Car insurance Garner NC – navigating the world of car insurance can feel like driving through a maze blindfolded. But don’t worry, we’re here to shine a light on the process, making it easier to find the best coverage for your needs in Garner, North Carolina. From understanding different policy types and comparing rates to uncovering hidden ways to save money, this guide will equip you with the knowledge to become a savvy car insurance shopper.

We’ll break down the factors that influence your premiums, from your driving history and age to the type of car you drive and even your credit score. We’ll also explore various coverage options, helping you choose the right level of protection without breaking the bank. Think of us as your trusted co-pilot, guiding you through every step of the way.

Finding Car Insurance Providers in Garner, NC

Securing affordable and reliable car insurance in Garner, North Carolina, is crucial for every driver. The right policy protects you financially in case of accidents or other unforeseen events. Choosing the right provider requires careful consideration of coverage options, pricing, and customer service. This section provides information to help you navigate the process.

Car Insurance Companies in Garner, NC

Finding the right car insurance provider can feel overwhelming, but several reputable companies operate in Garner. Below is a list of five companies, though this is not exhaustive, and it’s always best to shop around for the best rates. Remember, contact information can change, so always verify directly with the company’s website.

- GEICO: Known for their extensive advertising and often competitive rates. Contact information is readily available on their website.

- State Farm: A long-standing and widely recognized insurer with a strong local presence. They typically have agents throughout the area.

- Progressive: Offers a range of policies and is known for its online tools and resources. You can easily find their contact details online.

- Allstate: Another major insurer with a significant market share. They often have local agents you can contact directly.

- Nationwide: A large mutual insurance company offering a broad spectrum of insurance products, including auto insurance. Contact information is available on their website.

Types of Car Insurance Policies

Understanding the different types of car insurance policies is key to making an informed decision. Three major providers often offer similar basic coverage options, but the specifics and add-ons can vary. Here’s a look at what you might expect from State Farm, Progressive, and GEICO.

State Farm: Typically offers Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, and Personal Injury Protection (PIP) coverage. They often include various discounts based on driving history and safety features.

Progressive: Known for their Name Your Price® Tool, which allows you to customize your coverage and see how it impacts your premium. They generally offer similar coverage options to State Farm.

GEICO: Provides standard coverage options including Liability, Collision, Comprehensive, and Uninsured Motorist coverage. They also often offer discounts for good drivers and those who bundle policies.

Finding the right car insurance in Garner, NC can be a headache, but knowing your options is key. For example, if you’re looking for a broader perspective on insurance choices, check out the services offered by kaplansky insurance needham to see how different providers operate. This research can help you make informed decisions when choosing your car insurance in Garner, ensuring you get the best coverage for your needs and budget.

Average Car Insurance Rates in Garner, NC

The cost of car insurance can vary significantly based on several factors, including age, driving history, vehicle type, and coverage level. The following table presents estimated average rates for a 30-year-old driver with a clean driving record in Garner, NC, for basic liability coverage. These are estimates and actual rates may vary. Always obtain a personalized quote from each provider for the most accurate information.

| Provider | Coverage Type | Average Rate (Annual) | Additional Features |

|---|---|---|---|

| State Farm | Basic Liability | $750 | Accident forgiveness, discounts for safe driving |

| Progressive | Basic Liability | $700 | Name Your Price® Tool, online management tools |

| GEICO | Basic Liability | $650 | Easy online quote process, potential discounts |

Factors Affecting Car Insurance Costs in Garner, NC

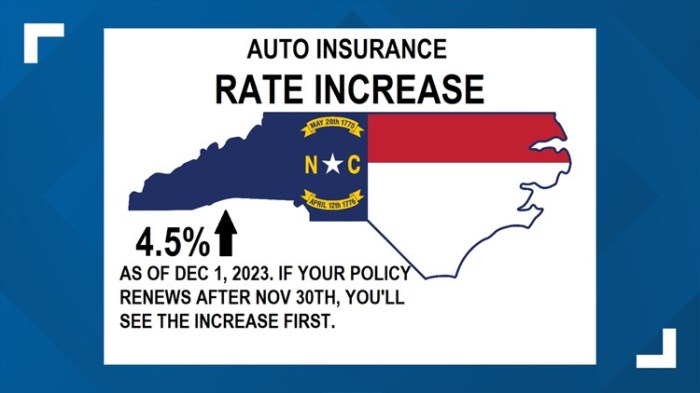

Source: wfmynews2.com

Getting the best car insurance rate in Garner, NC, isn’t just about luck; it’s about understanding the factors that influence the price. Several elements combine to determine your premium, and knowing these can help you make informed choices. Let’s break down some key players in the car insurance cost game.

Driving History’s Impact on Premiums

Your driving history is a major factor in determining your car insurance rates. Insurance companies view a clean driving record as a low-risk profile, rewarding you with lower premiums. Conversely, accidents and traffic violations significantly increase your risk profile, leading to higher premiums. A single at-fault accident could result in a premium increase of hundreds of dollars annually, depending on the severity of the accident and the resulting damages. Multiple accidents or serious offenses like DUI convictions can lead to even more substantial increases or even policy cancellations. In Garner, NC, as in most places, insurers carefully analyze your driving record, looking for patterns of risky behavior. Maintaining a clean record is the best way to keep your premiums affordable.

Age and Gender Influence on Rates

Age and gender also play a significant role in determining car insurance costs. Statistically, younger drivers, particularly those under 25, are considered higher risk due to their inexperience and higher likelihood of accidents. Insurance companies often charge higher premiums for this demographic. Gender can also be a factor, although the extent varies by insurer and state regulations. Historically, young male drivers have been statistically associated with higher accident rates compared to young female drivers, resulting in potentially higher premiums for young men. As drivers age and accumulate experience, their premiums generally decrease, reflecting a lower risk profile.

Additional Factors Affecting Car Insurance Costs

Beyond driving history and demographics, several other factors significantly influence your car insurance premiums in Garner, NC. These factors are often intertwined and can significantly impact your overall cost.

- Type of Vehicle: The make, model, and year of your vehicle heavily influence your insurance cost. Sports cars and luxury vehicles are often more expensive to insure due to higher repair costs and a greater likelihood of theft. Conversely, smaller, less expensive vehicles typically have lower insurance premiums. Features like anti-theft systems can also affect your rate.

- Location: Your address in Garner, NC, matters. Insurance companies consider the crime rate and accident frequency in your specific neighborhood. Areas with higher rates of theft or accidents will generally result in higher insurance premiums. Living in a safer, lower-risk area can lead to lower costs.

- Credit Score: In many states, including North Carolina, your credit score can impact your car insurance rates. Insurers often use credit scores as an indicator of risk, with those having higher credit scores typically receiving lower premiums. This is because a good credit score suggests financial responsibility, which is often correlated with responsible driving behavior.

Understanding Car Insurance Policy Features in Garner, NC

Source: carinsurance.com

Navigating the world of car insurance can feel like driving through a fog, especially when you’re trying to decipher the different coverage options. Understanding the features of your policy is crucial to ensuring you’re adequately protected in case of an accident. This section breaks down key policy features to help you make informed decisions.

Liability Insurance Coverage

Liability insurance is the cornerstone of any car insurance policy. It protects you financially if you’re at fault in an accident that causes injury or damage to another person or their property. In Garner, NC, like most states, carrying liability insurance is legally mandated. This coverage typically includes bodily injury liability and property damage liability. Bodily injury liability covers medical bills, lost wages, and pain and suffering for those injured in an accident you caused. Property damage liability covers repairs or replacement costs for the other person’s vehicle or property. The amounts of coverage are expressed as limits, for example, 25/50/25, meaning $25,000 per person for bodily injury, $50,000 total for all bodily injuries in one accident, and $25,000 for property damage. Choosing adequate liability limits is crucial, as exceeding these limits leaves you personally responsible for the difference.

Collision and Comprehensive Coverage Benefits

While liability insurance protects others, collision and comprehensive coverage protect you and your vehicle. Collision coverage pays for repairs or replacement of your car if it’s damaged in an accident, regardless of who is at fault. Comprehensive coverage goes a step further, covering damage caused by events outside of collisions, such as theft, vandalism, fire, hail, or even hitting a deer. While these are optional coverages, they provide significant peace of mind, especially if you have a newer vehicle or a loan on your car. The cost of repairing or replacing a car can be substantial, and these coverages can prevent significant financial burdens. Consider the value of your vehicle and your financial situation when deciding whether to include collision and comprehensive coverage in your policy.

Comparison of Uninsured/Underinsured Motorist and Medical Payments Coverage

Choosing the right coverage can be tricky, so let’s compare two important options: uninsured/underinsured motorist (UM/UIM) and medical payments (MedPay).

| Coverage Type | Description | Benefits | Limitations |

|---|---|---|---|

| Uninsured/Underinsured Motorist (UM/UIM) | Protects you if you’re injured by an uninsured or underinsured driver. | Covers medical bills, lost wages, and pain and suffering. Can also cover property damage to your vehicle. | Only covers injuries caused by an uninsured or underinsured driver. Coverage limits are set by your policy. May not cover all damages. |

| Medical Payments (MedPay) | Covers medical expenses for you and your passengers, regardless of fault. | Provides quick payment for medical bills, often without determining fault. | Coverage is limited to a specific amount stated in your policy. Doesn’t cover lost wages or pain and suffering. Usually doesn’t cover damage to your vehicle. |

Tips for Getting Affordable Car Insurance in Garner, NC: Car Insurance Garner Nc

Finding the right car insurance in Garner, NC, can feel like navigating a maze, especially when you’re trying to keep costs down. But with a little savvy and strategic planning, you can significantly reduce your premiums without sacrificing essential coverage. This section provides actionable tips and strategies to help you secure affordable car insurance.

Securing affordable car insurance involves proactive steps and a smart approach to comparing quotes. By understanding the factors that influence your premiums and employing effective negotiation tactics, you can significantly lower your overall costs.

Five Practical Tips for Lowering Car Insurance Premiums

Several simple changes can make a big difference in your car insurance bill. These aren’t just suggestions; they’re proven strategies used by savvy drivers to save money.

- Maintain a Clean Driving Record: Accidents and traffic violations significantly impact your premiums. Driving safely and avoiding tickets is the most effective way to keep your rates low. A single DUI, for example, can dramatically increase your premiums for several years.

- Bundle Your Insurance Policies: Many insurance companies offer discounts if you bundle your car insurance with other policies, such as homeowners or renters insurance. This is often a simple way to save money by leveraging loyalty with a single provider.

- Choose a Higher Deductible: Opting for a higher deductible (the amount you pay out-of-pocket before your insurance kicks in) can lower your monthly premiums. However, make sure you can comfortably afford the higher deductible in case of an accident.

- Shop Around and Compare Quotes: Don’t settle for the first quote you receive. Compare rates from multiple insurance providers to find the best deal. Use online comparison tools and contact insurers directly to get personalized quotes.

- Consider Your Car’s Safety Features: Cars with advanced safety features, such as anti-theft systems, airbags, and anti-lock brakes, often qualify for discounts. These features demonstrate a lower risk to the insurance company.

A Strategy for Comparing Car Insurance Quotes

Comparing quotes effectively requires a systematic approach. Don’t just focus on the price; consider the coverage as well.

Start by creating a list of insurance providers operating in Garner, NC. Then, obtain quotes from at least three different companies, ensuring you provide consistent information to each. Pay close attention to the details of each policy, comparing coverage limits, deductibles, and any additional features or discounts offered. Organize your findings in a spreadsheet or table to facilitate easy comparison. Finally, consider the provider’s reputation and customer service ratings before making a final decision. Remember, the cheapest option isn’t always the best if the coverage is insufficient.

Methods for Negotiating Lower Car Insurance Rates

Negotiating lower rates is possible, but it requires preparation and a confident approach. Remember, insurers want to retain your business.

- Highlight Your Clean Driving Record: Emphasize your excellent driving history and the lack of accidents or violations. This demonstrates your low-risk profile to the insurer.

- Bundle Your Policies: If you haven’t already, explicitly mention your interest in bundling policies. Remind the insurer of the potential savings and increased loyalty this represents.

- Explore Discounts: Actively inquire about any available discounts, such as those for good students, safe drivers, or those with multiple vehicles insured. Don’t assume they will automatically apply; ask specifically.

Resources for Finding Car Insurance in Garner, NC

Finding the right car insurance in Garner, NC, can feel like navigating a maze, but with the right resources, it’s surprisingly straightforward. This section Artikels reliable online tools and steps for securing a policy, whether you prefer online comparison or direct interaction with insurance providers.

The internet offers a wealth of tools to help you compare car insurance rates and find the best deal. Leveraging these tools can save you both time and money.

Reliable Online Resources for Comparing Car Insurance Rates

Several websites specialize in comparing car insurance quotes from multiple providers. Using these comparison sites allows you to see a range of prices and coverage options side-by-side, making informed decisions easier. It’s crucial to remember that these sites act as aggregators, not insurers themselves.

- The Zebra: The Zebra is known for its user-friendly interface and extensive network of insurance providers. It provides clear comparisons of rates and coverage details.

- Insurify: Insurify offers a similar service to The Zebra, with a focus on providing personalized recommendations based on your individual needs and driving history. They also offer tools to help you understand your coverage options.

- NerdWallet: NerdWallet is a comprehensive personal finance website that includes a robust car insurance comparison tool. They provide detailed reviews and ratings of different insurance companies, helping you choose a reputable provider.

Obtaining a Car Insurance Quote Online

Getting an online quote is typically a quick and easy process. Most comparison websites and individual insurance company websites follow a similar format.

- Visit the website: Navigate to the chosen comparison website or the insurer’s website.

- Enter your information: You’ll need to provide details such as your address (Garner, NC), driving history (accidents, tickets), vehicle information (make, model, year), and desired coverage levels.

- Review quotes: The website will generate a list of quotes from different providers. Carefully compare the prices, coverage options, and company ratings.

- Select a plan: Once you’ve chosen the best plan for your needs, you can usually proceed to the application process online.

Purchasing Car Insurance Directly from an Insurance Company in Garner, NC, Car insurance garner nc

Purchasing directly from an insurance company offers a more personalized experience, allowing you to speak with an agent and ask specific questions.

- Identify insurers: Research insurance companies that operate in Garner, NC. This could involve checking online reviews, contacting local insurance agents, or asking for recommendations.

- Contact the insurer: Reach out to the insurer either by phone, email, or visiting their local office. Request a quote and provide the necessary information.

- Review the quote and policy details: Carefully examine the quote, including the premium, coverage details, and any exclusions. Ask clarifying questions if anything is unclear.

- Complete the application: If you decide to proceed, complete the application process, which might involve providing additional documentation (driving license, vehicle registration).

- Make payment: Pay the initial premium to activate your policy. You’ll likely have options for payment methods (credit card, debit card, or check).

Illustrative Example

Let’s meet Sarah, a 28-year-old resident of Garner, NC, who recently purchased a used Honda Civic. She’s a careful driver with a clean driving record, having only received one minor speeding ticket three years ago. Sarah is looking for car insurance and wants sufficient coverage to protect herself and her vehicle. She’s aiming for liability coverage with a reasonable deductible for collision and comprehensive.

Sarah’s insurance cost will be influenced by several factors. Her age, while relatively young, is considered a moderate risk factor by insurance companies. Her clean driving record significantly lowers her premiums, however. The type of vehicle she owns, a Honda Civic, is generally considered a lower-risk vehicle due to its safety features and lower repair costs compared to, say, a sports car. Her desired coverage level, while including collision and comprehensive, is a standard choice and won’t dramatically increase her costs. However, the deductible she chooses will play a role; a higher deductible will lead to lower premiums. Finally, her location within Garner, NC will influence her rates, as some areas may have higher accident rates than others. The specific insurance company she chooses will also play a major role, as different companies have different rating systems and pricing structures.

Factors Affecting Sarah’s Insurance Cost

Several key factors are at play in determining Sarah’s car insurance premium. Her clean driving record is a significant positive, likely resulting in a substantial discount compared to drivers with accidents or multiple violations. The type of vehicle she owns, a Honda Civic, is generally considered less expensive to insure than more powerful or luxury vehicles. Her age (28) places her in a moderate risk category, neither the highest nor the lowest. The location within Garner, NC, affects premiums, reflecting local accident statistics and crime rates. Her choice of coverage levels and deductible amount will also influence the final price. A higher deductible will mean lower premiums, but also a higher out-of-pocket expense in the event of an accident.

Finding Affordable Insurance for Sarah

To find affordable insurance, Sarah can leverage the resources and tips discussed previously. She can start by using online comparison tools to get quotes from multiple insurers simultaneously. This allows her to compare prices and coverage options efficiently. She can also contact local insurance agents in Garner, NC, to discuss her needs and get personalized recommendations. By focusing on her clean driving record and considering a higher deductible, she can further reduce her premiums. Understanding her coverage needs and opting for the appropriate level, without unnecessary extras, will also contribute to affordability. By carefully comparing options and utilizing available resources, Sarah can find a policy that balances cost and the level of protection she needs.

Final Summary

Source: insuranceslist.com

So, there you have it – your comprehensive guide to car insurance in Garner, NC. Remember, finding the right coverage isn’t just about the lowest price; it’s about finding the right balance between cost and comprehensive protection. By using the tips and resources provided, you can confidently navigate the insurance landscape and secure the peace of mind you deserve behind the wheel.