Bad faith car insurance attorney – sounds intense, right? It is. Imagine this: you’re wrecked, literally and figuratively, after a car accident. You file a claim, expecting your insurance company to, you know, *insure* you. But instead, they stonewall, lowball, or even deny your claim despite clear evidence. That’s bad faith, and it’s where a skilled attorney becomes your lifeline. This isn’t just about money; it’s about justice, getting the compensation you deserve, and fighting back against unfair practices. This guide navigates the tricky terrain of bad faith claims, empowering you to understand your rights and fight for what’s yours.

We’ll break down what constitutes bad faith in the insurance world, explore the crucial role of a car insurance attorney, and guide you through the process of finding a reputable legal champion. We’ll also delve into common misconceptions, the impact of state laws, and proactive steps you can take to protect yourself. Buckle up; it’s going to be a bumpy, but informative, ride.

Defining “Bad Faith” in the Insurance Context

Bad faith in the insurance context refers to an insurance company’s unfair or unreasonable denial of a legitimate claim, or its unreasonable delay or handling of a claim. It essentially boils down to the insurer not acting in good faith with its policyholders. This breach of the implied covenant of good faith and fair dealing can have serious consequences.

Insurance companies have a legal and ethical obligation to investigate claims thoroughly and fairly. They must act in the best interests of their policyholders, even when the claim is complex or potentially expensive. Failing to meet this obligation constitutes bad faith. The specific definition and application of bad faith can vary slightly depending on the state and specific circumstances of the case.

Common Examples of Bad Faith Practices

Insurance companies engage in various practices that can be classified as bad faith. These actions often stem from a desire to minimize payouts or avoid paying claims altogether. This can include, but is not limited to, the following:

- Unreasonably delaying the investigation or processing of a claim, often without providing legitimate reasons for the delay. This might involve failing to promptly contact the insured, failing to obtain necessary medical records, or neglecting to communicate updates on the claim’s status.

- Denying a claim without a reasonable basis, often failing to conduct a thorough investigation or ignoring evidence supporting the insured’s claim. This might involve rejecting a claim based on minor discrepancies or technicalities while ignoring substantial evidence supporting the insured’s version of events.

- Failing to properly investigate a claim, neglecting to gather crucial evidence or interview witnesses. This could involve relying on incomplete or inaccurate information to deny a claim, or ignoring obvious evidence supporting the insured’s position.

- Using unfair or deceptive settlement tactics, such as offering unreasonably low settlements, or applying excessive pressure on the insured to accept a settlement they are not comfortable with. This could include misleading the insured about the value of their claim or the strength of their case.

- Failing to communicate effectively with the insured, leaving them in the dark about the status of their claim and making it difficult to obtain information or updates. This could involve ignoring phone calls, emails, or letters from the insured, or providing vague or misleading information.

Consequences for Insurance Companies Found Guilty of Bad Faith

The consequences for insurance companies found guilty of bad faith can be severe. These penalties are designed to deter such behavior and compensate policyholders for the harm caused. The penalties might include:

- Payment of the full amount of the claim, even if initially denied. This often includes additional compensation for any damages or losses suffered as a result of the delay or denial.

- Payment of punitive damages, which are designed to punish the insurance company for its misconduct and deter future bad faith actions. The amount of punitive damages can be substantial, significantly exceeding the actual value of the claim.

- Payment of the insured’s attorney fees and costs. The insured is typically entitled to recover the legal expenses incurred in pursuing the bad faith claim against the insurance company.

- Imposition of fines or other penalties by state regulatory authorities. Insurance companies can face significant financial penalties and even license suspension or revocation for repeated or egregious bad faith conduct.

- Reputational damage. Being found guilty of bad faith can severely damage an insurance company’s reputation, leading to loss of customers and decreased profitability.

The Role of a Car Insurance Attorney

Navigating the complexities of a car insurance claim, especially one involving allegations of bad faith, can feel like driving through a minefield. The process is often fraught with confusing jargon, bureaucratic hurdles, and potentially significant financial implications. This is where a skilled car insurance attorney becomes invaluable, acting as your guide and advocate throughout the challenging legal landscape.

A car insurance attorney provides a range of crucial services to clients facing bad faith claims. Their expertise helps ensure you receive the fair compensation you deserve, protecting your rights and navigating the often-aggressive tactics employed by insurance companies. They act as a buffer between you and the insurance company, allowing you to focus on your recovery while they handle the legal complexities.

Services Provided by Car Insurance Attorneys in Bad Faith Cases

Car insurance attorneys offer a comprehensive suite of services tailored to bad faith claims. These services typically include reviewing your policy, investigating the circumstances of the accident, gathering evidence to support your claim, negotiating with the insurance company, and, if necessary, filing a lawsuit. They’ll also handle all communications with the insurance company, ensuring you’re not pressured into accepting a settlement that undervalues your claim. This includes addressing delays in processing claims, denials of coverage, and lowball settlement offers—all hallmarks of potential bad faith. Attorneys also help clients understand their rights and responsibilities throughout the entire claims process.

Situations Requiring the Assistance of a Car Insurance Attorney

Several situations strongly suggest the need for legal counsel in a car insurance claim. For example, if the insurance company is unreasonably delaying the processing of your claim, denying your claim without proper justification, or offering a significantly low settlement that doesn’t cover your medical bills, lost wages, and property damage, seeking legal representation is crucial. This also applies if you suspect the insurance company is intentionally misinterpreting your policy or using unfair tactics to minimize their payout. Furthermore, if the insurance adjuster is being uncooperative or unresponsive, legal intervention can be highly beneficial. Cases involving serious injuries, significant property damage, or complex legal issues further underscore the importance of having a skilled attorney on your side. For instance, a case involving a dispute over policy coverage limits or a claim of uninsured/underinsured motorist coverage necessitates expert legal advice.

Common Strategies Employed by Attorneys in Bad Faith Cases

Attorneys handling bad faith insurance claims employ various strategies to secure fair compensation for their clients. These strategies often involve thorough investigation of the facts, careful analysis of the insurance policy, and a strong emphasis on building a compelling case. This might include obtaining expert witness testimony from medical professionals, accident reconstruction specialists, or vocational rehabilitation experts to support the client’s claim. Negotiation and settlement discussions are a primary focus; however, if a settlement cannot be reached, the attorney will be prepared to file a lawsuit and pursue the case through litigation. A key strategy is demonstrating a pattern of behavior by the insurance company indicating a deliberate attempt to avoid paying a legitimate claim. This could involve showing a history of similar bad faith practices by the insurance company or presenting evidence of internal communications revealing a strategy to minimize payouts. In essence, the attorney builds a strong case highlighting the insurance company’s breach of the implied covenant of good faith and fair dealing.

Identifying a Reputable Attorney

Choosing the right car insurance attorney can significantly impact the outcome of your case. A skilled and ethical lawyer will fight for your rights and ensure you receive fair compensation. Conversely, a less-than-reputable attorney could jeopardize your claim and leave you with nothing. This section Artikels key factors to consider when selecting an attorney to handle your bad faith insurance claim.

Navigating the legal system after a car accident can be overwhelming, especially when dealing with an insurance company that’s not acting in good faith. Therefore, selecting a lawyer with the right experience, reputation, and communication skills is crucial for a positive outcome. Don’t rush the process; thorough research is essential.

Checklist for Choosing a Car Insurance Attorney

Choosing the right attorney is a critical step. Consider these factors before making your decision:

- Experience with Bad Faith Claims: Look for an attorney with a proven track record of successfully handling bad faith insurance cases. Experience in this specific area is crucial because the legal nuances are different from standard car accident claims.

- Client Testimonials and Reviews: Check online reviews and testimonials from past clients. These provide valuable insights into the attorney’s communication style, responsiveness, and overall effectiveness.

- Fees and Payment Structure: Understand the attorney’s fee structure upfront. Many personal injury attorneys work on a contingency basis, meaning they only get paid if you win your case. Clarify the percentage they will take and any additional expenses you might be responsible for.

- Communication and Accessibility: A good attorney will keep you informed throughout the process. They should be responsive to your questions and concerns and provide regular updates on the progress of your case.

- Trial Experience: While many cases settle, a strong attorney should have experience going to trial if necessary. This demonstrates their willingness and ability to fight for your rights even when a settlement isn’t reached.

- Bar Association Membership and Disciplinary Record: Verify the attorney’s membership in good standing with their state’s bar association and check for any disciplinary actions against them. This information is usually publicly accessible.

Comparison of Good vs. Bad Car Insurance Attorneys

The table below highlights key differences between a good and a bad attorney.

| Quality | Good Attorney | Bad Attorney | Explanation |

|---|---|---|---|

| Communication | Responsive, proactive, and explains legal processes clearly. | Unresponsive, difficult to reach, and provides limited information. | Open communication builds trust and ensures you understand the case’s progress. |

| Experience | Extensive experience in bad faith insurance claims, with a proven track record of success. | Limited or no experience in bad faith claims; may focus on other areas of law. | Specialized experience is vital for navigating the complexities of bad faith litigation. |

| Fees | Transparent and upfront about fees and payment structures; often works on contingency. | Unclear or hidden fees; may pressure you into unfavorable payment plans. | Understanding the financial aspects prevents unexpected costs and ensures fair representation. |

| Professionalism | Maintains a professional demeanor, is prepared, and follows ethical guidelines. | Disorganized, unprofessional, and may disregard ethical rules. | Professionalism reflects the attorney’s dedication and competence. |

Red Flags Indicating an Unreliable Attorney

Several warning signs might indicate an attorney is not the right choice. These include:

- Guaranteeing a specific outcome: No attorney can guarantee a win. Be wary of anyone making such promises.

- Pressuring you to make quick decisions: A reputable attorney will give you time to consider your options and won’t rush the process.

- Unrealistic expectations: Be cautious of attorneys who overpromise or make unrealistic claims about the potential settlement amount.

- Poor communication or lack of responsiveness: Difficulty in contacting your attorney or receiving updates is a major red flag.

- Negative online reviews or disciplinary actions: Thoroughly research the attorney’s reputation before hiring them.

The Claim Process and Potential for Bad Faith: Bad Faith Car Insurance Attorney

Navigating a car insurance claim can feel like traversing a minefield, especially after a serious accident. The process itself is complex, and unfortunately, opportunities for insurance companies to act in bad faith abound. Understanding the typical steps and recognizing potential red flags is crucial for protecting your rights.

The typical car insurance claim process involves several key steps, each presenting a potential point of conflict. A smooth process relies on timely communication, fair assessment, and prompt payment. However, deviations from this ideal often lead to disputes and legal battles.

Stages of the Car Insurance Claim Process

The claim process generally begins with reporting the accident to your insurance company. This is followed by an investigation, including gathering evidence such as police reports and witness statements. Next, the insurer assesses the damages to your vehicle and any injuries sustained. Once the assessment is complete, a settlement offer is made. If you disagree with the offer, you may need to negotiate or pursue legal action. Throughout this entire process, documentation is key. Keep copies of all communications, including emails, letters, and recorded phone calls.

Points of Potential Bad Faith in the Claim Process

Several points within the claim process are particularly vulnerable to bad faith practices. For example, unreasonably delaying the investigation or failing to properly investigate the claim can constitute bad faith. Similarly, lowball settlement offers, unfair denial of claims based on flimsy pretexts, and failure to properly communicate with the insured are all hallmarks of bad faith. The use of aggressive tactics to pressure the insured into accepting an inadequate settlement also falls under this umbrella.

Illustrative Flowchart of the Claim Process and Potential Bad Faith Scenarios

Imagine a flowchart. The first box would be “Accident Occurs.” The next box, “Report Accident to Insurer,” branches into two paths: One path, “Claim Processed Fairly and Promptly,” leads to a final box, “Settlement Reached.” The other path, “Claim Handling Delays/Unfair Practices,” branches further into boxes representing specific bad faith scenarios. These could include: “Unreasonable Delay in Investigation,” “Lowball Settlement Offer,” “Denial of Claim Without Justification,” and “Failure to Communicate.” Each of these ultimately leads to a box labeled “Potential Bad Faith Claim.” This visual representation emphasizes the critical junctures where insurers may engage in bad faith practices. A fair and efficient claim process should ideally follow the first path; deviations indicate a need for careful review and potentially legal counsel.

Legal Recourse and Potential Outcomes

Source: johnrobinlaw.com

Navigating a bad faith car insurance claim requires understanding the legal avenues available and the potential outcomes. Successfully pursuing a claim can lead to significant financial compensation and a sense of justice, but the process can be complex and challenging. This section Artikels the legal options and possible results, illustrating the potential impact on your life.

The primary legal recourse for bad faith insurance practices is filing a lawsuit against the insurance company. This lawsuit typically alleges that the insurer acted in bad faith by unreasonably denying, delaying, or underpaying a legitimate claim. The specific legal grounds will vary depending on your state’s laws and the specifics of your case. Many states have specific statutes outlining the requirements for proving bad faith, often requiring demonstration of the insurer’s knowledge of the claim’s validity and their intentional disregard for the insured’s rights.

Types of Legal Actions

Several types of legal actions can be pursued in a bad faith car insurance claim. These actions often overlap and may be pursued concurrently. The choice of legal action will depend on the specifics of the case and the advice of your attorney.

A common approach is to file a breach of contract claim, arguing that the insurance company violated the terms of your policy. Another approach is to directly pursue a bad faith claim, which often requires proving that the insurer acted with malice or gross negligence. In some cases, punitive damages may be sought to punish the insurer and deter future bad faith conduct. The availability of punitive damages varies significantly by state.

Potential Outcomes of a Successful Lawsuit

A successful bad faith lawsuit can result in several forms of compensation for the policyholder. The most common outcome is the recovery of damages related to the underlying claim that was initially denied or mishandled. This could include medical bills, lost wages, property damage repairs, and pain and suffering.

Dealing with a bad faith car insurance attorney is a nightmare, especially when you’re already stressed. The last thing you need is to be fighting them while simultaneously facing the financial fallout of not having insurance in the event of an accident. These attorneys often exploit vulnerable situations, so securing strong legal representation of your own is crucial to avoid getting completely screwed over.

Beyond compensation for the initial claim, a successful bad faith lawsuit may also award additional damages. These can include: compensatory damages to cover emotional distress or other harm caused by the insurer’s actions; punitive damages intended to punish the insurer for their egregious conduct; and attorney’s fees and court costs incurred during the litigation process. The amount of these damages will vary depending on the specifics of the case and the judge or jury’s assessment of the insurer’s actions.

Examples of Court Cases

While specific details of court cases are often complex and vary by jurisdiction, several examples illustrate the potential outcomes of bad faith car insurance lawsuits. For instance, a case in California might involve a policyholder whose claim for injuries sustained in a car accident was repeatedly delayed and ultimately underpaid by the insurer. After litigation, the court might order the insurer to pay the full amount of the claim, plus significant punitive damages due to their demonstrably bad faith actions. Similarly, a case in Texas might involve an insurer who wrongly denied coverage based on a technicality, leading to a successful bad faith lawsuit resulting in the full policy payout, plus additional damages for the policyholder’s emotional distress and legal expenses. These examples highlight the importance of thorough documentation and legal representation in pursuing a bad faith claim.

Preventing Bad Faith Practices

Source: daveabels.com

Navigating the complexities of car insurance claims can be stressful, but proactive steps can significantly reduce your chances of encountering bad faith practices from your insurer. Understanding your rights and documenting everything meticulously are key to a smoother, fairer process. Remember, while insurance companies are there to help, they are also businesses operating under a bottom line. Being prepared and assertive protects your interests.

Knowing how to effectively communicate with your insurance company and understanding your legal options are crucial in avoiding bad faith situations. This involves clearly articulating your needs, maintaining detailed records, and being prepared to escalate the matter if necessary. Let’s explore some practical strategies.

Proactive Steps to Minimize Bad Faith

Taking proactive measures significantly reduces the likelihood of facing bad faith tactics from your insurer. These steps demonstrate your commitment to a fair and transparent claims process.

- Thoroughly Review Your Policy: Understand your coverage limits, deductibles, and the claims process Artikeld in your policy document. Knowing your rights and obligations prevents misunderstandings and delays.

- Gather Comprehensive Evidence: Document everything related to the accident, including police reports, photos of the damage, witness statements, and medical records. The more evidence you have, the stronger your claim.

- Communicate Clearly and Professionally: Maintain a written record of all communication with your insurer. Keep copies of emails, letters, and notes from phone conversations. Be polite but firm in your communication, clearly stating your expectations.

- Follow Up Promptly and Consistently: Don’t hesitate to follow up on your claim’s progress. Regularly check in with your adjuster and keep track of deadlines. Inaction can be interpreted as disinterest.

- Seek Legal Counsel Early: If you suspect bad faith practices or are facing significant difficulties, consult a car insurance attorney early in the process. Early intervention often yields better results.

The Importance of Thorough Documentation

Thorough documentation is your strongest defense against bad faith claims. It provides irrefutable evidence of the events surrounding your accident and your interactions with the insurance company. This detailed record can significantly impact the outcome of your claim.

Consider documenting every step of the process, from the initial accident report to the final settlement. This includes not only the factual details of the accident but also every communication with the insurance company, including dates, times, and the names of individuals involved. Photographs, videos, and even voice recordings can be valuable pieces of evidence. Remember, a well-documented claim is a strong claim.

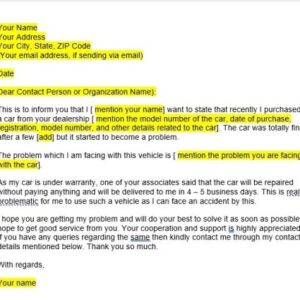

Sample Letter Addressing Insurance Claim Concerns

This sample letter provides a framework for addressing concerns about your insurance company’s handling of a claim. Remember to replace the bracketed information with your specific details.

To [Insurance Company Name],

[Address]Subject: Formal Complaint Regarding Claim Number [Claim Number]

Dear [Insurance Adjuster Name],

This letter constitutes a formal complaint regarding the handling of my car insurance claim, number [Claim Number], filed on [Date]. I am writing to express my serious concerns regarding [Specifically describe the issues you are facing, e.g., unreasonable delays, denial of coverage, low settlement offer].

I have attached copies of [List the supporting documents you are including, e.g., police report, medical records, repair estimates]. These documents clearly demonstrate [Explain how the documents support your claim].

I request that you [State your desired resolution, e.g., expedite the claim process, reconsider the denial of coverage, increase the settlement offer]. I expect a response within [Number] days outlining the steps you will take to address my concerns. Failure to respond satisfactorily will leave me with no option but to pursue further legal action.

Sincerely,

[Your Name]

[Your Contact Information]

Common Misconceptions about Bad Faith Claims

Source: bithubcoin.com

Navigating the complexities of insurance claims can be challenging, and unfortunately, several misconceptions surround bad faith claims, potentially jeopardizing a claimant’s ability to receive fair compensation. Understanding these misconceptions is crucial for protecting your rights and ensuring a successful outcome. Let’s clarify some common misunderstandings.

Bad Faith is Only About Denying a Claim, Bad faith car insurance attorney

Many believe bad faith only occurs when an insurance company outright denies a legitimate claim. This is a significant misconception. Bad faith encompasses a much broader range of actions or inactions by the insurer. For example, delaying the claims process unreasonably, failing to adequately investigate the claim, offering an unfairly low settlement, or engaging in aggressive tactics to pressure the claimant into accepting a less-than-fair offer are all potential examples of bad faith. The failure to communicate effectively or provide timely updates on the claim’s progress can also be categorized as bad faith. This broader understanding is vital; focusing solely on outright denial overlooks many other potential instances of bad faith behavior. The harm caused by this misconception is that claimants might miss opportunities to pursue legal action because they believe their case only qualifies if the claim was denied outright.

You Need Extensive Evidence to Prove Bad Faith

While substantial evidence is always beneficial, the belief that proving bad faith requires an overwhelming amount of irrefutable proof is incorrect. In reality, a pattern of questionable behavior, even without a single smoking gun, can demonstrate bad faith. For example, consistently delayed responses to communications, repeated requests for unnecessary documentation, or a history of low-ball settlement offers, taken together, can build a compelling case. The misconception that a single, definitive piece of evidence is necessary can dissuade claimants from pursuing their rights, believing they lack the necessary proof. This harm can lead to claimants abandoning their pursuit of justice, even when a collection of smaller infractions reveals a pattern of bad faith.

Only Large Insurance Companies Engage in Bad Faith

The size of the insurance company is not a reliable indicator of its potential for bad faith practices. Smaller insurers, while less frequent in the news for large-scale bad faith cases, can still engage in these practices. The belief that only large corporations with extensive resources are capable of such behavior is misleading. Regardless of size, any insurance company, motivated by profit maximization or inadequate internal procedures, could potentially act in bad faith. The harm of this misconception lies in the assumption of inherent fairness based solely on the size of the insurer. This can lead claimants to overlook potential bad faith actions from smaller companies, resulting in missed opportunities for redress.

The Impact of State Laws on Bad Faith Claims

Navigating the world of bad faith insurance claims can feel like traversing a minefield, and a crucial element often overlooked is the significant variation in state laws governing these claims. Understanding these differences is paramount to successfully pursuing your case, as the legal landscape can dramatically alter your chances of a favorable outcome. This section will highlight how state-specific legislation shapes the process and potential results of a bad faith claim.

State laws significantly impact the success of bad faith claims due to their varying definitions of “bad faith,” the available remedies, and the burden of proof placed on the claimant. Some states have more claimant-friendly laws, offering broader definitions of bad faith and more robust remedies, while others maintain stricter standards, making it harder to prove a case. This disparity underscores the importance of consulting with an attorney experienced in your specific state’s laws.

California’s Approach to Bad Faith Claims

California is known for its relatively claimant-friendly approach to bad faith insurance claims. The state’s courts have broadly interpreted the duty of good faith and fair dealing, recognizing a wide range of actions as potential bad faith. For example, unreasonable delays in investigating or processing claims, failure to properly investigate a claim, and denial of coverage without a reasonable basis are often considered bad faith in California. Furthermore, California law allows for recovery of significant damages, including not only the amount of the underlying claim but also punitive damages in cases of particularly egregious conduct. This means that a successful bad faith claim in California can result in a substantial financial award for the claimant. A landmark case illustrating this is Moradi-Shalal v. Fireman’s Fund Ins. Cos., which established the viability of bad faith claims against insurers.

Florida’s More Restrictive Approach

In contrast, Florida’s legal landscape for bad faith claims is often considered more challenging for claimants. The state’s courts generally require a higher level of proof to establish bad faith, demanding a demonstration of actual malice, gross negligence, or a knowing violation of the insurer’s duty. The definition of “bad faith” is narrower, and the available remedies might be more limited compared to California. This means that even if an insurer’s actions seem unreasonable, it might be harder to prove bad faith in Florida unless there’s clear evidence of intentional wrongdoing. The burden of proof rests heavily on the claimant to show not just negligence but a deliberate and malicious disregard for their rights. This stricter standard can significantly impact the success rate of bad faith claims in the state.

The Importance of State-Specific Legal Counsel

The stark differences between California and Florida’s bad faith laws highlight the critical need to understand the specific legal framework of your state when pursuing a claim. What constitutes bad faith in one state might be considered acceptable practice in another. Consulting with an attorney licensed in your state who specializes in bad faith insurance claims is essential. They can advise you on the applicable laws, assess the strength of your case based on the state’s legal precedents, and guide you through the process, significantly increasing your chances of a successful outcome. Attempting to navigate this complex legal terrain without expert guidance can lead to missed opportunities and ultimately, a less favorable result.

Final Thoughts

Navigating the complexities of a bad faith car insurance claim can feel like driving through a minefield blindfolded. But armed with the right knowledge and a skilled attorney by your side, you can significantly increase your chances of a successful outcome. Remember, your insurance company isn’t your friend; they’re a business. Don’t hesitate to seek legal counsel if you suspect bad faith practices. Your well-being and financial future depend on it. Fight for what you deserve. Don’t let them get away with it.