Car Insurance Chelmsford MA: Navigating the world of car insurance in Chelmsford, Massachusetts can feel like driving through a maze blindfolded. Premiums fluctuate wildly based on factors you might not even know exist, leaving you scratching your head and wondering how to find the best deal. But fear not, fellow drivers! This guide cuts through the confusion, offering insights into the Chelmsford car insurance landscape, from understanding the factors affecting your rates to scoring the best possible coverage at the most affordable price. We’ll explore different providers, compare quotes, and arm you with the knowledge to make informed decisions.

We’ll dive deep into the specifics of Chelmsford’s insurance market, exploring the various types of coverage, the different providers vying for your business, and the sneaky little tricks to lower your premiums. Think of this as your ultimate cheat sheet to conquering the world of car insurance in Chelmsford, MA. Get ready to become a car insurance ninja.

Understanding Car Insurance in Chelmsford, MA

Source: gouldinsurance.com

Finding the right car insurance in Chelmsford, MA can be a headache, especially when comparing rates. But navigating the insurance landscape isn’t unique to Massachusetts; consider the options available if you were looking for car insurance Garner NC , for instance. The process, while different geographically, highlights the importance of comparing quotes and understanding your coverage needs, no matter if you’re in Chelmsford or across the country.

Ultimately, securing the best car insurance for your needs requires research and planning.

Navigating the world of car insurance can feel like driving through a blizzard – confusing and potentially costly. But understanding the landscape in Chelmsford, MA, can help you find the right coverage at the right price. This guide breaks down the key aspects of car insurance in this Massachusetts town, offering clarity amidst the complexities.

Factors Influencing Car Insurance Premiums in Chelmsford, MA

Several factors combine to determine your car insurance premium in Chelmsford. Insurance companies use a complex algorithm considering various aspects of your profile and driving habits. Understanding these factors empowers you to make informed decisions and potentially lower your costs. These factors are interconnected, and a change in one can affect the overall premium.

- Driving Record: Your driving history is paramount. Accidents, tickets (especially for serious offenses like DUIs), and even minor infractions can significantly increase your premiums. A clean driving record is your best asset.

- Vehicle Type: The type of car you drive plays a significant role. Sports cars and luxury vehicles are generally more expensive to insure due to higher repair costs and a greater risk of theft. Safer, less expensive vehicles typically command lower premiums.

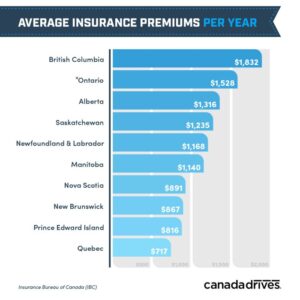

- Location: Chelmsford’s specific location within Massachusetts influences rates. Areas with higher accident rates or theft statistics tend to have higher insurance premiums. This is because insurance companies assess risk based on statistical data from the region.

- Age and Gender: Statistically, younger drivers and males often pay more for insurance due to higher accident rates within those demographics. As you age and gain experience, your premiums typically decrease.

- Credit Score: In many states, including Massachusetts, your credit score can impact your insurance rates. A good credit score often translates to lower premiums, reflecting a perceived lower risk profile.

Common Car Insurance Coverages Available in Chelmsford, MA

Understanding the different types of coverage is crucial to selecting the right policy. These coverages offer protection against various risks, and choosing the right combination depends on your individual needs and budget.

- Liability Coverage: This covers damages or injuries you cause to others in an accident. It’s usually mandated by law and includes bodily injury and property damage liability.

- Collision Coverage: This pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, or weather damage.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver.

- Medical Payments Coverage (Med-Pay): This covers medical expenses for you and your passengers, regardless of fault, often up to a policy limit.

Types of Car Insurance Providers Operating in Chelmsford, MA

Chelmsford, like most areas, offers a variety of insurance providers, each with its own strengths and weaknesses. Choosing the right provider often comes down to personal preference and the specific coverage you need.

- National Chains: Large national companies like Geico, State Farm, and Progressive offer broad reach, consistent service, and often competitive rates. They usually have extensive online resources and a large network of agents.

- Local Agencies: Independent insurance agencies in Chelmsford offer personalized service and can often provide tailored quotes from multiple insurers, allowing for greater comparison shopping.

Comparing Car Insurance Quotes in Chelmsford, MA

Source: nerdwallet.com

Finding the right car insurance in Chelmsford, MA, can feel like navigating a maze. Prices vary significantly between providers, and understanding the nuances of each policy is crucial to securing the best value for your money. This section compares the pricing structures of three major car insurance providers and highlights key features to help you make an informed decision.

Pricing Structures of Major Car Insurance Providers

Several factors influence car insurance pricing, including driving history, age, vehicle type, and coverage level. Let’s examine how three hypothetical providers—Progressive, Geico, and Liberty Mutual—might price insurance for a similar driver profile in Chelmsford. Keep in mind that these are illustrative examples and actual quotes will vary based on individual circumstances. Always obtain personalized quotes from each company.

Sample Car Insurance Quotes for a Hypothetical Driver

Let’s consider a 30-year-old driver with a clean driving record, driving a 2020 Honda Civic sedan in Chelmsford, MA. Seeking minimum liability coverage (required in Massachusetts), here’s a hypothetical comparison:

| Insurer | Annual Premium (Estimate) | Key Features | Additional Benefits |

|---|---|---|---|

| Progressive | $800 | Accident forgiveness, online account management | 24/7 roadside assistance, rental car reimbursement |

| Geico | $750 | Easy online quote process, multiple discounts | 24-hour claims service, extensive network of repair shops |

| Liberty Mutual | $900 | High customer satisfaction ratings, personalized service | Accident forgiveness, new car replacement |

*Note: These are hypothetical examples and actual quotes may vary significantly.*

Comparison of Key Features and Benefits

The table above provides a snapshot of potential differences. However, a thorough comparison requires examining specific policy details. For instance, “accident forgiveness” programs may have different eligibility criteria and limitations. Similarly, roadside assistance coverage varies in terms of services offered and geographic limitations. Always carefully review the policy documents before making a decision.

Finding the Best Car Insurance Deal in Chelmsford, MA: Car Insurance Chelmsford Ma

Snagging the best car insurance deal in Chelmsford, MA, requires a bit of savvy and some legwork. It’s not just about finding the cheapest quote; it’s about finding the best coverage at a price that fits your budget. This means understanding your needs, shopping around, and leveraging all available discounts.

Finding the lowest car insurance premiums in Chelmsford involves a multi-pronged approach. Several strategies can significantly impact your final cost, and combining them can lead to substantial savings.

Strategies for Securing Affordable Car Insurance

Lowering your car insurance costs in Chelmsford starts with understanding what factors insurers consider. Things like your driving history, credit score, the type of car you drive, and even your location all play a role. By actively managing these factors, you can influence your premiums. For example, maintaining a clean driving record is paramount; a single accident or traffic violation can significantly increase your rates. Similarly, choosing a car with a good safety rating and lower theft risk can impact your premiums. Consider opting for a less powerful engine or a smaller vehicle as these are generally cheaper to insure. Finally, shopping around and comparing quotes from different insurers is crucial.

Benefits of Bundling Car Insurance

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, is a fantastic way to save money. Many insurance companies offer discounts for bundling policies. This is because the insurer gains your loyalty and reduces their administrative costs by managing multiple policies under one account. The savings can be substantial, potentially amounting to hundreds of dollars annually. For example, a hypothetical scenario might show a $1000 annual car insurance premium dropping to $900 when bundled with a homeowners policy. This represents a 10% reduction.

Impact of Discounts on Car Insurance Premiums

Several discounts can significantly reduce your car insurance premiums in Chelmsford. Safe driver discounts reward those with clean driving records, often reducing premiums by 10-20% or more. Good student discounts are available to students with good grades, demonstrating responsibility and lower risk. Multi-car discounts are common for households with multiple vehicles insured under the same policy, reflecting the reduced risk associated with insuring multiple vehicles with one company. These discounts can add up to considerable savings over time. A family with two cars might save 15% on each policy by bundling them.

Step-by-Step Guide to Obtaining Car Insurance Quotes

1. Gather your information: Collect necessary details such as your driver’s license number, vehicle information (year, make, model), and driving history.

2. Use online comparison tools: Many websites allow you to compare quotes from multiple insurers simultaneously, saving you time and effort.

3. Contact insurance companies directly: Reach out to insurers you’re interested in and request quotes. This allows you to ask specific questions and get personalized advice.

4. Compare quotes carefully: Don’t just focus on the price; compare coverage options and deductibles to find the best balance of protection and affordability.

5. Review the policy details: Before finalizing your choice, carefully review the policy documents to ensure you understand the terms and conditions.

6. Choose the best option: Select the policy that offers the best coverage at the most affordable price.

Understanding Insurance Policies in Chelmsford, MA

Navigating the world of car insurance can feel like driving through a blizzard – confusing and potentially costly. Understanding your policy’s specifics is crucial to avoid unpleasant surprises down the road. This section clarifies common exclusions, the claims process, and helps you decipher your policy document.

Common Exclusions and Limitations

Standard car insurance policies in Chelmsford, MA, like those across the state, typically exclude certain events or limit coverage under specific circumstances. For instance, damage caused by wear and tear, or damage resulting from driving under the influence of alcohol or drugs, is usually not covered. Similarly, there might be limitations on coverage for certain types of vehicles or for accidents that occur outside of the state. Many policies also have limitations on the amount they will pay for rental cars while your vehicle is being repaired. Always carefully review the policy’s “exclusions” section to fully understand what isn’t covered. For example, flood damage might require a separate flood insurance policy.

The Claims Process for a Typical Car Accident

After a car accident in Chelmsford, MA, promptly reporting the incident to both your insurer and the police is vital. Contact your insurance company as soon as possible, providing all relevant details, including the date, time, location, and circumstances of the accident, as well as the other driver’s information. Gather evidence like photos of the damage, police reports, and witness statements. Your insurer will guide you through the next steps, which may involve an adjuster inspecting the damage and negotiating settlements with the other party’s insurance company. Be prepared for potential delays, as processing claims can take time. Remember, accurate and thorough documentation is key to a smooth claims process.

Types of Car Insurance Claims

Car insurance policies in Massachusetts typically include several types of coverage. Liability coverage pays for damages you cause to others’ property or injuries you inflict on others in an accident. Collision coverage pays for repairs to your vehicle regardless of who is at fault. Comprehensive coverage covers damage to your car from events other than collisions, such as theft, vandalism, or weather damage. Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who lacks sufficient insurance. Understanding these different types of coverage helps you choose the right policy for your needs and anticipate what your insurance will cover in various scenarios. For example, a collision claim would cover repairs to your car after you rear-ended another vehicle, while a comprehensive claim might cover damage from a hailstorm.

Reading and Understanding Your Policy

Your car insurance policy is a legal contract. Understanding its key sections is crucial. The declarations page summarizes your coverage, including the policy period, insured vehicles, and coverage limits. The definitions section clarifies the meaning of specific terms used in the policy. The exclusions section, as mentioned earlier, Artikels what isn’t covered. The conditions section details your responsibilities as a policyholder, such as notifying the insurer promptly of an accident. Carefully review each section, and don’t hesitate to contact your insurer if anything is unclear. Understanding your policy empowers you to make informed decisions and avoid potential disputes later. A thorough understanding of your policy’s terms and conditions is your best defense against unexpected costs and complexities.

Local Resources and Considerations in Chelmsford, MA

Source: foolcdn.com

Navigating the world of car insurance in Chelmsford, MA, requires more than just comparing prices. Understanding the local landscape – from regulations to resources – is key to finding the best coverage at the right price. This section dives into the specifics, offering insights into the factors that shape your car insurance experience in this Massachusetts town.

Chelmsford, like all municipalities, operates within the framework of state and federal laws governing car insurance. These regulations dictate minimum coverage requirements, the types of insurance available, and the processes for filing claims. Understanding these regulations is crucial for ensuring you meet legal obligations and avoid potential penalties.

Local Regulations and Laws Affecting Car Insurance

Massachusetts is a no-fault insurance state. This means that after an accident, your own insurance company will cover your medical bills and lost wages, regardless of who caused the accident. However, you can sue the at-fault driver for damages exceeding your policy’s limits. Chelmsford drivers must adhere to these state-mandated minimum coverage levels, which include personal injury protection (PIP) and bodily injury liability. Specific regulations concerning uninsured/underinsured motorist coverage also apply. Staying informed about these regulations through the Massachusetts Division of Insurance website is highly recommended.

Local Resources for Car Insurance Assistance

Chelmsford residents needing assistance with car insurance issues can turn to several valuable resources. The Massachusetts Division of Insurance offers consumer guides, complaint filing procedures, and information on resolving disputes with insurance companies. Additionally, local consumer protection agencies can provide guidance and support in navigating insurance-related problems. These agencies often offer free consultations and can help resolve disputes or investigate unfair practices. The Better Business Bureau (BBB) is another valuable resource, offering information on the reliability and trustworthiness of various insurance providers.

Impact of Local Driving Conditions and Traffic Patterns on Insurance Rates, Car insurance chelmsford ma

Chelmsford’s traffic patterns and road conditions directly influence car insurance rates. Areas with higher accident rates or increased congestion typically lead to higher premiums. For instance, rush hour traffic on major roads like Route 3 and Route 495 can increase the risk of accidents, influencing insurance calculations. Similarly, the prevalence of certain types of accidents (e.g., rear-end collisions due to stop-and-go traffic) in specific areas can also impact rates. Insurance companies use statistical data to assess risk, and these local factors play a significant role in determining individual premiums.

Frequently Asked Questions about Car Insurance in Chelmsford, MA

Understanding car insurance can be tricky, so here are answers to some common questions faced by Chelmsford drivers:

- What are the minimum car insurance requirements in Massachusetts? Massachusetts mandates minimum bodily injury liability coverage, typically expressed as a combination of limits (e.g., 20/40/10, meaning $20,000 per person, $40,000 per accident for bodily injury, and $10,000 for property damage). Personal Injury Protection (PIP) coverage is also required. It’s important to consult the Massachusetts Division of Insurance for the most up-to-date requirements.

- How can I compare car insurance quotes in Chelmsford? Several online comparison websites allow you to enter your information and receive quotes from multiple insurers simultaneously. You can also contact insurance agents directly to obtain personalized quotes. Remember to compare not just price, but also coverage levels and policy details.

- What factors affect my car insurance rate in Chelmsford? Your driving history (accidents, violations), age, credit score, type of vehicle, and the location where you park your car overnight all play a role in determining your premium. Local driving conditions and the frequency of accidents in your area also contribute to your rate.

- What should I do if I’m involved in a car accident in Chelmsford? First, ensure everyone is safe. Then, call the police, exchange information with other drivers involved, and document the accident scene with photos and videos if possible. Report the accident to your insurance company as soon as possible. In a no-fault state like Massachusetts, your own insurance company will handle your initial claims, regardless of fault.

Epilogue

So, there you have it – your comprehensive guide to conquering car insurance in Chelmsford, MA. Remember, securing the right coverage shouldn’t feel like a Herculean task. By understanding the factors influencing your premiums, comparing quotes strategically, and leveraging available discounts, you can find a policy that perfectly fits your needs and budget. Don’t just settle for any old policy; take control of your car insurance and drive confidently knowing you’ve got the best possible protection.