Car insurance Baldwinsville NY: Navigating the world of car insurance can feel like driving through a blizzard blindfolded. Finding the right coverage at the right price in Baldwinsville, New York, requires understanding your options, comparing providers, and knowing what factors influence your premiums. This guide cuts through the confusion, offering insights into local providers, coverage types, rate influencers, and tips for securing the best deal. We’ll explore everything from liability and collision coverage to the impact of your driving history and age on your rates. Buckle up, because finding the perfect policy is about to get a whole lot easier.

From understanding the minimum insurance requirements in New York State to comparing quotes from major insurers and local agents, we’ll cover it all. We’ll also delve into the claims process, offer advice on safe driving practices to potentially lower your premiums, and even provide a handy checklist of questions to ask potential providers. This isn’t just another insurance guide; it’s your personalized roadmap to securing affordable and comprehensive car insurance in Baldwinsville.

Insurance Providers in Baldwinsville, NY

Finding the right car insurance in Baldwinsville, NY, can feel like navigating a maze. With numerous providers offering various plans and prices, it’s crucial to understand your options and compare before committing. This section provides a snapshot of insurers operating in the area, along with a glimpse into their rates and customer service experiences.

Car Insurance Companies in Baldwinsville, NY

The following table lists some car insurance companies that operate in or near Baldwinsville, NY. Keep in mind that this is not an exhaustive list, and the availability of specific companies and their offerings may vary. Always verify directly with the company for the most up-to-date information.

| Company Name | Address (May Vary by Location) | Phone Number (May Vary by Location) | Website |

|---|---|---|---|

| Geico | Various Locations; Check their website for nearest office. | 1-800-GEICO (434-26) | www.geico.com |

| State Farm | Various Locations; Check their website for nearest office. | 1-800-STATE FARM (782-8332) | www.statefarm.com |

| Progressive | Various Locations; Check their website for nearest office. | 1-800-PROGRESSIVE (776-4737) | www.progressive.com |

| Allstate | Various Locations; Check their website for nearest office. | 1-800-ALLSTATE (255-7828) | www.allstate.com |

| Liberty Mutual | Various Locations; Check their website for nearest office. | 1-800-4LIBERTY (454-2378) | www.libertymutual.com |

Average Rates Comparison for Three Major Providers

Precise average rates for car insurance in Baldwinsville, NY, are difficult to pinpoint without specific driver profiles (age, driving history, vehicle type, etc.). However, we can offer a generalized comparison based on industry averages and commonly reported experiences. Keep in mind that these are estimates and your actual rates may differ significantly.

Let’s consider Geico, State Farm, and Progressive as examples. Generally, Geico is often cited for competitive pricing, particularly for drivers with clean driving records. State Farm, known for its extensive network, may offer slightly higher rates in some cases, balancing it with comprehensive coverage options. Progressive, with its name-your-price tool, offers flexibility but rates can vary widely depending on the selected coverage and discounts. A hypothetical comparison might show Geico slightly lower than State Farm, with Progressive falling somewhere in between, depending on individual circumstances. For precise quotes, obtaining personalized quotes from each provider is necessary.

Customer Service Experiences

Customer service experiences are subjective and vary widely based on individual interactions and specific agents. However, analyzing online reviews and customer feedback provides a general sense of common experiences.

State Farm, with its vast network of local agents, often receives praise for personalized service and readily available local support. However, some reviews mention inconsistencies in agent responsiveness or difficulty reaching specific agents.

Geico, known for its online and phone-based services, frequently receives mixed reviews regarding customer service. While its online tools are praised for convenience, some customers report challenges resolving complex issues through phone support or experiencing longer wait times. The overall experience often depends on the specific agent or channel utilized.

Types of Car Insurance Coverage Available

Source: agencyheight.com

Navigating the world of car insurance can feel like driving through a blizzard—confusing and potentially costly. Understanding the different types of coverage is crucial to protecting yourself and your vehicle in Baldwinsville, NY, and beyond. This guide breaks down the essential coverages, clarifies New York’s minimum requirements, and provides real-world examples to illustrate their importance.

New York State, like all states, mandates specific minimum insurance coverages to ensure drivers are financially responsible for accidents they cause. Beyond these minimums, however, drivers can choose additional coverage to provide broader protection and peace of mind.

Liability Coverage

Liability insurance protects you financially if you cause an accident that injures someone or damages their property. This coverage pays for the other person’s medical bills, lost wages, and property repairs. In New York, the minimum liability coverage is 25/50/10, meaning $25,000 per person for bodily injury, $50,000 total for bodily injury per accident, and $10,000 for property damage. For example, if you cause an accident resulting in $30,000 in medical bills for one person, your liability coverage would only pay $25,000, leaving you responsible for the remaining $5,000. Higher liability limits offer greater protection against significant financial losses.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This is optional coverage, but highly recommended. Imagine a scenario where you hit a deer while driving through Baldwinsville’s scenic countryside. Collision coverage would take care of the repairs to your car, even though the deer wasn’t insured.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, hail, or even damage from hitting a deer (unlike collision, which doesn’t cover this). It also covers damage from natural disasters. This type of coverage provides a safety net for unforeseen circumstances that can leave you with significant repair bills. For instance, if a tree falls on your car during a severe thunderstorm, comprehensive coverage will cover the damages.

Uninsured/Underinsured Motorist Coverage

This crucial coverage protects you if you’re involved in an accident caused by an uninsured or underinsured driver. Unfortunately, such drivers exist, and this coverage steps in to pay for your medical bills and vehicle repairs even if the at-fault driver lacks sufficient insurance. Consider this example: you’re stopped at a red light in Baldwinsville when an uninsured driver rear-ends you. Uninsured/underinsured motorist coverage would help cover your medical expenses and vehicle damage.

Minimum Insurance Requirements in Baldwinsville, NY

New York State mandates a minimum of 25/50/10 liability coverage. This means $25,000 per person for bodily injury, $50,000 total for bodily injury per accident, and $10,000 for property damage. While these are minimums, it’s advisable to consider higher limits to adequately protect yourself financially.

Factors Affecting Car Insurance Rates in Baldwinsville, NY

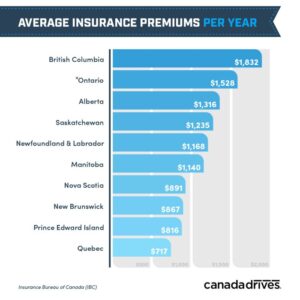

Source: slideserve.com

Finding the right car insurance in Baldwinsville, NY, can feel like navigating a maze, but getting the best coverage is key. Think about the peace of mind that comes with knowing you’re protected – it’s a similar feeling to securing great insurance in other parts of the country, like finding the perfect plan for insurance Kingsport TN.

Ultimately, securing the right car insurance in Baldwinsville boils down to careful research and comparing quotes to find the best fit for your needs and budget.

Securing affordable car insurance in Baldwinsville, NY, requires understanding the factors influencing your premium. Several elements contribute to the final cost, and knowing these can help you make informed decisions to potentially lower your rates. This section explores key factors that impact your car insurance premiums.

Driving History

Your driving record significantly impacts your car insurance costs in Baldwinsville, NY, as it reflects your risk profile to insurers. A clean driving history, free of accidents and traffic violations, generally translates to lower premiums. Conversely, accidents, speeding tickets, DUIs, or other moving violations will likely result in higher premiums. The severity of the incident and the frequency of infractions are also considered. For example, a single minor fender bender might increase your rates less than a serious accident resulting in injuries or property damage. Multiple violations within a short period will significantly increase your risk profile and, consequently, your premiums. Insurers view consistent safe driving as a sign of responsibility, rewarding it with lower rates.

Age and Gender

Statistically, age and gender are factors influencing car insurance rates. Younger drivers, particularly those under 25, typically pay higher premiums due to higher accident rates in this demographic. This is because younger drivers often lack experience and may be more prone to risky driving behaviors. As drivers age and gain experience, their premiums usually decrease. Gender also plays a role, with some studies suggesting that statistically, men tend to have higher accident rates than women, leading to potentially higher premiums for male drivers in certain age groups. However, it’s important to note that these are broad statistical trends and individual driving records remain the most significant determinant of rates.

Type of Vehicle

The type of vehicle you drive directly affects your insurance premiums. Sports cars and high-performance vehicles are generally more expensive to insure than sedans or smaller, more fuel-efficient cars. This is due to higher repair costs, a greater likelihood of theft, and the potential for higher speeds and more severe accidents. The vehicle’s safety features, such as airbags and anti-lock brakes, also play a role. Vehicles with advanced safety technologies might qualify for discounts. The year, make, and model of your car are all considered when calculating your insurance premium.

Location, Car insurance baldwinsville ny

Your address in Baldwinsville, NY, can impact your insurance rates. Insurers assess the risk of theft, accidents, and other incidents in specific geographic areas. Areas with higher crime rates or a higher frequency of accidents tend to have higher insurance premiums. This reflects the increased likelihood of claims in these zones. Even within Baldwinsville, variations in risk profiles between neighborhoods can lead to differing insurance costs.

Credit Score

In many states, including New York, your credit score can be a factor in determining your car insurance rates. Insurers often use credit-based insurance scores to assess your risk. A good credit score is generally associated with lower premiums, while a poor credit score might lead to higher premiums. The reasoning behind this is that individuals with good credit are often considered more responsible and less likely to file fraudulent claims. However, the impact of credit score on insurance rates varies by insurer and state regulations.

Finding the Best Car Insurance Deal in Baldwinsville, NY: Car Insurance Baldwinsville Ny

Landing the best car insurance deal in Baldwinsville requires a bit of savvy shopping. Don’t just settle for the first quote you see – a little legwork can save you hundreds, if not thousands, of dollars annually. This section will equip you with the tools and strategies to navigate the world of car insurance quotes and find the policy that perfectly fits your needs and budget.

Comparing car insurance quotes effectively hinges on a systematic approach. You need to be comparing apples to apples, ensuring the coverage levels are consistent across different providers. Ignoring this crucial step can lead to inaccurate comparisons and ultimately, a less-than-optimal choice. Consider factors like deductibles and coverage limits – a lower premium might come with a higher deductible, meaning you’ll pay more out-of-pocket in the event of an accident.

Comparing Car Insurance Quotes from Different Providers

To effectively compare quotes, utilize online comparison tools. These tools allow you to input your information once and receive quotes from multiple insurers simultaneously. Remember to carefully review the details of each quote, paying close attention to the coverage limits, deductibles, and any additional features included or excluded. Don’t just focus on the premium amount; consider the overall value and protection offered. For example, comparing a quote with liability-only coverage to one with comprehensive coverage isn’t a fair comparison; the latter will cost more but provide significantly more protection. Look for insurers with strong financial ratings and positive customer reviews.

Obtaining Car Insurance Quotes Online: A Step-by-Step Guide

- Gather your information: Before you start, collect necessary details like your driver’s license number, vehicle information (make, model, year), and driving history (including any accidents or violations).

- Use online comparison websites: Several websites specialize in comparing car insurance quotes. Popular options include The Zebra, NerdWallet, and Policygenius. Input your information into the comparison tool and let the site do the work.

- Review the quotes: Once you receive the quotes, meticulously compare the coverage details, premiums, and deductibles. Don’t just focus on the price; consider the value of the coverage offered.

- Check the insurer’s reputation: Research the insurance companies offering quotes. Look at their financial stability ratings (e.g., from AM Best) and read customer reviews to gauge their reputation for claims handling.

- Contact insurers directly: If you find a few promising quotes, contact the insurers directly to ask any clarifying questions or request additional information.

- Choose a policy: Once you’ve compared quotes and thoroughly researched the insurers, select the policy that best suits your needs and budget. Ensure you understand all the terms and conditions before purchasing.

Questions to Ask Insurance Providers Before Purchasing a Policy

Before committing to a policy, it’s crucial to clarify any uncertainties. Asking the right questions can save you from unexpected costs and ensure you have the appropriate coverage. Avoid vague questions; instead, focus on specific details relevant to your circumstances.

- What are the specific coverage limits for liability, collision, and comprehensive coverage?

- What is the deductible for each type of coverage, and how does it affect my premium?

- What discounts are available (e.g., safe driver, good student, multi-car)?

- What is the claims process, and how long does it typically take to resolve a claim?

- What is the insurer’s financial strength rating, and what does it mean for my protection?

- Are there any additional fees or surcharges that may apply?

- What is the insurer’s customer service reputation, and how can I contact them if I have a question or need assistance?

Understanding Your Car Insurance Policy

Source: cloudinary.com

Navigating the world of car insurance can feel like driving through a blizzard—confusing and potentially costly. Understanding your policy isn’t just about avoiding hefty bills; it’s about knowing your rights and ensuring you’re adequately protected. This section breaks down the key elements of a typical car insurance policy, helping you decipher the fine print and feel confident in your coverage.

Your car insurance policy is a legally binding contract outlining the agreement between you and your insurance company. It details the specific coverage you’ve purchased, the terms and conditions under which that coverage applies, and your responsibilities as a policyholder. Understanding these components is crucial for making informed decisions and successfully navigating any claims process.

Key Terms and Conditions

A standard car insurance policy includes several crucial terms. These terms define your coverage, limitations, and responsibilities. For example, the “declarations page” summarizes your policy’s key features, including the covered vehicle, coverage limits, and premium amount. The “policy provisions” section Artikels your obligations, such as notifying the insurer of an accident promptly and cooperating fully with their investigation. Understanding terms like “deductible” (the amount you pay out-of-pocket before your insurance coverage kicks in), “premium” (the amount you pay for your insurance), and “liability coverage” (which covers injuries or damages you cause to others) is essential. Other important terms often include uninsured/underinsured motorist coverage (protecting you if you’re hit by an uninsured driver), collision coverage (covering damage to your car regardless of fault), and comprehensive coverage (covering damage from events other than collisions, like theft or weather damage).

The Claims Process for a Car Accident in Baldwinsville, NY

Getting into a car accident is stressful enough; dealing with the insurance claim shouldn’t add to the burden. The process generally begins with reporting the accident to the police and your insurance company as soon as possible. Accurate documentation is key—gather information like the other driver’s insurance details, contact information of witnesses, and photos of the damage. Your insurance company will then investigate the accident to determine liability and the extent of the damage. Depending on the circumstances, this might involve reviewing police reports, conducting interviews, and obtaining independent appraisals. This process varies depending on the specifics of the accident and the insurance company’s procedures, but clear and prompt communication is always vital.

Steps Involved in Filing a Claim

Filing a claim efficiently requires a structured approach. Following these steps will help ensure a smoother process:

- Report the accident to the police: This creates an official record of the incident.

- Contact your insurance company: Report the accident promptly, usually within 24-48 hours, as stipulated in your policy.

- Gather information: Collect all relevant details, including police report numbers, contact information of all involved parties, witness statements, and photographic evidence of the damage.

- Complete the claim form: Provide accurate and detailed information on the claim form provided by your insurer.

- Cooperate with the investigation: Respond to your insurer’s requests for information promptly and honestly.

- Seek medical attention if necessary: Document all medical expenses related to the accident.

- Follow up on your claim: Regularly check the status of your claim with your insurance company.

Local Resources for Car Insurance in Baldwinsville, NY

Finding the right car insurance in Baldwinsville can feel overwhelming, but leveraging local resources can significantly simplify the process and potentially save you money. Knowing where to look for reliable agents and understanding the benefits of local expertise can make all the difference in securing the best coverage for your needs.

Local Independent Insurance Agents in Baldwinsville, NY

Independent insurance agents act as brokers, comparing policies from multiple companies to find the best fit for your situation. This contrasts with working directly with a single insurance company, which limits your options. Using a local agent offers personalized service and access to a wider range of insurance products. The following table provides examples; note that this information may change, so always verify directly with the agency.

| Agent Name | Agency Name | Address | Phone Number |

|---|---|---|---|

| (Agent Name 1 – Replace with actual agent name) | (Agency Name 1 – Replace with actual agency name) | (Address 1 – Replace with actual address) | (Phone Number 1 – Replace with actual phone number) |

| (Agent Name 2 – Replace with actual agent name) | (Agency Name 2 – Replace with actual agency name) | (Address 2 – Replace with actual address) | (Phone Number 2 – Replace with actual phone number) |

| (Agent Name 3 – Replace with actual agent name) | (Agency Name 3 – Replace with actual agency name) | (Address 3 – Replace with actual address) | (Phone Number 3 – Replace with actual phone number) |

| (Agent Name 4 – Replace with actual agent name) | (Agency Name 4 – Replace with actual agency name) | (Address 4 – Replace with actual address) | (Phone Number 4 – Replace with actual phone number) |

Benefits of Using a Local Insurance Agent

Local agents offer several key advantages. Their in-depth knowledge of the Baldwinsville area allows them to understand local risks and regulations, leading to more tailored insurance recommendations. They provide personalized service, building relationships with clients and offering ongoing support beyond just the initial policy sale. This personal touch can be invaluable when dealing with claims or making adjustments to your coverage. Finally, local agents often have strong ties to the community, potentially offering additional resources or connections that larger companies might not.

Local Resources for Affordable Car Insurance

Several resources might be available to help Baldwinsville residents find more affordable car insurance. These may include community-based organizations offering financial literacy programs or assistance with navigating insurance options. State-sponsored programs or initiatives focused on providing affordable insurance for low-income individuals might also exist. Contacting local social service agencies or the New York State Department of Insurance is recommended to explore these possibilities. Always verify eligibility requirements for any such programs.

Car Insurance and Driving Safety in Baldwinsville, NY

Safe driving practices aren’t just about avoiding accidents; they significantly impact your car insurance premiums in Baldwinsville, NY. Insurance companies reward responsible drivers with lower rates, reflecting the reduced risk they represent. Conversely, a history of accidents or violations leads to higher premiums, a direct consequence of increased risk to the insurer. Understanding this relationship is crucial for saving money and maintaining a clean driving record.

Your driving habits directly influence your insurance costs. A clean driving record, characterized by the absence of accidents and traffic violations, translates to lower premiums. Conversely, at-fault accidents, speeding tickets, and other moving violations increase your risk profile, resulting in higher insurance rates. The severity of the offense also matters; a major accident will typically result in a more substantial premium increase than a minor infraction. This system incentivizes safe driving and responsible behavior on the road.

Safe Driving Practices in Baldwinsville, NY

Baldwinsville, like any other community, presents its own set of driving challenges. Understanding these challenges and adopting proactive safety measures can significantly reduce your risk of accidents and, consequently, your insurance costs. This involves awareness of local traffic patterns, road conditions, and potential hazards specific to the Baldwinsville area. For instance, awareness of common rush hour congestion points and adapting driving accordingly can prevent accidents. Regularly checking local news for road closures or construction can help you avoid unexpected delays and hazardous situations.

Defensive Driving Techniques for Accident Reduction

Defensive driving is more than just obeying traffic laws; it’s about anticipating potential hazards and reacting proactively to minimize risk. This includes maintaining a safe following distance, allowing ample time for braking, and being aware of blind spots. In Baldwinsville, defensive driving becomes even more crucial due to varying road conditions and traffic patterns. For example, anticipating the actions of other drivers, such as sudden lane changes or unexpected stops, is vital in preventing collisions. Being prepared for unexpected events significantly reduces the likelihood of being involved in an accident. Mastering defensive driving techniques translates directly to a lower risk of accidents, which positively impacts your car insurance premiums.

Ultimate Conclusion

Securing the right car insurance in Baldwinsville, NY, shouldn’t be a headache. By understanding the different coverage options, comparing quotes, and considering the factors influencing your rates, you can find a policy that fits your needs and budget. Remember, proactive driving and a thorough understanding of your policy are key to saving money and ensuring you’re protected on the road. So, take control of your car insurance journey, and drive confidently knowing you’re covered.