landscape of car insurance lawsuits is intricate and demanding. Insurance companies often employ skilled legal teams to protect their interests, making it difficult for individuals to navigate the process alone. An attorney provides crucial guidance on legal procedures, evidence gathering, and negotiation strategies. They can significantly improve the chances of obtaining a fair settlement or a favorable judgment. Without legal representation, individuals risk overlooking crucial legal deadlines, making procedural errors, and ultimately receiving less compensation than they deserve. The complexities of personal injury law, including proving negligence, quantifying damages, and understanding insurance policies, necessitate the expertise of a legal professional. For example, a seemingly straightforward case can become complicated by issues of comparative negligence or disputes over the extent of injuries, highlighting the need for skilled legal counsel.

Selecting an Attorney for a Car Insurance Lawsuit

Choosing the right attorney is a critical decision. Several factors should be considered. First, look for an attorney specializing in personal injury or car accident cases. Experience is key; a lawyer with a proven track record of success in similar cases is more likely to achieve favorable results. Secondly, consider the attorney’s communication style and responsiveness. Effective communication is essential throughout the legal process. Review online reviews and testimonials to gauge other clients’ experiences. Finally, discuss fees and payment arrangements upfront. Most personal injury attorneys work on a contingency fee basis, meaning they only get paid if they win your case. However, it’s important to understand the details of the fee agreement before proceeding. Failing to carefully vet potential attorneys could lead to missed opportunities for compensation or a less favorable outcome.

Strategies Employed by Attorneys to Build a Strong Case

Building a robust case involves meticulous investigation and evidence gathering. Attorneys will collect police reports, medical records, witness statements, photographs of the accident scene, and vehicle damage reports. They’ll also interview witnesses and consult with medical experts to assess the extent of injuries and future medical needs. Strong cases rely on clear evidence of negligence, proving that the other driver acted carelessly or recklessly, leading to the accident. This often involves demonstrating a violation of traffic laws or other evidence of negligent behavior. For example, an attorney might use accident reconstruction experts to illustrate the sequence of events and determine fault. In addition, they might employ medical experts to corroborate the extent of the plaintiff’s injuries and their long-term effects. Effective presentation of this evidence is critical in securing a favorable outcome, whether through negotiation or litigation.

Summary

Source: etsystatic.com

So, you’ve just been through a car accident and the idea of a car insurance lawsuit is looming large. Don’t panic! Armed with the right knowledge, understanding the different types of claims, gathering compelling evidence, and knowing your legal options can transform a stressful situation into a manageable one. Remember, the goal isn’t just to win; it’s to get the compensation you deserve to cover medical bills, repairs, lost wages, and more. This guide provides a solid foundation, but always remember to consult with a legal professional for personalized advice tailored to your specific circumstances.