AARP secondary insurance to Medicare: Navigating the often-confusing world of Medicare supplemental insurance can feel like a maze. Medicare, while a vital safety net, often leaves gaps in coverage, leaving seniors facing unexpected medical bills. This is where AARP’s Medicare Supplement plans step in, offering crucial secondary insurance to bridge those gaps and provide peace of mind. Understanding the different plans, their costs, and the enrollment process is key to making informed decisions about your healthcare future.

This guide will walk you through everything you need to know about AARP’s Medicare Supplement plans, comparing them to other options and helping you determine if they’re the right fit for your needs. We’ll cover the intricacies of Medicare coverage, the various AARP plan options, cost comparisons, and the enrollment process, ensuring you have all the information you need to make a smart choice.

Understanding Medicare’s Coverage Gaps

Source: cloudinary.com

Medicare, while a vital safety net for seniors and people with disabilities, doesn’t cover everything. Understanding its limitations is crucial to avoid unexpected medical bills and financial strain. Many find that supplemental insurance is necessary to bridge these gaps and ensure comprehensive healthcare coverage.

Medicare Coverage Limitations

Medicare’s coverage is extensive, but it’s not all-encompassing. Several areas consistently present significant coverage limitations. These gaps can leave individuals responsible for a substantial portion of their healthcare costs, highlighting the importance of understanding what Medicare does and doesn’t cover. Common areas where coverage is limited include prescription drugs, vision care, hearing aids, and dental care. These services are often significant expenses for seniors, and out-of-pocket costs can quickly accumulate.

Healthcare Expenses Not Fully Covered by Medicare

Medicare Parts A and B, often referred to as Original Medicare, don’t fully cover several crucial healthcare expenses. For instance, while Part A covers hospital stays, it often has a deductible and coinsurance requirements. Part B, which covers doctor visits and outpatient care, also requires a premium and a 20% coinsurance payment for most services. Prescription drugs are largely uncovered under Original Medicare, requiring a separate Part D plan. Similarly, most preventive services, while often covered, may have cost-sharing requirements. Long-term care is another significant area where Medicare coverage is severely limited; it primarily covers short-term rehabilitation after a hospital stay.

Situations Requiring Supplemental Insurance

Supplemental insurance, such as Medigap or Medicare Advantage plans, becomes vital in several scenarios. For example, a senior diagnosed with a chronic condition requiring ongoing medication and frequent doctor visits might face substantial out-of-pocket expenses under Original Medicare. Similarly, an individual needing extensive dental work or hearing aids would quickly discover the limitations of Original Medicare’s coverage. A sudden, unexpected hospitalization with prolonged recovery could also lead to significant uncovered costs. In essence, supplemental insurance acts as a buffer against unexpected high medical costs, providing peace of mind and financial security.

Comparison of Original Medicare and Medicare Advantage Coverage Gaps

| Coverage Area | Original Medicare (Parts A & B) | Medicare Advantage (Part C) | Gaps |

|---|---|---|---|

| Hospital Stays | Covers inpatient care, but with deductibles and coinsurance. | Generally covers inpatient care, but specific coverage varies by plan. | High out-of-pocket costs possible due to deductibles and coinsurance; potential for limitations on choice of providers. |

| Doctor Visits | Covers 80% of the Medicare-approved amount; 20% coinsurance applies. | Coverage varies by plan; may include lower cost-sharing than Original Medicare. | 20% coinsurance under Original Medicare; potential for higher premiums or limited provider networks with Medicare Advantage. |

| Prescription Drugs | No coverage; requires separate Part D plan. | Often includes prescription drug coverage, but specifics vary widely by plan. | Separate Part D plan needed with Original Medicare, leading to additional premiums and potential coverage gaps; Medicare Advantage drug formularies can limit drug choices. |

| Vision, Hearing, Dental | Limited or no coverage. | Some plans offer limited coverage; often requires additional premiums. | Significant out-of-pocket costs for these services under both Original Medicare and many Medicare Advantage plans. |

| Preventive Services | Generally covered, but may involve cost-sharing. | Generally covered, but cost-sharing varies by plan. | Cost-sharing (deductibles, coinsurance) for preventive services can still apply. |

AARP’s Role in Medicare Supplement Plans

AARP doesn’t actually *offer* Medicare Supplement plans themselves. Instead, they partner with UnitedHealthcare to offer a range of plans under the AARP name. This partnership leverages AARP’s strong brand recognition and trust among older Americans, providing a convenient and potentially attractive option for those seeking supplemental Medicare coverage. Understanding the nuances of these plans is crucial for making an informed decision.

AARP Medicare Supplement plans, underwritten by UnitedHealthcare, aim to bridge the gaps in Original Medicare coverage. These plans help cover out-of-pocket costs like deductibles, copayments, and coinsurance, offering a more comprehensive and predictable healthcare experience. However, it’s essential to compare these plans with those offered by other providers to ensure you’re getting the best value for your needs.

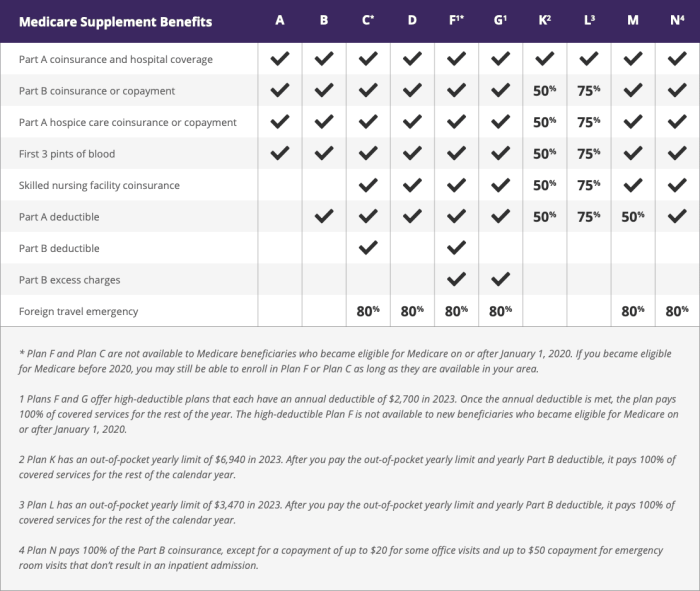

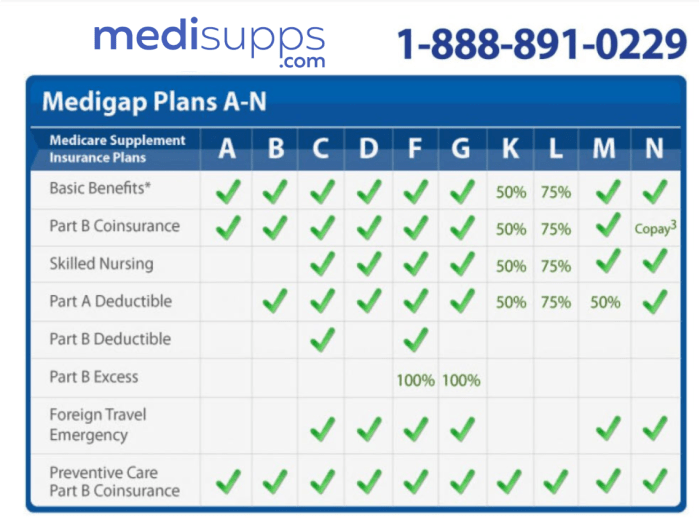

AARP Medicare Supplement Plan Types and Features

AARP, through its partnership with UnitedHealthcare, offers a variety of Medicare Supplement plans, typically categorized by letters (Plan A, Plan F, etc.). Each plan letter corresponds to a specific level of coverage. While the exact plans available can vary by location and year, common features include coverage for hospital costs, medical expenses, and sometimes even foreign travel emergencies. Key differences lie in the extent of coverage and the associated premiums. For instance, Plan G typically covers more than Plan N, but this increased coverage comes with a higher premium. It’s crucial to carefully review the specific benefits and exclusions of each plan to determine which best suits your individual health needs and budget.

Comparison of AARP and Other Providers’ Medicare Supplement Plans

Choosing between AARP plans and those from other insurers requires a careful comparison. While AARP plans benefit from the organization’s reputation and often include member discounts or benefits, other insurers may offer comparable coverage at potentially lower premiums or with additional perks. Factors to consider include the plan’s cost, the network of providers, the level of customer service, and any additional benefits offered beyond standard Medicare Supplement coverage. For example, some insurers might offer telemedicine benefits or wellness programs not included in AARP plans. Direct comparison shopping is essential to find the best fit.

Key Factors in Choosing an AARP Medicare Supplement Plan

Before enrolling in any AARP Medicare Supplement plan (underwritten by UnitedHealthcare), consider these factors:

- Cost: Premiums vary significantly between plan types and can change annually. Compare monthly premiums against the potential out-of-pocket savings offered by each plan.

- Coverage: Carefully review the specific benefits and exclusions of each plan letter. Consider your health history and anticipated healthcare needs to determine the appropriate level of coverage.

- Eligibility: You must be enrolled in both Medicare Part A and Part B to be eligible for a Medicare Supplement plan. Age and health status do not typically affect eligibility for these plans.

- Network: While Medicare Supplement plans don’t typically have networks in the same way that Medicare Advantage plans do, understanding which doctors and hospitals participate in UnitedHealthcare’s network can be beneficial.

Cost and Value Comparison of AARP Plans

Choosing a Medicare Supplement plan involves careful consideration of premiums and potential out-of-pocket expenses. AARP offers several plans, each with varying costs and benefits. Understanding these differences is crucial for making an informed decision that aligns with your individual financial situation and healthcare needs. This section will compare the costs and value proposition of different AARP Medicare Supplement plans.

Factors Influencing AARP Medicare Supplement Plan Costs

Several factors influence the cost of AARP Medicare Supplement plans. Your age is a significant determinant; older individuals generally pay higher premiums. Your location also plays a role, as insurance companies adjust pricing based on regional healthcare costs and claims patterns. The specific plan you choose (Plan F, Plan G, etc.) significantly impacts your monthly premium. Higher coverage plans, offering greater protection against out-of-pocket expenses, naturally come with higher premiums. Finally, your health status, while not directly used for underwriting in most states, can indirectly affect your cost through the overall claims experience in your area.

Premium and Out-of-Pocket Cost Comparison

AARP Medicare Supplement plans offer various coverage levels, each with a corresponding premium and out-of-pocket maximum. Lower-cost plans often have higher out-of-pocket maximums, meaning you’ll pay more if you need extensive healthcare services. Conversely, higher-premium plans typically offer lower out-of-pocket maximums, providing greater financial protection. It’s important to weigh the monthly premium against the potential savings on medical expenses to determine the best value for your individual circumstances.

Long-Term Savings with AARP Medicare Supplement Plans

While the monthly premiums for AARP Medicare Supplement plans may seem substantial, the potential for long-term savings is significant. These plans help protect you from the unpredictable and potentially high costs of healthcare expenses not covered by Original Medicare. Consider a scenario where you require extensive hospitalization or long-term care; a Medicare Supplement plan can significantly reduce your out-of-pocket expenses, potentially saving you thousands of dollars over time. The long-term financial security offered by these plans can outweigh the monthly premium payments, especially for individuals anticipating significant healthcare needs in the future.

Cost-Benefit Analysis for a 65-Year-Old

The following table illustrates a hypothetical cost-benefit analysis for a 65-year-old individual considering several AARP Medicare Supplement plans. These figures are for illustrative purposes only and may vary based on location, specific plan details, and individual circumstances. Always consult with an insurance professional or refer to the insurer’s website for the most up-to-date and accurate information.

| Plan Name | Monthly Premium | Annual Out-of-Pocket Maximum | Overall Cost Estimate (Annual) |

|---|---|---|---|

| AARP Plan G | $150 | $2,000 | $3,800 |

| AARP Plan F | $200 | $0 | $4,400 |

| AARP Plan N | $100 | $3,500 | $2,900 |

Eligibility and Enrollment Process

Navigating the world of Medicare supplements can feel like traversing a maze, but understanding the eligibility requirements and enrollment process for AARP Medicare Supplement plans simplifies the journey. This section clarifies the steps involved, ensuring a smooth and informed experience.

AARP Medicare Supplement plans, offered through UnitedHealthcare, are available to individuals who meet specific eligibility criteria and are enrolled in Medicare Part A and Part B. Understanding these requirements and the enrollment process is key to securing the supplemental coverage you need.

Eligibility Requirements

Eligibility for AARP Medicare Supplement plans hinges on your Medicare enrollment status and your age. You must be enrolled in both Medicare Part A (hospital insurance) and Part B (medical insurance) to be eligible. While there isn’t a specific age requirement beyond Medicare eligibility (generally age 65 or older, or those with qualifying disabilities), it’s crucial to confirm your eligibility directly with UnitedHealthcare or AARP.

Enrollment Process

The enrollment process for AARP Medicare Supplement plans involves several key steps. First, you’ll need to determine which plan best suits your needs and budget. AARP offers various plans with differing coverage levels and premiums. Second, you’ll need to gather the necessary documents. Finally, you will submit your application.

Required Documents

Before you begin the application, gather the following documents to streamline the process:

- Your Medicare card.

- Your driver’s license or other government-issued identification.

- Information about your current prescription medications.

- Your banking information for premium payments (checking account or credit card).

Having these documents ready will expedite the application review.

Enrollment Process Flowchart

Imagine a flowchart with the following steps:

1. Start: Begin by determining your eligibility and choosing a plan.

2. Gather Documents: Collect the necessary documentation (Medicare card, ID, medication list, banking information).

3. Apply: Submit your application, either online, by phone, or through mail. The application will request personal information, Medicare details, and plan selection.

4. Review and Approval: UnitedHealthcare reviews your application. This may involve verifying your information with Medicare.

5. Policy Issuance: Once approved, you’ll receive your policy, outlining your coverage details and premium payments.

6. End: Your AARP Medicare Supplement plan is now active.

This visual representation simplifies the process, offering a clear path to securing your supplemental coverage.

Claims and Customer Service

Source: medisupps.com

Navigating the claims process and accessing customer service is crucial for a smooth experience with your AARP Medicare Supplement plan. Understanding how to file a claim, what information is needed, and how to resolve potential issues will ensure you receive the benefits you’re entitled to. This section clarifies these procedures, providing a clear pathway for managing your plan effectively.

AARP Medicare Supplement plans generally follow a straightforward claims process. The specific steps may vary slightly depending on the provider processing your claim, but the overall procedure remains consistent. The ease of filing a claim, combined with the accessibility of AARP’s customer service, contributes significantly to the overall value proposition of these plans.

The AARP Medicare Supplement Claims Process

Filing a claim typically involves submitting the necessary documentation to the insurance provider. This usually includes the claim form (often available online), your Medicare card information, and details of the medical services received, such as the date of service, provider information, and a detailed description of the services. Many providers offer online claim submission portals for convenience. After submission, the claim is processed, and payment is typically sent directly to the provider, or in some cases, reimbursed to you. The processing time varies depending on the provider and the complexity of the claim. It’s advisable to keep a copy of all submitted documentation for your records.

AARP Customer Service Options and Accessibility

AARP offers various customer service channels to assist members with their Medicare Supplement plans. These typically include a toll-free telephone number, a website with FAQs and online resources, and potentially email support. The availability of these options ensures members can easily access support when needed. Customer service representatives are trained to handle a wide range of inquiries, from claim status updates to plan changes and benefit explanations. The accessibility of these options, coupled with the helpfulness of the representatives, aims to provide a positive and efficient customer experience. Consider checking your plan documents or the AARP website for the most up-to-date contact information.

Filing a Claim and Required Information, Aarp secondary insurance to medicare

To file a claim, you’ll typically need to complete a claim form provided by your insurance provider. This form will request information such as your policy number, the date of service, the provider’s name and address, a description of the services rendered, and the amount charged. You will also need to provide your Medicare identification number. Supporting documentation, such as an explanation of benefits (EOB) from Medicare and the provider’s bill, may also be required. Many plans allow for online claim submission, which simplifies the process and often allows for real-time tracking of claim status. Always retain copies of all submitted documentation for your records.

Resolving Claim Issues or Disputes

If you encounter a problem with your claim, such as a delay in processing or a discrepancy in payment, contact AARP’s customer service immediately. Explain the situation clearly and provide all relevant documentation. A representative will investigate the issue and work to resolve it. If the issue remains unresolved, you may need to escalate the complaint to a higher level within the AARP customer service department or potentially file a complaint with your state’s insurance department. Keeping detailed records of all communication with the insurance provider is crucial in resolving any disputes efficiently. Thorough documentation will greatly assist in demonstrating the facts of the case and support your position.

Alternatives to AARP Plans

Source: shortpixel.ai

Navigating Medicare supplements can be tricky, especially understanding AARP’s secondary insurance options. Finding the right coverage often involves careful planning, just like securing the best deal on your car insurance; check out options for car insurance leominster if you’re in the area. Back to Medicare, remember to compare plans and benefits before committing to AARP’s supplemental coverage to ensure it fits your specific needs and budget.

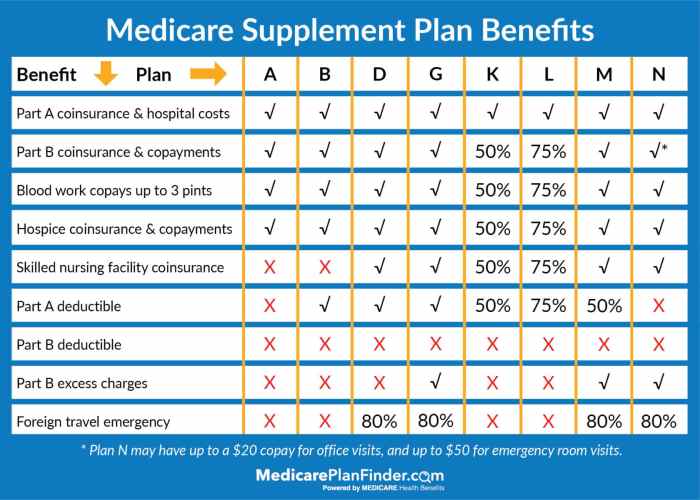

Choosing a Medicare Supplement plan can feel overwhelming, with numerous providers and plans vying for your attention. While AARP plans offer a recognizable name and potentially strong customer service, they aren’t the only game in town. Understanding the alternatives is crucial for making an informed decision that best fits your budget and health needs.

AARP Medicare Supplement plans are underwritten by UnitedHealthcare, offering a range of plans (like Plan G, Plan N, etc.) with varying coverage levels and premiums. However, other insurance companies, such as Humana, Mutual of Omaha, and Aetna, also offer competitive Medicare Supplement plans. Comparing these options directly allows you to identify the best value for your individual circumstances.

Comparison of AARP and Competitor Medicare Supplement Plans

The key to choosing the right Medicare Supplement plan lies in comparing coverage, features, and cost across different providers. While AARP plans often benefit from strong brand recognition and potentially streamlined customer service, other providers may offer comparable coverage at a lower price or with additional perks.

| Provider | Plan Type | Key Features | Cost Comparison |

|---|---|---|---|

| AARP (UnitedHealthcare) | Plan G | Covers most Medicare gaps, including Part B coinsurance and deductibles. May offer additional benefits like telehealth access. | Costs will vary based on age, location, and specific plan details. Check current quotes for comparison. |

| Humana | Plan G | Similar coverage to AARP Plan G, potentially including additional benefits or discounts. | Costs will vary based on age, location, and specific plan details. Check current quotes for comparison. |

| Mutual of Omaha | Plan F | Covers most Medicare gaps, including Part B coinsurance and deductibles. May have a higher premium than Plan G but offers broader coverage. | Costs will vary based on age, location, and specific plan details. Check current quotes for comparison. |

| Aetna | Plan N | Covers most Medicare gaps but may have a copay for doctor visits. Generally lower premiums than Plan G. | Costs will vary based on age, location, and specific plan details. Check current quotes for comparison. |

Advantages and Disadvantages of Choosing an AARP Plan vs. a Different Provider

Choosing between an AARP plan and a plan from another provider involves weighing several factors. AARP plans benefit from brand recognition and a potentially strong customer service reputation. However, other providers might offer lower premiums or more comprehensive coverage for the same plan type. Direct cost comparison is vital. For instance, a Humana Plan G might be cheaper than an equivalent AARP Plan G in a specific geographic area. Similarly, Mutual of Omaha might offer a broader Plan F option, although at a higher premium.

Alternative Supplemental Insurance Options

Medicare Supplement plans aren’t the only way to fill Medicare’s coverage gaps. Medicare Advantage plans (Part C) offer an alternative approach, bundling Part A, Part B, and often Part D coverage into a single plan. These plans often include extra benefits like vision, dental, and hearing coverage. However, they typically have a network of providers, unlike traditional Medicare. Another option is a stand-alone Part D prescription drug plan, crucial for managing medication costs. The best choice depends on individual needs and preferences.

Illustrative Scenarios

Understanding the nuances of Medicare supplemental insurance requires considering real-life situations. Choosing the right plan hinges on individual needs and financial circumstances. Let’s examine scenarios where different supplemental options prove advantageous.

AARP Medicare Supplement Plan Benefits: The Case of Mr. and Mrs. Smith

Mr. and Mrs. Smith, both in their early 70s, recently retired and are facing significant medical expenses. Mr. Smith requires ongoing dialysis treatment, a costly procedure not fully covered by Original Medicare. Mrs. Smith has a history of heart conditions and anticipates needing frequent specialist visits and potential hospitalizations. An AARP Medicare Supplement Plan, specifically a Plan F or G, would be highly beneficial for them. These plans cover most out-of-pocket costs associated with Medicare Part A (hospital insurance) and Part B (medical insurance), including deductibles and co-pays. This would significantly reduce their financial burden, offering peace of mind knowing that unexpected medical bills won’t cripple their retirement savings. The predictable monthly premium, while higher than a Medigap plan with less coverage, offers the Smiths financial security and eliminates the worry of large, unpredictable medical bills.

Alternative Supplemental Insurance: The Case of Ms. Jones

Ms. Jones, a healthy 67-year-old, recently enrolled in Medicare. She leads an active lifestyle and has few pre-existing conditions. She’s looking for affordable supplemental coverage to fill the gaps in Medicare’s coverage, but doesn’t anticipate needing extensive medical care. For Ms. Jones, a Medicare Advantage (Part C) plan with a low premium and a decent prescription drug benefit might be a more suitable option. While it might offer less comprehensive coverage than an AARP Medigap plan, the lower monthly cost and potential inclusion of extra benefits, such as vision or dental coverage, could align better with her needs and budget. She can opt for a plan with a low monthly premium and potentially a low out-of-pocket maximum to limit her overall healthcare spending.

Financial Implications of Plan Choices

The financial implications of choosing between an AARP Medicare Supplement Plan and a Medicare Advantage plan are significant and depend heavily on individual health circumstances and risk tolerance. For individuals anticipating substantial healthcare costs, such as Mr. and Mrs. Smith, the higher premiums of a comprehensive AARP Medigap plan (like Plan F or G) might be justified by the significant reduction in out-of-pocket expenses. They would pay a predictable monthly premium but face minimal surprise bills. Conversely, Ms. Jones, with her lower anticipated healthcare utilization, might find a Medicare Advantage plan more cost-effective. The lower premiums would save her money in the long run, even if she faces higher out-of-pocket expenses for some services. The potential for added benefits like vision or dental care within a Medicare Advantage plan further enhances its attractiveness for her specific situation. The key is to carefully weigh the predictable, higher premiums of a Medigap plan against the potential for lower premiums but higher out-of-pocket costs associated with a Medicare Advantage plan, considering individual health status and financial resources.

Closure: Aarp Secondary Insurance To Medicare

Ultimately, choosing the right Medicare supplemental insurance is a deeply personal decision. While AARP offers competitive plans with strong customer service, it’s crucial to carefully weigh your individual needs, budget, and health status against the various options available. Don’t hesitate to compare AARP plans with others on the market and seek professional advice if needed. By understanding the intricacies of Medicare and supplemental insurance, you can confidently navigate this crucial aspect of your retirement planning and secure your healthcare future.