Auto insurance Bradford PA: Navigating the world of car insurance in Bradford, Pennsylvania can feel like driving through a blizzard—confusing and potentially costly. But fear not, fellow drivers! This guide cuts through the jargon, revealing the secrets to finding the best auto insurance deal in Bradford. We’ll explore the local market, compare top providers, and arm you with the knowledge to make informed decisions, saving you time and money.

From understanding the unique factors affecting premiums in Bradford—like driving conditions and demographics—to mastering the art of negotiating rates, we’ll equip you to become a savvy insurance shopper. We’ll delve into the different types of coverage, helping you choose the right protection for your needs and budget. Get ready to ditch the insurance confusion and embrace the open road with confidence.

Understanding the Bradford, PA Auto Insurance Market: Auto Insurance Bradford Pa

Source: marshallinsurance.net

Bradford, Pennsylvania, presents a unique auto insurance landscape shaped by its demographics, prevalent vehicle types, driving conditions, and local economic factors. Understanding these elements is crucial for residents seeking the best insurance coverage at a competitive price. This analysis delves into the specifics of the Bradford auto insurance market, offering insights into what factors influence premiums and coverage options.

Bradford’s demographics significantly influence its auto insurance market. The city boasts a mix of urban and rural populations, with a relatively older demographic compared to national averages. This older population may drive less frequently and be involved in fewer accidents, potentially leading to lower premiums for some. Conversely, a larger percentage of senior drivers could increase the number of claims related to age-related driving issues. The income levels also play a role; lower-income households might opt for minimum coverage due to budgetary constraints, while higher-income households might seek comprehensive coverage with higher limits.

Vehicle Types and Insurance Premiums

The types of vehicles driven in Bradford impact insurance costs. While precise data on vehicle distribution is unavailable publicly, observation suggests a mix of passenger cars, trucks, and SUVs. Trucks and SUVs, generally more expensive to repair, typically command higher premiums than smaller cars. The prevalence of older vehicles, which may lack advanced safety features, could also contribute to higher premiums due to increased risk of accidents and repair costs. For example, a higher concentration of older pickup trucks, commonly used for work or recreational purposes in the region, might skew the average premium upward compared to an area dominated by newer compact cars.

Driving Conditions and Accident Rates, Auto insurance bradford pa

Bradford’s driving conditions influence accident rates and, consequently, insurance costs. The area experiences varied weather patterns, including periods of snow and ice during winter months, leading to increased accident risks and higher claims. Rural roads surrounding Bradford may also present unique challenges, such as wildlife crossings and less-maintained roadways, further contributing to the potential for accidents. These factors are considered by insurance companies when calculating premiums; drivers in areas with higher accident rates typically face higher premiums. The increased frequency of accidents due to adverse weather translates directly into higher insurance costs for drivers in the region.

Economic Factors Influencing Auto Insurance Choices

Economic factors significantly influence the auto insurance market in Bradford. The local economy, largely reliant on industries like healthcare and manufacturing, dictates the disposable income available to residents. Individuals with limited disposable income might opt for minimum coverage, focusing on liability protection rather than comprehensive or collision coverage. Conversely, those with higher disposable income might opt for more comprehensive coverage with additional benefits, such as roadside assistance or rental car reimbursement. Furthermore, competition among insurance providers within the Bradford area influences pricing and available options, creating a dynamic market for consumers to navigate. Economic downturns could also lead to a greater emphasis on price-sensitive insurance options.

Top Auto Insurance Providers in Bradford, PA

Finding the right auto insurance in Bradford, PA can feel like navigating a maze. With numerous providers offering a variety of coverage options and price points, understanding your choices is crucial. This section will highlight some of the major players in the Bradford auto insurance market, comparing their offerings and customer experiences to help you make an informed decision.

Major Auto Insurance Companies in Bradford, PA

Several large national and regional insurers operate within Bradford, Pennsylvania, offering a competitive landscape for consumers. These include well-known names like State Farm, Geico, and Erie Insurance, alongside smaller, regional providers. The availability and specific offerings of each company may vary slightly. It’s always best to contact the providers directly to confirm coverage details in your specific area.

Comparison of Coverage Options from Three Prominent Providers

Direct comparison of coverage options requires contacting each insurer directly for precise details as plans change frequently. However, we can discuss general coverage types offered. State Farm, for instance, typically offers a comprehensive suite of options, including liability, collision, comprehensive, uninsured/underinsured motorist coverage, and various add-ons like roadside assistance. Geico is known for its competitive pricing and often features similar coverage options. Erie Insurance, being a regional provider, may have specific strengths catering to the local Bradford community, possibly offering tailored plans or discounts. Remember, the specific details of each plan, including deductibles and premiums, will vary based on individual factors like driving history, vehicle type, and coverage level.

Customer Reviews and Ratings of Bradford, PA Auto Insurers

Customer satisfaction is a key factor when choosing an insurance provider. Online reviews and ratings offer valuable insights into the experiences of other policyholders. While specific ratings fluctuate, the following table provides a general overview based on aggregated data from various review platforms (Note: These are illustrative examples and may not reflect current ratings. Always check independent review sites for the most up-to-date information).

| Provider | Average Rating (Example) | Key Features | Customer Comments (Example) |

|---|---|---|---|

| State Farm | 4.5 stars | Wide range of coverage options, strong customer service reputation, numerous agent locations | “Easy to work with, claims process was smooth.” “Agent was very helpful and responsive.” |

| Geico | 4.2 stars | Competitive pricing, convenient online tools and app, 24/7 customer service | “Affordable rates, easy to manage policy online.” “Claims process could be improved.” |

| Erie Insurance | 4.0 stars | Strong local presence, personalized service, potentially better rates for local drivers | “Knowledgeable and friendly local agent.” “Slightly higher rates compared to national providers.” |

Pricing Strategies of Auto Insurers in Bradford, PA

Auto insurance pricing in Bradford, PA, is influenced by several factors. Insurers use complex algorithms considering your driving record, age, location, vehicle type, and the level of coverage you choose. Some insurers, like Geico, often emphasize competitive pricing as a key selling point, while others, such as Erie Insurance, might focus on personalized service and potentially offer better rates for local residents. State Farm and other national providers usually offer a balance of price and comprehensive coverage options. Ultimately, obtaining quotes from multiple insurers is the best way to compare prices and find the most suitable option for your individual needs. Remember that discounts are frequently available for things like safe driving records, bundling policies (home and auto), and opting for higher deductibles.

Factors Affecting Auto Insurance Premiums in Bradford, PA

Securing affordable auto insurance in Bradford, PA, requires understanding the various factors influencing your premium. Insurance companies use a complex algorithm to assess risk, and this translates into the price you pay. Let’s break down the key elements that determine your auto insurance costs.

Driving History’s Impact on Insurance Costs

Your driving record is a significant factor in determining your auto insurance rates. A clean driving history, free of accidents and traffic violations, typically results in lower premiums. Conversely, accidents and tickets, especially those involving significant damage or injuries, will dramatically increase your premiums. For example, a DUI conviction could lead to a substantial increase, sometimes doubling or even tripling your insurance costs for several years. Multiple at-fault accidents within a short period will also significantly impact your rates. Insurance companies view these incidents as indicators of higher risk, leading them to charge more to cover potential future claims.

Age and Gender Influence on Auto Insurance Rates

Statistically, younger drivers, particularly those under 25, are considered higher risk and often pay more for auto insurance. This is due to their higher likelihood of being involved in accidents due to inexperience. Gender also plays a role, though the extent varies by insurer and state regulations. Historically, young male drivers have been statistically shown to be involved in more accidents than young female drivers, which may lead to higher premiums for young men. However, these trends are constantly being analyzed and adjusted by insurance companies, and the differences may be less pronounced than in the past.

Credit Score’s Role in Determining Insurance Premiums

In many states, including Pennsylvania, your credit score can significantly influence your auto insurance premiums. Insurance companies often use credit-based insurance scores (CBIS) as an indicator of risk. A good credit score generally correlates with responsible behavior, which insurers see as a sign of lower risk. Conversely, a poor credit score may lead to higher premiums. The rationale behind this is that individuals with poor credit may be more likely to file fraudulent claims or be less likely to pay their premiums on time. This is a controversial practice, and its legality and fairness are subject to ongoing debate.

Other Factors Affecting Auto Insurance Costs

Beyond driving history, age, and credit score, several other factors contribute to your auto insurance premium. The type of vehicle you drive plays a significant role; sports cars and luxury vehicles often cost more to insure due to their higher repair costs and greater potential for theft. The level of coverage you choose also impacts your premium; comprehensive and collision coverage offers more protection but comes with higher costs than liability-only coverage. Finally, your location matters. Areas with higher rates of accidents and theft tend to have higher insurance premiums. Living in a high-crime area in Bradford, PA, for instance, could result in a higher premium compared to a quieter, safer neighborhood.

Finding the Best Auto Insurance Deal in Bradford, PA

Source: general.com

Finding the right auto insurance in Bradford, PA, can feel like navigating a maze, but securing your financial future extends beyond just your car. Consider supplementing your healthcare planning too, perhaps with options like humana supplemental medicare insurance , to ensure comprehensive coverage. Returning to auto insurance, remember to compare quotes and coverage levels to find the best fit for your needs in Bradford.

Securing the most affordable and comprehensive auto insurance in Bradford, PA requires a strategic approach. By understanding the market, comparing quotes, and negotiating effectively, drivers can significantly reduce their premiums without sacrificing necessary coverage. This section provides a practical guide to help you navigate the process.

Obtaining Multiple Quotes from Different Providers

Gathering multiple quotes is crucial for finding the best deal. Begin by identifying at least three to five reputable insurance providers operating in Bradford, PA. Utilize online comparison tools, which allow you to input your information once and receive multiple quotes simultaneously. Alternatively, contact providers directly via phone or visit their offices in person. Remember to provide consistent information across all quotes to ensure accurate comparisons. This includes details about your vehicle, driving history, and desired coverage levels.

Important Questions to Ask Insurance Agents

Before committing to a policy, ask clarifying questions to ensure you understand the coverage details and limitations. These questions will help you make an informed decision.

- What specific coverages are included in your policy, and what are the limits for each?

- What are the deductibles for collision, comprehensive, and liability coverage?

- Does the policy include roadside assistance, rental car reimbursement, or other additional benefits?

- What discounts are available, and am I eligible for any of them (e.g., good driver, multi-car, bundling)?

- What is the claims process, and how quickly can I expect a response in case of an accident?

- What is the company’s customer service rating and complaint history?

Comparing Auto Insurance Policies

Once you’ve gathered several quotes, organize the information into a comparison chart to facilitate decision-making. Consider the following factors:

| Policy | Coverage | Monthly Premium | Deductible | Additional Benefits |

|---|---|---|---|---|

| Policy A | Comprehensive, Collision, Liability ($100,000/$300,000) | $85 | $500 | Roadside assistance, rental car reimbursement |

| Policy B | Comprehensive, Collision, Liability ($100,000/$300,000) | $95 | $1000 | Roadside assistance |

| Policy C | Liability only ($100,000/$300,000) | $60 | N/A | None |

Note: These are sample premiums and may vary based on individual circumstances.

Negotiating Insurance Rates

Don’t hesitate to negotiate your insurance rates. Armed with multiple quotes, you can leverage competition to your advantage. Highlight lower offers from competitors and politely inquire about matching or improving upon those rates. Mention any discounts you are eligible for, such as a good driver discount or bundling home and auto insurance. Consider increasing your deductible to lower your premium, but only if you can comfortably afford a higher out-of-pocket expense in case of an accident. Remember to be respectful and professional throughout the negotiation process. A well-prepared and polite approach often yields positive results.

Types of Auto Insurance Coverage in Bradford, PA

Source: cloudfront.net

Navigating the world of auto insurance can feel like driving through a blizzard without windshield wipers. Understanding the different types of coverage is crucial to ensuring you’re adequately protected on the roads of Bradford, PA. This section breaks down the key coverages, their benefits, limitations, and real-world examples to help you make informed decisions.

Liability Coverage

Liability insurance protects you financially if you cause an accident that injures someone or damages their property. It covers the costs of medical bills, lost wages, and property repairs for the other party involved. Bradford, PA, like any other area, has its share of accidents, and liability coverage is legally mandated in most states. The policy typically includes bodily injury liability and property damage liability. For instance, if you rear-end another car, causing injuries and significant damage, your liability coverage would help pay for the other driver’s medical expenses and vehicle repairs. However, it won’t cover your own medical bills or vehicle damage. The limits of your liability coverage (e.g., 25/50/25) represent the maximum amounts your insurance will pay per person injured, per accident for injuries, and per accident for property damage.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This is particularly beneficial in situations where you’re involved in a single-car accident (like hitting a deer or a tree) or if you’re at fault in a multi-vehicle collision. Let’s say you slide on an icy Bradford road and hit a parked car. Collision coverage will help cover the cost of repairing your vehicle. However, it typically has a deductible, meaning you’ll pay a certain amount out-of-pocket before the insurance kicks in.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions. This includes things like theft, vandalism, hail damage, fire, and even damage from hitting an animal. Imagine a tree branch falling on your car during a Bradford thunderstorm, or someone keying your vehicle. Comprehensive coverage will assist with the repairs. Similar to collision coverage, it usually has a deductible.

Uninsured/Underinsured Motorist Coverage

This crucial coverage protects you if you’re involved in an accident caused by an uninsured or underinsured driver. Sadly, such drivers exist everywhere, including Bradford. If you’re seriously injured by an uninsured driver, this coverage can help pay for your medical bills and lost wages. It’s important to note that the coverage limits should be carefully considered to ensure adequate protection.

Personal Injury Protection (PIP)

PIP coverage helps pay for your medical expenses and lost wages, regardless of who is at fault in an accident. This is particularly useful in situations where you’re injured, even if the accident was your fault. It also often covers medical expenses for your passengers. For example, if you’re involved in a minor accident in Bradford and sustain injuries, PIP can cover your medical bills, regardless of fault.

Visual Representation of Coverage Areas

A Venn diagram showing the overlapping coverage areas of liability, collision, and comprehensive insurance. Liability coverage is represented by a circle encompassing the area representing damages to other people and their property. Collision coverage is shown as a separate circle encompassing damage to your own vehicle caused by a collision. Comprehensive coverage is a third circle encompassing damage to your vehicle from events other than collisions (like hail or theft). There is some overlap between the circles, illustrating situations where multiple coverages might apply. For example, the area where collision and liability circles overlap represents a situation where you cause an accident, damaging both your car and another person’s property.

Closing Summary

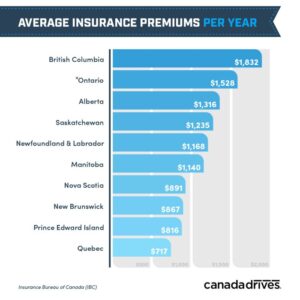

Finding the perfect auto insurance policy in Bradford, PA doesn’t have to be a headache. By understanding the local market, comparing providers, and knowing what questions to ask, you can secure the best coverage at the best price. Remember, a little research goes a long way in saving you money and ensuring you’re adequately protected on the road. So, buckle up, and drive confidently knowing you’ve got this covered!