Best insurance rates in NC? Finding the perfect policy shouldn’t feel like navigating a maze. This guide cuts through the jargon, offering practical advice and insider tips to help North Carolina residents snag the best deals on auto, home, and health insurance. We’ll unpack the factors influencing rates, explore different coverage options, and walk you through the claims process, ensuring you’re armed with the knowledge to make informed decisions and save some serious cash.

From understanding how your driving history affects your auto insurance premiums to learning the secrets to securing homeowners insurance discounts, we’ll cover it all. We’ll even help you decipher those often-confusing insurance policy documents, empowering you to choose the coverage that best fits your needs and budget. Get ready to become a savvy insurance shopper!

Understanding North Carolina’s Insurance Market

Navigating the insurance landscape in North Carolina requires understanding the factors that influence costs and the diverse range of coverage options available. This involves considering the state’s regulatory environment, the major players in the market, and the specific insurance needs of its residents.

Factors Influencing Insurance Rates in North Carolina are complex and interconnected. Location plays a significant role; areas prone to hurricanes or other natural disasters will generally see higher premiums for home and auto insurance. Individual risk profiles also heavily influence rates. This includes driving history (for auto insurance), credit score (often used in assessing risk for various insurance types), and claims history (across all types of insurance). The type of vehicle, home features (security systems, building materials), and the coverage level selected also impact premiums. Competition among insurance providers can also affect pricing, with more competition potentially leading to lower rates.

Major Insurance Providers in North Carolina

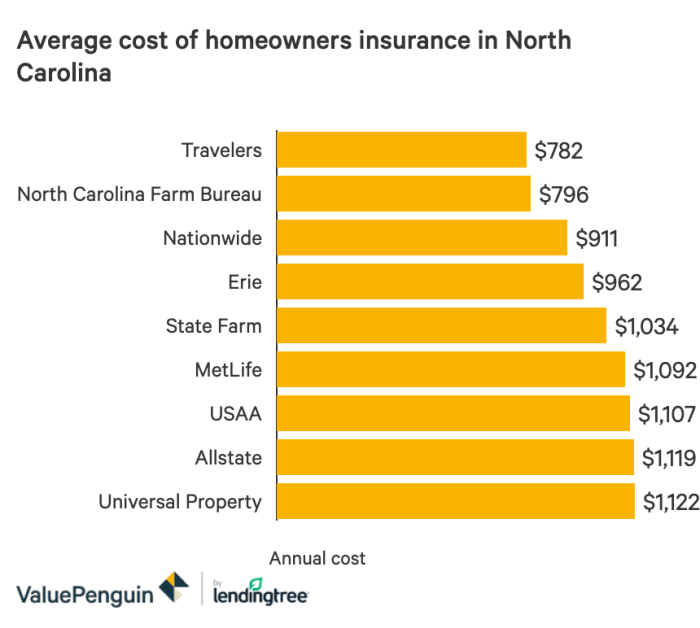

Several large national insurers have a substantial presence in North Carolina, along with numerous regional and smaller companies. State Farm, GEICO, Allstate, Progressive, and Nationwide are some of the most prominent national providers. These companies often compete aggressively, offering a variety of plans and discounts to attract customers. However, it’s crucial to compare quotes from multiple providers to ensure you are getting the best rate for your specific needs, as pricing can vary significantly even among large companies. Beyond these national giants, a significant number of smaller, regional insurers operate within the state, potentially offering more specialized or localized coverage options.

North Carolina’s Insurance Regulatory Environment

North Carolina’s insurance market is regulated by the North Carolina Department of Insurance. This department sets standards for insurers, investigates consumer complaints, and works to ensure fair and competitive pricing. Compared to some other states, North Carolina’s regulatory approach might be considered relatively moderate. While there are consumer protections in place, the state generally allows for a degree of market-based competition in setting rates. This differs from states with more stringent rate regulation, where the government has more direct control over the pricing of insurance policies. This difference in regulatory approaches leads to variations in insurance costs across states, with some states having stricter regulations and potentially higher average premiums, while others prioritize market competition which may lead to lower average premiums but also potentially higher variability in pricing.

Common Types of Insurance in North Carolina

North Carolinians, like residents of other states, seek various types of insurance to protect themselves and their assets. Auto insurance is mandatory in North Carolina, with minimum coverage requirements established by the state. Homeowners insurance is crucial for protecting property from damage or loss, and renters insurance provides similar protection for renters. Health insurance is increasingly important, with options ranging from employer-sponsored plans to plans purchased through the Affordable Care Act marketplaces. Other common types include life insurance, which provides financial security for beneficiaries, and umbrella insurance, which provides additional liability coverage beyond what’s offered by other policies. The specific needs and priorities for each type of insurance will vary significantly from individual to individual, emphasizing the importance of personalized assessment and comparison shopping.

Factors Affecting Personal Insurance Rates

Navigating the world of insurance in North Carolina can feel like a maze, especially when it comes to understanding what factors influence your premiums. Your rates aren’t randomly assigned; several key elements play a significant role in determining how much you pay for auto, homeowners, and health insurance. Let’s break down the major players.

Auto Insurance Rate Determinants

Several factors significantly impact your auto insurance premiums. These include your age, driving history, and credit score. Insurance companies use these metrics to assess your risk profile, determining the likelihood of you filing a claim.

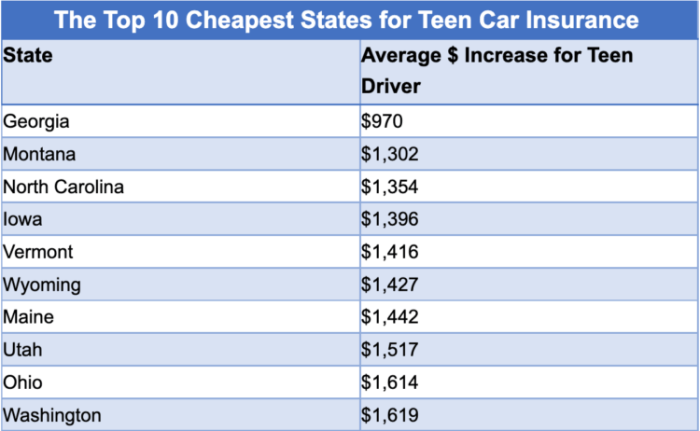

Age often plays a role because younger drivers, statistically, have a higher accident rate. Mature drivers, on the other hand, often benefit from lower rates due to their accumulated experience and safer driving records. Driving history is arguably the most significant factor. Accidents, traffic violations, and even the number of years you’ve been driving license-free influence your risk profile. A clean driving record translates to lower premiums, while multiple accidents or violations will likely result in higher rates. Your credit score also factors in because it reflects your overall financial responsibility, which insurers often correlate with responsible driving behavior. A higher credit score typically leads to lower premiums.

Homeowners Insurance Rate Determinants

The cost of homeowners insurance in North Carolina depends heavily on the location, value, and features of your property. Location is crucial because insurers consider the risk of natural disasters, such as hurricanes or wildfires, in specific areas. Properties in high-risk zones will generally command higher premiums. The value of your home directly impacts your insurance costs; a more expensive home typically requires higher coverage and therefore a higher premium. Finally, the features of your home, such as the type of roofing material, security systems, and fire-suppression systems, can influence your rates. Homes with features that mitigate risk often receive discounts. For example, a home with a fire-resistant roof and a monitored alarm system might qualify for a lower premium than a comparable home lacking these features.

Health Insurance Premium Determinants

Health insurance premiums are affected by a range of factors, including pre-existing health conditions and lifestyle choices. Pre-existing conditions can significantly impact premiums, as insurers consider the potential cost of treating these conditions. Lifestyle choices such as smoking, excessive alcohol consumption, or a lack of regular exercise can also influence premiums. Insurers may consider these factors because they are associated with increased health risks and potentially higher healthcare costs. For example, smokers typically pay higher premiums than non-smokers due to the higher likelihood of smoking-related illnesses.

Discounts Available in North Carolina

Many discounts can help reduce your insurance costs in North Carolina. Here’s a table outlining some common examples:

| Discount Type | Description | Eligibility Requirements | Estimated Savings |

|---|---|---|---|

| Good Driver Discount | Rewarding safe driving habits. | Clean driving record (no accidents or violations for a specified period). | 5-15% |

| Bundling Discount | Combining multiple insurance policies (auto, home, etc.) with the same insurer. | Purchasing multiple policies from the same company. | 10-20% |

| Home Security System Discount | Incentivizing home security measures. | Installation of a monitored security system. | 5-10% |

| Multi-Car Discount | Insuring multiple vehicles under the same policy. | Owning and insuring two or more vehicles with the same insurer. | 10-15% |

Finding the Best Rates

Source: foolcdn.com

Navigating the world of North Carolina insurance can feel like a maze, but finding the best rates doesn’t have to be a headache. With a strategic approach and a little legwork, you can significantly reduce your insurance premiums. This guide provides practical steps to help you secure the most competitive rates for your needs.

Comparing quotes from various insurance providers is crucial to finding the best deal. Don’t settle for the first quote you receive; shopping around is essential for securing the lowest price. Remember, insurance companies use different algorithms and risk assessments, leading to varying prices for the same coverage.

Comparing Insurance Quotes

To effectively compare insurance quotes, organize the information you receive from different providers into a simple table. This allows for easy side-by-side comparison of premiums, deductibles, and coverage details. Consider using a spreadsheet program or a notebook to keep track of your research. Key factors to compare include annual premiums, deductibles for different coverage types (collision, comprehensive, liability), and the specific coverage limits offered by each policy. Pay close attention to any exclusions or limitations mentioned in the policy documents. For example, compare the liability limits for bodily injury and property damage across different providers. A policy with a higher liability limit will typically cost more but offer greater protection.

Obtaining Insurance Quotes

Securing insurance quotes is a straightforward process, whether you prefer the convenience of online platforms or the personalized service of a phone call.

- Online Quotes: Many insurance companies offer online quote tools. Simply visit their websites, enter your personal information (driving history, vehicle details, address etc.), and the system will generate a preliminary quote. Remember to compare quotes from multiple providers using this method to get a comprehensive view of available options. Be aware that online quotes are often estimates and may require further verification before finalizing the policy.

- Phone Quotes: Contacting insurance companies directly by phone allows for a more personalized experience. An agent can answer your questions and provide tailored advice based on your specific circumstances. Be prepared to provide the same information you would online, such as your driving record, vehicle information, and desired coverage levels. Make sure to clearly state your needs and preferences to receive the most accurate quote.

Questions to Ask Insurance Agents

Before committing to a policy, ask these clarifying questions:

- What are the specific coverage limits for liability, collision, and comprehensive?

- What are the deductibles for each coverage type?

- Are there any discounts available (e.g., bundling, safe driving, good student)?

- What is the claims process like, and what is the typical processing time?

- What are the policy’s renewal terms and conditions?

- What are the exclusions or limitations of the policy?

Interpreting Insurance Policy Documents

Insurance policies can seem dense and complicated, but understanding key details is crucial. Carefully review your policy document to ensure you comprehend the coverage provided. Pay close attention to the declarations page, which summarizes your policy details, including coverage limits, deductibles, and premiums. Also, review the definitions of terms, especially regarding coverage exclusions and limitations. For example, understand what constitutes a covered accident versus an excluded event. Don’t hesitate to contact your insurance agent if any part of the policy remains unclear. A thorough understanding of your policy ensures you’re adequately protected and that you are paying for the appropriate coverage.

Insurance Coverage Options and Comparisons

Source: cloudinary.com

Navigating the world of insurance in North Carolina can feel overwhelming, especially when faced with the diverse range of coverage options available. Understanding the differences between various policies is crucial for securing the right protection at the best price. This section will break down the key coverage types for auto and homeowners insurance, along with a look at health insurance plans prevalent in the state. We’ll compare and contrast these options to help you make informed decisions.

Auto Insurance Coverage Levels

Auto insurance in North Carolina, like elsewhere, offers varying levels of protection. Liability coverage pays for damages you cause to others; collision coverage repairs your vehicle after an accident, regardless of fault; and comprehensive coverage protects against non-collision damage, such as theft or weather-related events. Choosing the right combination depends on your individual risk tolerance and financial situation. Higher coverage limits offer greater financial protection but come with higher premiums. For example, a minimum liability policy might only cover $30,000 in bodily injury per person, while a higher limit could reach $100,000 or more. Similarly, collision and comprehensive coverage can have deductibles ranging from a few hundred dollars to several thousand.

Homeowners Insurance Coverage Types

Homeowners insurance protects your property and your liability. Dwelling coverage protects the physical structure of your house; personal property coverage protects your belongings inside; and liability coverage protects you against lawsuits if someone is injured on your property. Additional coverages, such as loss of use (covering temporary living expenses after a covered event) and medical payments to others, provide broader protection. The amount of coverage needed depends on the value of your home and possessions. For instance, a homeowner with a $300,000 home would need sufficient dwelling coverage to rebuild it in case of a fire, factoring in current construction costs. Personal property coverage should account for the value of your furniture, electronics, and other belongings.

Health Insurance Plans in North Carolina

North Carolina offers a variety of health insurance plans, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Point of Service (POS) plans. HMOs typically require you to choose a primary care physician (PCP) within their network, who then refers you to specialists. PPOs offer more flexibility, allowing you to see any doctor in their network or out-of-network for a higher cost. POS plans combine elements of both HMOs and PPOs. The best plan for you depends on your healthcare needs and preferences. Consider factors like your preferred doctors, the plan’s network, and the cost-sharing responsibilities (deductibles, co-pays, etc.). For example, a person with chronic health conditions might prefer a PPO for greater access to specialists, while a healthy individual might find an HMO more cost-effective.

Auto and Home Insurance Coverage: Pros and Cons

Understanding the advantages and disadvantages of each coverage type is vital for making informed decisions.

- Liability Coverage (Auto):

- Pros: Legally required in most states, protects you financially if you cause an accident.

- Cons: Doesn’t cover your vehicle’s damage; minimum coverage limits may be insufficient.

- Collision Coverage (Auto):

- Pros: Covers damage to your vehicle in an accident, regardless of fault.

- Cons: Higher premiums; usually has a deductible.

- Comprehensive Coverage (Auto):

- Pros: Covers damage from non-accidents (theft, weather, vandalism).

- Cons: Higher premiums; usually has a deductible.

- Dwelling Coverage (Homeowners):

- Pros: Protects the structure of your home from damage.

- Cons: Doesn’t cover personal belongings; may not cover all types of damage.

- Personal Property Coverage (Homeowners):

- Pros: Protects your belongings inside your home.

- Cons: Usually has a deductible; may have limits on specific items.

- Liability Coverage (Homeowners):

- Pros: Protects you from lawsuits if someone is injured on your property.

- Cons: Doesn’t cover damage to your property or belongings.

Navigating the Claims Process: Best Insurance Rates In Nc

Source: corneliustoday.com

Filing an insurance claim in North Carolina can feel overwhelming, but understanding the process can significantly reduce stress and improve your chances of a successful outcome. This section breaks down the steps involved, provides examples of common claim scenarios, and emphasizes the crucial role of documentation.

The claims process generally follows a predictable sequence, although specific steps might vary slightly depending on your insurance company and the type of claim. Effective communication and thorough documentation are key throughout the entire process.

Steps Involved in Filing an Insurance Claim

Successfully navigating the claims process begins with prompt action. Delaying reporting can impact your claim’s outcome. The steps typically include:

- Report the Incident: Immediately contact your insurance company to report the incident. Note the claim number provided.

- Gather Information and Documentation: Collect all relevant information, including police reports (if applicable), photos and videos of the damage, repair estimates, and witness statements.

- File the Claim Form: Complete and submit the claim form accurately and thoroughly. Double-check all information for accuracy.

- Cooperate with the Adjuster: Fully cooperate with your assigned adjuster. Provide any requested information promptly and truthfully.

- Review the Settlement Offer: Carefully review the settlement offer and negotiate if necessary. Understand your rights and options.

- Appeal if Necessary: If you disagree with the settlement, understand the appeals process Artikeld in your policy.

Common Claim Scenarios and Handling Strategies

Different claim types require different approaches. Understanding common scenarios can help you prepare and react appropriately.

- Auto Accident: Immediately call the police, exchange information with other drivers, take photos of the damage, and document witness details. Report the accident to your insurance company as soon as possible.

- Home Damage (e.g., storm, fire): Secure the property to prevent further damage, document the damage with photos and videos, contact emergency services if needed, and report the claim to your insurance company immediately.

- Theft: Report the theft to the police and obtain a police report. Gather any documentation proving ownership of the stolen items, such as receipts or photos. Contact your insurance company and provide all necessary documentation.

The Importance of Documentation in the Claims Process

Thorough documentation is your strongest ally in a successful claim. It serves as irrefutable evidence supporting your claim.

Examples of crucial documentation include:

- Police reports

- Photographs and videos of the damage

- Repair estimates from qualified professionals

- Witness statements

- Medical records (for injury claims)

- Receipts and invoices

Claims Process Flowchart, Best insurance rates in nc

A visual representation can clarify the process. Imagine a flowchart starting with “Incident Occurs,” branching to “Report to Insurer,” then “Gather Documentation,” followed by “File Claim,” “Adjuster Investigation,” “Settlement Offer,” and finally, “Resolution (Acceptance or Appeal).” Each step could have smaller sub-steps, and the appeal path would lead to a further review and potential revised settlement.

Hunting for the best insurance rates in NC can feel like a wild goose chase, but comparing quotes is key. Your search might even lead you to explore options outside the state, like checking out what kind of deals you can find with allstate insurance warwick ri , to get a broader perspective before finalizing your NC policy.

Remember, the best rates often depend on your specific needs and risk profile, so shop around!

Illustrative Examples of Insurance Scenarios

Understanding insurance is easier with real-world examples. Let’s look at common scenarios and how insurance coverage plays out. These examples are for illustrative purposes and should not be considered legal or financial advice. Always consult with a qualified professional for personalized guidance.

Car Accident Claim Process

Imagine Sarah, driving her 2018 Honda Civic, is rear-ended by Mark in his 2021 Ford F-150. Sarah’s car sustains significant rear-end damage, including a dented bumper and a damaged taillight. Mark admits fault. Sarah’s injuries include whiplash and requires medical attention. Sarah contacts her insurance company, reporting the accident and providing details including police report information, photos of the damage, and medical documentation. Her insurer assesses the damage to her vehicle, arranging for repairs or providing a payout for the vehicle’s diminished value. They also cover her medical bills, subject to her policy’s deductibles and co-pays. Meanwhile, Mark’s insurance company handles the claim, potentially negotiating with Sarah’s insurer to determine liability and coverage. The entire process involves paperwork, appraisals, and potential legal consultations if settlements aren’t reached amicably. The timeline for resolution varies depending on the complexity of the case and the responsiveness of the insurance companies involved.

Home Insurance Claim After a Hurricane

Consider John and Mary, whose beachfront home in Wilmington, NC, suffers extensive damage during a hurricane. High winds tear off parts of the roof, causing significant water damage throughout the house. The storm surge floods the first floor, ruining furniture, appliances, and personal belongings. John and Mary immediately contact their homeowners insurance provider, documenting the damage with photos and videos. Their insurer sends an adjuster to assess the damage, determining the extent of the covered losses. The claim process involves filing paperwork, providing proof of ownership, and cooperating with the insurer’s investigation. The insurance company covers the cost of temporary housing, repairs to the roof and structural damage, replacement of damaged belongings, and potentially the cost of debris removal. The payout depends on their policy’s coverage limits, deductibles, and the extent of the damage. The process can take several weeks or months, depending on the scale of the damage and the availability of contractors for repairs.

Health Insurance Plan Comparison

Let’s say David is shopping for health insurance on the NC HealthCare.gov marketplace. He’s comparing two plans: Plan A and Plan B. Plan A has a monthly premium of $300, a $5,000 deductible, and a 20% coinsurance after meeting the deductible. Plan B has a monthly premium of $450, a $2,000 deductible, and a 10% coinsurance after meeting the deductible. David needs to consider his expected healthcare costs. If he anticipates needing significant medical care, Plan B’s lower deductible and coinsurance might be more cost-effective in the long run, despite the higher premium. However, if he expects minimal healthcare needs, Plan A’s lower premium might be more financially suitable. David carefully reviews each plan’s provider network to ensure his preferred doctors are in-network. He also compares prescription drug formularies to see if his medications are covered under each plan. He analyzes the out-of-pocket maximum for each plan to understand the most he would pay in a year. This careful comparison helps David choose the plan that best balances cost and coverage based on his individual needs and anticipated healthcare utilization.

Last Recap

Securing the best insurance rates in NC is a journey, not a destination, but with the right information and strategies, you can significantly reduce your premiums. Remember to compare quotes from multiple providers, understand the factors influencing your rates, and don’t hesitate to ask questions. By being proactive and informed, you can confidently navigate the insurance landscape and find a policy that provides comprehensive coverage without breaking the bank. Happy hunting!