Car insurance Biddeford: Navigating the world of car insurance in Biddeford, Maine can feel like driving through a fog. But don’t worry, we’re here to clear the road ahead. This guide breaks down everything you need to know, from understanding coverage options and finding the best providers to saving money and filing claims. Buckle up, because we’re about to make insurance less of a headache.

We’ll cover the typical insurance landscape in Biddeford, comparing premiums to state and national averages. We’ll explore different coverage types, the impact of local laws, and how factors like your driving history and credit score influence your rates. We’ll also show you how to find the best deals and what to do if you need to file a claim. Think of this as your ultimate survival kit for navigating the sometimes-tricky world of Biddeford car insurance.

Understanding Car Insurance in Biddeford, ME

Navigating the world of car insurance can feel like driving through a blizzard—confusing and potentially costly. But understanding the landscape in Biddeford, Maine, can help you find the right coverage at the right price. This guide breaks down the key aspects of car insurance in this coastal Maine city.

Biddeford, with its mix of residential areas and bustling commercial districts, presents a unique car insurance profile. The demographics, including age ranges and driving habits, influence the risk assessment made by insurance companies. Driving conditions, especially during the winter months with snow and ice, also play a significant role in determining premiums.

Average Insurance Premiums in Biddeford

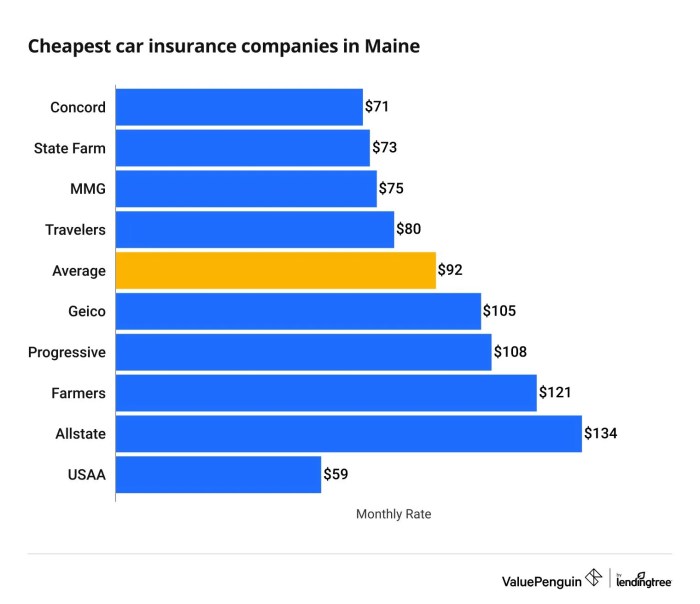

Comparing insurance costs in Biddeford to state and national averages reveals important insights into the local market. While precise figures fluctuate based on individual factors like driving history and vehicle type, a general comparison can be helpful. For example, a recent study might show that the average annual premium in Biddeford is slightly higher than the Maine state average due to factors like higher accident rates or a higher concentration of certain vehicle types. This difference might be further amplified when compared to the national average, reflecting the unique characteristics of the Maine insurance market. It’s crucial to obtain multiple quotes to find the best rate.

Types of Car Insurance Coverage in Biddeford

Several types of car insurance coverage are commonly available in Biddeford, mirroring the options across the state and nation. Liability coverage is typically required by law and protects you financially if you cause an accident resulting in injuries or property damage to others. Collision coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage extends beyond accidents, covering damage from events like theft, vandalism, or hail. Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who lacks sufficient insurance.

Impact of Local Laws and Regulations

Maine state laws and regulations significantly impact car insurance in Biddeford. The state mandates minimum liability coverage levels, which all drivers must meet. These minimums dictate the minimum amount of financial protection drivers must carry to cover potential damages. Furthermore, Maine’s regulations regarding uninsured motorist coverage and other specific aspects of insurance policies influence the options and costs available to Biddeford residents. Understanding these regulations is key to choosing appropriate coverage.

Finding Car Insurance Providers in Biddeford

Source: americaninsurance.com

Finding the right car insurance in Biddeford can be a hassle, but managing your policy shouldn’t be. That’s where simplifying things comes in; check out your policy details and make changes easily through my insurance portal. Getting back to Biddeford car insurance, remember to compare quotes before committing to a plan to ensure you’re getting the best deal for your needs.

Securing affordable and comprehensive car insurance in Biddeford, Maine, requires navigating a landscape of providers. Understanding your options and comparing offerings is key to finding the best fit for your needs and budget. This section will guide you through the process of identifying and selecting a car insurance provider in Biddeford.

Major Car Insurance Companies in Biddeford

Several major car insurance companies operate in Biddeford, offering a range of coverage options. Choosing the right one depends on individual needs and preferences. Below is a table summarizing some of the prominent players. Note that contact information and specific coverage offerings can change, so it’s always best to verify directly with the company. Customer review summaries are based on general online sentiment and may not reflect every individual’s experience.

| Company Name | Contact Information (Example – Verify Directly) | Types of Coverage Offered (Example – Verify Directly) | Customer Reviews Summary (Example – Verify Directly) |

|---|---|---|---|

| Geico | 1-800-GEICO, Website: geico.com | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist | Generally positive reviews, known for competitive pricing. |

| State Farm | Local Agent Contact Information (Find via StateFarm.com) | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, etc. | Mixed reviews, strong local agent network praised by some. |

| Progressive | 1-800-PROGRESSIVE, Website: progressive.com | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, etc. | Positive reviews for online tools and customer service, some complaints about claims handling. |

| Allstate | Local Agent Contact Information (Find via Allstate.com) | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, etc. | Mixed reviews, known for a wide range of coverage options. |

Independent Insurance Agents in Biddeford

Independent insurance agents in Biddeford offer a valuable service by representing multiple insurance companies. This allows them to shop around for the best rates and coverage options tailored to your specific needs. They often provide personalized advice and assistance with claims. Their services typically include policy comparison, personalized recommendations, and assistance with claims processing. Finding a reputable independent agent can streamline the process of finding the right insurance.

Using Online Insurance Comparison Tools

Online insurance comparison tools offer a convenient way to quickly gather quotes from multiple insurers. These tools typically require you to input your information once, then present a range of options. The advantages include convenience and the ability to compare various plans side-by-side. However, the information presented may not be completely comprehensive, and it’s crucial to carefully review the details of each policy before making a decision. Some tools may prioritize certain companies, potentially skewing the results. Directly contacting insurers after using comparison tools can help ensure you have a complete picture.

Obtaining a Car Insurance Quote in Biddeford: A Flowchart

The process of obtaining a car insurance quote can be visualized as a flowchart. This flowchart illustrates a simplified version; some steps may vary slightly depending on the provider.

[Imagine a flowchart here. The flowchart would start with “Need Car Insurance?” Yes leads to “Gather Necessary Information (Driver’s License, Vehicle Information, etc.)”. This leads to “Choose Method: Online Comparison Tool, Direct Contact with Insurer, Independent Agent”. Each of these branches would lead to “Request Quote”. “Request Quote” leads to “Review Quote and Coverage Options”. “Review Quote and Coverage Options” branches to “Accept Quote and Purchase Policy” or “Reject Quote and Repeat Process”. “Accept Quote and Purchase Policy” leads to “Policy Confirmation”. “Reject Quote and Repeat Process” loops back to “Choose Method”.]

Factors Affecting Car Insurance Rates in Biddeford

Securing affordable car insurance in Biddeford, Maine, depends on a variety of factors. Understanding these influences allows you to make informed decisions and potentially lower your premiums. This section details the key elements that insurance companies consider when calculating your rate.

Driving History

Your driving record is a major determinant of your insurance cost. A clean record, free of accidents and traffic violations, will typically result in lower premiums. Conversely, accidents, particularly those deemed your fault, and traffic violations like speeding tickets or DUIs, significantly increase your rates. The severity and frequency of incidents directly impact the cost. For instance, a single speeding ticket might lead to a modest increase, while a DUI conviction could result in a substantial premium hike, sometimes even leading to policy cancellation. Insurance companies view these incidents as indicators of higher risk.

Age and Driving Experience

Insurance companies often categorize drivers by age groups, reflecting the statistical risk associated with each. Younger drivers, especially those with limited driving experience, are generally considered higher risk and pay higher premiums. This is because younger drivers statistically have a higher accident rate. As drivers gain experience and age, their premiums typically decrease, reaching their lowest point in middle age, before potentially increasing again in later years.

Vehicle Type

The type of vehicle you drive significantly influences your insurance rate. Sports cars and luxury vehicles are often more expensive to insure than sedans or smaller cars due to higher repair costs and a greater likelihood of theft. Features like safety technology, such as anti-lock brakes and airbags, can influence the premium, with vehicles equipped with advanced safety features potentially receiving lower rates. The vehicle’s age and its safety rating also play a role.

Credit Score

In many states, including Maine, insurance companies use credit-based insurance scores to assess risk. A good credit score generally translates to lower insurance premiums, while a poor credit score can lead to higher rates. The rationale is that individuals with good credit history tend to be more responsible, and this behavior is correlated with safer driving habits. It’s important to note that this practice is controversial, but it remains a factor in many insurance calculations.

Discounts

Several discounts can significantly reduce your insurance premiums. A safe driver discount rewards accident-free driving over a specific period. Good student discounts are often available to students maintaining a certain GPA. Multi-car discounts are offered when insuring multiple vehicles under the same policy. Other discounts may be available for bundling insurance policies (e.g., home and auto) or for completing defensive driving courses. These discounts can add up to substantial savings.

Obtaining a Lower Insurance Rate

Several strategies can help you obtain a lower insurance rate. Maintaining a clean driving record is paramount. Shopping around and comparing quotes from multiple insurance providers is crucial. Improving your credit score can also positively impact your premiums. Taking advantage of available discounts, such as safe driver or good student discounts, can further reduce your costs. Consider opting for higher deductibles, though this increases your out-of-pocket expenses in case of an accident. Finally, choosing a less expensive vehicle to insure can also lower your overall premiums.

Filing a Claim in Biddeford: Car Insurance Biddeford

Source: neilsmotors.com

Navigating the car insurance claim process after an accident in Biddeford, Maine can feel overwhelming, but understanding the steps involved can significantly ease the stress. This guide provides a clear path to filing a claim effectively and efficiently. Remember, prompt action is key.

Reporting the Accident to Your Insurance Company

Immediately after a car accident in Biddeford, your first step should be contacting your insurance company. This initiates the claims process and allows them to begin investigating the incident. The sooner you report, the quicker the process can begin.

Steps Involved in Filing a Car Insurance Claim

- Contact your insurance company: Call your insurer’s claims hotline as soon as possible. They will provide you with a claim number and guide you through the next steps.

- Gather information at the accident scene: Before leaving the scene, collect crucial details such as the other driver’s insurance information, contact details, license plate number, and vehicle information. Take photos of the damage to both vehicles, the accident scene, and any visible injuries. If possible, obtain contact information from any witnesses.

- Complete an accident report: Your insurance company will likely require you to complete an accident report form detailing the circumstances of the accident. Be accurate and thorough in your description.

- Seek medical attention: If you or anyone involved sustained injuries, seek immediate medical attention. Document all medical treatments and expenses.

- Submit supporting documents: This includes the accident report, photos of the damage, police report (if applicable), medical records, and repair estimates.

Required Documents for a Car Insurance Claim, Car insurance biddeford

It’s crucial to gather all relevant documentation to support your claim. A complete and accurate submission streamlines the process and avoids delays. Missing information can significantly hinder your claim’s progress.

- Copy of your driver’s license and vehicle registration

- Police report (if applicable): If the police were involved, obtain a copy of the accident report.

- Photos and videos of the accident scene and vehicle damage

- Contact information of all parties involved, including witnesses

- Medical records and bills for any injuries sustained

- Repair estimates from certified mechanics

- Your completed claim form

Dealing with Insurance Adjusters in Biddeford

An insurance adjuster will be assigned to your claim to investigate the accident and assess the damages. Cooperate fully with the adjuster, providing them with all the necessary documentation promptly. Be prepared to answer questions about the accident and be honest and accurate in your responses. Remember, you have the right to legal representation throughout this process. If you feel the adjuster’s assessment is unfair, don’t hesitate to seek professional advice. Maintain clear and concise communication throughout the process. Keep copies of all correspondence and documentation.

Tips for Saving Money on Car Insurance in Biddeford

Navigating the world of car insurance can feel like driving through a blizzard – confusing and potentially costly. But fear not, Biddeford residents! There are several smart strategies you can employ to significantly reduce your premiums and keep more money in your pocket. By understanding the factors that influence your rates and taking proactive steps, you can achieve substantial savings.

Saving money on car insurance in Biddeford isn’t about luck; it’s about smart choices. This section Artikels practical strategies to lower your premiums, ensuring you get the best possible coverage without breaking the bank.

Bundling Insurance Policies

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, is a classic way to save. Many insurance companies offer discounts for bundling policies. This is because the insurer reduces administrative costs by handling multiple policies for a single customer. For example, if you bundle your car insurance with your homeowners insurance through the same company, you could see a discount of 10-15% or more on your overall premiums. The exact savings will vary depending on the insurer and the specific policies you bundle. This is a simple yet effective way to reduce your overall insurance expenses.

Maintaining a Good Driving Record

Your driving history is a major factor in determining your car insurance rates. A clean driving record, free of accidents and traffic violations, significantly lowers your premiums. Insurance companies view drivers with a history of accidents or tickets as higher risks, leading to increased premiums. Conversely, a spotless record demonstrates responsible driving habits, making you a lower-risk driver and resulting in lower costs. Consider taking a defensive driving course; many insurers offer discounts for completing such courses, further rewarding safe driving practices.

Resources for Finding Affordable Car Insurance in Biddeford

Finding the best car insurance deal requires some legwork, but it’s worth the effort. Here are some valuable resources to help you in your search for affordable car insurance in Biddeford:

- Online comparison websites: Websites like The Zebra, NerdWallet, and Insurify allow you to compare quotes from multiple insurers simultaneously, making it easy to identify the best rates.

- Independent insurance agents: These agents work with multiple insurance companies, allowing them to shop around for the best rates on your behalf.

- Direct insurers: Companies like Geico, Progressive, and State Farm offer competitive rates and convenient online tools.

- Local insurance brokers in Biddeford: Reaching out to local brokers can provide personalized service and access to insurers that may not be widely advertised online.

Remember to compare quotes from multiple sources and carefully review policy details before making a decision. Don’t just focus on the price; ensure the coverage meets your needs.

Closing Summary

Source: cloudinary.com

So, there you have it – your comprehensive guide to car insurance in Biddeford. Finding the right coverage shouldn’t be a stressful experience. By understanding the factors that influence your rates, comparing providers, and utilizing smart strategies, you can secure affordable and reliable protection for your vehicle. Remember, being informed is your best defense against unexpected costs and hassles. Drive safe, and drive smart!