AAA Insurance Norman Oklahoma: Need car, home, or life insurance in the Sooner State? Navigating the world of insurance can feel like a maze, but AAA aims to make it simpler. We’re diving deep into what AAA Insurance offers Norman residents, from policy details and customer experiences to how they stack up against the competition. Buckle up, because this is your ultimate guide to AAA in Norman.

This comprehensive guide covers AAA Insurance’s Norman branch, exploring their services, customer reviews, competitive landscape, and more. We’ll uncover the nitty-gritty of their insurance products, helping you decide if AAA is the right fit for your needs. We’ll also tackle common questions and address concerns many Norman residents have about their insurance options.

AAA Insurance Norman Oklahoma

Source: co.nz

AAA Insurance in Norman, Oklahoma, offers a comprehensive suite of insurance products designed to protect residents and their assets. While a specific history of AAA’s Norman branch isn’t readily available through public sources, its presence reflects the broader national footprint of AAA, a trusted name in automotive and insurance services for over a century. Understanding their local services helps Norman residents make informed decisions about their insurance needs.

AAA Insurance Services in Norman, Oklahoma

AAA Insurance in Norman likely provides a range of insurance options typical of a major provider. This includes auto insurance, encompassing liability, collision, and comprehensive coverage; homeowners insurance, protecting property and belongings; renters insurance, offering similar protection for renters; and potentially other specialized insurance like motorcycle or boat insurance. Specific policy details and available coverage levels would need to be confirmed directly with the Norman AAA office. The convenience of accessing these services locally is a significant benefit for Norman residents.

AAA Insurance’s Mission and Values in Norman

While a specific mission statement tailored to the Norman branch isn’t publicly accessible, it’s safe to assume that AAA’s core values – customer service, reliability, and financial strength – are central to their operations in Norman. These values translate to a commitment to providing competitive rates, efficient claims processing, and readily available customer support for Norman residents. The overall AAA brand reputation for dependability is a key factor attracting customers.

AAA Insurance Norman: Company Profile

AAA Insurance in Norman, Oklahoma offers a compelling proposition for consumers seeking reliable insurance solutions. Key features include access to a wide range of insurance products, a strong national brand reputation built on trust and stability, and likely the convenience of local service and potentially personalized attention. Benefits for clients include competitive pricing, streamlined claims processes, and the peace of mind that comes with being insured by a well-established and reputable company. The specific benefits will vary based on individual policy choices and needs.

Insurance Products and Services

AAA Insurance in Norman, Oklahoma, offers a range of insurance products designed to protect your assets and provide financial security. Understanding the different options available and how they fit your needs is crucial before making a decision. This section provides a clear overview of AAA’s offerings and helps you navigate the process of securing the right coverage.

AAA Insurance Product Comparison

Choosing the right insurance policy can feel overwhelming, so we’ve created a handy comparison table to help you understand the various products offered by AAA in Norman. Remember that prices are estimates and can vary based on individual factors like coverage level and risk assessment.

| Product Name | Coverage Details | Price Range (Annual Estimate) | Key Features |

|---|---|---|---|

| Auto Insurance | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist | $700 – $2500+ | Accident forgiveness, roadside assistance, rental car reimbursement |

| Homeowners Insurance | Dwelling, Personal Property, Liability, Medical Payments | $1000 – $3000+ | Guaranteed replacement cost, mold coverage options, identity theft protection |

| Renters Insurance | Personal Property, Liability, Medical Payments | $200 – $600+ | Affordable protection for personal belongings, liability coverage for accidents |

| Life Insurance | Term Life, Whole Life, Universal Life | Varies greatly based on coverage amount and policy type | Options for various coverage amounts and durations, potential cash value accumulation (whole life) |

Auto Insurance Coverage Options in Norman, Oklahoma

AAA offers a comprehensive suite of auto insurance options tailored to the specific needs of drivers in Norman. These options include liability coverage (protecting you financially if you cause an accident), collision coverage (covering damage to your vehicle in an accident regardless of fault), comprehensive coverage (covering damage from events like theft or hail), and uninsured/underinsured motorist coverage (protecting you if you’re involved in an accident with an uninsured driver). Specific coverage limits and deductibles are customizable to suit your budget and risk tolerance. For example, you can choose higher liability limits for greater protection in case of a serious accident.

Obtaining a Home Insurance Quote

Getting a home insurance quote from AAA in Norman is straightforward. You can either visit a local AAA office, call their customer service line, or obtain a quote online through their website. The online process typically involves providing information about your home, such as its address, square footage, age, and features. You’ll also need to provide details about your coverage preferences and any existing security systems. Once you submit the information, AAA will provide you with a personalized quote outlining the estimated cost and coverage details.

AAA Insurance’s Unique Selling Propositions

AAA’s insurance products stand out in the Norman market due to several key factors. Their long-standing reputation for reliability and customer service is a significant advantage. Additionally, AAA often bundles insurance products, offering discounts for those who purchase multiple policies (auto and home, for example). Their roadside assistance program, a hallmark of AAA membership, provides added peace of mind and is a valuable benefit for policyholders. Finally, AAA’s competitive pricing and various coverage options cater to a wide range of customer needs and budgets, making them a strong contender in the Norman insurance market.

Customer Experience and Reviews

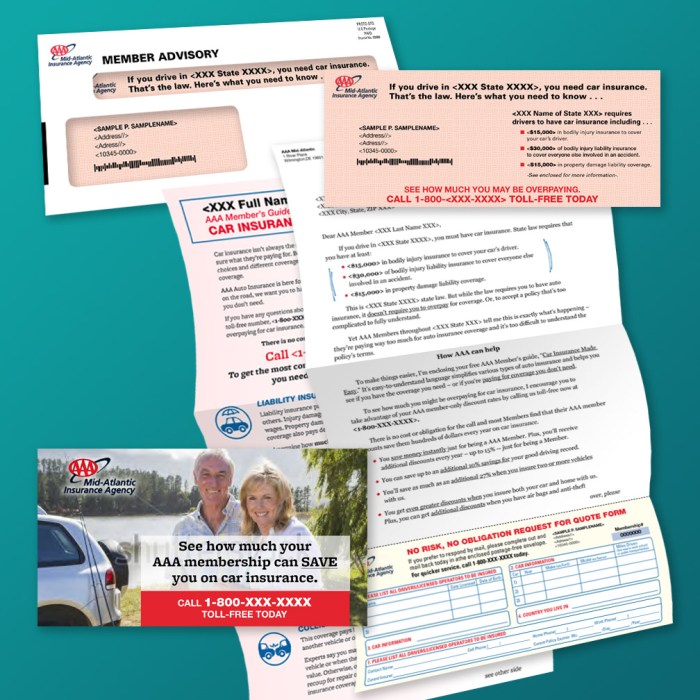

Source: 321creativeinc.com

AAA Insurance in Norman, Oklahoma, strives to provide a positive and efficient customer experience. Understanding customer feedback is crucial to maintaining high service standards and continuously improving. This section details customer reviews, the typical customer journey, complaint resolution, and methods employed to ensure satisfaction.

Customer Reviews and Testimonials

Online reviews offer valuable insight into customer perceptions of AAA Insurance in Norman. Analyzing feedback from various platforms allows for a comprehensive understanding of both positive and negative experiences.

- Many customers praise the friendly and helpful staff, highlighting their responsiveness and expertise in explaining policy details.

- Positive feedback frequently mentions the ease and speed of the claims process, with many citing efficient handling and timely settlements.

- Some reviews point to competitive pricing and a wide range of insurance products offered, catering to diverse needs.

- Occasionally, negative reviews mention longer-than-expected wait times during peak periods or minor issues with online portal navigation.

- Overall, the majority of reviews reflect a positive experience with AAA Insurance in Norman, suggesting a strong commitment to customer service.

The Typical Customer Journey

The customer journey with AAA Insurance in Norman typically begins with an initial contact, often through the website, phone call, or in-person visit. This is followed by a needs assessment, where an agent helps determine the appropriate coverage. The next step involves policy selection and pricing discussions. Once the customer agrees on a policy, the application process begins, requiring necessary documentation. Finally, after successful completion of the application and payment, the policy is issued. This entire process is designed to be streamlined and efficient, minimizing inconvenience for the customer.

Complaint Resolution and Issue Handling

AAA Insurance in Norman employs a multi-step process for handling customer complaints. Initial complaints are typically addressed by the agent who manages the customer’s account. If a resolution cannot be reached at this level, the complaint escalates to a supervisor or manager. Thorough investigation and documentation are maintained throughout the process. The goal is to find a fair and equitable solution for the customer, often involving adjustments to policy coverage, refunds, or other appropriate remedies. For instance, a customer experiencing a delayed claim settlement might receive a partial refund for the inconvenience, or a customer with a billing error may have their account corrected and receive a credit.

Methods to Ensure Customer Satisfaction

AAA Insurance in Norman uses several methods to actively ensure customer satisfaction. These include regular customer surveys to gauge overall happiness and identify areas for improvement, ongoing staff training programs focusing on customer service excellence and product knowledge, and proactive communication to keep customers informed about policy changes or important updates. Additionally, AAA provides multiple channels for customer feedback, including phone, email, online portal, and in-person interaction, allowing customers to reach out in their preferred way. The company actively monitors online reviews and responds to both positive and negative comments, demonstrating a commitment to transparency and accountability.

AAA Insurance Norman Oklahoma

Source: behance.net

So you’re looking into AAA insurance Norman Oklahoma? That’s smart! Finding the right coverage is key, and understanding your options is half the battle. If you’re curious about similar services elsewhere, check out the options for aaa home insurance nj to see how coverage can vary by state. Back to Oklahoma though, remember to compare quotes before settling on a plan for your Norman home or auto.

AAA Insurance holds a significant presence in the Norman, Oklahoma insurance market, but understanding its competitive landscape is crucial for potential customers. This section will compare AAA with other major providers, highlighting strengths, weaknesses, and factors influencing consumer choices. We’ll also delve into a price comparison to illustrate the nuances of choosing an insurance provider.

Competitive Analysis of AAA Insurance in Norman, Oklahoma

AAA Insurance competes with several established players in Norman’s insurance market. Direct comparisons with State Farm, Geico, and Farmers Insurance reveal distinct advantages and disadvantages for each provider. AAA’s strength lies in its reputation for roadside assistance and its potential bundling opportunities for members, offering a holistic approach to insurance and emergency services. However, competitors like Geico often advertise aggressively with lower initial premiums, potentially attracting price-sensitive customers. State Farm boasts a vast network of local agents, providing personalized service that may appeal to customers valuing face-to-face interactions. Farmers Insurance also offers a strong local presence and diverse product offerings. Ultimately, the choice depends on individual needs and priorities.

Strengths and Weaknesses of AAA Insurance Compared to Competitors

AAA Insurance’s strengths include its established brand recognition and the added value of roadside assistance, especially appealing to those who frequently travel. Bundling options for members can also lead to cost savings. However, AAA might not always be the most competitive on price for individual policies compared to Geico’s often-advertised low rates. State Farm and Farmers Insurance, with their extensive agent networks, offer more personalized service and potentially greater flexibility in policy customization. This personalized approach can be a significant advantage for customers who prefer in-person consultations and tailored solutions.

Factors Influencing Customer Choice Between AAA and Competitors

Several factors influence customer decisions. Price is a major consideration, with many customers opting for the lowest premium regardless of other benefits. However, the level of customer service, policy flexibility, and the availability of bundled services (like AAA’s roadside assistance) also play significant roles. Customers valuing convenience and personalized service might favor State Farm or Farmers Insurance’s agent-based approach. Those prioritizing solely on low initial premiums might choose Geico. The perceived value of AAA’s membership benefits, including roadside assistance, becomes a crucial differentiator for a significant portion of their customer base.

Price Comparison of Similar Insurance Products

The following table compares average prices for similar insurance products across different providers in Norman, Oklahoma. Remember that actual prices vary based on individual factors like driving history, location, and coverage choices. These are estimates based on publicly available information and should not be considered definitive quotes.

| Insurance Provider | Product Type | Average Price (Annual) | Key Differences |

|---|---|---|---|

| AAA Insurance | Auto Insurance (Liability) | $800 | Includes roadside assistance for members |

| State Farm | Auto Insurance (Liability) | $750 | Strong local agent network, personalized service |

| Geico | Auto Insurance (Liability) | $700 | Generally lower premiums, online-focused |

| Farmers Insurance | Auto Insurance (Liability) | $850 | Diverse product offerings, strong local presence |

Agent Network and Accessibility

Finding the right AAA Insurance agent in Norman, Oklahoma is key to securing the best coverage for your needs. AAA’s network in the area ensures accessibility, offering various ways to connect with a knowledgeable professional who can guide you through the insurance process. This accessibility extends beyond just physical locations, encompassing various communication channels designed for modern convenience.

AAA Insurance maintains a robust network of agents across Norman, Oklahoma. While a precise map isn’t available here, imagine a network spread fairly evenly across the city, mirroring Norman’s population density. Areas with higher population concentrations, like the University of Oklahoma area and downtown Norman, likely have a higher concentration of agents. Conversely, more sparsely populated areas may have slightly fewer agents, but still within reasonable reach for residents. This ensures that no matter where you live in Norman, you’re never too far from an AAA representative.

Contacting AAA Insurance Agents in Norman

Customers can connect with AAA Insurance agents in Norman through several convenient methods. Direct phone calls remain a popular choice, offering immediate assistance and personalized guidance. Many agents also provide email addresses on their individual profiles or the main AAA website, facilitating asynchronous communication for those who prefer written correspondence. Finally, an online contact form, usually found on the AAA website, provides a convenient way to reach out and request information or schedule an appointment.

Scheduling Appointments with Local Agents

Scheduling an appointment with a local AAA Insurance agent is straightforward. The preferred method is typically via phone, allowing for direct confirmation of availability and immediate scheduling. Many agents also offer online appointment scheduling through their individual websites or the main AAA website. This online method provides flexibility, allowing customers to select a time slot that fits their schedules without the need for phone calls. In some cases, email may be used to request an appointment, but confirming availability and setting the exact time will likely still involve a follow-up phone call.

Geographical Coverage of AAA Agents in Norman, Aaa insurance norman oklahoma

Visualizing the geographical coverage of AAA agents in Norman, imagine concentric circles emanating from the city center. The densest concentration of agents is likely within the inner circle, encompassing the main commercial areas and densely populated residential neighborhoods. As you move outward towards the city’s edges, the concentration of agents gradually decreases, but remains distributed relatively evenly to ensure convenient access for all Norman residents. This strategic distribution aims to minimize travel time and maximize accessibility for everyone, regardless of location within the city limits.

Ending Remarks

So, is AAA Insurance Norman Oklahoma the right choice for you? Ultimately, the best insurance provider depends on your individual needs and budget. But hopefully, this deep dive has armed you with the knowledge to make an informed decision. Remember to compare quotes, read reviews, and don’t hesitate to reach out to AAA directly with any questions. Protecting your assets is crucial, so choose wisely and drive (and live) with peace of mind.