Best workers comp insurance for construction isn’t just about ticking a box; it’s about safeguarding your crew and your business. Construction sites are inherently risky, with falls, electrocutions, and heavy machinery accidents a constant threat. Finding the right workers’ compensation insurance means understanding these risks, comparing policies, and choosing a provider that prioritizes both cost-effectiveness and comprehensive coverage. This isn’t just about compliance – it’s about building a safer, more secure future for your company.

This guide dives deep into the world of construction workers’ comp, exploring everything from common workplace injuries and policy features to selecting the right insurer and implementing effective safety programs. We’ll break down the complexities of premiums, legal compliance, and budgeting, providing you with the knowledge you need to make informed decisions and protect your bottom line. Get ready to build a stronger, safer, and more financially secure construction business.

Understanding Construction Worker Risks: Best Workers Comp Insurance For Construction

Construction work, while vital to our infrastructure, is inherently dangerous. The nature of the job—working at heights, operating heavy machinery, and handling hazardous materials—leads to a significantly higher rate of workplace injuries compared to other industries. Understanding these risks is crucial for both employers and employees to implement effective safety measures and secure appropriate workers’ compensation insurance.

Construction workers face a multitude of hazards daily, resulting in a wide range of injuries. These injuries not only impact the individual worker’s health and well-being but also significantly affect productivity and increase the cost of workers’ compensation claims for businesses. A comprehensive understanding of these risks is paramount for mitigating these issues.

Common Construction Workplace Injuries

Falls, struck-by incidents, caught-in/between events, and electrocutions are the leading causes of fatalities and serious injuries in construction. Falls from heights remain the most prevalent and often result in catastrophic injuries, including fractures, spinal cord damage, and traumatic brain injuries. Struck-by incidents involve being hit by falling objects, vehicles, or equipment, leading to a variety of injuries depending on the force and object involved. Caught-in/between incidents occur when workers become trapped or compressed by equipment or materials, often resulting in crushing injuries or asphyxiation. Electrocution, due to contact with energized electrical components, can be fatal or cause severe burns and neurological damage. Beyond these major categories, repetitive strain injuries, lacerations, and burns are also common occurrences.

Specific Hazards by Construction Trade

The specific risks faced vary significantly depending on the trade. Electricians, for example, face a high risk of electrocution and arc flash injuries. Carpenters work with sharp tools and heavy materials, leading to lacerations, crush injuries, and repetitive strain injuries like carpal tunnel syndrome. Roofers face a significant risk of falls from heights, as well as injuries from working with sharp roofing materials. Ironworkers work at great heights and with heavy steel components, facing risks of falls, crush injuries, and struck-by incidents. Demolition workers deal with unstable structures and hazardous materials, increasing the likelihood of collapses and exposure to harmful substances.

Factors Contributing to High Workers’ Compensation Claims

Several factors contribute to the high cost of workers’ compensation claims in the construction industry. Inadequate safety training and enforcement of safety regulations are significant contributors. A lack of proper personal protective equipment (PPE) leaves workers vulnerable to injuries. Time pressures and rushed work practices often lead to shortcuts that compromise safety. Furthermore, the prevalence of subcontracting can sometimes lead to gaps in safety oversight and accountability. Finally, the physical demands of the job, combined with the potential for severe injuries, result in high medical costs and extended periods of lost work time.

Frequency and Severity of Common Construction Injuries

| Injury Type | Frequency | Severity | Example |

|---|---|---|---|

| Falls | High | High | Fractures, spinal cord injuries, traumatic brain injuries |

| Struck-by | High | Moderate to High | Contusions, fractures, lacerations |

| Caught-in/between | Moderate | High | Crushing injuries, amputations |

| Repetitive Strain Injuries | High | Low to Moderate | Carpal tunnel syndrome, tendonitis |

Key Features of Workers’ Compensation Insurance Policies

Navigating the world of workers’ compensation insurance for your construction firm can feel like scaling a skyscraper without safety gear. Understanding the key features of these policies is crucial to ensuring your business and your employees are adequately protected. This section will break down the essential elements you need to know to make informed decisions.

A typical workers’ compensation policy for construction firms provides coverage for medical expenses and lost wages resulting from work-related injuries or illnesses. This includes doctor visits, hospital stays, physical therapy, and lost income due to time off work. The policy also typically covers the costs associated with rehabilitation and retraining if an employee is unable to return to their previous job. Beyond direct medical and wage replacement, many policies also cover death benefits for the families of workers who are fatally injured on the job. The specifics of coverage vary depending on the state and the chosen policy.

Finding the best workers comp insurance for construction is crucial for protecting your crew. But securing the right coverage isn’t always easy; it’s a bit like navigating the world of car insurance, where sometimes you need options like car insurance without inspection for convenience. Ultimately, both require careful consideration to ensure you’re adequately protected against unforeseen circumstances, so shop around and compare policies for the best workers comp insurance.

Types of Workers’ Compensation Policies

Construction companies have a choice between obtaining workers’ compensation insurance through monopolistic state funds or competitive private insurers. Monopolistic state funds, as the name suggests, are the sole provider of workers’ compensation insurance in that specific state. These funds are typically government-run and offer a standardized policy. Competitive private insurers, on the other hand, offer a wider variety of policy options, potentially with more customized coverage and pricing. The choice between these two depends on factors such as the state’s regulations, the company’s risk profile, and budget considerations. For example, a smaller construction firm in a state with a monopolistic fund might find it simpler to work with the single provider, while a larger firm in a competitive market might benefit from negotiating more favorable terms with a private insurer.

Policy Limits and Deductibles

Policy limits represent the maximum amount the insurance company will pay out for a specific claim or over the policy period. Deductibles are the amount the employer pays out-of-pocket before the insurance coverage kicks in. In the context of construction, where high-risk activities are commonplace, carefully considering policy limits and deductibles is critical. A higher policy limit provides greater financial protection in the event of a serious accident, while a higher deductible reduces premiums but increases the employer’s financial responsibility. For example, a large construction project with numerous employees might require a policy with higher limits to account for the potential for multiple or severe injuries, even if it means a higher premium. Conversely, a smaller project with fewer employees might opt for a higher deductible to lower the overall cost of insurance.

Common Policy Exclusions and Limitations

While workers’ compensation insurance provides extensive coverage, it’s crucial to understand its limitations. Common exclusions often include injuries resulting from intentional acts by the employee, injuries occurring outside of work hours (unless directly related to work duties), and injuries caused by intoxication or drug use. Some policies might also place limitations on the types of medical treatments covered or the duration of wage replacement benefits. For instance, a worker injured while driving their personal vehicle to a job site might not be covered unless it was a company-owned vehicle or directly related to company business. Similarly, coverage for long-term rehabilitation or disability benefits may be subject to specific timeframes and limitations defined in the policy. Understanding these exclusions and limitations is vital to prevent unexpected financial burdens.

Choosing the Right Insurance Provider

Source: amazonaws.com

Picking the right workers’ compensation insurance provider for your construction company is crucial. The wrong choice can lead to inadequate coverage, slow claims processing, and ultimately, financial hardship. A thorough evaluation process is key to securing a policy that protects your business and your employees.

Factors to Consider When Selecting a Workers’ Compensation Insurance Provider

Selecting the ideal workers’ compensation insurance provider involves a careful assessment of several key factors. These factors directly influence the effectiveness and value of your insurance coverage, ensuring you receive the support you need when facing workplace incidents.

A comprehensive evaluation should include examining the insurer’s financial stability, its experience in the construction industry, the breadth and depth of its coverage options, its claims handling process, and the availability of risk management and safety programs. The reputation of the insurer, as reflected in customer reviews and industry ratings, also plays a significant role. Finally, understanding the communication channels and accessibility of customer support is essential for seamless interactions.

Comparison of Services Offered by Different Insurers

Different insurers offer varying levels of service, impacting your overall experience. Claims handling efficiency, the comprehensiveness of safety programs, and the quality of risk management assistance are critical differentiators. Some insurers excel in rapid claims processing and minimal paperwork, while others may offer extensive safety training and consultation services to proactively reduce workplace accidents. The level of personalized support provided, including dedicated account managers and readily available resources, also varies considerably.

Decision-Making Framework for Choosing an Insurance Provider

Choosing a workers’ compensation insurance provider requires a balanced approach considering cost, coverage, and service quality. A useful framework involves assigning weights to each factor based on your company’s priorities. For example, a company with a strong safety culture might prioritize insurers with robust safety programs, even if their premiums are slightly higher. Conversely, a company focused on minimizing costs might prioritize affordability, while still ensuring adequate coverage. This weighted scoring system allows for a systematic comparison of different insurers. A simple formula could be: (Weight_Cost * Score_Cost) + (Weight_Coverage * Score_Coverage) + (Weight_Service * Score_Service), where each weight and score is a number between 0 and 1.

Comparison of Three Major Insurance Providers

The following table compares three hypothetical major insurance providers, highlighting key features. Remember that these are examples, and actual offerings vary by location and specific policy details. Always obtain current quotes and policy information directly from the insurers.

| Provider | Premium Cost (Example) | Claims Handling Speed (Days) | Safety Program Offerings |

|---|---|---|---|

| Insurer A | $10,000 | 7-10 | Basic safety training, online resources |

| Insurer B | $12,000 | 3-5 | On-site safety consultations, comprehensive training programs |

| Insurer C | $9,000 | 10-14 | Limited online resources |

Impact of Safety Programs on Premiums

Your workers’ compensation insurance premiums aren’t just a fixed cost; they’re a direct reflection of your company’s safety performance. A strong safety record translates to lower premiums, while a history of accidents can significantly increase your costs. Proactive safety measures aren’t just ethically responsible – they’re a smart business investment.

Implementing effective safety programs is a powerful tool for reducing workplace accidents and, consequently, lowering your insurance costs. Insurance providers reward companies that demonstrate a commitment to safety by offering discounted premiums. This incentivizes businesses to prioritize safety, creating a win-win situation for both employers and employees. The lower your incident rate, the lower your risk profile, and the more attractive you become to insurers.

Construction Safety Program Elements

A comprehensive construction safety program is multifaceted, requiring a coordinated effort across all levels of the organization. It’s not just about ticking boxes; it’s about creating a culture of safety that permeates every aspect of the job site. This involves regular training, meticulous equipment maintenance, and proactive hazard identification and control.

A robust program starts with thorough employee training. This isn’t a one-time event; it’s an ongoing process involving regular refresher courses, updates on new regulations, and tailored training for specific job tasks. Equipment maintenance is equally crucial. Regular inspections, preventative maintenance, and prompt repairs minimize the risk of equipment failure, a leading cause of accidents. Finally, proactive hazard control involves identifying potential risks before they lead to incidents. This requires regular job site inspections, hazard assessments, and the implementation of appropriate control measures, such as personal protective equipment (PPE) and engineering controls.

Specific Safety Measures to Reduce Common Construction Injuries

Prioritizing specific safety measures directly targets the most common causes of construction injuries. By focusing efforts here, companies can see significant reductions in accidents and, consequently, their insurance premiums.

- Fall Protection: Implementing robust fall protection systems, including guardrails, safety nets, and personal fall arrest systems, is crucial on elevated work surfaces. This drastically reduces the risk of fatal falls, a major concern in construction.

- Proper Lifting Techniques: Training employees in proper lifting techniques and providing mechanical assistance for heavy loads minimizes back injuries and strains. This includes using lifting equipment where appropriate and avoiding manual handling whenever possible.

- Hazard Communication: Clearly communicating hazards and providing appropriate safety data sheets (SDS) ensures that workers are aware of potential risks and know how to protect themselves. This includes proper labeling of materials and clear signage indicating hazards.

- Lockout/Tagout Procedures: Strict adherence to lockout/tagout procedures prevents accidental energization of equipment during maintenance or repair, protecting workers from electrical shocks and other serious injuries.

- Personal Protective Equipment (PPE): Ensuring that workers consistently use appropriate PPE, including hard hats, safety glasses, high-visibility clothing, and hearing protection, significantly reduces the risk of a wide range of injuries.

Cost Factors and Budgeting

Navigating the world of workers’ compensation insurance for your construction business can feel like scaling a skyscraper without safety gear – daunting, but achievable with the right knowledge. Understanding the cost factors and incorporating them effectively into your budget is crucial for maintaining financial stability and project profitability. Ignoring these aspects can lead to unexpected financial burdens and jeopardize your business’s bottom line.

Payroll, classification codes, and experience modification ratings are the cornerstones of your workers’ compensation insurance premium. These factors, along with others, significantly impact the final cost. Effective budgeting requires a thorough grasp of how these elements interact.

Payroll’s Influence on Premiums

Your company’s total payroll is the most significant factor influencing your workers’ compensation insurance premiums. Insurers base their calculations on a percentage of your payroll, meaning a higher payroll generally results in higher premiums. For example, a construction company with a $1 million annual payroll will likely pay a significantly higher premium than one with a $200,000 payroll, even if both companies have similar safety records. Accurate payroll reporting is vital; underreporting can lead to penalties and higher premiums in the long run. Regularly review and update your payroll records to ensure accuracy.

Classification Codes and Their Impact

Construction work encompasses a diverse range of tasks, each carrying different levels of risk. Insurers use classification codes (also known as NAICS codes) to categorize the various jobs performed within your company. Each code corresponds to a specific risk level, impacting the premium rate. High-risk jobs, like demolition or roofing, will attract higher rates than less hazardous tasks, such as office administration. Accurate classification codes are paramount. Misclassifying your workers’ job duties can lead to significantly higher premiums or even policy cancellation.

Experience Modification Rating (EMR)

The EMR reflects your company’s past loss experience. It’s a multiplier applied to your base premium, reflecting your safety record. A low EMR (typically below 1.0) indicates a better-than-average safety record, resulting in lower premiums. Conversely, a high EMR (above 1.0) signifies a higher-than-average loss experience, leading to higher premiums. This emphasizes the importance of proactive safety programs and thorough incident reporting. For instance, a company with an EMR of 1.2 will pay 20% more than the base premium. Investing in safety training and implementing robust safety protocols is a direct route to lowering your EMR over time.

Strategies for Managing Workers’ Compensation Insurance Costs

Effective cost management requires a multifaceted approach. Implementing comprehensive safety programs, conducting regular safety training, and utilizing safety equipment are crucial steps in reducing workplace accidents and, consequently, lowering premiums. Additionally, carefully reviewing and negotiating your insurance policy terms and exploring different insurance providers to compare rates can yield significant savings. Regularly reviewing your classification codes and payroll reports ensures accuracy and prevents unexpected premium increases. Consider forming a safety committee to actively monitor workplace safety and make improvements.

Incorporating Workers’ Compensation Costs into Project Budgets

Workers’ compensation insurance costs should be explicitly included in every construction project budget. This involves calculating the estimated premium based on projected payroll and considering the EMR and classification codes for the specific project. For example, a project requiring specialized high-risk tasks like scaffolding might necessitate a higher premium allocation compared to a standard construction project. Accurately estimating these costs prevents unforeseen financial strains and ensures project profitability. Consider including a contingency buffer for unexpected claims or premium adjustments. This approach allows for better financial planning and prevents potential project delays or cost overruns.

Legal and Regulatory Compliance

Source: top10theworld.com

Navigating the complex world of workers’ compensation insurance for construction companies requires a thorough understanding of state-specific legal requirements and potential penalties for non-compliance. Failure to adhere to these regulations can lead to significant financial and legal repercussions, impacting your business’s bottom line and reputation. This section Artikels the key legal aspects and common challenges faced by construction firms.

Workers’ Compensation Insurance Requirements by State, Best workers comp insurance for construction

Each state mandates workers’ compensation insurance for construction businesses, but the specifics vary considerably. Some states have a monopolistic state fund, meaning employers are required to purchase insurance from the state-run program. Others allow for private insurance carriers, offering employers a choice among multiple providers. Key differences include the level of required coverage, the types of injuries covered, and the administrative procedures for filing claims. For example, California has a stringent system with specific requirements for reporting injuries and providing benefits, while Texas has a more employer-friendly system with certain limitations on coverage. Understanding your state’s specific regulations is crucial for compliance.

Penalties for Non-Compliance with Workers’ Compensation Laws

The consequences of failing to secure workers’ compensation insurance can be severe. Penalties vary by state but typically include significant fines, potential imprisonment for business owners in some jurisdictions, and the inability to bid on public projects. Furthermore, if a worker is injured on the job and the employer lacks proper insurance, they could face substantial legal liabilities, including paying all medical expenses and lost wages directly. These financial burdens can cripple a construction business, making compliance not just a legal necessity but a critical business decision. For instance, a contractor in New York found to be operating without insurance could face fines reaching tens of thousands of dollars, plus back payments for any injured workers.

Common Legal Issues Faced by Construction Companies

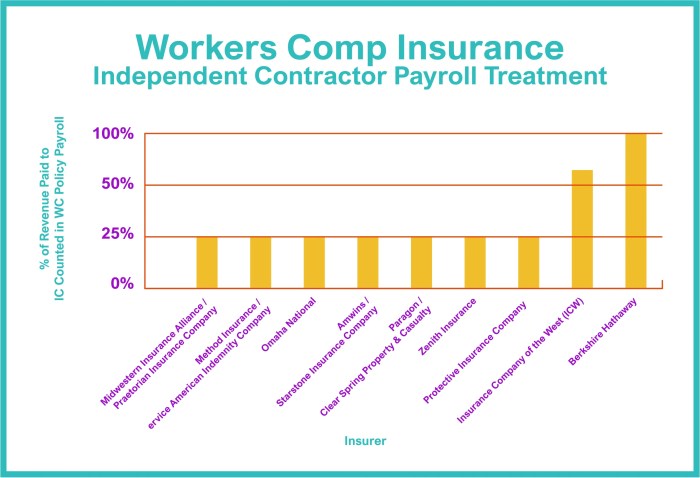

Construction work inherently involves high-risk activities, leading to a higher frequency of workplace injuries and consequently, workers’ compensation claims. Common legal disputes include disagreements over the nature and extent of injuries, delays in claim processing, and challenges regarding the legitimacy of the claim. Another frequent issue is the proper classification of independent contractors versus employees, as misclassification can significantly impact insurance obligations and liability. For example, a dispute might arise if a worker claims a pre-existing condition was aggravated by a workplace incident, requiring careful examination of medical records and work history to determine the extent of the employer’s responsibility. Accurate record-keeping and clear communication are essential to mitigating these risks.

The Process of Filing a Workers’ Compensation Claim

The process of filing a workers’ compensation claim typically involves several steps. First, the injured worker must report the injury to their employer promptly. The employer then reports the incident to their insurance carrier, initiating the claims process. Medical treatment is arranged, and the worker receives temporary disability benefits while unable to work. The insurance company investigates the claim, potentially requiring additional medical evaluations and witness statements. Once the extent of the injury and the worker’s ability to return to work are determined, a settlement or ongoing benefits may be negotiated. This process can be complex and time-consuming, requiring close collaboration between the employer, the insurance carrier, and the injured worker’s medical professionals. Failure to properly navigate these steps can lead to delays, disputes, and increased legal costs.

Illustrative Case Studies

Source: c3insurance.com

Understanding the impact of safety programs and insurance choices on a construction company’s bottom line is best illustrated through real-world examples. These case studies highlight the potential benefits of proactive safety management and the significant financial consequences of neglecting worker safety and adequate insurance coverage.

Successful Workers’ Compensation Cost Management Through Proactive Safety

Ace Construction, a mid-sized firm specializing in commercial building projects, implemented a comprehensive safety program that dramatically reduced their workers’ compensation costs. The program involved several key initiatives. First, Ace invested in extensive employee training, including regular safety briefings, hands-on demonstrations of safe equipment operation, and participation in external safety courses. They also implemented a robust safety observation program, encouraging employees to report near-misses and potential hazards without fear of reprisal. This created a culture of safety awareness. Further, Ace invested in updated safety equipment, including advanced fall protection systems, and implemented a rigorous equipment maintenance schedule. Finally, they introduced a points-based incentive system, rewarding teams with the best safety records. As a result of these measures, Ace Construction saw a 40% reduction in workplace accidents within two years, leading to a corresponding 30% decrease in workers’ compensation premiums. Their experience demonstrates that a proactive approach to safety not only protects workers but also significantly improves the company’s financial health.

Significant Financial Losses Due to Inadequate Workers’ Compensation Coverage and Poor Safety Practices

In contrast, Builder’s Best, a smaller construction company, experienced devastating financial losses due to a combination of inadequate workers’ compensation insurance and poor safety practices. They opted for the cheapest workers’ compensation policy available, failing to adequately assess their risk profile. Simultaneously, they lacked a formal safety program, resulting in a high incidence of workplace accidents. A serious accident involving a fall from a significant height resulted in substantial medical expenses and prolonged worker disability. The inadequate insurance policy failed to cover the full extent of the costs, leaving Builder’s Best with significant out-of-pocket expenses. The company faced legal challenges, further escalating costs. This incident led to a substantial decrease in their credit rating, impacting their ability to secure future projects and ultimately leading to the company’s closure. This case starkly illustrates the critical importance of selecting appropriate workers’ compensation insurance and prioritizing a robust safety program.

Last Word

Securing the best workers’ comp insurance for your construction business is a crucial step in mitigating risk and ensuring long-term stability. By understanding the inherent dangers of the industry, carefully comparing insurance providers, and prioritizing comprehensive safety programs, you can significantly reduce your exposure to costly accidents and claims. Remember, it’s not just about finding the cheapest policy; it’s about finding the policy that best protects your workers and your business. Investing in safety and comprehensive coverage is an investment in your future success.