Can you cancel claim car insurance – Can you cancel car insurance claim? That’s a question many drivers grapple with after an accident. Navigating the complexities of insurance claims can feel like driving through a minefield, especially when you’re unsure if canceling a claim is even an option. This guide breaks down everything you need to know, from understanding cancellation policies and the process itself, to the potential consequences and smarter alternatives. We’ll explore the legal aspects, offer real-world scenarios, and arm you with the knowledge to make the best decision for your situation.

Whether you’re dealing with a minor fender bender or a more significant collision, understanding your rights and options is crucial. This isn’t just about the immediate aftermath; canceling a claim can have long-term implications for your premiums and future insurance coverage. So, buckle up and let’s dive into the world of car insurance claim cancellations.

Understanding Cancellation Policies

So, you’re thinking about cancelling a car insurance claim? It’s a valid thought, especially if circumstances have changed or you’ve reconsidered your initial decision. However, it’s not always a straightforward process. Understanding your insurer’s cancellation policy is crucial to avoid any unexpected complications or fees.

Claim Cancellation Timeframes

The timeframe for cancelling a car insurance claim varies significantly depending on the insurer and the stage of the claim process. Generally, the sooner you act, the easier it is to cancel. Many insurers allow cancellations before the claim is fully processed, often within a few days to a couple of weeks of reporting the incident. However, once an adjuster has begun investigating, or repairs have commenced, cancellation becomes significantly more difficult, if not impossible. Contacting your insurer immediately is key.

Factors Affecting Cancellation Eligibility

Several factors determine whether you can cancel a car insurance claim. The type of claim plays a significant role. For instance, cancelling a claim for minor damage might be easier than cancelling a claim involving significant injury or extensive vehicle damage. Your policy terms and conditions also dictate the cancellation process. Look for clauses specifically addressing claim withdrawals or cancellations. Additionally, the insurer’s internal policies and procedures will influence their willingness to allow a cancellation. Each insurer has its own set of rules and guidelines.

Examples of Possible Claim Cancellations

Imagine you reported a minor fender bender, but later discovered the damage was less significant than initially thought and you’re comfortable covering the costs yourself. This is a scenario where claim cancellation might be possible. Another example could be if you mistakenly reported a claim, realizing later that you were not at fault. Or perhaps you found an alternative method of resolving the damage, such as a direct settlement with the other party involved. However, it’s crucial to remember that not all situations allow for cancellation.

Comparison of Cancellation Policies Across Insurers

It’s important to note that the information below is for illustrative purposes only and may not reflect the current policies of these insurers. Always refer to your individual policy documents and contact your insurer directly for the most accurate and up-to-date information.

| Insurer | Typical Cancellation Timeframe | Factors Affecting Eligibility | Cancellation Fees (Example) |

|---|---|---|---|

| Insurer A | Within 7 days of claim reporting | Claim severity, policy terms, investigation status | None (in some cases) |

| Insurer B | Before claim processing begins | Policy terms, insurer’s discretion | Potential administrative fee |

| Insurer C | Before repairs commence | Claim type, investigation progress | Variable, depending on circumstances |

| Insurer D | Highly restrictive; unlikely after investigation starts | Extensive factors, largely at insurer’s discretion | Potentially significant fees |

The Cancellation Process

Source: co.in

So, you’ve decided to cancel your car insurance claim. It’s a decision that requires a clear understanding of the process to ensure a smooth and efficient outcome. While the specifics might vary slightly depending on your insurer, the general steps remain consistent. Let’s break down exactly how to navigate this.

Initiating a claim cancellation request involves several key steps, each contributing to the overall success of your action. Proper documentation and clear communication are paramount to avoid any unnecessary delays or complications.

Required Documentation for Claim Cancellation

Gathering the necessary documents beforehand streamlines the cancellation process. This avoids back-and-forth communication and potential delays. Generally, you’ll need your policy number, the claim number (if applicable), and a clear statement explaining the reason for cancellation. Additional documents might be requested depending on the specific circumstances of your claim. For instance, if you’re canceling due to a settlement with a third party, proof of that settlement would be essential. Keep copies of all documentation for your records.

Communication Methods for Contacting Your Insurer

Contacting your insurance provider is a crucial step, and you have several options available. A phone call often provides the quickest way to initiate the process and speak directly with a representative. However, emailing your request allows for a written record of your communication. Sending a cancellation request via mail is a less common method, but it does provide a physical record. Choose the method that best suits your needs and comfort level, remembering to keep a copy of your communication for your records.

Claim Cancellation Procedure Flowchart

Imagine a flowchart. The first box would be “Initiate Cancellation Request.” Arrows branch out to “Phone,” “Email,” or “Mail.” Each of these branches leads to a box labeled “Submit Required Documentation,” which includes the policy number, claim number, and reason for cancellation. From there, an arrow leads to “Insurer Review and Confirmation.” This box then branches into two possibilities: “Cancellation Approved” or “Cancellation Denied (with reason).” “Cancellation Approved” leads to a final box: “Claim Cancellation Complete.” “Cancellation Denied” would ideally loop back to “Submit Required Documentation” to allow for corrections or further clarification. This visual representation clearly Artikels the steps involved, ensuring a clear understanding of the process.

Potential Consequences of Cancellation: Can You Cancel Claim Car Insurance

Cancelling a car insurance claim, while seemingly a simple solution to a stressful situation, can have significant and long-lasting repercussions. Understanding these potential consequences is crucial before making such a decision. The impact extends beyond the immediate situation and can affect your insurance costs and your ability to secure future coverage.

Cancelling a claim, especially after the process has begun, can severely impact your future insurance premiums. Insurance companies use claims history to assess risk. A cancelled claim, regardless of the reason, often flags you as a higher-risk driver. This translates to increased premiums for years to come, potentially costing you significantly more than the initial claim settlement would have. The exact increase depends on various factors, including your insurance provider, your driving history, and the specifics of the cancelled claim.

Impact on Future Premiums After Claim Cancellation

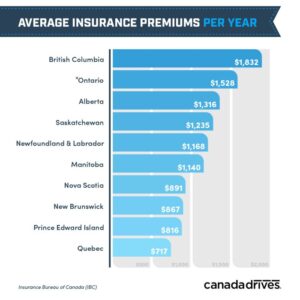

Insurance companies maintain detailed records of all claims, including those that are cancelled. When you renew your policy, this information is factored into the calculation of your premium. A cancelled claim suggests a higher likelihood of future claims, leading insurers to increase your premium to offset the perceived increased risk. For example, a driver who cancels a relatively minor claim might see a 10-20% increase in their premiums for the next few years. Larger, more significant claims could lead to even steeper increases, or even policy non-renewal. This increase in premiums can persist for several years, making the short-term financial gain from cancellation a poor long-term investment.

Repercussions for Cancelling a Claim Mid-Process

Cancelling a claim mid-process can create additional complications. The insurance company may have already started investigating the claim, incurring costs in doing so. These costs, while often absorbed by the insurer, could potentially influence their assessment of future claims. Furthermore, cancelling a claim after you’ve already provided information and potentially engaged with repair shops or other involved parties can create administrative headaches and potentially damage your credibility with the insurer.

Long-Term Effects of Cancelling Versus Proceeding with a Claim

The long-term financial implications of cancelling versus proceeding with a claim often favor proceeding. While the immediate payout from a claim might seem undesirable, the potential long-term costs of a cancelled claim in the form of higher premiums can significantly outweigh any short-term savings. A realistic cost-benefit analysis, considering the potential for premium increases over several years, often demonstrates that proceeding with the claim is the more financially prudent choice in the long run.

Potential Financial Implications of Claim Cancellation

The financial implications of cancelling a car insurance claim can be substantial and long-lasting.

- Increased insurance premiums for several years.

- Difficulty securing future insurance coverage, potentially leading to higher premiums with a new insurer.

- Potential for a negative impact on your credit score, though less common.

- Lost opportunity for compensation for damages and medical expenses.

- Increased out-of-pocket expenses to cover repair costs or medical bills.

Alternatives to Cancellation

So, you’re facing a car insurance claim, and the thought of cancelling it entirely is looming. Before you take that leap, let’s explore some less drastic – and potentially more financially savvy – options. Sometimes, a little negotiation can go a long way.

Cancelling your claim might seem like the easiest route, but it could have unforeseen consequences on your premiums and future claims. Let’s examine some alternatives that might save you money and hassle in the long run. Remember, the goal is to find a solution that works for both you and your insurance company.

Negotiating Settlements

Negotiating a settlement with your insurance company is a viable alternative to cancelling your claim. This involves discussing the damages and reaching an agreement on a fair compensation amount. This often requires providing detailed documentation of the damages, such as repair estimates or medical bills. Successful negotiation hinges on presenting a strong case, clearly outlining the extent of your losses, and remaining calm and professional throughout the process. A strong case might include photos of damage, witness statements, and police reports. The benefits include avoiding the potential negative impact on your premiums associated with claim cancellation and receiving some financial compensation for your losses. However, it requires time, effort, and the ability to effectively communicate your needs. The cost-effectiveness depends on the negotiation outcome; a successful negotiation could save you money compared to paying for repairs or medical bills out of pocket. A poorly negotiated settlement, however, might leave you financially worse off.

Utilizing Alternative Dispute Resolution

If negotiations with your insurance company fail to yield a satisfactory outcome, consider alternative dispute resolution (ADR) methods. ADR encompasses various approaches such as mediation and arbitration, which provide a neutral platform for resolving disagreements. Mediation involves a neutral third party facilitating communication between you and the insurance company, helping to reach a mutually agreeable solution. Arbitration, on the other hand, involves a neutral third party making a binding decision. The benefits include a structured approach to resolving disputes, potentially avoiding costly litigation, and access to a neutral party’s expertise. Drawbacks include the cost of mediation or arbitration fees and the time commitment involved. Cost-effectiveness depends on the specific ADR method chosen and the outcome achieved; it could potentially save you money compared to legal action, but the fees themselves need to be factored in.

Steps Before Considering Cancellation

Before even contemplating cancelling your car insurance claim, consider these crucial steps:

- Thoroughly document all damages and losses, including photos, repair estimates, and medical bills.

- Review your insurance policy carefully to understand your coverage and the claims process.

- Communicate clearly and professionally with your insurance adjuster, providing all necessary documentation.

- Explore all available options for dispute resolution before considering cancellation.

- Seek legal counsel if you believe your claim is being unfairly handled.

These steps can help you build a strong case and potentially avoid the need to cancel your claim altogether. Remember, proactive communication and thorough documentation are key.

Legal Aspects of Claim Cancellation

Source: co.uk

Navigating the legal landscape surrounding car insurance claim cancellations can be tricky, involving a complex interplay of rights and responsibilities for both the insured and the insurer. Understanding these legal aspects is crucial to avoid potential pitfalls and ensure a fair outcome. This section explores the legal ramifications of claim cancellations, highlighting key considerations and potential consequences.

Insurers and insureds operate under a contract governed by state laws and common law principles of contract interpretation. The insurance policy itself acts as the primary legal document outlining the terms and conditions, including procedures for filing and cancelling claims. Breaches of this contract can lead to legal disputes. State regulations often dictate specific procedures for claim cancellation, adding another layer of legal complexity.

Insured’s Rights and Responsibilities

The insured has the right to file a claim under their policy, provided the claim falls within the policy’s coverage. However, this right is not absolute. The insured is obligated to provide accurate and truthful information when filing a claim. Submitting fraudulent information or attempting to deceive the insurer is a serious breach of contract and can have significant legal consequences. The insured also has the right to appeal a claim denial, usually through a formal process Artikeld in the policy or by state law. Failure to comply with the insurer’s reasonable requests for information or cooperation during the claims process can jeopardize the claim.

Insurer’s Rights and Responsibilities

Insurers have the right to investigate claims thoroughly to determine coverage and liability. They can request documentation, conduct inspections, and interview witnesses. They also have the right to deny a claim if it is found to be fraudulent, outside the scope of coverage, or if the insured has violated the terms of the policy. However, insurers must conduct their investigations fairly and reasonably. Arbitrary or capricious denial of a legitimate claim can lead to legal action. They also have a responsibility to process claims in a timely manner, as stipulated by state regulations and their own internal policies.

Legal Consequences of Fraudulent Claim Cancellation

Attempting to fraudulently cancel a claim, such as by misrepresenting facts or concealing information, is a serious offense with potentially severe consequences. This could involve civil penalties, such as breach of contract lawsuits leading to financial penalties and legal fees for the insured. In more serious cases, particularly those involving significant financial losses for the insurer, criminal charges, such as insurance fraud, could be filed, leading to fines, imprisonment, and a criminal record. The insurer could also pursue legal action to recover any payments made on the fraudulent claim.

Influence of State Laws

State laws significantly impact claim cancellation procedures. Each state has its own insurance regulations, which dictate aspects like claim filing deadlines, investigation procedures, and the grounds for claim denial. Some states may have stricter regulations regarding claim cancellations than others, offering greater protection for the insured or the insurer. For example, some states may have specific laws regarding bad faith claims handling, allowing the insured to sue the insurer for unreasonable delays or denials. It’s crucial to understand the specific laws of your state when dealing with a claim cancellation. Consulting with an attorney specializing in insurance law can provide valuable guidance.

Illustrative Scenarios

Let’s explore some real-world situations to understand when cancelling a car insurance claim is a smart move and when it’s a risky gamble. We’ll examine the nuances of each scenario to highlight the crucial differences.

Understanding the implications of cancelling a car insurance claim requires careful consideration of the potential benefits against the possible drawbacks. The decision hinges on the specific circumstances surrounding the accident and the overall cost-benefit analysis.

Advisable Cancellation Scenario: Minor Damage, High Deductible

Imagine you’re involved in a fender bender. The damage to your car is minor – a small scratch on the bumper, easily fixed with a touch-up paint job. Your insurance deductible is $1000, and the estimated repair cost is only $500. In this case, filing a claim would mean paying the deductible and potentially impacting your insurance premiums. Cancelling the claim and self-paying for the repairs is the financially wiser option. You avoid the potential premium increase and save money overall.

Inadvisable Cancellation Scenario: Significant Damage, Low Deductible, Liability Involved

Now, picture a more serious accident. Your car is significantly damaged, requiring extensive repairs exceeding $5000. Your deductible is only $250. Furthermore, the accident was your fault, and the other driver sustained injuries and significant vehicle damage. Cancelling the claim in this situation would be unwise. You’d be responsible for all repair costs, potentially facing substantial medical bills for the other driver, and leaving yourself vulnerable to lawsuits. Your insurance coverage protects you from these potentially catastrophic financial burdens.

Comparison of Scenarios, Can you cancel claim car insurance

The key difference lies in the balance between the cost of repairs, the deductible, the potential impact on premiums, and the involvement of liability. In the first scenario, the cost of repairs was low relative to the deductible, and there was no liability. In the second, the cost of repairs and potential liability were significantly higher, outweighing the cost of the deductible and the potential premium increase.

| Feature | Advisable Cancellation | Inadvisable Cancellation |

|---|---|---|

| Damage Severity | Minor (e.g., small scratch) | Significant (e.g., extensive body damage) |

| Repair Cost | Less than deductible | Greater than deductible |

| Deductible | High | Low |

| Liability Involved | None | Present (potential injury/damage to others) |

Final Conclusion

Source: myfirst.com

So, can you cancel a car insurance claim? The short answer is: sometimes. The reality is far more nuanced than a simple yes or no. Understanding your policy, the type of claim, and the potential repercussions is key. While canceling might seem like a quick fix, it could have unforeseen financial and legal consequences. Weigh the pros and cons carefully, explore alternatives like negotiation, and if necessary, seek legal counsel. Remember, informed decisions lead to better outcomes, especially when navigating the tricky waters of car insurance.